ipopba/iStock via Getty Images

A Quick Take On Paymentus

Paymentus Holdings, Inc. (NYSE:PAY) went public in May 2021, raising approximately $210 million in gross proceeds in an IPO that priced at $21.00 per share.

The firm provides payment solutions for a variety of customer verticals seeking omni-channel capabilities.

I’m cautious on PAY for the near term due to its worrying GAAP Operating Income trend and the potential for a recession that is already underway.

Paymentus Overview

Redmond, Washington-based Paymentus was founded to develop a cloud-delivered payment technology stack for financial institutions and other businesses to provide omni-channel payment services with customers.

Management is headed by founder, Chairman and CEO Dushyant Sharma, who was previously co-founder of Derivion, a SaaS electronic billing company.

The company’s primary offering features include:

-

IPN – Instant Payment Network

-

Engagement

-

Presentment

-

Empowerment

-

Payment

-

Intelligence

The firm seeks relationships with billers via a direct sales and marketing model and with no development or implementation fees required.

Paymentus’ Market & Competition

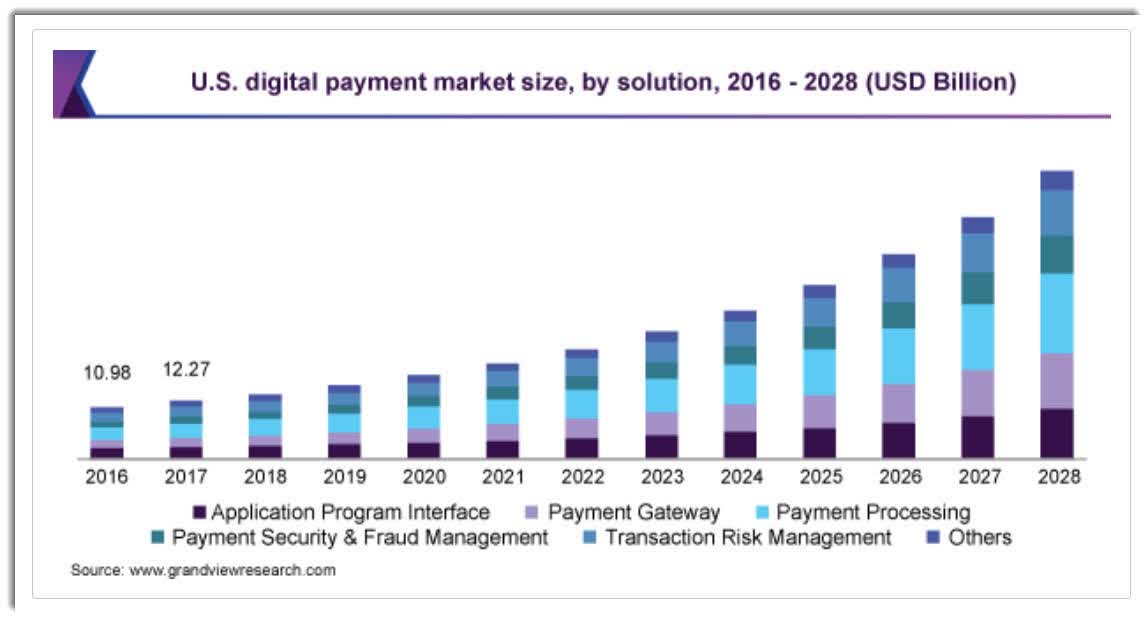

According to a 2021 market research report by Grand View Research, the global market for digital payments (as a proxy) was an estimated $58.3 billion in 2020 and is expected to reach $241 billion in 2028.

This represents a forecast very strong CAGR of 19.4% from 2021 to 2028.

The main drivers for this expected growth are continued high adoption of smartphones, growth in e-commerce and rising internet penetration and adoption of online payment technologies.

