Justin Sullivan/Getty Images News

For a leading fintech, PayPal Holdings (NASDAQ:PYPL) went through some dark days during early 2022. From a normalization of e-commerce and online payments, albeit at higher levels, to a strange bid for a social media platform, the company appears to have finally hit rock bottom. My investment thesis is Bullish on the fintech returning to 20% growth after removal of eBay (EBAY) headwinds and rewarding shareholders no longer enamored with PayPal.

Normalizing Back At 20%

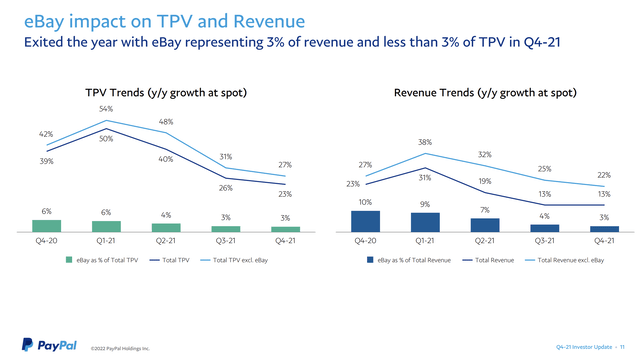

As with a lot of fintechs and tech related stocks, Covid shifted a large portion of transactions online causing a boost in revenues. PayPal was no different with revenues pulled forward thru Q2’21 when ex-eBay growth was still sailing above 30%.

Source: PayPal Q4’21 presentation

At the time, eBay was still close to 10% of total revenues. Over the last couple of years, eBay has moved to a new payments system stripping PayPal from the business and causing a major headwind to the TPV trends. Not to mention, eBay saw a major boost in volumes due to Covid pull forwards.

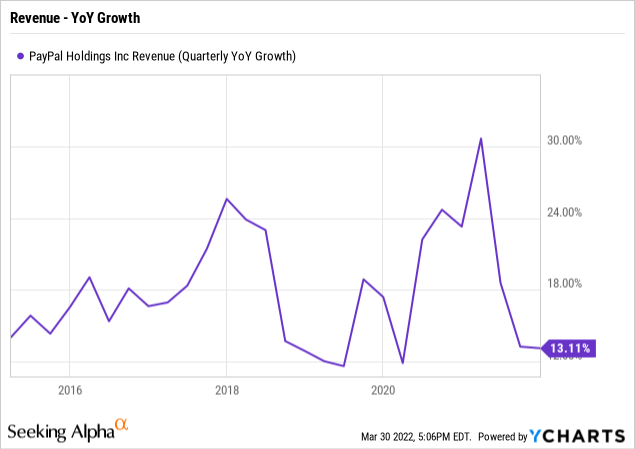

The combination of losing peak eBay volumes with Covid pull forwards from their other revenue sources is exasperating the trends and making the current PayPal business appear far worse than reality. After all, the company would’ve reported a dip in revenue growth from a peak of 38% in Q1’21 to a forecast for only 14% in Q1’22.

The numbers appear even worse when adding on the escalated losses of the eBay business. The Q4’21 reported revenue growth of only 13% combined with guidance for only 6% growth in the current quarter made the market nervous.

Over the last decade, PayPal had traditionally bounced around the 20% growth rates. Investors should value the stock based on growth rates slightly below 20% as the company scales to a nearly $30 billion business this year.

Lucky Misses

The biggest lucky miss for shareholders is that PayPal didn’t acquire Pinterest (PINS). The rumored $45 billion deal at ~$70 per share was terminated as PayPal shareholders balked at the idea.

The social media company has struggled since the rumored deal from last October. Nearly 6 months later, Pinterest now trades below half the rumored buyout price due to losing users from the peak Covid pull forward numbers.

Any potential investor that missed the boat on the Covid surge can now luckily buy the stock for a fraction of the $310 peak just last July. PayPal is now back to more reasonable valuations and trades back at 2019 levels despite the substantial revenue growth during the period. The stock now only trades at 20x 2023 EPS targets of $5.83. Analysts generally forecast earnings growth surging back above the 20% clip by 2023 with the eBay headwinds basically resolved in 2022.

While the payments firm appeared to face dark days when reporting Q4’21 numbers and slashing 2022 targets, the reality is that the eBay headwinds will quickly pass and the reduced active customer growth is a symptom of the Covid pull forwards.

At the time, PayPal reported a 2022 guidance of $4.60 to $4.75 in EPS versus the consensus estimate of $5.26 due to the active account trend. The fintech only guided to new active account growth of 15 to 20 million for the year after growing 120 million actives in the prior years.

The company taking a $0.50+ EPS hit for 2022 with official reported revenue growth of just 6% in Q1’22 made the market think dark days had arrived. In reality, PayPal is innovating with new financial products and expanding Venmo beyond just P2P payments.

Despite the weak new accounts, PayPal forecasted strong payments volume growth of at least 19%, as new and existing customers engage at higher levels. The payments volume growth isn’t representative of a stock that should trade back at 2019 levels after a couple of fabulous years.

Takeaway

The key investor takeaway is that the stock still trades down at $118, as the company will need to report some accelerating growth following the Q1 numbers in order to attract investors back. The ex-eBay guidance numbers are still solid 14% revenue growth during the quarter and any improvement in this number along with the headwind disappearing will have PayPal trading back at elevated levels again.

Investors should use these dark days to start loading up for when PayPal returns to more normalized growth rates.

Be the first to comment