Gareth Cattermole/Getty Images Entertainment

Investment Thesis

Rising inflation and recession fears have dragged down the whole stock market, and Paramount Global (NASDAQ:PARA) (NASDAQ:PARAA) is no exception. However, the multinational entertainment conglomerate is coming out stronger from the recent merger and the pandemic and currently trades at a deep discount to its intrinsic value. Thus, the strong buy rating is premised upon PARA’s undervaluation with a deep margin of safety of 54.3% and provides a unique medium-term play while paying a fair dividend.

PARA’s Growth Momentum

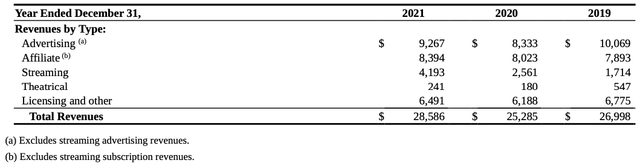

PARA had a great start to the year as the company’s overall gross revenue has increased by 13% YoY during 2021, reflecting growth across all revenue streams. The growth is primarily attributable to an increase in the streaming advertising revenue segment. In addition, the advertisements on streaming services and streaming subscription revenues have meaningfully boosted the company’s revenues. More specifically, the streaming revenues witnessed a yearly increase of nearly 64%, with growth across the company’s overall streaming services.

Favorably, the advertisement services increased by 11%, primarily due to CBS broadcasts of the NCAA Tournament, which was canceled in 2020 because of the pandemic. In addition, the affiliate revenues raised by almost 5%, driven by expanded distribution for domestic cable networks and growth in fees received from television stations affiliated with the CBS Television Network. Finally, despite being the smallest revenue segment, theatrical revenues were up 34% due to a higher number of theatrical releases in 2021, but this is still below pre-pandemic levels when it reached $547 million or roughly 2% of 2019 total revenue.

PARA SEC 10-K Form (Paramount IR)

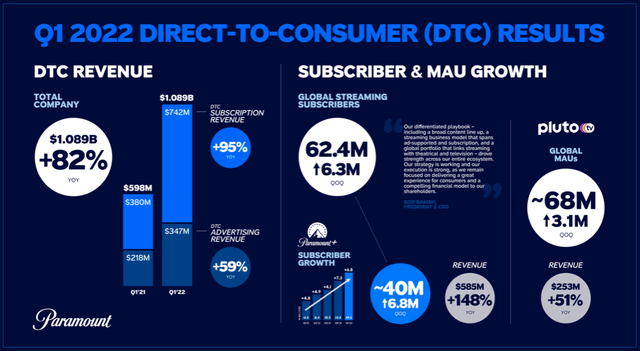

According to the company’s earnings press release for Q1 2022, the company demonstrated continued momentum in Direct-to-Consumer (DTC) services, supported by the addition of 6.8 million Paramount+ subscribers in the quarter, reaching 62 million global streaming subscribers. At the same time, the company’s family of networks delivered a leading share of views, with the CBS being the most-watched broadcast network for the 14th consecutive season.

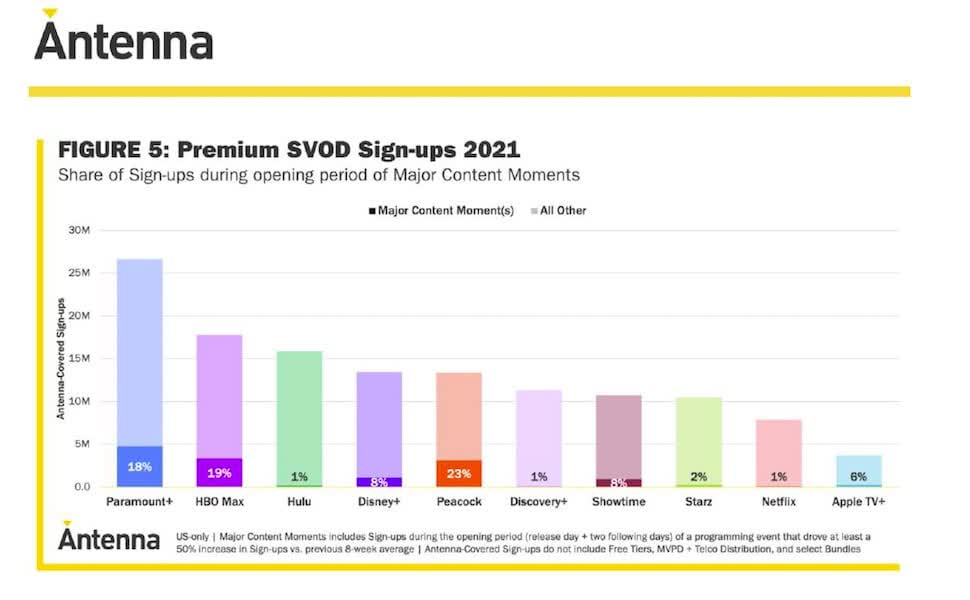

Last but not least, Paramount Pictures had a phenomenal start to the year with several box office hits during the quarter; Scream, Jackass Forever, The Lost City, Sonic The Hedgehog 2, and Top Gun which reached an outstanding milestone of $887.6 million globally. Remarkably, PARA has seen tremendous growth, reporting 27 million US antenna-covered signups during 2021, outperforming all other streaming peers.