Also, the chart below shows the historical and projected U.S. digital payments market by solution type, from 2016 to 2028:

U.S. Digital Payment Market (Grand View Research)

Major competitive or other industry participants by type include:

-

Legacy solution providers

-

Internal financial institution systems

-

Phone-based payments

Paymentus’ Recent Financial Performance

-

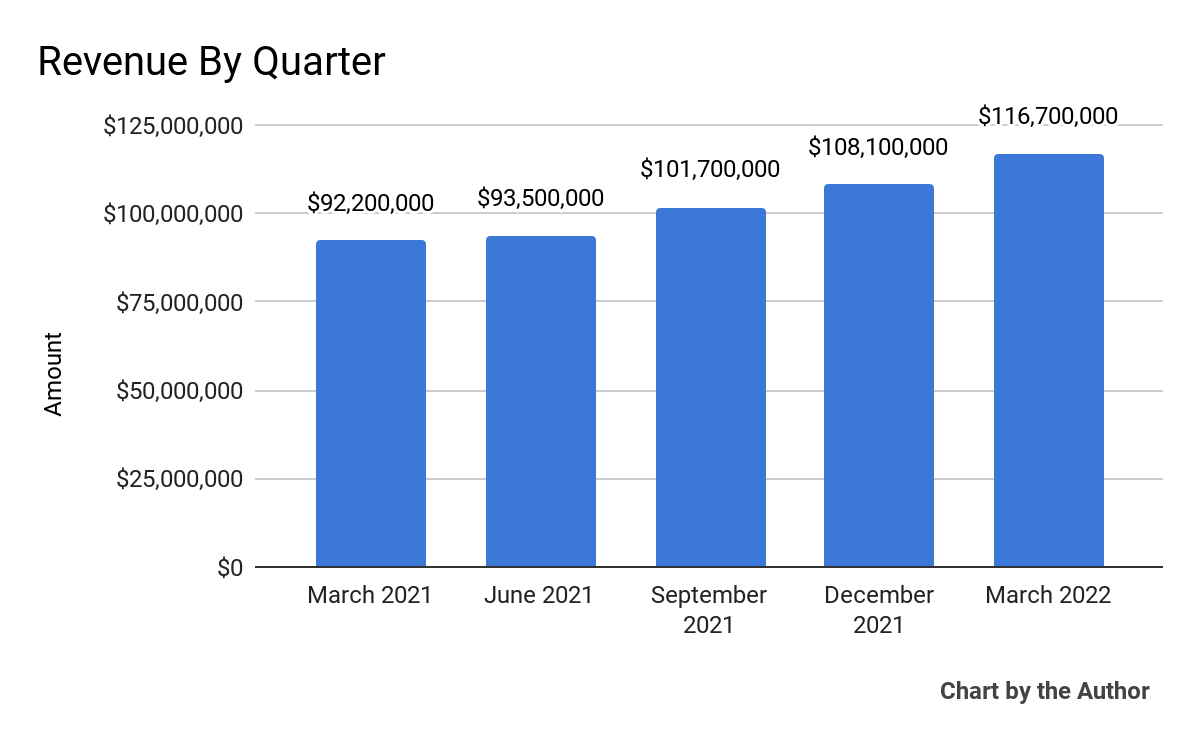

Total revenue by quarter has grown steadily in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

