junce/iStock via Getty Images

Last August, I warned that a Stock Market Correction Is Due And It Could Be Deep.

I followed that up with My 2022 Futile Forecast: The Dollar, Stocks, REITs, Crypto, Inflation which discussed a likely bear market in 2022.

We are now facing the bear market I predicted, and it might turn out to be a vicious Grizzly Bear.

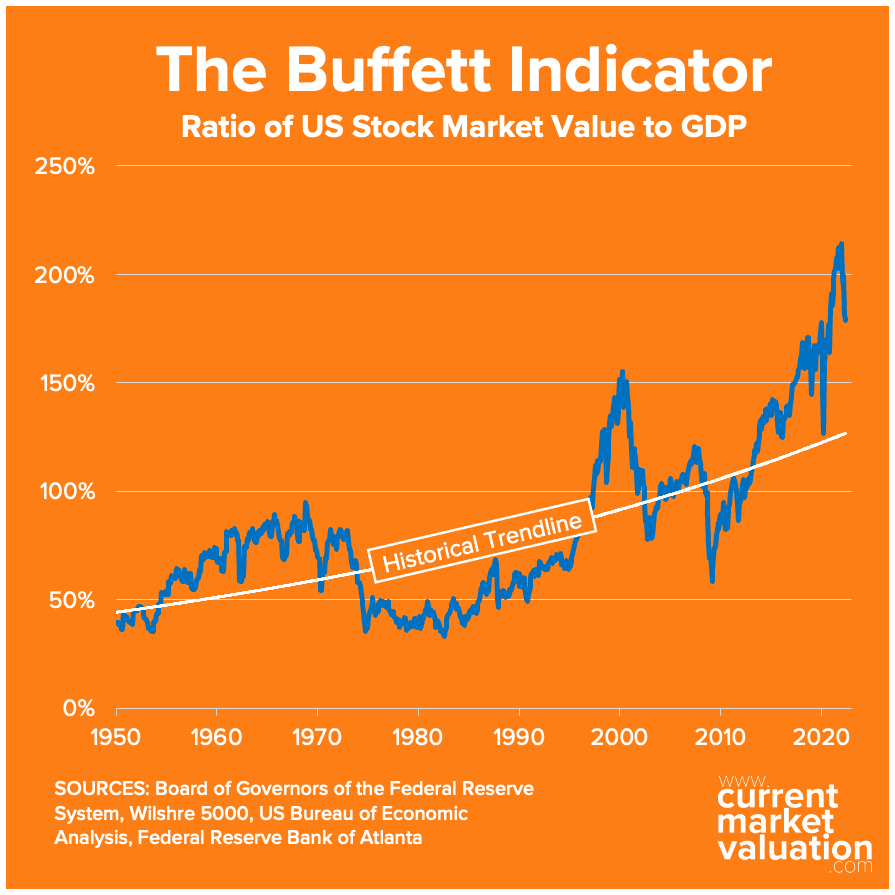

This bear market is following a period of irrational exuberance that pushed valuations to never before seen levels. It makes sense that as the primary fuel, Federal Reserve Quantitative Easing, is pulled from markets, that risk assets will fall in price.

Yet, retail investors are still largely focused on what to buy, rather than what to sell. They are making the same mistakes they always make: Buy high before they panic and sell low.

Valuations Are Always Important

Throughout the Covid rebound rally, I warned that valuations never really got undervalued and that they were racing right back to overvalued. I got mocked as “not getting it” and that the Fed’s “money printer go brrr.” A few know-it-alls called me out for being too bearish. And, that was despite me recommending Bitcoin (BTC-USD) and these stocks in April 2020:

Kirk Spano’s April 2020 Recommendations (Margin Of Safety Investing)

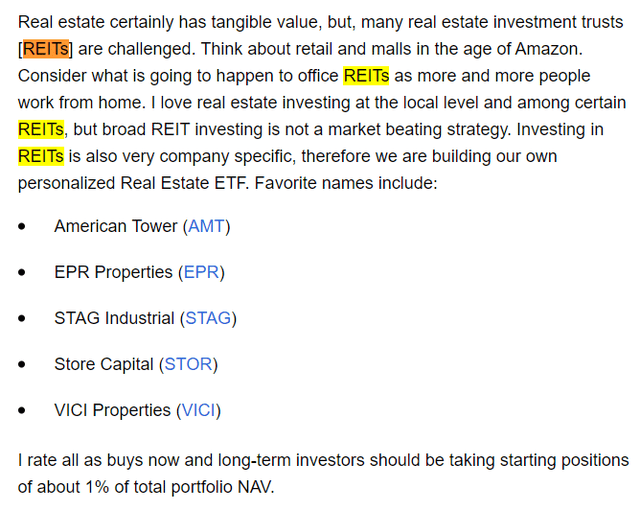

I also recommended these REITs in place of buying a real estate ETF:

Kirk Spano’s Top REITs April 2022 (Margin Of Safety Investing)

So, while I correctly identified a likely rebound rally in high beta and other assets, I also was mindful of valuations, which kept me with one foot over the brakes (and why I was out of about 60% of my equity holdings by late 2021).

