hapabapa/iStock Editorial via Getty Images

Investment Thesis

For growth investors, a dream deal is to invest in a business that shows both scale and perfect scalability. Unfortunately, scale and scalability do not like each other. The gravity of diminishing marginal return catches up sooner or later. As a business expands, it gradually runs out of high margin opportunities to further invest. Thus, the next best deal is to invest in a business that A) has a high and stable return, and B) that is still in the scalable stage. You get on board before the gravity of diminishing return catches up and enjoy the ride for a while.

The thesis of this article is that PayPal (NASDAQ:PYPL) represents such a business at its current stage, i.e., a dominating scale leader that still enjoys perfect scalability.

First, PYPL certainly has the scale to enjoy operational efficiency, reduce cost, and boost margins. It is ranked third among the most popular mobile payment methods accepted by online merchants worldwide. Worldwide, it has 392 million verified users and merchants as of 2021, and it processes a mind-boggling 41 million transactions every day on average. Its Venmo partnership with Amazon (AMZN) will further boost its scale in the near term.

Second, in terms of scalability, PYPL has certainly reached a critical scale to benefit from the network effects. As you will see, PYPL has not only earned a consistently high ROCE (return on capital employed) in the past (partially thanks to its scale) but it is also perfectly scalable at its current stage, as indicated by its stable MROCE (marginal return on capital employed). And looking forward and in the longer term, our world’s unstoppable transition to digital transactions will sustain its scalability.

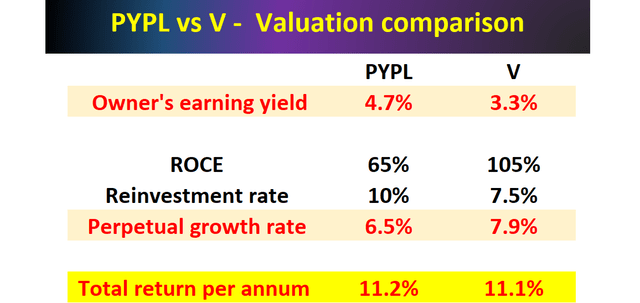

Finally, it is not only a good business but also a good investment at its current valuation. Despite its scale and scalability, PYPL currently is for sale at a very reasonable valuation both in absolute terms (about 18x adjusted PE) and relative terms. Especially when compared to its peer Visa (V), another quintessential example of scale and scalability, it features a very attractive return/risk profile. Even assuming its valuation remains compressed, it already provides favorable odds for a double-digit return (projected to be about 11%) in the long term.

The Moat And The Network Effects

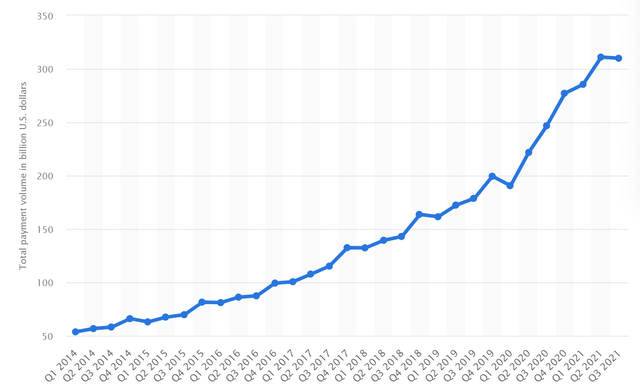

PYPL has certainly passed a critical scale to benefit from the so-called network effects. As one example, the following chart shows its total payment value (“TPV”) from the 1st quarter of 2014 to the 3rd quarter of 2021 in billion U.S. dollars. As can be seen, PayPal’s TPV just surpassed $300 billion in 2021 Q2. As an example, its 2021 Q2’s net payment volume amounted to around $311 billion, representing a 41 percent year-on-year growth. According to Statista, PayPal ranked third among the most popular mobile payment methods accepted by online merchants worldwide, only behind credit and debit cards.

Furthermore, it is unlikely that such dominance would change in the future (barring any major regulation or antitrust legislation change) due to the so-called “network effects”. As detailed in my earlier article on Visa,

The network effects refer to the fact that the value of certain products or services increases as more people use them. In other words, certain networks become increasingly more valuable as they become bigger. Not every network enjoys this magic feature, and as a matter of fact, most networks suffer a diminishing marginal rate of return – i.e., the additional return decreases as the network becomes bigger – as to be elaborated on later. A chain restaurant network is an example. As the network becomes larger, the nodes begin to compete against each other for customers and the return diminishes.

But certain networks, like the services PYPL provides, enjoy this magic trait – the network becomes more profitable as it becomes bigger. And payment networks (e.g., Visa, American Express, and PYPL too) are textbook examples of such network benefits.

And next, we will see that PYPL is a beneficiary of such network effects.