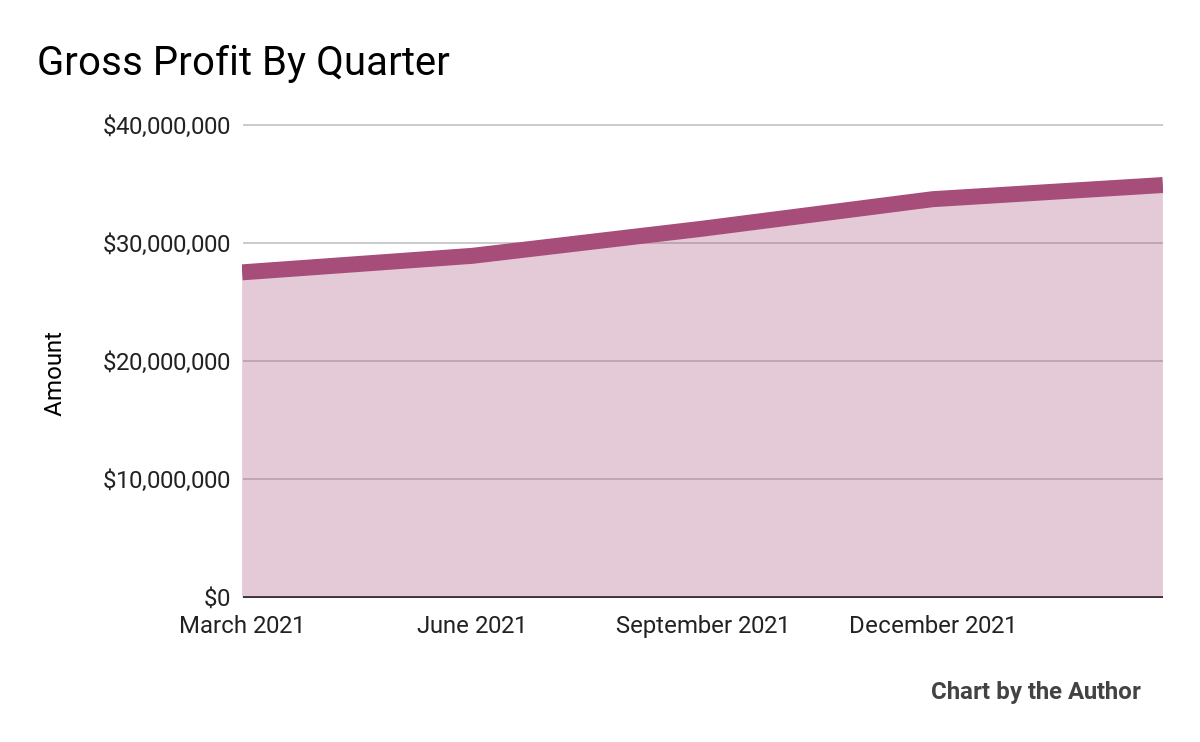

Gross profit by quarter has grown by a similar trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

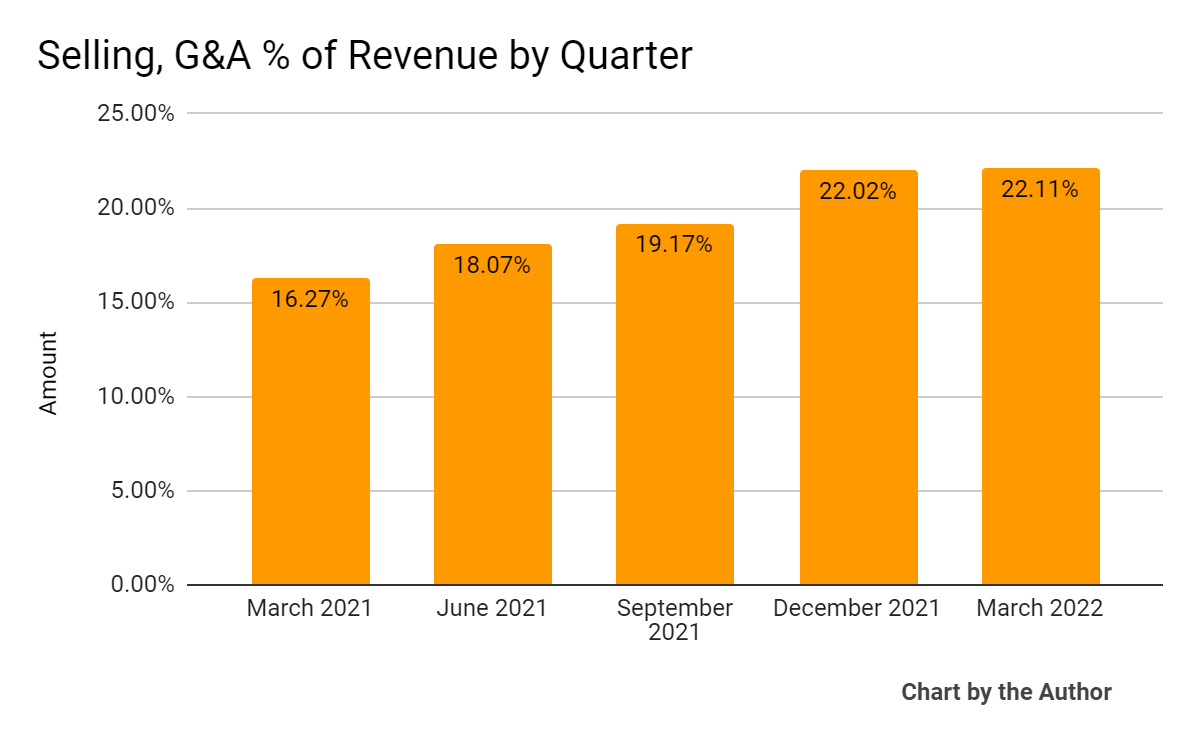

Selling, G&A expenses as a percentage of total revenue by quarter have risen as revenue has increased:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

