Sundry Photography

Before the market opened on Monday, August 8th, the management team at big data analytics company Palantir Technologies (NYSE:PLTR) announced financial results covering the second quarter of the company’s 2022 fiscal year. Unfortunately, things did not go exactly as expected. Although the company beat expectations when it came to revenue, it missed on profitability. The company also revised down its expectations for the current fiscal year and removed formal guidance from now through its 2025 fiscal year. The company is still growing at a rapid pace, and investors should expect that to continue. But given recent developments, shares are looking astronomically expensive and it would likely be better for investors to look elsewhere for attractive opportunities.

Palantir Q2 earnings – The dangers of growth investing

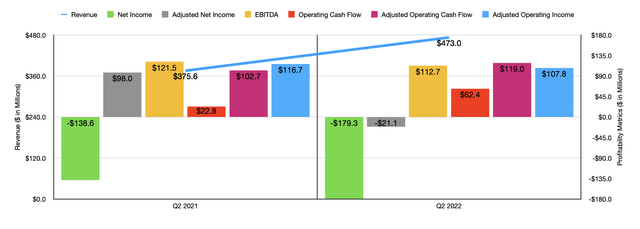

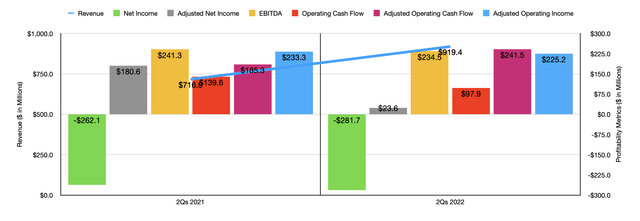

Growth investing can be incredibly rewarding. But even when things go somewhat right, the pain put on investors can be awful. A great example of this can be seen by looking at the most recent quarterly data provided by Palantir Technologies. For the second quarter of the company’s 2022 fiscal year, management reported revenue of $473 million. That represents an increase of 25.9% over the $375.6 million the company generated the same quarter just one year earlier. In addition to this, it also beat analysts’ expectations to the tune of nearly $1.3 million. Although that level of outperformance is not that great, any sort of strength above what analysts were hoping for is generally considered a positive.

This increase in sales was driven by growth across the board. However, that growth was not evenly distributed. Government revenue for the company increased a more modest 13% year-over-year. Meanwhile, commercial revenue skyrocketed by 46%, rising from $143.5 million to $210 million, with the company benefiting from a 250% increase in customer count in the commercial category, taking the number of customers from 34 to 119. This in and of itself is a positive because management has been focused on trying to capture additional business from the commercial space. That so far seems to be working out quite nicely.

Unfortunately, this is where most of the good news ends. Consider the company’s profitability. During the quarter, Palantir Technologies generated earnings per share of negative $0.09. This actually missed analysts’ expectations to the tune of $0.04. In addition to that, it’s also worse than the $0.07 loss per share the company generated in the same quarter of its 2021 fiscal year. Put in dollar terms, the company’s net income dropped from negative $138.6 million to negative $179.3 million. Given that investors in growth-oriented companies can be awfully forgiving when it comes to a firm’s bottom line results, this alone might not have sunk the ship, ultimately resulting in shares of the company declining by 14.2% by the time the market closed on August 8th. But unfortunately, this was just the tip of the iceberg.

Other profitability metrics for the company did not come in all that strong. Adjusted net income went from roughly $98 million to negative $21.2 million. Operating cash flow did increase, climbing from $22.8 million to $62.4 million. On an adjusted basis, however, the increase was more modest from $102.7 million to $119 million. Meanwhile, however, EBITDA for the company worsened, falling from $121.5 million to $112.7 million.

Outside of the immediate results provided, the company also posted a rather disappointing outlook. For starters, they forecasted that revenue for the 2022 fiscal year should come in between $1.9 billion and $1.902 billion. This is actually down from the $1.98 billion that analysts had been forecasting for the year. This shouldn’t be surprising when you consider that the total remaining deal value of the company’s contracts increased only modestly during the quarter, climbing from $3.4 billion in the first quarter of the year to $3.5 billion today. For the third quarter alone, the expectation is for revenue of between $474 million and $475 million. By comparison, analysts had been forecasting $505.6 million for the quarter.

But undeniably the worst thing was the change in the company’s operating income. For the year as a whole, this number should come in at between $341 million to $343 million. To put this in perspective, the company had previously forecasted an adjusted operating income margin for the year of 27%. Had the firm delivered on analysts’ expectations for $1.98 billion in sales, this would have translated to $534.6 million in operating income on an adjusted basis. Using midpoint figures, this means that profitability for the company will be roughly 36% below what the market was anticipating. To add insult to injury, management also removed from their investor documents their claim that they’re targeting a 30% annualized increase in revenue with the goal of taking sales to $4.5 billion by 2025. This certainly caught the market’s attention since a high-growth company with limited profitability only makes sense from an investment perspective if it can grow into its valuation.

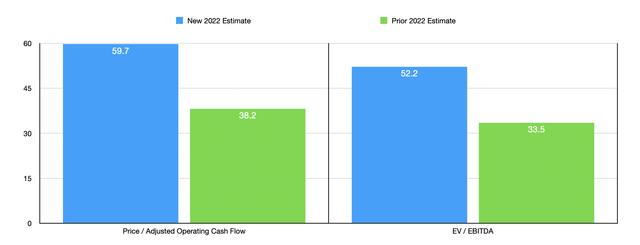

This is not to say that the company is giving up on its rapid growth goals. On the investor call covering second quarter results, the company did reiterate its target of $4.5 billion in sales by 2025. But they no longer label this a forecast, instead using language like ‘driving the company’ to get to that point. That sort of rhetoric seems more aimed at trying to keep investor enthusiasm up while also limiting legal liability should the company come in far short of its goal. Although it is possible that the company may ultimately achieve its targets, it does nothing to change the fact that shares look incredibly pricey at this point in time. As I stated in a prior article, there is good reason to equate the adjusted operating income for the company to its adjusted operating cash flow and its EBITDA. Doing this, the company is now trading at a forward price to operating cash flow multiple of 59.7 and at an EV to EBITDA multiple of 52.2. If, instead, we were to use the prior expected results for the firm for the year, these multiples would be considerably lower, but still pricey, at 38.2 and 33.5, respectively.

Takeaway

Based on all the data provided, I do believe that investors in Palantir Technologies should tread very carefully. The company has gone from being pricey to being very expensive overnight. Growth for the year as a whole is coming in slower than analysts anticipated, and profitability still remains an issue. The good news is that the company is still growing at a nice pace, and it has no debt with $2.51 billion in cash on hand. So the actual risk of something like bankruptcy is incredibly low. But this doesn’t mean that the company should be considered a worthy investment prospect at this time. Frankly, I’m shocked that the stock didn’t fall further than it did based on results provided by management. And given how pricey the company is today, I have decided to downgrade the company from a ‘hold’ to a ‘sell’.

Be the first to comment