XtockImages/iStock via Getty Images

Introduction

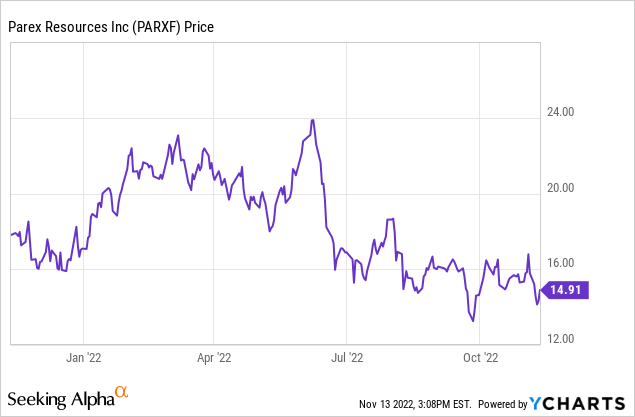

I originally picked up Parex Resources (OTCPK:PARXF) (TSX:PXT:CA) during the COVID-related oil price crisis in Q2 2020 as I figured the company’s low-cost production base and massive net cash position would shield Parex from going under. The share price tripled in the subsequent years (as the company was deemed ‘safer’, its share price stood its ground) and has recently lost about 30-40% since Colombia elected a new leftist president who ran on an anti-oil agenda. However, recent updates seem to indicate the impact on the oil sector may be less severe than originally thought, and that suddenly makes Parex more appealing again.

The free cash flow is still gushing in, despite elevated exploration capex

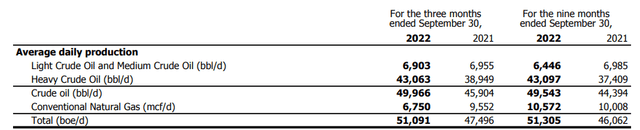

Parex Resources has done a good job in keeping its oil production stable without too much of an effort. The average production rate in the third quarter was approximately 51,100 barrels of oil-equivalent per day and about 98% of the oil-equivalent output actually consisted of oil (with about 86% of the oil classified as heavy oil). While it’s always nice to have some natural gas in the mix as well, especially in Colombia where the natgas prices are pretty stable around $5.5-6/Mcf (Parex recorded an average realized sales price of exactly $6.00 in the third quarter), the total revenue generated by natural gas sales was just over $3.7M making it a negligible by-product.

Parex Resources Investor Relations

During the quarter, the average Brent oil price was $97.70 and the local Vasconia price was $94.05 for a differential of just $3.65 which is one of the lowest levels in a while. This helped to reduce the average differential to the Brent oil price which, at $8.37 per barrel, was also the lowest in a while. Including transportation, the net realized oil price was $11.72 per barrel lower than the Brent oil price.

Parex Resources Investor Relations

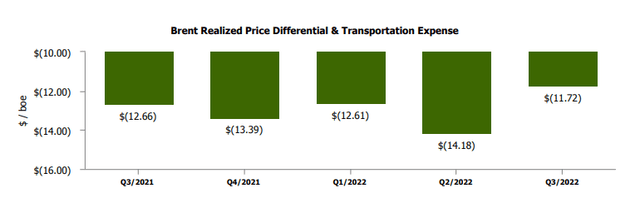

The total revenue during the third quarter was approximately $405M (Parex reports in USD despite being a Canadian company operating in Colombia) and after deducting the royalty payments the net revenue came in at $323M.

Parex Resources Investor Relations

As you can see in the overview of operating expenses above, the cash operating expenses are exceptionally low. While the total amount of opex is just under $174M, $113M of that amount is related to the non-cash depreciation, depletion and impairment charges. Despite this, the pre-tax income of $151M and net income of $66M for an EPS of $0.59 is pretty strong. This means that despite the $77M impairment charge recorded during the quarter, Parex is still trading at just 6 times earnings using a net realized oil price of US$85 per barrel.

