Studio4/E+ via Getty Images

Investment Thesis

Palantir Technologies Inc (NYSE:PLTR) may have reduced its FY2022 guidance then, but its forward execution is likely revised upward significantly by now. The latter is natural as a result of its numerous new partnerships in recent months. Though investors had previously expressed concern about the company’s high concentration of government contracts, it is evident that these have provided the crucial lifeline during a period of worsening macroeconomics. Furthermore, despite the perceived loss of commercial demand, PLTR continues to prove its leadership and moat with three new partners in Concordance Healthcare Solutions, Beckett Collectibles, and Hertz (NASDAQ:HTZ).

Though 38.5% of analysts are predicting a 75-basis points hike in the Fed’s December meeting, things are looking a little rosier now against the previous gloom and doom party, due to the Bank of Canada’s recent pivot. Assuming a similarly dovish stance from the Feds then, we may expect market sentiments to improve moderately, giving way to reasonable stock recovery ahead. Of course, no one knows how long this optimism will last, since December rate hikes will also depend on the October & November PPI/ CPI/ labor market results. Thereby, indicating the stock’s potential volatility ahead.

Viewing PLTR’s Numbers With An Adjusted Lens

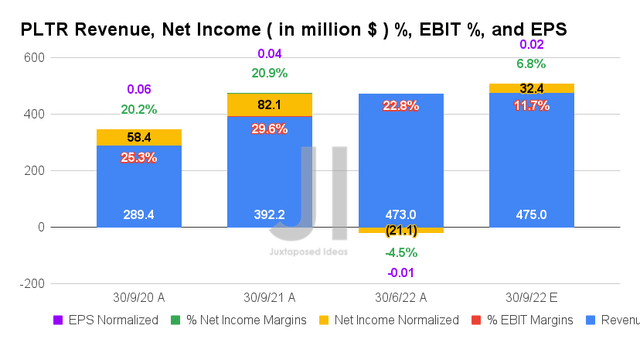

In its upcoming FQ3’22 earnings call, PLTR has guided revenues of $475M, indicating in-line QoQ though a notable improvement of 21.17% YoY. Though its gross margins are expected to improve QoQ from 78.4% to 79.2%, it is evident that elevated operating expenses are expected to impact its adj. EBIT margins to 11.7% for the next quarter, due to its guidance of adj. operating income of $55M, indicating a decline of -49.07% QoQ.

Nonetheless, analysts are still relatively optimistic about PLTR’s profitability, given the projected adj. net incomes of $32.4M and adj. net income margins of 6.8% in FQ3’22. Thereby, naturally boosting its EPS to $0.02 compared to FQ2’22 levels of -$0.01.

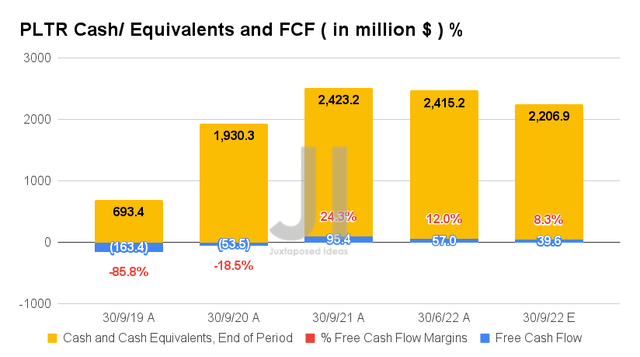

In the meantime, PLTR may still report positive Free Cash Flow (FCF) generation of $39.6M and an FCF margin of 8.3% in FQ3’22. Thereby, negating the need to rely on any debts through the worsening macroeconomics, especially aided by the robust projected cash and equivalents of $2.2B then.

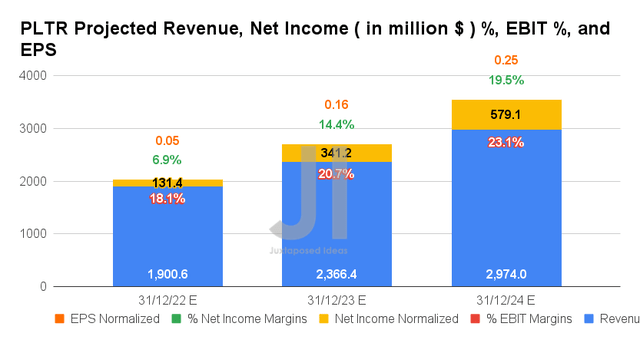

In addition, PLTR’s top and adj. bottom line growth ahead remains intact since our previous analysis. Notably, the company is expected to report a normalized EPS of $0.25 by FY2024, indicating an impressive CAGR of 24.36%. On the other hand, investors keen on understanding the company’s GAAP numbers would probably be disappointed that the CEO has guided 2025 profitability, with consensus estimating net incomes of $381.49M and EPS of $0.16 then. It is apparent by now that we had made a grave mistake in assuming GAAP profitability of $131M by FY2022 in our previous analysis.

