Justin Sullivan

Perhaps no payment processing company in the world is as well-known as the industry giant PayPal Holdings (NASDAQ:PYPL). In recent years, the company has grown at a nice pace and has been a true cash cow. The current fiscal year is looking a bit mixed, but the overall trajectory for the company is still positive. Shares of the enterprise are definitely getting closer to fair value, but on the whole, they do still want to be cheap enough to warrant some upside potential. And because of that, I have decided to retain my ‘buy’ rating on the firm, which means that I feel it should still continue to outperform the broader market for the foreseeable future.

The picture is mixed

Back in April of this year, I wrote an article that looked upon PayPal Holdings in a favorable light. I called the company undervalued, citing its relative valuation compared to similar firms. I also acknowledged that the firm had done well to grow both its top and bottom lines over the past few years. I was particularly enamored by the amount of cash that the company generates and I felt like this trend, in the long run, would continue. All of this, combined, eventually led me to rate the business a ‘buy’. So far, that call has played out quite well. While the S&P 500 has dropped by 1.6% since that article was published, investors in PayPal Holdings would have seen an increase of 14%.

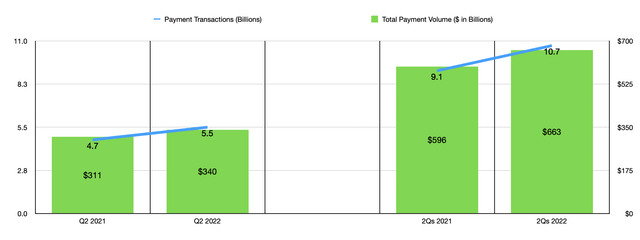

This is quite a nice improvement and it was driven by continued strong performance for the company from a top line perspective. Consider, for instance, how things have gone so far this year. In the second quarter of the year, sales came in at a robust $6.81 billion. That represents an increase of 9.1% compared to the $6.24 billion generated the same quarter just one year earlier. This was driven by a number of factors, including the number of active accounts on the platform rising from 403 million to 429 million. Total payments processed grew from 4.7 billion to 5.5 billion, with the value of those transactions climbing from $311 billion to $340 billion.

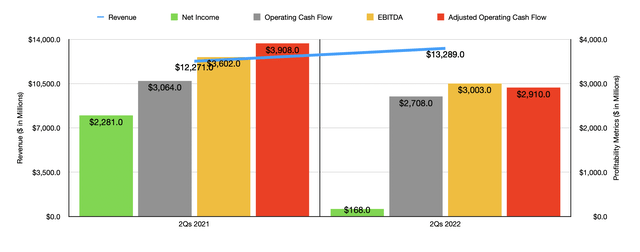

Of course, this was only the latest example of strong performance from the company. For the first half of the 2022 fiscal year as a whole, sales came in at $13.29 billion. That’s 8.3% higher than the $12.27 billion generated the same time one year earlier. This came as the number of transactions processed grew from 9.1 billion to 10.7 billion, while total payment volume rose from $586 billion to $663 billion.

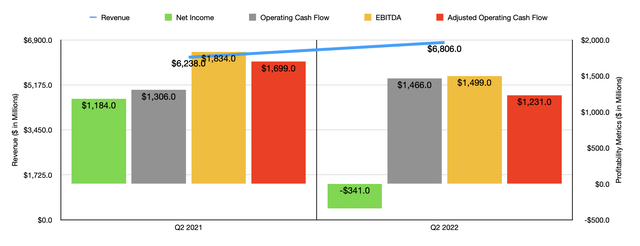

So far so good. But unfortunately, not everything for the company has been positive. Although revenue increased, profitability did take something of a beating. In the latest quarter alone, the firm generated a net loss of $341 million. That compares to the $1.18 billion profit achieved the same time one year earlier. Management attributed this to an 18% increase in total operating expenses that were, in turn, largely driven by an increase in transaction expense and to increases in transaction and credit losses. The 21% increase in transaction expense came in large part as a result of a greater proportion of its total payment volume coming from unbranded card processing activities. These generally, according to management, have higher expense rates than other products and services a company has. The company also suffered some from an unfavorable change in funding mix. When it comes to transaction and credit losses, meanwhile, the company cited a loss associated with an ongoing merchant insolvency proceeding. However, there were other factors at play as well, such as fraud schemes and higher expenses impacting its Venmo products and services during the quarter. Activities on Venmo are now eligible for coverage by the company’s protection program. So any losses that do occur under that umbrella need to be made up for.