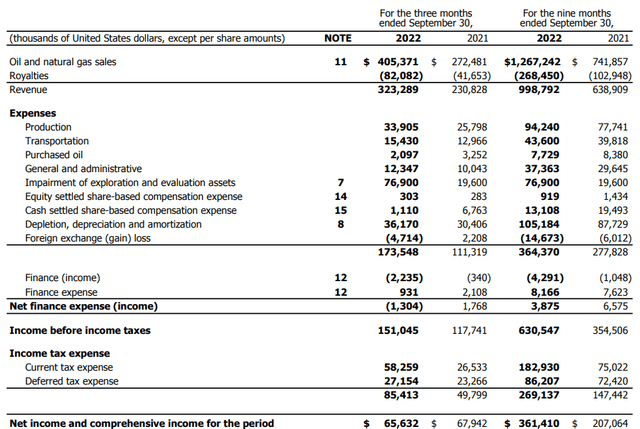

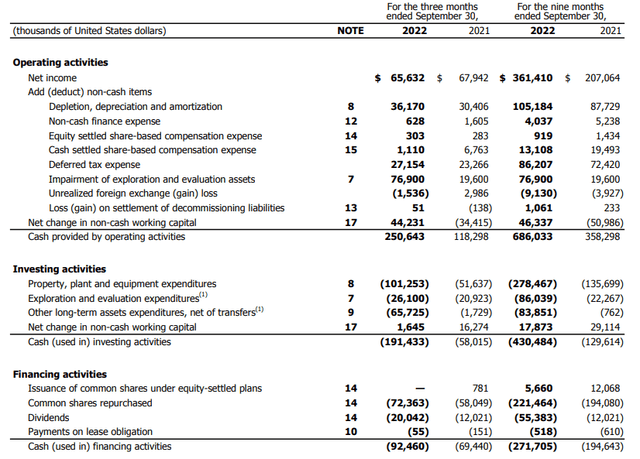

The cash flow result actually shows the impact of the non-cash expenses on the net income. As you can see below, the reported operating cash flow was $250.6M. This includes $44.2M in working capital releases and also includes adding back the $27M in deferred taxes. On an adjusted basis, the operating cash flow before changes in the working capital was $206M.

Parex Resources Investor Relations

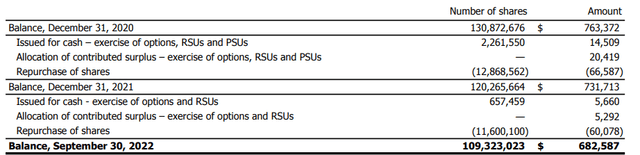

The total capex was $127M as Parex has aggressively ramped up its exploration investments, and despite the elevated capex (which is almost 4 times higher than the depreciation and depletion expenses), the underlying free cash flow was $79M. That’s $0.72 per share or almost C$1 using the current exchange rate. That’s very strong, considering Parex is spending cash at a rate that’s roughly double last year’s spending pattern. On top of that, a substantial amount of cash is used to buy back stock, and in the past seven quarters, Parex has repurchased in excess of 24 million shares which helped to reduce the net share count by just over 21 million to 109.3M shares.

Parex Resources Investor Relations

We see quite a few Colombia-focused companies ramping up their exploration and development plans. Canacol Energy (CNE:CA) (OTCQX:CNNEF) is for instance also spending much more than it used to.

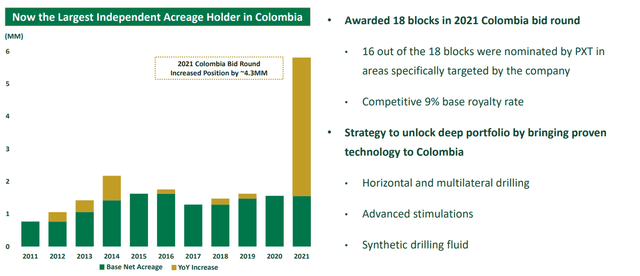

I think there’s two important reasons for Parex to have aggressively ramped up its exploration programs. First of all, the company was awarded 18 blocks in a 2021 acreage ‘auction’. This roughly quadrupled Parex’s land position.

Parex Resources Investor Relations

A second potential reason to increase the investments this year is the uncertainty since the new leftist president was elected in Colombia. The new president ran on an anti-oil platform, so the oil sector should likely expect some flak. However, initial proposals to aggressively increase taxes on oil companies didn’t make it, and a more watered down proposal excluding an export tax is now making its way through the political landscape. Additionally, the president also said existing contracts will be honored, so it looks like the fallout in the Colombian oil sector could actually remain pretty limited.

Investment thesis

I think the main reason why Parex is currently trading at a market cap of $1.65B and an enterprise value of $1.3B (as of the end of September, Parex had a net cash position of $353B despite the high capex bill and its decision to continuously buy back stock) was/is the political uncertainty. It is starting to look like the new tax proposals won’t be anywhere near as severe as the sector feared, and that could provide a boost to Parex’s share price.

I still have a long position in Parex as I picked up the stock in the low-10 range during the 2020 oil crisis, and although I was considering an exit, the more reasonable sounds coming out of Colombia are actually making me consider adding to the position again. The option premiums are quite attractive so perhaps I will write some (out of the money) put options.

Be the first to comment