Torsten Asmus

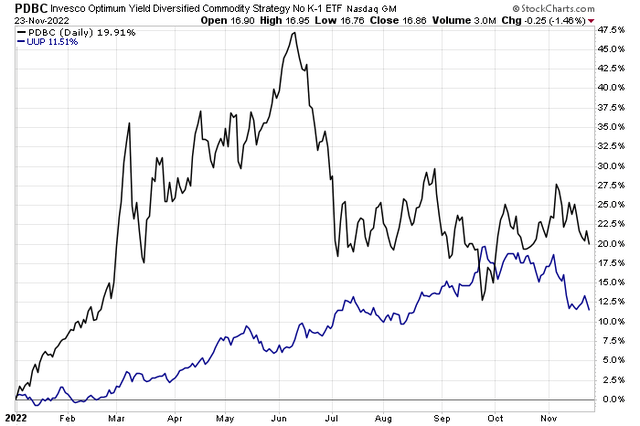

Commodities are not performing well despite a weaker U.S. dollar. The Invesco Optimum Yield Diversified Strategy No K-1 ETF (NASDAQ:PDBC) is up 20% so far this year but has simply meandered since a steep drop back in June.

What was impressive was how well commodities, namely oil, performed during the first five months of the year as the greenback soared. According to Seeking Alpha, commodities had been pacing for their best year since WWII after a strong first half.

PDBC Struggles Despite A Weaker Dollar

Commodity bulls were hoping that an eventual turn lower in the U.S. Dollar Index would be a second wind to oil, natural gas, copper, gold, and the like. That has not happened, and I am growing increasingly concerned about the prospects for lower hard and soft commodity prices as risks shift from inflation to a looming global recession.

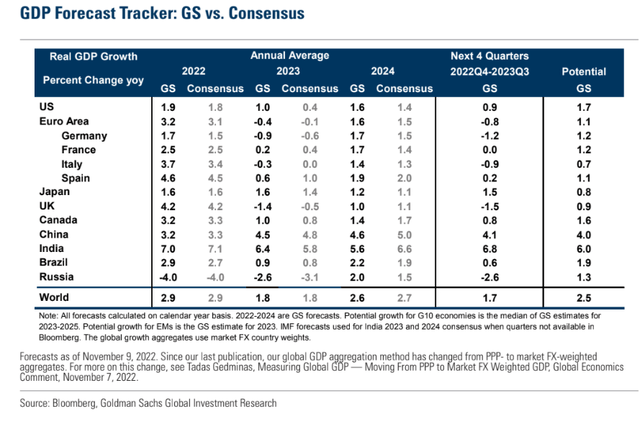

Consider that, according to Goldman Sachs, 2023 global GDP growth is expected to be just 1.8% with several regions forecast to endure economic contraction.

Real GDP Growth Forecasts

Goldman Sachs Investment Research

According to Invesco, the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF is an actively managed exchange-traded fund that seeks to achieve its investment objective by investing in commodity-linked futures and other financial instruments that provide economic exposure to a diverse group of the world’s most heavily traded commodities.

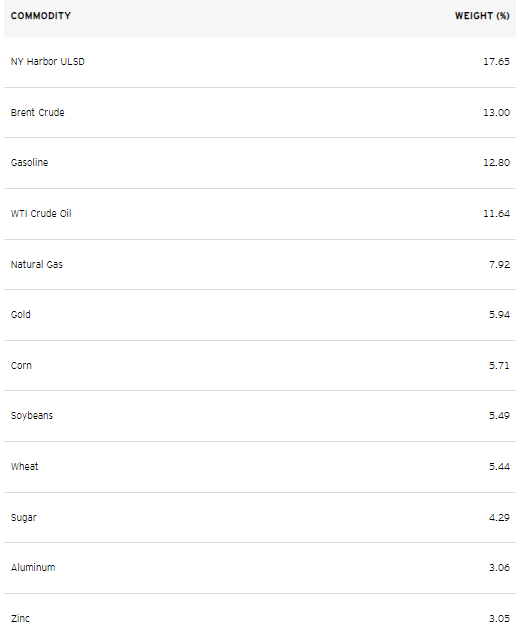

The ETF holds 14 different commodities spanning energy, precious metals, industrial metals, and agriculture. FactSet reports that the fund has $7.4 billion in assets under management.

