24K-Production

The Invesco WilderHill Clean Energy Portfolio ETF (NYSEARCA:PBW) or “the Fund” or “ETF” is a portfolio which seeks to track the investment results (before fees and expenses) of the WilderHill Clean Energy Index (ECO), (the “Index”). The Index is a selection of:

…businesses that stand to benefit substantially from a societal transition toward use of cleaner energy, zero-CO2 renewables, and conservation. Stocks and sector weightings within the ECO Index are based on their significance for clean energy, technological influence and relevance to preventing pollution in the first place. We emphasize new solutions that make both ecological and economic sense, and aim to stay the leaders in this field,” according to WilderShares, LLC., (“Wilder”) the Index provider.

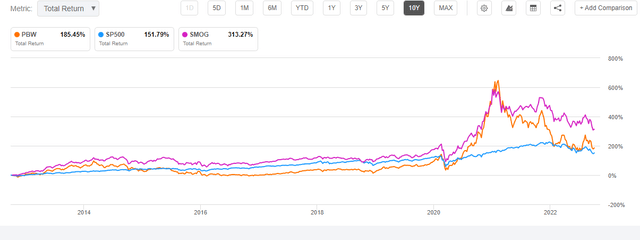

Over the past ten years, the Fund benefited mostly from the shift in investors’ interest in clean energy around the 2020 U.S. presidential election. Prior to that, the Fund’s performance was similar to the S&P (SP500TR). In the last couple of years, PBW’s return has sunk and underperformed the SP500TR.

Ultimately, the performance of the ETF and Index depends on what companies are in the Index, how they perform, how they are weighted, and how they are selected. That selection is highly dependent on who is selecting them and their process.

WilderHIll

In a discussion about the Index, WilderShares, LLC. (“Wilder”) explains:

Stocks and sector weightings within the ECO Index are based on their significance for clean energy, technological influence and relevance to preventing pollution in the first place. We emphasize new solutions that make both ecological and economic sense, and aim to stay the leaders in this field.

We do not take defensive positions within the Index when the markets decline, appear over-valued, or the Index is experiencing unusual volatility. Rather than try to select Index components based on financial or market data, we robustly look at clean energy broadly conceived and select stocks and sectors on technical and environmental criteria. We judge our performance by how well the Index tracks movements of the clean energy sector-down and upwards-and anticipate significant ongoing volatility in this sector.

We apply qualitative analysis at the Quarterly rebalancings to determine Index securities, sectors and weightings. Criteria include importance of the stock and sector to clean energy, relevance to climate change, pollution prevention, technological significance, intellectual property rights, salience to preserving biodiversity or ecological integrity and other non-financial criteria. The Index is expected to be a diversification tool. Given the inherent volatility of this sector with many small high-tech companies and strong price movement, the WilderHill Index (ECO) is expected to be notably volatile as well. Nuclear power is not allowed in ECO.

We weight the Index sectors according to importance and technological relevance, not views about individual stocks. ECO components are evenly divided within a sector to assign weights–we feel this modified equal weighting is the most intellectually-robust approach for ECO. Following Quarterly rebalancings, stocks will move for the next three months according to their respective prices, and then are automatically reset for the next Quarter’s start.”

Based on the above “qualitative analysis,” it matters who is making the Index selection. In addition, based on the lack of “financial or market data” in the selection process, it raises concerns over the potential financial fitness of stocks in the Index.

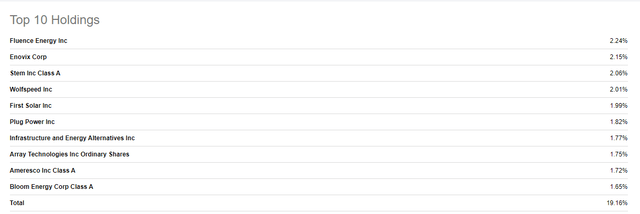

To that point, I read an article, titled, PBW: The Bloom Is Off This Clean Energy Rose, dated December 17, 2021, in which the author made some observations about the top ten holdings in the Index when he wrote the article.

Specifically, the author noted:

The #1 holding with a 2.2% stake is Enovix Corp. (ENVX). The Fremont, California-based company designs and manufactures lithium-ion based batteries. ENVX is not yet profitable and is not expected to turn a profit next year as well.

As far as I am concerned, Enovix is a very odd choice to be the high-profile #1 holding in a clean energy fund considering it has no revenue and just produced its first battery cell in September of this year.”

I’m not a big fan of the company’s top-10 holdings. They seem overly and unnecessarily risky to me, while, overall, the fund is heavily weighted toward small-cap companies – many of which are not yet profitable.”