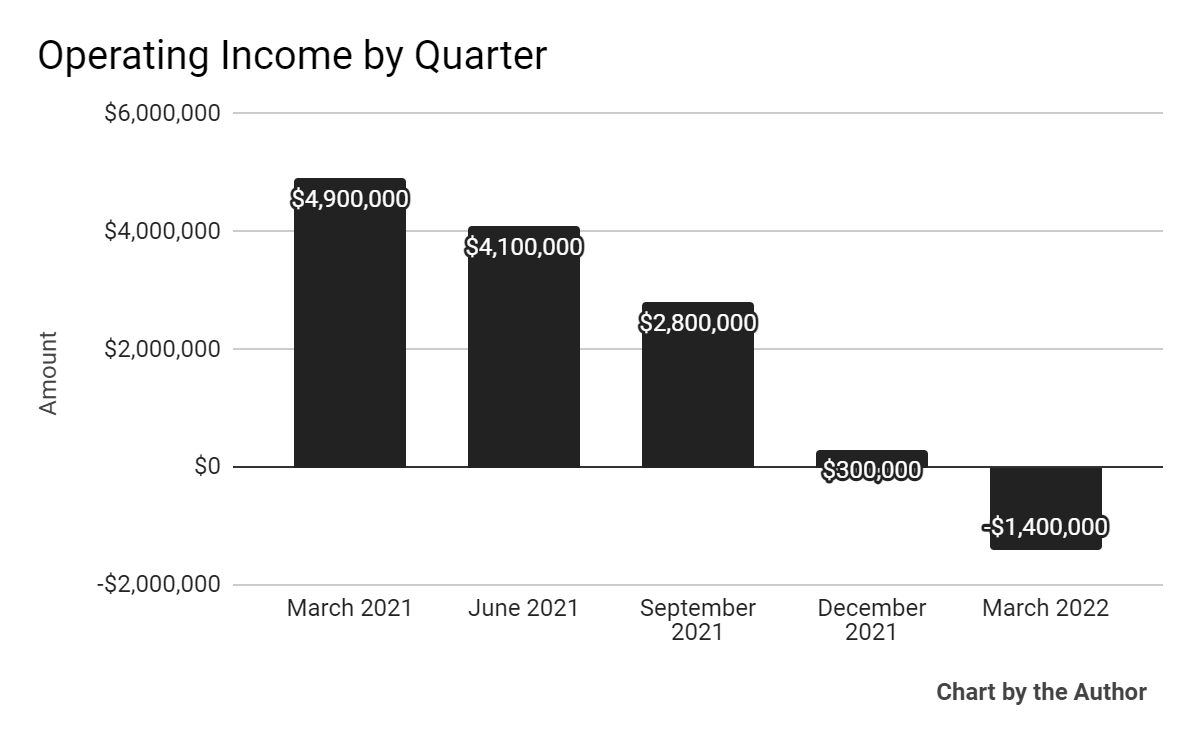

Operating income by quarter has swung into negative territory in the most recent quarter:

5 Quarter Operating Income (Seeking Alpha)

-

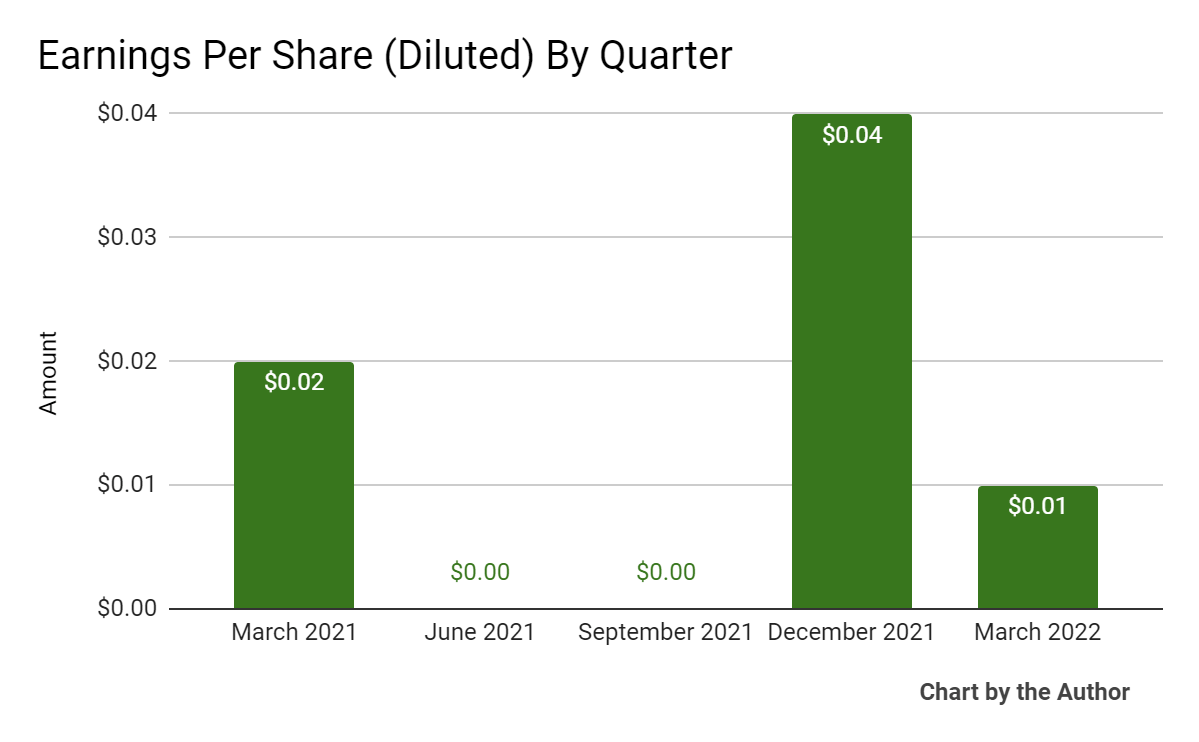

Earnings per share (Diluted) have been at breakeven or positive, although uneven:

