grinvalds/iStock via Getty Images

Paycom Software, Inc. (NYSE:PAYC) is based in Oklahoma City and has considerable nationwide influence as a human resource technology and solutions provider. Operating in the world’s largest market, the company is widely known for being innovative and practical in the solutions to its clients. Companies are fast approaching complete adoption of SaaS, a tool that has left little doubt in its ability to solve large-scale solutions. Paycom did well to specifically target human capital management.

ycharts.com

We will take a closer look at the company’s ability to provide software solutions to its clients that can help with management and how Paycom is managing its affairs, including its large employee base and growing revenues. The more the company’s financial statements and position in the industry are uncovered, it doesn’t take long to gain a sense of optimism in the company’s stability, making it an excellent selection for bullish investors.

Paycom Services & News

Paycom offers its software-as-a-service (SAAS) by providing cloud-based solutions for human capital management (HCM). These include solutions for talent acquisition, talent management, payroll, HR management, and time and labor management tools. By providing functionality and data analytics to businesses, they are able to completely manage the HCM process from beginning through to end. In a world where companies have to manage thousands of employees across different geological locations, such as Paycom, which employs over 5000 individuals, these internet-based tools have become increasingly popular as medium and large corporations see the benefits of their implementation.

Paycom was added to the S&P 500 at the beginning of January and was listed 6th in the top 100 Fastest-Growing Companies according to Forbes magazine in 2019. The criteria were based on the company’s revenue performance, as well as profits and stock returns, and included companies with an average annual return of 29% over the three years leading up to the publication. The company’s most recent accolades include being included in Fast Company’s top ten most innovative companies, published in March this year, with Paycom landing 7th. The company’s innovation is nothing new, as it is also credited with being one of the first complete online payroll providers. Finally, the company’s Better Employee Transaction Interface (BETI) software, the first self-service payroll platform, was recognized as the top HR product of the year.

Paycom also saw a solid end to 2021, with the company reporting a 9% customer increase to a total of over 33,8875, or about 5% of the total addressable market. The company expanded its target enterprises from companies with 5,000 employees to up to 10,000 employees. In the final half of the year, the company oversaw the opening of five new sales offices in Brooklyn, Cincinnati, Kansas City, Nashville, and Pittsburgh.

SaaS Growth

The SaaS market has been rapidly growing over the years as more and more companies adopt this tool as a means to manage their resources efficiently. By 2021, the total market value was reported at $145.5 billion, growing at an annual growth rate (CAGR) of 18%. This corresponds to a total market value of $108.4 billion in the United States alone, where over 15,000 companies use SaaS, out of the global 24,469 in total. While the clientele is in the thousands, the use of the aforementioned companies correlates to 14 billion customers worldwide. Looking at the largest market, the United States is expected to reach a total market value of $225 billion by 2025, where 61.3% of all SaaS companies are currently located. The global SaaS revenue is estimated to reach $369.4 billion by 2024, at the current growth rate, with the US continuing to lead the way.

Paycom has done considerably well when compared to its competitors. Despite having only a small share of the overall market, and an even smaller share by revenue at 0.39%, sales growth surpassed the market average. At the same time, the quarterly revenue growth reported by Paycom was 11.24% in Q4’21, only slightly better than the market average of 11.8%. However, looking at the year-on-year growth demonstrates the major difference, with Paycom reporting a 28.98% growth, compared to the average 21.1% market average reported by its competitors.

While these numbers are good, individually they are not enough to take a bullish stance on, given that smaller companies have a higher probability of experiencing rapid growth leaps as opposed to larger or more established corporations. Paycom’s competitors are massive, with the likes of Microsoft and Salesforce dominating the market. Still, they are leaders within their specific sector and should be able to reflect that with their financials.

Internal Management

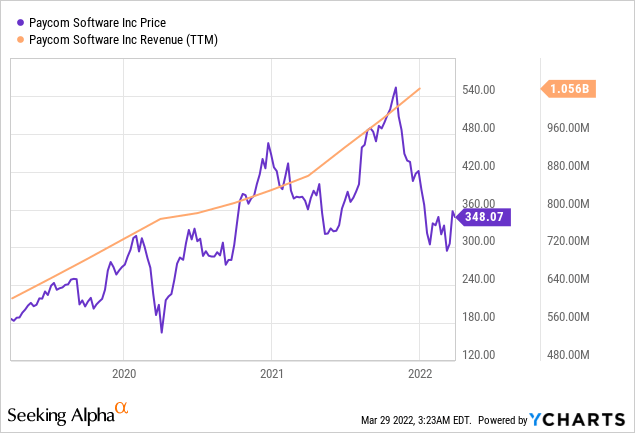

ycharts.com

Paycom broke past the billion-dollar mark in 2021 after reporting a full-year revenue of $1.05 billion. This represented a 25.4% year-over-year increase from the $841.434 million reported in 2020. Quarterly revenue rose steadily after experiencing a slight dip from the first quarter, finishing at $284.986 million by the end of the quarter, or 29% higher than the same quarter in the previous year.