PDBC is an effective way to get broad commodity exposure without owning equities. Moreover, the fund is liquid with a median 30-day bid/ask spread of just six basis points, according to the fund’s website. It is not overly cheap, though, with an annual management fee of 0.59% and acquisition costs of an additional five basis points.

Investors should be aware that PDBC, like the Invesco DB Commodity Index Tracking Fund (DBC), holds primarily energy commodities. So, it’s a very globally cyclical fund. While it benefitted from Russia’s invasion of Ukraine earlier this year, should geopolitical tensions continue to wane from the spotlight, we could see further lower oil prices.

A curveball in my eye could come from a colder-than-forecast winter across Europe and the U.S. As of now, forecasters predict a generally mild few months ahead, but that could always change.

Overall, I view more bearish risks stemming from global economic growth concerns versus what a harsh winter could bring in terms of bullish commodity price action.

PDBC: Mainly An Energy Commodity Fund

Invesco

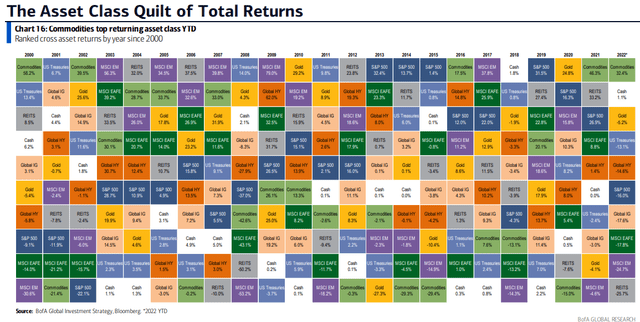

I’m also hesitant to think that commodities won’t cool off after a solid two-plus years. The asset class quilt of total returns shows that commodities as a group has never led for three consecutive years.

2022: A Banner Year For Commodities Following A Stellar 2021

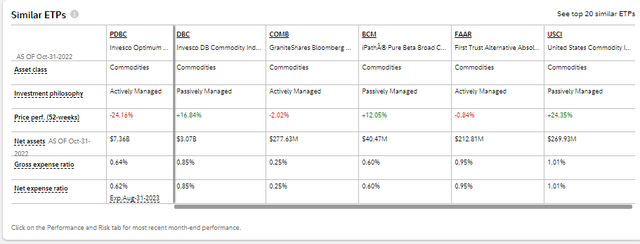

It is also helpful to assess similar funds. PDBC is a solid way to play commodities when comparing the costs of similar exchange-traded products. I agree with Morningstar’s four-star rating based on its performance and fees. Moreover, the favorable tax nature of PDBC is ideal for traders and investors using taxable accounts. So, this is a positive aspect for the fund.

PDBC Versus Comparable Funds: A Solid Choice

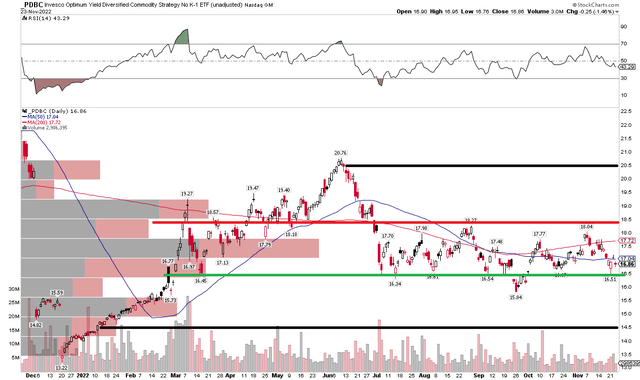

The Technical Take

Commodity traders must carefully monitor PDBC’s current trading range between $16 and just above $18. A break lower could lead to a measured move bearish price objective to near $14.50. I could see that scenario playing out should economic numbers around the globe deteriorate. Moreover, further lockdowns in China could be a catalyst for bearish price action.

On the bullish side, a breakout above $18 and change would suggest upside risks back up to near the June high.

PDBC: Shares Hovering At Key Support

The Bottom Line

I do not like how commodities are performing in this new weaker-dollar environment. Moreover, global real GDP growth risks ahead will provide many bearish headlines for commodities to trade on. I think a break of support is more likely than a breakout through resistance, so I would be a buyer of PDBC on a pullback to $14.50 to $14.75.

Be the first to comment