Return On Capital Employed (“ROCE”)

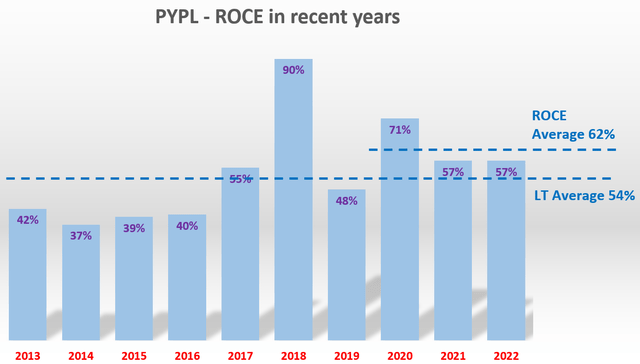

ROCE stands for the return on capital employed. Note that ROCE considers the return of capital ACTUALLY employed, and therefore is different from the return on equity. A detailed analysis of the ROCE for PYPL has been published in my earlier article here. And I will just directly quote the results as shown in the next chart. The ROCE of PYPL over the past few years is about 62%. It is higher than its long-term average of 54% and is also a very competitive level even when compared to the overachievers in the FAAMG group (whose average ROCE is between about 60% in recent years).

Source: author and Seeking Alpha.

Marginal Return On Capital Employed (“MROCE”)

However, ROCE only tells us how profitable the business has been or is SO FAR. And the marginal return on capital employed (“MROCE”) sheds insights into which direction the profitability is likely to go. Detailed background information on MROCE can be found in my earlier article on Visa. And a brief summary is provided here to facilitate this discussion for readers who are new to this concept.

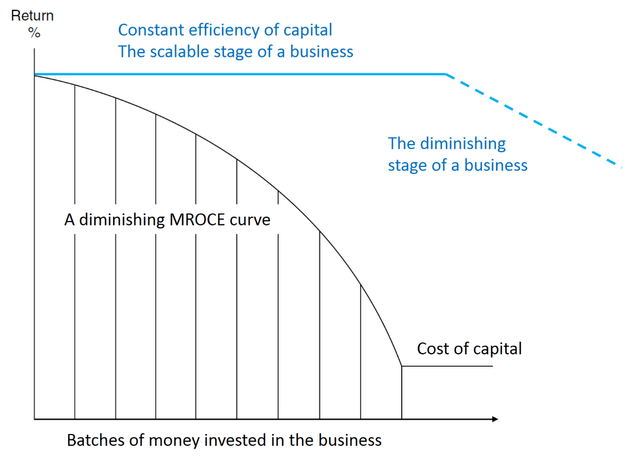

What the MROCE concept captures is a basic law in economic activities: the law of diminishing returns. As illustrated in the next chart, a business will first invest its money at projects with the highest possible rate of return. Therefore, the first batch of available resources is invested at a high rate of return – the highest the business can possibly identify. The second batch of money will have to be invested at a somewhat lower rate of return since the best ideas have been taken by the first batch of resources already, and so on. And finally, the end result is a declining MROCE curve as shown.

Warren Buffett commented on this concept on multiple occasions too. As an example, the following is a quote from his 1992 Berkshire Hathaway Shareholder Letter (the emphasis is added by me):

Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.

The operative here is “incremental capital”. A really good business not only has to enjoy a healthy return on its capital already invested (which is captured by ROCE) but also has to keep finding equally good or better opportunities to make future incremental investments – which is captured in MROCE.

And you will see next that PYPL is showing no diminishing marginal return in its current stage.

PayPal’s MROCE

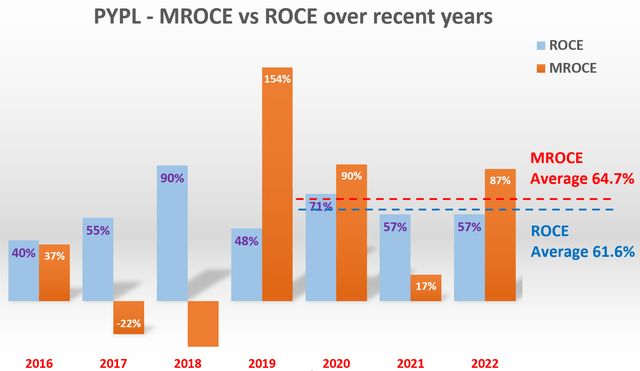

This chart shows the MROCE and ROCE for PYPL over recent years. The ROCE data are the same as those shown in the previous section. The method used to compute the MROCE data is also detailed in my Visa article above and won’t be repeated here. The only note that I will highlight is that during years when there were large fluctuations in either the incremental earnings or the incremental capital employed, a multi-year running average was taken to smooth the fluctuations.

The results shown in the following chart show that at this stage, PYPL has been actually able to maintain an MROCE that is essentially the same as the average ROCE so far. As seen, the ROCE has been on average 62% in recent years, and the MROCE has been on average 65%. And the small difference is most likely due to inevitable uncertainties in the financial data and rounding off errors. So, this result suggests that PYPL has not reached the stage of diminishing return yet – gravity has not caught up yet. And if the current MROCE continues, PYPL will continue its high and consistent ROCE.