Paramount Signups (TheWrap)

Powerful Brand Network & Competitive Advantage

PARA is on track to deliver its long-term goals and has shown strong drive across its business empire, from fast-growing streaming services to highly weighted television programming and top box-office films. The company’s broad content, diversified streaming business model, wide range of platforms, and global operating footprint suggest a compelling growth story in the following years.

Among the differentiators that set the company apart is its international operating scale. PARA is a genuinely global operating company with professional setups in more than 30 markets and a number of studios around the world creating original content. This international presence with an extensive portfolio of cable networks, a larger content library, and a strong brand network is unquestionably a powerful competitive advantage.

By the end of the year, the company’s combined SVOD premium services, including Paramount+ and Sky Showtime, will be available in more than 60 markets with more than 60 partners worldwide. Similarly, Pluto’s streaming service expansion on a global scale will further support the monthly active user base. Moreover, the company’s long-term model targets DTC margins and is bullish about its long-term goal of reaching over 100 million global DTC subscribers and generating at least $9 billion in revenue by 2024.

Favorable Earnings Outlook Ahead With Normalization

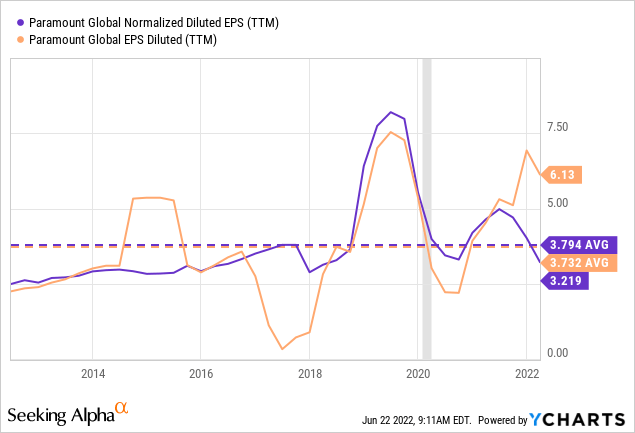

PARA has significant growth ahead; its broad content offering has proven appeal, the dual revenue stream model is attracting subscribers, its content investments are capturing returns, and the global footprint is delivering strategic and financial benefits. As a result, the overall net earnings from continuing operations attributable to PARA increased by 90% in 2021. Similarly, diluted EPS has also jumped from $3.73 to $6.69 per share, reflecting a 79% YoY increase.

However, the abovementioned DEPS growth figure also includes the impact of extraordinary one-off line items, mainly the massive gains on real estate of $2.34 billion, which, if excluded, the adjusted DEPS reports a decline of 17%. Nevertheless, despite the recession fears and current headwinds, the earnings outlook remains favorable, but normalization with reversion to the mean is inevitable.

The Rewards Outweighs The Risks

In the media and entertainment world, unpredictable risks and uncertainties may cause actual performance and results to differ from anticipated. Risks include the inability of PARA to maintain its existing attractive brands and global market reputation. In addition, most electronic media businesses are threatened by changing consumer behavior and related viewership, the evolution of technology, and a change in distribution platforms. As a result, if viewership expectations fall short and underperform, advertising revenue growth will be dragged down. Furthermore, considering that 40% of PARA’s total revenues are generated from advertising, the company remains vulnerable to advertisers’ sentiment and spending as well as exposed to a potential economic downturn.

Also, there are underlying risks in unending PARA investments in new businesses, products, services, and technologies through acquisitions and other strategic initiatives. Additionally, larger competitors such as Netflix (NFLX), Disney (DIS), and Apple (AAPL) have much larger spending budgets and networks for accumulating and maintaining a massive subscriber base.

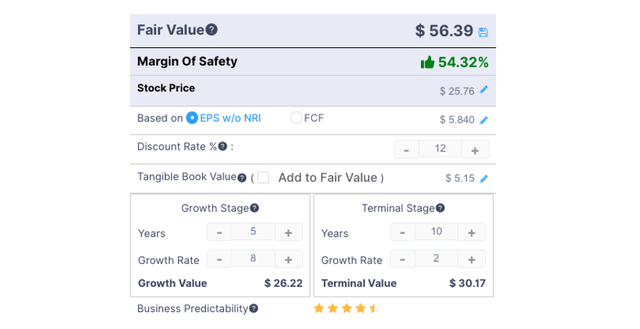

From a valuation standpoint, using a conservative and attainable growth rate of 8% for the next five years as well as a terminal growth rate close to the normalized inflation rate of 2%, the basic DCF model suggests a fair value of $56, implying a 119% upside potential from current levels. Therefore, despite the certain company-specific risks, PARA stock remains attractive at current levels and offers a favorable risk/reward profile.

Author’s calculations using GuruFocus

Last but not least, despite PARA’s cheap valuation with a P/E multiple of just 4.2, investors also enjoy a fair dividend yield of 3.9%. In the past two years, the company declared total per-share dividends of $0.96, resulting in total annual dividends of $625 million and $601 million for 2021 and 2020, respectively. Thus, it is reasonable to expect the payout ratio to increase in the following years in light of improved margins, supporting a higher total return for investors.

Conclusion

Following the merger of Viacom/CBS, Paramount Global has become a rebranded powerhouse with a solid portfolio of leading cable networks, strong brands with a global footprint, and a growing content library. With the current growth momentum, especially in streaming revenue, PARA remains undervalued and offers an attractive entry point with a fair dividend yield.

Be the first to comment