Michael Vi

In the coming days, the management team at Palantir Technologies (NYSE:PLTR), a company focused on providing big data analytics and services, is expected to report financial results covering the third quarter of its 2022 fiscal year. The past few months have not been particularly kind for investors, as shares of the enterprise have fallen mightily. In fact, while the S&P 500 is down meaningfully, shares of Palantir Technologies have fallen by 52.6% since the start of this year. This comes even at a time when the company continues to expand from a revenue perspective. But at the end of the day, that just goes to show the risks that are involved in growth investing. Heading into the third quarter earnings release, there are a few things that investors should keep an eye on. These are items that are almost certain to be discussed by management that will go a long way toward determining the overall health and prospects of the enterprise moving forward.

Keep an eye on expectations

First and foremost, we should discuss what analysts are currently anticipating. Generally speaking, I don’t care much about what analysts expect or whether those expectations are met. But when it comes to growth investing, matching or exceeding expectations is vital. Even if a company reports strong growth year over year on both its top and bottom lines, falling short of what analysts anticipated could result in shares tumbling. Consider how the market reacted to Palantir Technologies when it reported second quarter results. Revenue for the company had increased 25.9% year over year, even beating analysts’ expectations by $1.3 million. Unfortunately, earnings per share missed by just $0.04. That sent shares tumbling over 14% for the day.

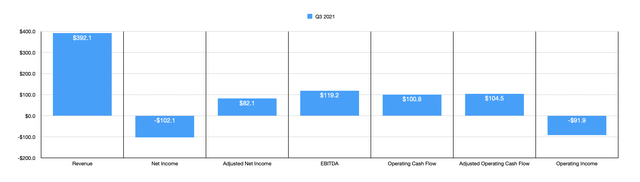

Author – SEC EDGAR Data

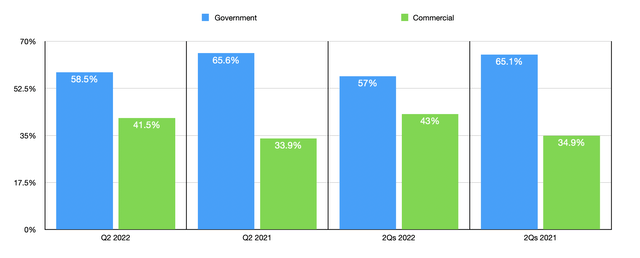

Given the company’s status as a growth play, it’s important that management at least meet expectations. At present, the market anticipates revenue of $474.96 million. If this comes to fruition, it would translate to a year-over-year growth rate of 21.1% compared to the $392.1 million generated in the third quarter of 2021. The biggest risk for investors, as I see it, involves the commercial operations of the firm. You see, at present, management is pushing for rapid growth for the enterprise over the next few years. And a big part of that is a bet on the commercial space finding demand for the company’s offerings. In recent years, the company has done well on this front. In the second quarter of 2021, for instance, 33.9% of its revenue came from the commercial space. This number shot up to 41.5% in the second quarter of the year. In the first six months of 2022, 43% of revenue came from the commercial space, up from 34.9% in the first half of 2021.

Author – SEC EDGAR Data

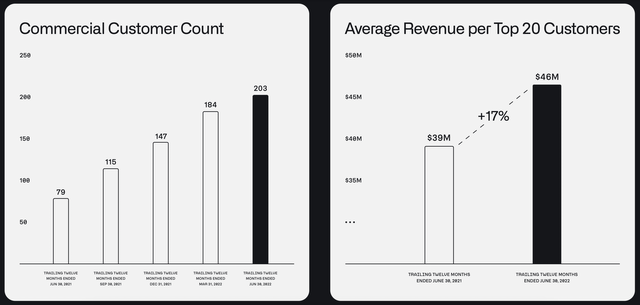

Of course, growth in this space is likely going to be very tricky. You see, in the commercial market, the company ended the second quarter with only 203 customers. That is up significantly from the 79 customers reported one year earlier. This pushed total commercial revenue growth for the company up 46% year over year, climbing from $144 million to $210 million. And average revenue for the trailing 12 months for the top 20 customers combined came out to $46 million. That was up from $39 million experienced only one year earlier. This high dollar amount is rather telling because it indicates just how small the pool of viable prospects are out there who can afford its offerings.