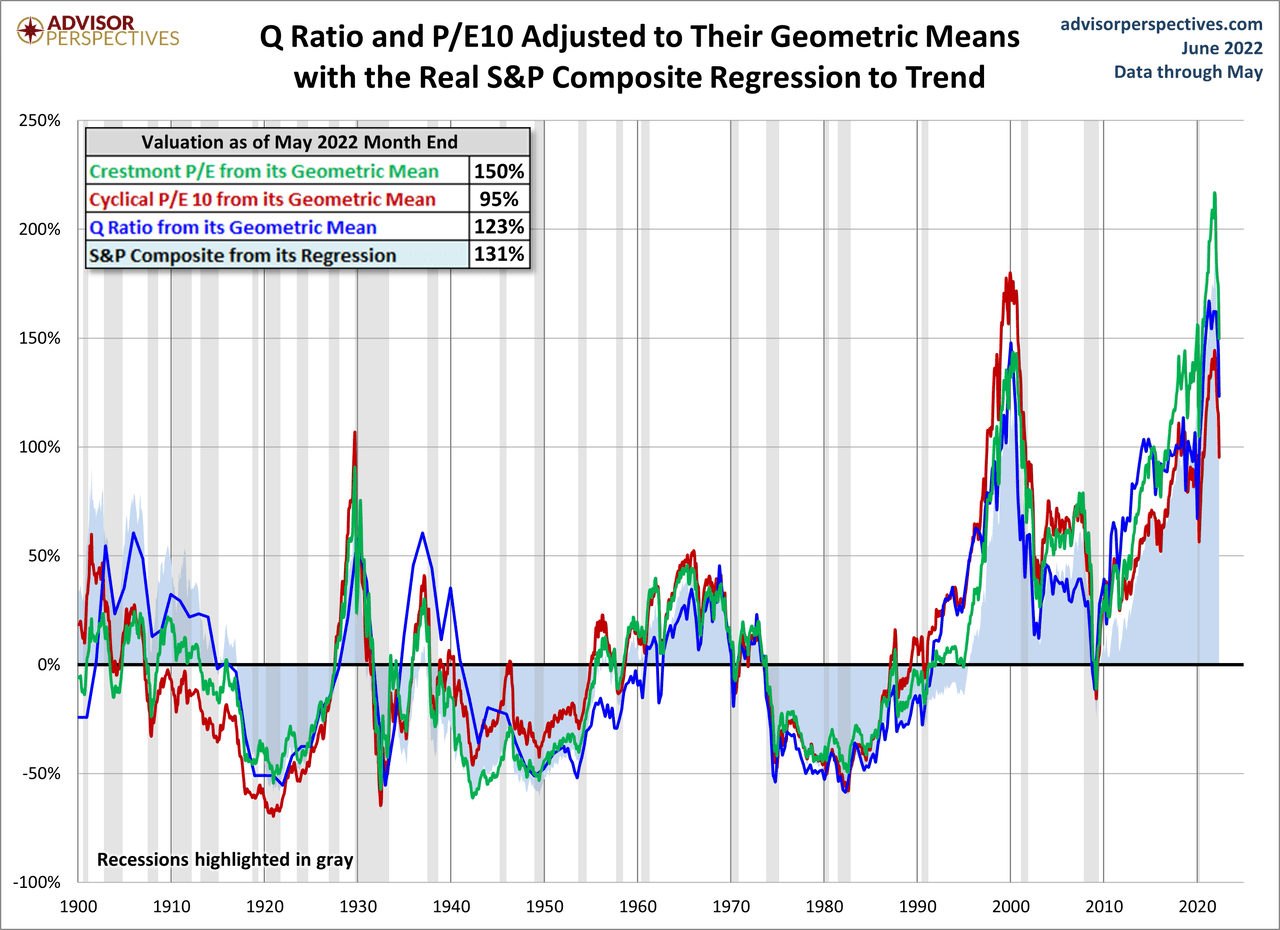

Here’s what has concerned me about valuations and continues to concern me.

Buffett Indicator (CurrentMarketValuations.com) 4 SPY Valuation Ratios (advisorperspectives.com)

In the second chart, we can see that valuations are still high even with the sell-off. It’s actually a shade better now with the past couple down days. And, there is a glimmer of hope emerging as the 10-year cyclically adjusted P/E (essentially Shiller Ratio) starts to sniff almost normal.

A couple questions I think we should ask are:

- With all the negativity among consumers and investors, will cautious become panic?

- Will the stock market stop near fair value, or will stocks become undervalued?

Follow The Big Money

I know there are a lot of magical voodoo trading systems out there, but, most break in the face of tightening liquidity conditions.

There are several important reasons why this is true, but most important is that, sometimes, liquidity speaks and sentiment is forced to listen. Math over emotions. Spock would be proud.