I doubt this is good positioning when the market is arguably shifting from growth to value and concerned about higher interest rates sooner rather than later. I would rather see a significantly heavier weighting in leaders and profitable top-10 holdings Tesla (TSLA) and Ormat as well as companies like Enphase (ENPH), First Solar (FSLR), and SunPower (SPWR) for instance.”

Those observations led me to research who is on the ECO Index Advisory Committee.

Eco Index Advisory Committee

The Committee is led by CEO Dr. Robert Wilder. There are several other PhDs listed, but all of their academic credentials were surprising.

Dr. Wilder’s PhD. is in political science, not finance, economics or environmental sciences. He also has a law degree. He does not list any prior experience or credentials in investment management or financial analysis on his bio.

Other PhDs are for social and organizational psychology, physics, and one is for “mathematical biology.” One has a BA in languages and course work in Community Planning. And another has a masters in Oceanography.

There is only one member who has an (undergraduate) economics degree and is described as an “independent index expert.” He also worked as a research analyst (entry level?) for Salomon Smith Barney’s Global Equity Indexes.

There appears to be no Registered Investment Advisors (“RIAs”), no finance degrees nor MBAs, and no one with banking or venture capital experience. That may explain why the author of the above-named article found the top ten holdings to “seem overly and unnecessarily risky to me, while, overall, the fund is heavily weighted toward small-cap companies – many of which are not yet profitable.”

The specific “Eligibility Criteria for Index Components” and Index sector and stock weights are detailed on the Wilder website. The five major sectors are:

Renewable Energy Harvesting – 17% weight (12 stocks @1.41% each)

Energy Storage – 26% sector weight (20 stocks @1.27 each + 1 *banded)

Power Delivery & Conservation – 24% sector (18 stocks @1.25% each + 3 *banded)

Energy Conversion – 23% sector weight (18 stocks @1.25% each + 1 *banded)

Greener Utilities – 8% sector weight (6 stocks @1.25% each + 1 *banded)

Cleaner Fuels – 2% sector weight (2 stocks @1.00% each)

The top ten holdings are listed below:

Holdings

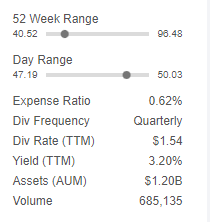

Expense Ratio and AUM

The Fund charges an expense ratio of 0.62% and has assets under management (“AUM”) of $1.2 billion.

Seeking Alpha.

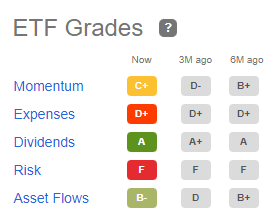

Seeking Alpha assigns a “D+” grade for ETF expenses.

Seeking Alpha.

Performance

Over the past ten years, PBW provided a total return of 185%. That compares to another clean energy fund, the VanEck Vectors Low Carbon Energy ETF (SMOG) of 313% and the S&P 500 (SP500TR) of S&P 151%. And as mentioned above, much of PBW’s return was due to a sudden change in investor sentiment, which has waned significantly as it applies to PBW.

I recently wrote an article, SMOG: A Well-Diversified Bet On The Energy Transition, and concluded:

The Index is well-diversified and includes corporations at just about every stage of technological development. The Index is also not a bet on any one solution but rather a bet across the entire spectrum. It would not be easy for individual investors to construct a portfolio such as SMOG’s.

For long-term investors, the Fund should outperform the broader equity market, and its thesis is fundamentally strong. For those reasons, I believe it is a long-term Hold.”

SMOG is based on the MVIS Global Low Carbon Energy Index. The index provider is MarketVector Indexes, the index business of VanEck, a US-based investment management firm and provider of the VanEck Vectors ETFs.

Approximately USD 22.27 billion in assets under management are currently invested in financial products based on MarketVector Indexes. Many of those products are the largest in their investment category. MarketVector Indexes also develops and maintains customized indexes for third parties that aim to track specific investment themes.”

The leadership has advanced degrees in economics and international studies. One is a Certified International Investment Analyst (CIIA) holder.

The CIIA diploma is an internationally recognised, advanced professional qualification programme and certification for individuals working in the finance and investment industry.”

Those are the types of credentials I am looking for in a financial management firm that offers financial products. I simply don’t trust a political scientist, social and organizational psychologist, physicist, mathematical biologist, community planning specialist, or an oceanographer for picking stocks for my portfolio.

Conclusions

PBW is an ETF based on the WilderHill Clean Energy Index. While the sectors that compose the Index are appropriate, the selection of specific companies is based on “clean energy broadly conceived and select stocks and sectors on technical and environmental criteria.” Investment and market data analysis are excluded. And no one on the Index Advisory Committee appears to have an RIA background or credentials.

Based on that finding, I am more confident in the future performance of the SMOG ETF because of the MarketVectors team performing the selections. I believe that professional investment knowledge and substantial financial credentials are essential when offering a financial product.

Be the first to comment