5 Quarter Earnings Per Share (Seeking Alpha)

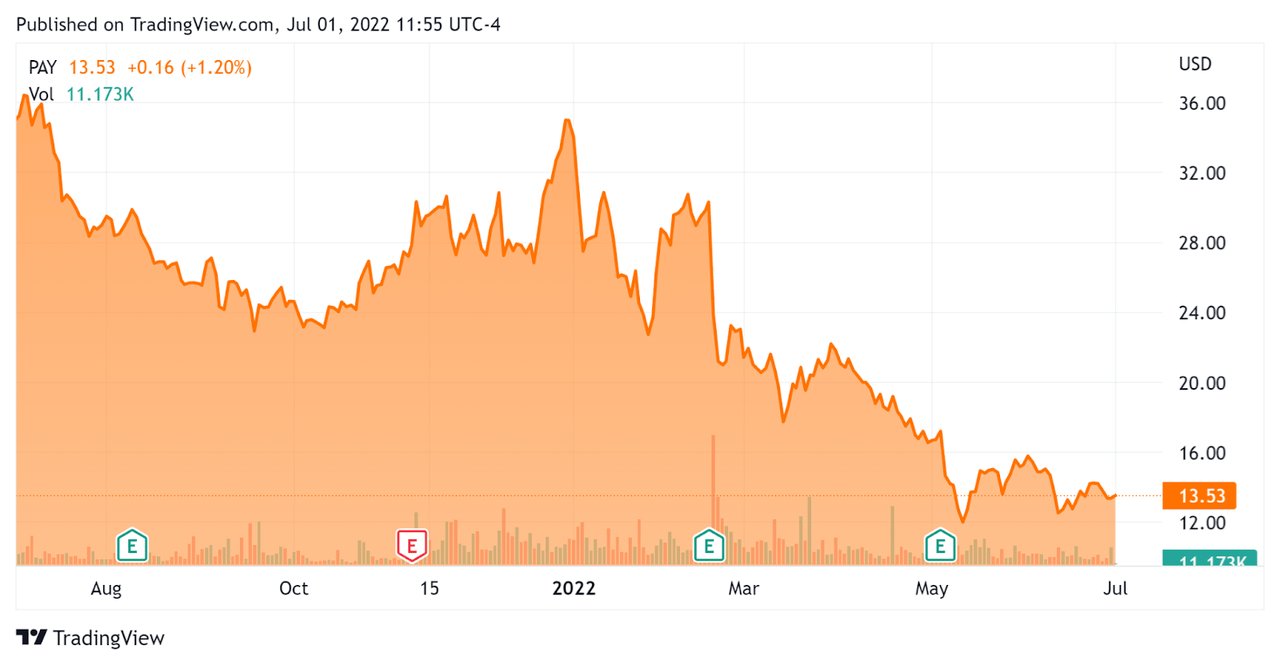

In the past 12 months, PAY’s stock price has dropped 61.5 percent vs. the U.S. S&P 500 index’ drop of around 12.8 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Paymentus

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$1,620,000,000 |

|

Enterprise Value |

$1,470,000,000 |

|

Price / Sales [TTM] |

3.73 |

|

Enterprise Value / Sales [TTM] |

3.50 |

|

Operating Cash Flow [TTM] |

$15,560,000 |

|

Revenue Growth Rate [TTM] |

29.47% |

|

CapEx Ratio |

11.10 |

|

Earnings Per Share |

$0.05 |

(Source – Seeking Alpha)

Commentary On Paymentus

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted crossing an annual run rate of $100 billion in payments volume amid a greater diversity of clients.

The company saw recent client wins in the verticals of city services, insurance and mortgage payments, while it saw a reduction of utility clients to under 40%.

PAY also sought to increase relationships in the telecom and multi-family real estate sectors.

Management seeks customers in areas that are non-discretionary and pre-occurring.

As to its financial results, transaction volume increased 40.9% year-over-year and revenue growth was 26.5% while contribution profit rose by 35%, growing faster than revenue due to improved transaction mix.

Contribution profit per transaction was flat at $0.54, ‘ahead of expectations,’ but management said ‘we do not anticipate that tailwind to carry forward in the subsequent quarters.’

However, Selling, G&A % of Revenue has been steadily rising and GAAP Operating Income turned negative in the most recent quarter and has been trending in a negative direction over the past 5 quarters, as my chart earlier in this report shows.

Looking ahead, management increased its 2022 revenue guidance to around 25% growth year-over-year and contribution profit growth to around 30.5%.

Notably, the firm doesn’t believe the current inflationary environment ‘will have a negative impact on our top line.’ But, that belief doesn’t extend to its bottom line, as PAY has to deal with wage inflation and other increasing costs of doing business.

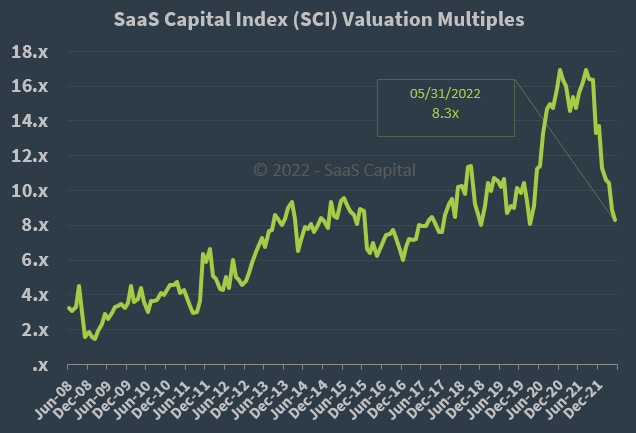

Regarding valuation, the market is valuing PAY at an EV/Sales multiple of around 3.5x, which is quite low for a SaaS company.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 8.3x at May 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, PAY is a relative bargain at forward EV/Revenue of around 3.0x.

But, the primary risk to the company’s outlook is slowing growth from a U.S. recession impacting payment volumes.

If a recession is shallow, the firm could see an upside catalyst later in 2022 depending on guidance and future results.

In any event, I’m cautious for PAY in the near term due to its worrying GAAP Operating Income trend and the potential for a recession that is already underway.

I’m on Hold for PAY until we see a reversal of its operating income metrics and how the firm performs in Q3.

Be the first to comment