Source: author and Seeking Alpha data.

PYPL Stock Valuation And Growth Potential

In terms of valuation, PYPL’s current valuation is compressed both in absolute and relative terms. There is about $8.6 of cash behind each PYPL share, about 8.6% of the share price. Therefore, in absolute terms, adjusted for the cash position, PYPL’s owner’s PE is only about 18x.

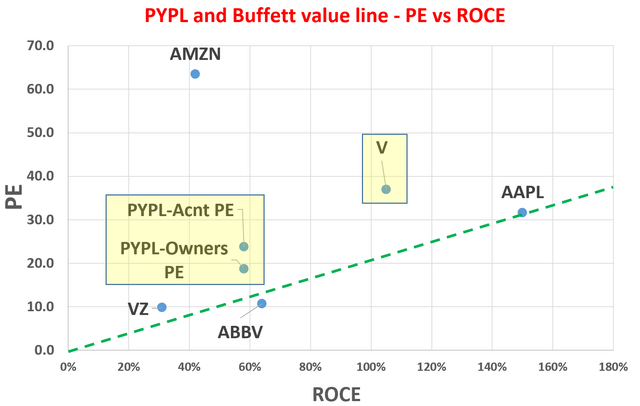

In relative terms, such a valuation is substantially below the overall market even though PYPL’s profitability is more than 2x better than the overall market (62% of ROCE vs. about 20% for the overall market). As a more visual way of showing valuation adjusted for quality, the next chart is my favorite chart. It compares the PE vs. ROCE for various Buffett-type businesses. Instead of looking at PE alone, it makes more sense to look at PE in the context of quality.

The green line is what I call the Buffett value line. It is a line linking A) the origin (a business that has 0 ROCE should be worth 0x PE), and B) Buffett’s largest holding AAPL (which happens to have the highest ROCE among this group of stocks). As you can see, PYPL’s valuations are really close to this line now, and Visa is far above it on the other hand.

Source: author and Seeking Alpha data.

Looking forward,

- I see PYPL’s total return in the long term in the double-digit range (projected to be ~11%). The total returns are a balanced combination of current earning yield (about 4.7%) and organic growth rates (about 6.5%).

- A few catalysts could push the growth rate even higher. For example, its Venmo partnership with Amazon will further augment its scale. And it could grow through acquisitions too. It recently completed its $2.7 billion purchase of Japanese-based buy now, pay later operator, Paidy.

- In the longer term, PYPL is well-positioned to benefit from the unstoppable trend of our world’s unstoppable transition into digital payment. Even though PYPL had already captured 392 million verified users, the reality is that the majority of the world has yet to migrate to digital payment. In the long term, PayPal should benefit from the economic development of underserved regions.

- Also, note that this projection assumed no change in its valuation. I expect its profit scalability and sustainability to drive a dramatic change in the compressed valuation. If this materializes, it would add to the total return.

- Finally, a word about Visa. As you can see, my projection shows that Visa provides a similar level of total return potential. Although the composition of the return is different. In Visa’s case, its total return will mostly come from growth because of A) its elevated valuation, and B) its higher ROCE. I do not see a bad choice here – both PYPL and Visa are excellent businesses with double-digit long-term return potentials. Investors just need to pick the one that suits their own risk profile and preference.

Risks

- PYPL is facing headwinds recently in customer acquisition. Despite its different engagement strategies, customer acquisition is expected to slow down dramatically. Management expected to add 15-20 million new customer accounts in 2022, a far cry from its past days when it added 10 million or more new accounts per quarter. Although at its current valuation, it does not need neck-breaking growth rates to provide a decent total return.

- In the long term, PYPL is in competition with other larger payment companies. PayPal is still substantially smaller than Visa or Mastercard. At the same time, as aforementioned, the ROCE of Visa is also substantially higher than PYPL.

- Finally, its role in the ongoing FinTech evolution is uncertain too with ample crises and opportunities. It is possible that banks and other new FinTech solutions can bypass PYPL as a middleman and just perform bank-to-bank transactions. On the other hand, crypto also provides a potential growth opportunity. PYPL is certainly well-positioned to participate in the infrastructure and support services for crypto-based payment solutions.

Conclusion And Final Thought

This article analyzes PYPL with a focus on its scalability and valuation and return potentials (especially compared to Visa). The main takeaways are:

- PYPL not only earns a consistently high ROCE in the past but is still perfectly scalable at its current stage, indicating sustainable profit ahead. The ROCE has been on average about 62% and the MROCE has been on average 64% in recent years.

- Finally, even assuming its valuation remains compressed, it is projected to deliver a double-digit return in the long term already, primarily consisting of current owners’ yield. I expect its profit scalability and sustainability to drive a dramatic change in the compressed valuation. If this materializes, it would further increase the total return. In contrast, in Visa’s case, the total return will mostly come from growth given its elevated valuation.

Thanks for reading! Look forward to your comments and thoughts!

Be the first to comment