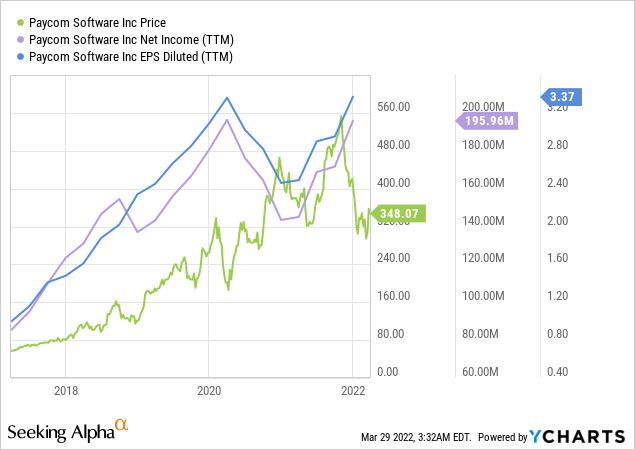

The functionality offered by the company’s BETI software, allowing employees to DIY their payroll, helped drive sales throughout the year. GAAP net income in the final quarter was reported at $48.7 million, representing a $24.3 million appreciation from the fourth quarter in 2020, or almost double the income appreciation in 12 months. Income for the entire fiscal year finished at $196 million, compared to the $143.5 million total income reported in the previous year. Earnings per share in the fourth quarter also saw a rise from $0.42 per diluted share in Q4’20 to $0.84 per diluted share in the last quarterly report.

ycharts.com

The opening of new offices and the popularity of their HR SaaS will continue to drive revenue and income properly. Several costs are incurred with continued expansion, such as the increased headcount seen last year, which could affect the company’s profit margins. Net income applicable to shareholders was reported at $195.96 million at the end of the year, and while this is better than the $143.45 million reported in 2020, it isn’t much higher than 2019’s pre-pandemic figure of $180.58 million. This is still an improvement, which should reflect in the coming quarters as the company continues to spearhead HR software services.

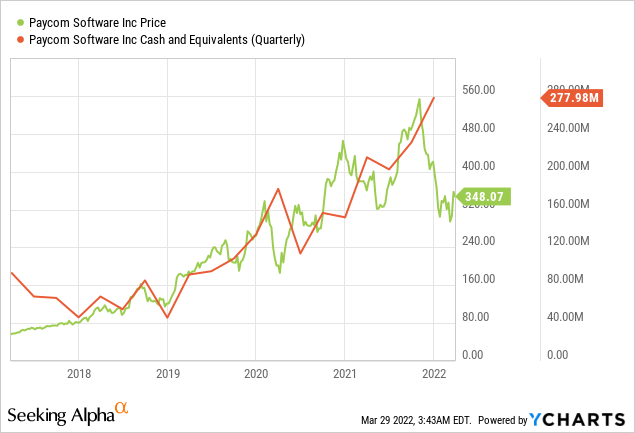

ycharts.com

Paycom finished with higher cash and cash equivalents with a reported $278 million by the end of 2021. Total net debt was slightly lower, down from $30.9 million to $29.2 million. However, the highlight of the year was in the company’s retention rate. While it only saw a 1% uptick from the year before, this still represented annual revenue retention of 94%, a record for the company. The fourth quarter is soon coming to an end, with the company’s financial guidance targeting revenues of over $340 million for the first quarter of 2022. If they can keep up the annual revenue retention rate, the company is on course for another successful year.

Conclusion

Paycom could not hope to pitch its products to large companies, especially those with the employee count it is now targeting, without proving that their services work internally. At the start of 2021, the company was listed third in the Top Workplaces USA list after having nabbed a 1st place spot in Oklahoma’s Top Workplaces in December of the previous year. Just under a year later, Paycom was also named the best company for women in the United States, based on the company’s work culture. These awards and recognitions aren’t irrelevant, as they highlight their services by demonstrating first-hand how it should work, and investors shouldn’t take that for granted. If the company is to keep seeing financial success, it will need to keep up boasting success on all fronts, and thankfully there are no signs that things will slow down any time soon.

The company’s ability to provide software solutions to its clients is what enables it to grow revenues. In order to determine the future price action of Paycom, and decide on a potential price target the two most important factors to consider are expected industry growth and the ability to maintain margins so that revenue can yield profits. In the case of Paycom, they operate in a niche within the larger SaaS market, which is expected to see growth of over $80 billion dollars to a total market value of $225 billion over the next three years. By operating in a niche within this market Paycom is able to maintain a stable market share and should as a result be able to capitalize on the brunt of this growth. With regards to profitability, we saw that revenue grew over 25% year over year with income growing to nearly $200 million during the last year in comparison to approximately $140 million in the previous year. This is nearly a year-over-year income increase of 35% demonstrating that profitability has outpaced even the significant revenue growth that we saw. Due to both of these factors, the bullish case for the future of Paycom remains strong.

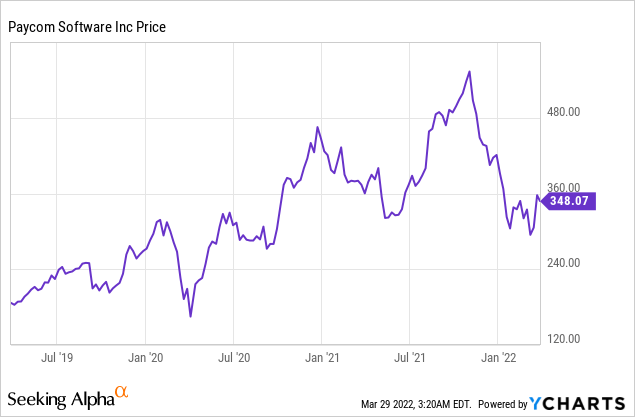

Taking a look at the recent price action of Paycom we can see that over the last year the price is down nearly 37% from highs in early November 2021. This significant dip in price provides in my opinion strong evidence that Paycom is currently undervalued given its future growth potential. Thus currently there is a major opportunity for investors to build a long position and benefit from what I believe will be significant appreciation over the next several quarters. In the short, to medium-term, I believe there is evidence to support at the minimum that the price will surpass the highs that approached $550 during early November. With strong fundamentals and industry growth on the horizon, Paycom Software is a company set to continue to bring outstanding returns to its shareholders.

Be the first to comment