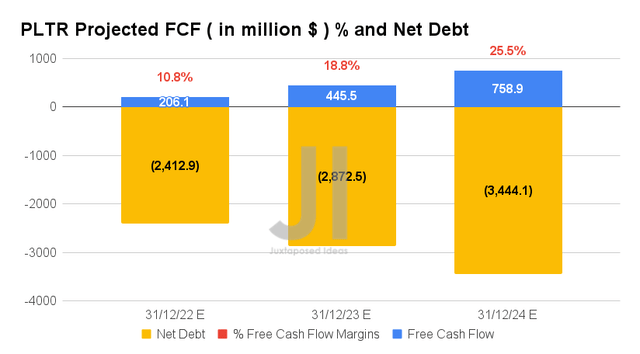

In the meantime, PLTR has already been FCF-positive since FY2021, with a projected CAGR of 33.19% through FY2024. Impressive indeed, despite the uncertain macroeconomics. Furthermore, the company is expected to report GAAP net income/ FCF margins of 8.79%/27.3% by FY2025, indicating massive expansion from FY2021 levels of -33.74%/20.8% and FY2019 levels of -78.06%/-24%. Naturally, these numbers are speculative, since many things can change over the next four years.

Meanwhile, we encourage you to read our previous article on PLTR, which would help you better understand its position and market opportunities.

- Palantir: Karp, This Is A Problem

- Palantir’s Hype Train Crashed – The Bears Could Have Been Right After All

So, Is PLTR Stock A Buy, Sell, or Hold?

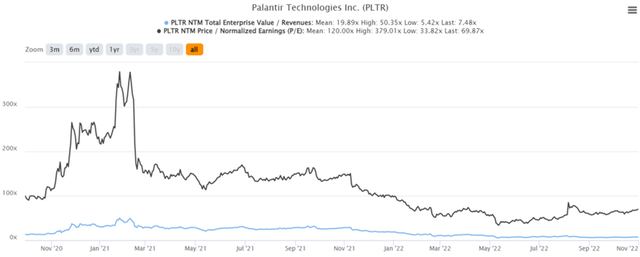

PLTR 2Y EV/Revenue and P/E Valuations

PLTR is currently trading at an EV/NTM Revenue of 7.48x and NTM P/E of 69.87x, lower than its 2Y mean of 19.89x and 120.00x, respectively. The stock is also trading at $8.22, down -69.67% from its 52 weeks high of $27.11, though at a premium of 27.63% from its 52 weeks low of $6.44. Nonetheless, consensus estimates remain bullish about PLTR’s prospects, given their price target of $12.67 and a 44.14% upside from current prices.

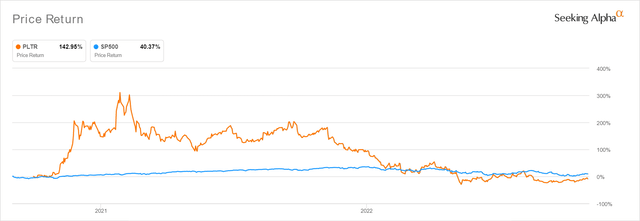

PLTR 2Y Stock Price

Now, after three bullish and two pessimistic articles, where do we stand? Personally, it has been a struggle since we harbor a love/ hate relationship for adjusted numbers. We concur with Buffett on this:

Too many managements – and the number seems to grow every year – are looking for any means to report, and indeed feature, “adjusted earnings” that are higher than their company’s GAAP earnings. There are many ways for practitioners to perform this legerdemain. Two of their favorites are the omission of “restructuring costs” and “stock-based compensation” as expenses. ( Insider )

Naturally, for PLTR, the issue really remains with its elevated Stock-Based Compensation (SBC) of $646.84M over the last twelve months (LTM), further diluting its long-term shareholder by 8.45% sequentially. Then again, we are encouraged by its wide moat, at which there have been few competitors out there able to replicate its technological offerings. There is a reason why PLTR continues to boast one after another government contracts, significantly aided by the recent DoD IL6 Provisional Authorization from the Defense Information Systems Agency. Consequently, joining the ranks of Microsoft (MSFT) and Amazon Web Services (AMZN) as one of the only three companies with the highest security clearance.

Does that change our perspective? Hell yeah, since it is clear that PLTR continues to be overly beaten down and dismissed due to its secretive nature. It is also important to note that it takes time for a company to ramp up and firmly grasp profitability, since it already reported an excellent adj. operating margin of 23% in FQ2’22 against MSFT’s Intelligent Cloud segment of 44.17% in FQ1’23 and AMZN’s AWS at 26.3% in FQ3’22. Notably, PLTR will also report an excellent adj. EBIT margin of 39.5% by FY2025, against MSFT’s and AMZN’s performance of 43.48% and 29.79% in FY2021. For those who are still decrying PLTR’s elevated SBC expenses, you may want to compare it against MSFT’s $7.99B and AMZN’s $17.69B over the LTM. A whole new world, isn’t it?

As a result, creating the massive potential for a vertical rally ahead, once macroeconomics improves and commercial demand returns. Of course, this is assuming that market analysts finally appreciate PLTR’s technological offerings and subsequently award its forward execution. In the meantime, we have also started a small position at the recent bottom levels, fully understanding the stock’s tremendous prospects through the next decade. Patience will be rewarded.

Be the first to comment