Other profitability metrics for the company were somewhat mixed. For instance, operating cash flow went from $1.31 billion in the second quarter of 2021 to $1.47 billion in the second quarter of this year. If we adjust for changes in working capital, however, this number would have actually dropped from $1.70 billion to $1.23 billion. Meanwhile, EBITDA for the company also dropped, declining from $1.83 billion to $1.50 billion. This weakness also impacted the results for the first half of the year as a whole. Net income of $168 million was far surpassed one year earlier by the $2.28 billion in profits the company achieved. Operating cash flow fell from $3.06 billion down to $2.71 billion. If we adjust for changes in working capital, it would have looked even worse, plunging from $3.91 billion to $2.91 billion. Meanwhile, EBITDA declined from $3.60 billion to $3 billion. To address these profitability concerns, management is cutting costs actively. In fact, management believes that it will cut expenses by the end of this year in the amount of $900 million, a number that should translate to an annualized improvement starting in 2023 of $1.30 billion. This temporary pain on the bottom line also does not stop management from initiating a $15 billion share buyback program. If this sounds overly ambitious, consider that in the first half of this year alone, the company repurchased $2.25 billion and, for the year as a whole, is targeting $4 billion in buybacks.

For the 2022 fiscal year as a whole, management expects that total payment volume will rise by about 12%. Factoring in foreign currency fluctuations, this number increases further to 16%. Overall revenue for the company should come in about 10% higher than what it was in 2021, with that number rising modestly to 11% if current foreign currency fluctuations are being accurately reflected. This increase will be driven in part by the addition of 10 million net new customer accounts. Management is currently forecasting earnings per share of between $1.52 and $1.62. However, if we use the adjusted figures, this should be between $3.87 and $3.97. This particular guidance is greater than the $3.85 analysts were previously anticipating for the current fiscal year. This would translate to net income for the year of roughly $4.54 billion on an adjusted basis. No guidance was given when it came to other profitability metrics. But if we were to annualize results experienced so far for the year, we would get operating cash flow of roughly $5.60 billion and EBITDA of $4.35 billion.

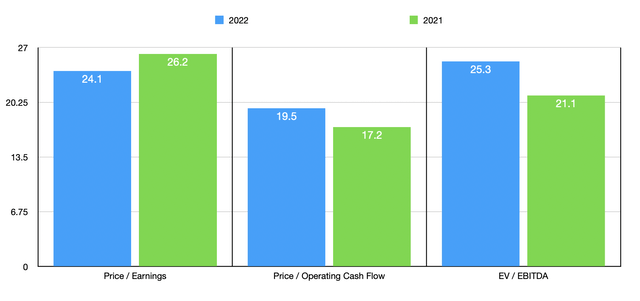

Taking this data, valuing the company becomes fairly straightforward. On a forward basis, the firm is trading at a price-to-earnings multiple of 24.1. This compares to the 26.2 multiple that we get if we use 2021 results. The price to operating cash flow multiple should increase some from 17.2 to 19.5, while the EV to EBITDA multiple should climb from 21.1 to 25.3. To put this in perspective, I compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 34.1 to a high of 71.6. Only one of the four companies with positive results ended up being cheaper than our prospect. Using the price to operating cash flow approach, the range was from 12.3 to 66.8. Compared to our 2021 figures, only one of the companies was cheaper than PayPal Holdings. When it comes to the EV to EBITDA approach, the range was from 14.7 to 60.4. In this scenario, two of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| PayPal Holdings | 26.2 | 17.2 | 21.1 |

| Automatic Data Processing (ADP) | 35.7 | 33.5 | 24.2 |

| Fiserv (FISV) | 34.5 | 17.7 | 14.7 |

| Fidelity National Information Services (FIS) | 71.6 | 12.3 | 18.4 |

| Block (SQ) | N/A | 66.8 | 60.4 |

| Paychex (PAYX) | 34.1 | 31.3 | 23.0 |

Takeaway

For the most part, PayPal Holdings continues to be a growth machine. Admittedly, profitability is suffering to some extent this year. But that should be viewed as a temporary bump in the road. To be clear, shares of the company are not exactly cheap. But compared to similar firms, they do look quite affordable at this point in time. The firm also continues to expand from a customer account perspective and from a revenue perspective. Long-term, I do think that trend will continue. But I do also think that the easy money has been made for investors, likely meaning that further upside, while certainly probable, will not be quite as great as it was previously.

Be the first to comment