Michael Vi

Thesis

Palantir Technologies (NYSE:PLTR) reported mixed Q3 results and uninspiring guidance. I wrote an article back in November, entitled “Why The Insiders Are Selling”, to analyze the insider selling activities preceding the Q3 earnings. And the key thesis is that:

The dominant selling volume occurred in a range from $7.5 to $8.5, effectively forming a ceiling for its stock prices in the near term. And after a Kelly bet size analysis, I have to conclude that the insiders’ sell decisions are the right call.

In this article, I will switch the focus and look at the stock from the options market. And the main thesis is that the stock now offers a good setup for a put option play. And first, let me start with a recap of its Q3 results and the uncertainties I see ahead. Its Q3 revenue came in at $477.88M, translating into an annual growth rate of 21.9% YOY and beating consensus estimates slightly by $2.92M, while it is still struggling with its bottom line. Its Q3 Non-GAAP EPS dialed in at $0.01 and missed consensus estimates by $0.01.

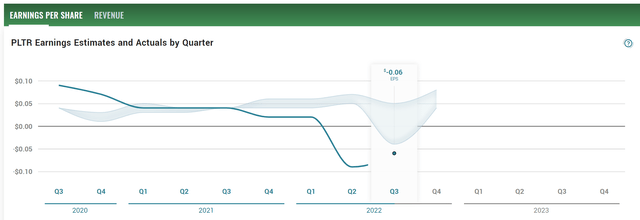

What is more concerning is the cloudy outlook. Its Q3 earnings report (“ER”) cited several headwinds, which are very likely to persist over the next few quarters the way I see things. For example, it now expects Q4 sales in a range of $503M and $505M, below consensus estimates of $505.9M. With this adjusted guidance, it is also likely that PLTR would miss its 30% annual revenue growth target this year. At a more fundamental level, I also see strong headwinds coming from intensified competition in the years ahead from other enterprise software stalwarts, defense contractors, and/or even in-house development teams from its own customers. The dimmed view of its outlook and large uncertainties are vividly displayed in the earnings estimates for the next few quarters on the following chart.

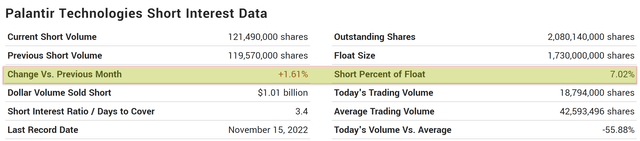

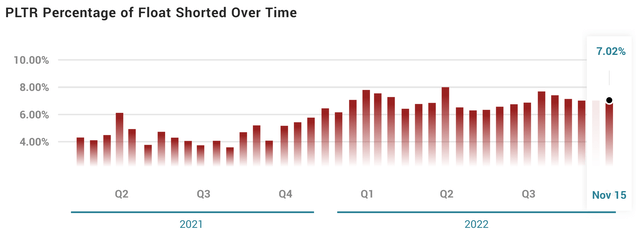

The market response to this cloudy outlook was quite brutal. Its stock price plunged nearly 12% under tremendous selling pressure shortly after the ER. The stock has been trading in the $7 to $8 range since then. Currently, the short interest hovers around 7.02%, among the highest level since Q2 2021 as you can see from the following MarketBeat data. To wit, its current short volume sits at 121.49 million shares, translating into 7.02% of the float size (1,730 million shares). Compared to the short volume in the previous month (119.57 million shares), the short interest rose by 1.61% MOM. In addition to the above uncertainties in the business fundamentals and also the selling pressure, the stock is also trading at quite an expensive valuation (more on this later). As such, I have a pretty bearish view on the stock.

In case you share the same bearish view, the remainder of this article will argue that the current conditions present a good setup for a put option play to express this view. Next, you will see that despite the very uncertain outlook and large selling pressures, its option premiums are quite low, providing a skewed risk/return profile.

Source: www.marketbeat.com Source: www.marketbeat.com

PLTR’s put option

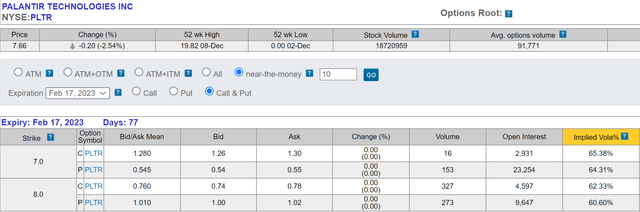

The options market is pricing its implied volatility (“IV”) around 62% to 65% as you can see from the following chart for near-the-money put options expiring on Feb 17, 2023. I picked this particular expiry date because PLTR is scheduled to report its Q4 ER around Feb. 15, 2023. Given the uncertainties analyzed above and the actual volatilities the stock has demonstrated over its recent ERs, I expect large price movements during its Q4 ER as well.

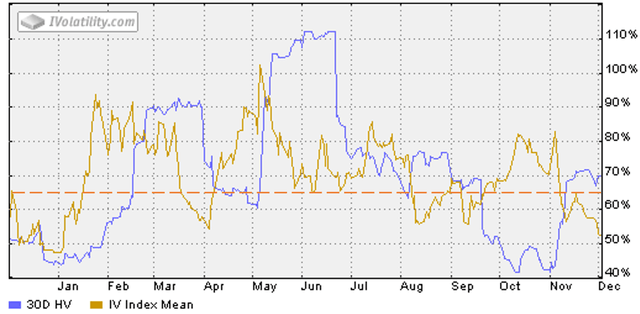

Yet, as you can see from the next chart, its current IV (again, in the range of around 62% to 65%) is towards the lower end of its historical records. Its IV has stayed above 75% for most of the time during the past year and I see its future more, not less, uncertain now. As a matter of fact, its current IV is even below its historical IV (the orange line).

Skewed risk/return profile

Due to the relatively low IV, the option premiums are quite low, providing a skewed risk/return profile.

Let’s first analyze the risk side. Take the put option with the $8 strike price as an example. The bid/ask mean price is at $0.76 as of this writing. Note that I am quoting all these numbers on a per-share basis and will do the same for the rest of this article. If you hold the option to its expiration and PLTR’s price closes above $8 on the expiry date, then the option expires worthless and you lose the $0.76 premium, which is the most you can lose.

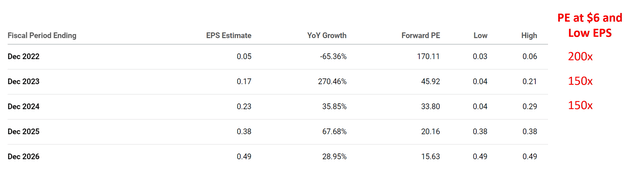

Now let’s analyze the potential returns. As mentioned above, due to the combination of a very uncertain outlook, large selling pressures, and extreme historical volatility (especially shortly after the ER), I anticipate large downward movements in its stock prices. On top of all these issues, the stock is already trading at an expensive valuation as you can see from the following chart. Its current P/E (170x) probably is meaningless given the negligible EPS currently (recall it is $0.01 for this quarter). Even when we look forward to two or three years (i.e., in 2023 and 2024), you can see that its P/Es are still in an extremely lofty range of 34x to 46x. And keep in mind that these P/E are quoted based on the midpoint of their EPS forecasts, while the variance among the forecasts is huge as seen. The variance between the high and low end of the estimate is 200% for 2022, more than 500% for 2023, and more than 700% for 2024.

With these above factors, I won’t be surprised if the stock price drops to the $6 range. Actually, even at a price of $6, the P/E is still in the unsustainable range in my view (150x to 200x if the EPS fall on the lower end of the forecasts). And if the price does fall to $6, the put option would be worth $2 (the intrinsic value) plus whatever the time value is left in the option, leading to a reward/risk ratio of at least 263% ($2/$0.76 of premium).

Source: Author based on Seeking Alpha data

Risks and final thoughts

Since the thesis is a bearish thesis with a long put option play, I want to mention both the fundamental upside risks and also the risks associated with options (primarily for investors new to options). The company depends heavily on government contracts, but it has been taking initiatives to widen its customer base. These initiatives could lead to a large private sector customer unexpectedly and trigger a large upward price movement. It also has substantial margin expansion opportunities on multiple fronts, including reductions of its deployment costs and offering commercially available solutions to prospects. Lastly, the use of options could lead to a total loss of capital. As aforementioned, if you long the put option with the $8 strike price and hold the option to its expiration, you could lose the $0.76 premium entirely if its price closes above $8 on the expiry date.

To recap, PLTR is facing an uncertain outlook and large selling pressure ahead. I anticipate many of these headwinds persisting into the next few quarters and the impacts reflected in its Q4 ER, causing large downward price movements. The company depends heavily on government contracts, which adds another source of uncertainties due to unexpected policy changes, budget priority changes, and also just general macroscopic economic slowdowns. Yet, the options market currently demands a relatively low premium (with an IV in the range of 62% to 65%). Such a combination of high earnings uncertainty, large selling pressures, and relatively low IV presents a good setup for a put option play with a very skewed return/risk profile.

Be the first to comment