Now, I was a quant before being a quant was cool. Back in 2007, I made a presentation to my investment firm and showed that the stock market was in big trouble. I got poo poo’d and that was that, until, of course, 2008.

Here is the most important quant thing I can tell you, and it actually came from my grandfather. He said, “Kirk, if you want to know how things work and why they are what they are, follow the money.”

I know a lot of you got that advice at some point in your life. It’s good advice. It has served me well and probably you too.

I have amended that thought for the stock market to this: follow the big money to know what’s really going.

I use a small handful of quantitative factors to track the “big money” in the market. It’s mostly based on volume weighted activity.

You can use a Level II system to trade that data if you are a star trader, or, you can use very basic charts to show you where the “big money” is interested in buying certain assets for the long-term.

I’m only going to show you one chart as an example, and I’m not teaching a class, but, I want to make a point about where the S&P 500 is right now.

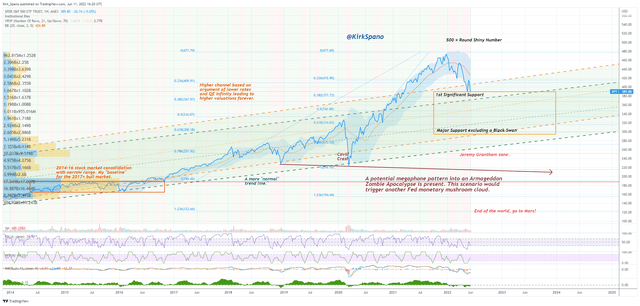

Here’s my tracking chart for the S&P 500 ETF (NYSEARCA:SPY).

When analyzing a chart, it is important to pick the appropriate time frame to analyze. Most analysis is done on far too short of a time frame, in my opinion. It disrespects the inherent cyclical nature of markets. It also misses where the big money are likely to be big buyers.

I’m going back to the flat market of 2014-16, because that is where the market based before we went on this epic bull market, with a few breaks, from 2017 to 2021. In my mind, round tripping to 2014-16 stock market price is the absolute “worst case” scenario. I don’t think it’s very likely, but it’s not impossible, so I start there.

Knowing where the big buyers are is a great way to find “bottom fishing” prices. If you have had your FOMO inoculation, then being a bottom fisher is a great way to invest. Unfortunately, most retail investors have the FOMO bug and can’t get over it.

On the right-hand side of the chart, you will see a basic volume profile study. Again, I’m not going to teach a class here, but the short of it is this:

- Big bars mean big interest, usually, big money selling or buying.

- Short bars mean low interest, usually retail small fries satisfying FOMO.

And, big interest usually moves up a bit over time. Prices rise about 80% of the time right, so that’s easy to understand.

You’ll see that big interest starts to manifest for the S&P 500 around the upper 2000s and lower 3000s. My base case scenario for this bear market is to get to around 3000.

Unfortunately, there’s more.

If the Fed doesn’t back off a bit by autumn, as I expect, then we could see a hard landing in the economy. Nobody knows what the Fed is going to do. I am not in the camp that they need to get very tight. I know many are.

My opinion is that the Fed should back off come autumn to support the supply side of the economy. They don’t ask for my opinion, and could choose to force us into a pretty significant recession.

In that case, then the lower “big buyer” interest comes into play. That’s way down in the lower 2000s on the S&P 500. I don’t think that’s likely, but a correction of that magnitude is a higher probability today than normal given the inflation numbers.

Is It Too Late To Sell?

That’s a great question, actually. The answer is maybe and it depends.

I don’t know your financial circumstances, goals, time frame, tax situation or risk tolerance. So, it’s hard to say definitively, even in a world where people want “actionable.”

What I do know is that most people sell with no plan on buying back in. And, in the long run, you want at least 60-80% of your money in equities, so you must have a plan to get back in with the money that you took out.

If you have a hard time buying back in because you get scared, then probably maintain the same asset allocation to equities as is normal for you, but look to upgrade your portfolio with holdings that are zombie free. Don’t be afraid to call a zombie, a zombie, they don’t mind, their executives still get paid.

Asset allocation is where most folks ought to focus. How much do you have in small caps, mid caps, large caps, developing markets and fixed income? Start there.

At this point, if you are largely correlated to the S&P 500 (SPY) (VOO), you can either decide to wait things out (which might be years), or formulate a plan to upgrade your portfolio.

I think we are seeing a generational opportunity in small caps right now. I believe that as the economy transitions to having more supply chains in the United States and the cleaner energy transition plays out, we will see small caps become mid caps become large caps. That’s a stock pickers game, though.

For most folks, I would strongly suggest fewer large caps and more mid caps. Why? Simply, mid caps are past the speculative phase and have higher growth than large caps. Mid-cap stocks have also outperformed for decades.

Unlike small caps, which do not have many good ETF solutions, there are several good mid-cap ETF answers. Our ETFavorites list has several.

If I were heavy large caps (I am not), I would trim those back substantially, and engage in a scaling in process on mid caps with most of that money. You do not have to be perfect. Time will fix the things you are imperfect on.

Be the first to comment