jntvisual/iStock via Getty Images

Anyone who lives within their means suffers from a lack of imagination.”― Oscar Wilde

Today, we take an in-depth look at PaySign (NASDAQ:PAYS). The shares of this small cap financial concern have been punished recently thanks to weak forward guidance. Analysts also seem to be negative on the shares at the moment. However, the company is at breakeven status and still should see revenue growth in the mid-teens in the coming fiscal year. Buy the dip or avoid the shares? We attempt to answer that question via the analysis below.

Company Overview:

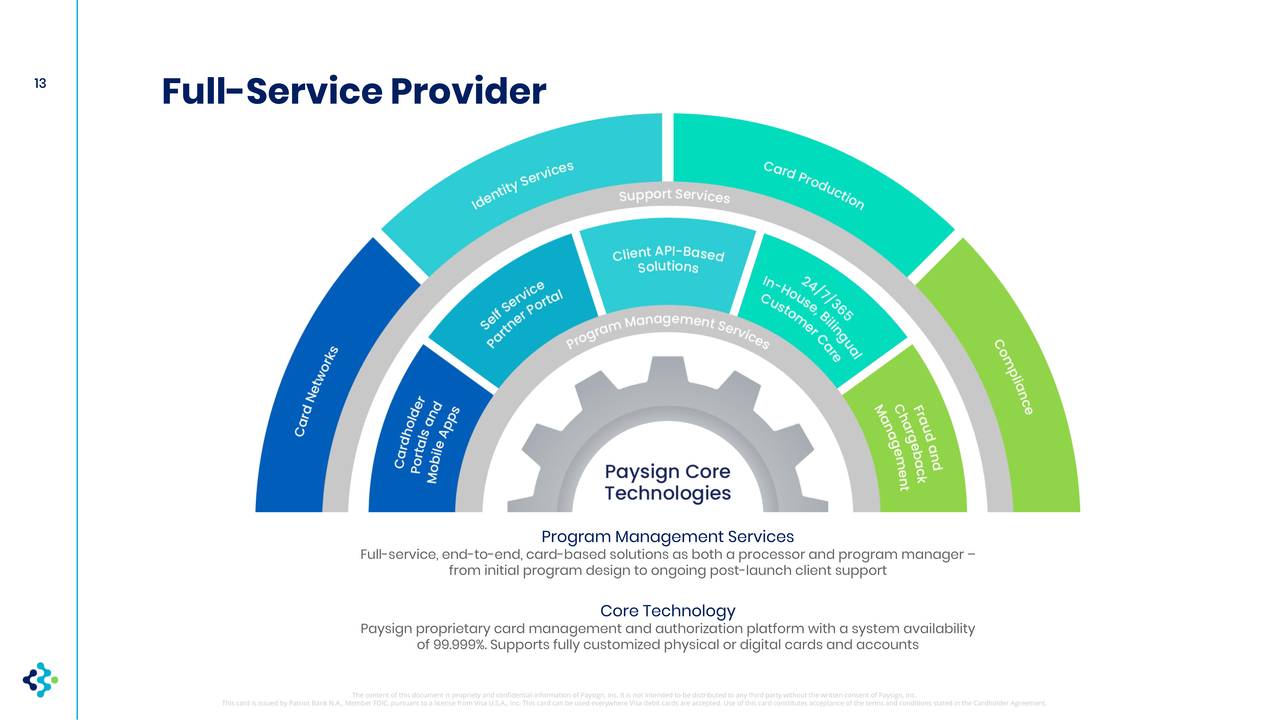

PAYS – Company Capabilities (November Company Presentation)

PaySign is based out of Las Vegas. The company provides prepaid card products and processing services under the PaySign brand for corporate, consumer, and government applications. PaySign also develops prepaid card programs for corporate incentive and rewards, including consumer rebates, donor compensation, clinical trials, healthcare reimbursement payments, and pharmaceutical payment assistance among other functionalities. At the end of 2021, the company had approximately 4.3 million cardholders and 440 card programs. The stock currently trades for just under two bucks a share and sports an approximate $100 million market capitalization.

PAYS – Company History (November Company Presentation)

The company’s primary product line is focused on compensating blood plasma donors via a modest stipend that is loaded onto a prepaid card that PaySign provides. The COVID-19 pandemic caused numerous plasma center closures. In addition, the various stimulus packages signed into law during 2020 and 2021 reduced the incentive for individuals to donate plasma for supplementary income. The company should benefit from ‘normalcy‘ continuing to return to the medical space as the pandemic ebbs. This is the vast bulk of PaySign’s current operations/revenues. The rest consists of a much smaller business in pharmaceutical co-pay assistance and corporate incentive rewards.