Palantir Technologies

Current market conditions make it unsure whether the commercial space can pull through on meaningful growth. This is different from the company’s government customers that largely make up for the commercial space during difficult economic times. So any sort of weakness will almost certainly be on this side of the equation. As for those who wonder what kind of use cases there would be for Palantir Technologies’ platform, consider two that I discovered. One customer, utility giant PG&E (PCG), uses the Palantir Technologies platform to help with the operation of their grid so that they can conduct preventive maintenance and the rollout of enhanced powerline safety settings in order to help protect high-risk parts of the grid. And in another case, involving Swiss Re, the company is able to connect all of the organizations under that firm’s umbrella to a central platform that helps to aggregate, organize, and analyze data collected for the purpose of providing valuable insights like those associated with the risk of specific climate impacts on insurance claims.

Outside of the revenue picture, investors should also pay attention to profitability. At present, analysts are anticipating a loss per share of $0.05. On an adjusted basis, this would translate to a profit per share of $0.02. to put this in perspective, during the third quarter of last year, the company lost $0.05 per share, totaling $102.1 million in all. But on an adjusted basis, the company generated a profit of $82.1 million. Obviously, investors should also be paying attention to other profitability metrics. For context, in the third quarter of last year, the company generated operating cash flow of $100.8 million. On an adjusted basis, this number was $104.5 million. And finally, EBITDA for that time totaled $119.2 million.

Keep valuation in mind

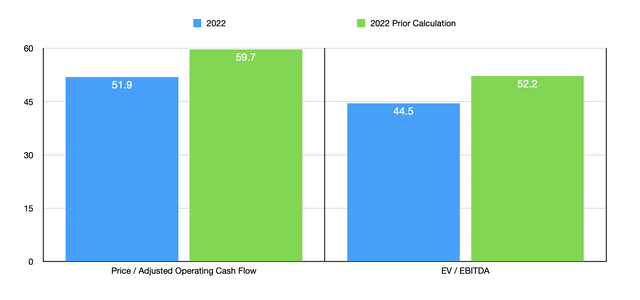

In all the articles that I wrote about Palantir Technologies, I felt as though the long-term outlook for the company was favorable. Having said that, my big gripe was that shares looked pricey. Well, since I last wrote about the firm in August of this year, rating it a ‘sell’, the stock has fallen by 6.6%. That compares to the 5.4% loss experienced by the S&P 500. This has certainly made shares cheaper. Using the same methodology that I utilized in my last article on the firm, I recalculated just how expensive shares are now that they have fallen further. Naturally, this assumes that management does not provide any data that requires a decrease in guidance for this year or moving forward like they did when they reported results for the second quarter of the year.

Author – SEC EDGAR Data

As you can see, shares are still looking rather pricey for this year. This data can be seen in the table above. There’s already considerable pessimism in the market regarding the company’s ability to achieve its growth targets. This comes after management removed all discussion of hitting $4.5 billion in sales by 2025.

Takeaway

Based on the data provided, it seems to me as though analysts are currently expecting rather strong performance on the top line this quarter. Whether or not the company can deliver is anybody’s guess. In the event that management misses expectations when it comes to the top or bottom lines, we could see some downside for investors. Having said that, shares are definitely getting cheaper and significant downside from here looks unlikely absent management missing materially on guidance for the future. All things considered, I am becoming more interested in Palantir Technologies from an investment perspective. But shares still warrant a soft ‘sell’ until we see what the company can deliver in this upcoming earnings release.

Be the first to comment