Fourth Quarter Results:

On March 22nd, the company posted fourth quarter results. PaySign reported quarterly Non-GAAP EBITDA of $0.02 ($1.3 million) a share as revenues increased slightly over 21% on a year-over-year basis to $8.8 million. Plasma sales accounted for $1.3 million of the $1.5 million increase in sales from 4Q2020 during the quarter. Net income increased $4.4 million from a profit of $105,000 in 4Q2020 primarily to a $3.7 million income tax provision. For all of FY2021, PaySign recorded a loss from operations of $2.7 million. This was an increase of $5.6 million from the operating loss of $8.3 million in FY2020. For the year, the company signed six new plasma clients and onboarded an additional 26 net new plasma centers to end the year with 366 centers. The company averaged $6,800 of revenue monthly per plasma center.

Leadership provided initial guidance for FY2022 within the press release that accompanied fourth results. Management expects full year adjusted EBITDA to double over FY2021 levels to $4 million as revenues rise 20% to 30% to $35.25 million to $38.35 million. Plasma will make up approximately 90% of overall sales.

Analyst Commentary & Balance Sheet:

The analyst community has not been impressed with the company’s fourth quarter numbers and guidance. Since quarterly results posted, BTIG reissued their Hold rating on PAYS. Maxim Group maintained its Buy rating on the stock but lowered its price target a buck a share to $4. Finally, Ladenburg Thalmann downgraded the shares to a Neutral from a Buy rating.

The company ended FY2021 with unrestricted cash of $7.4 million. PaySign also had restricted cash of $61.3 million, which are funds used for customer card funding with a corresponding offset under current liabilities. The CFO sold just over $55,000 worth of shares on March 2nd. That is the only insider activity in the stock so far in 2022.

Verdict:

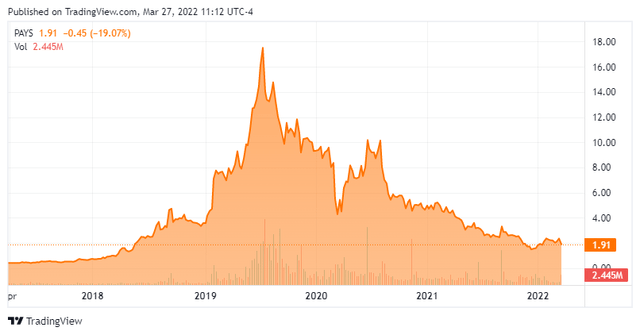

PAYS – Stock Chart (TradingView)

The main case for owning PaySign is the stock rebounds to where it was trading before the pandemic swept onto our shores. The stock did trade above ten bucks a share late in 2019 and began 2020 north of five bucks a piece. At just over 2.5 times forward revenues, the shares don’t seem expensive.

PAYS might merit a small ‘watch item‘ holding here, both as a return to normalcy play in the plasma space but also as an ‘off the radar‘ stagflation play, which seems the most likely scenario for the U.S. economy right now.

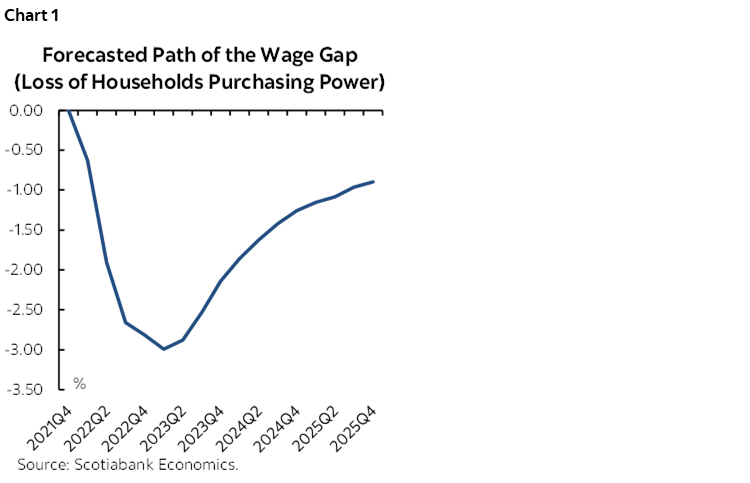

Over the past year, the average consumer has lost nearly three percent of their buying power. That is if you compared average the wage gains of the past 12 months to recent CPI reports. This trend is expected to continue in the coming quarters. In addition, government statistics tend to undercount inflation in my opinion.

Avg Wages versus Inflation (Scotiabank)

The situation is significantly worse for those that commute or rent given gasoline was up over 50% over the past year before Ukraine happened and rents were up in the mid to high teens on average in 2021. That should mean more and more people at the low end of the income scale could easily turn to other gigs such as giving plasma regularly to make ends meet here in 2022. Albeit somewhat of a ‘ghoulish’ investment take, but possibly a profitable one.

Wealth consists not in having great possessions, but in having few wants.”― Epictetus

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment