Michael Vi

Thesis

The two main risks all investors face are quality risk and valuation risk. With high-growth stocks with little or negative profits such as Palantir (NYSE:PLTR), both risks are magnified. In terms of quality, there have been no meaningful earning records to evaluate the quality yet. In terms of valuation, common valuation metrics like P/E and price/cash multiples are meaningless due to the negligible or even negative earnings. In this article, I will describe a method (a sort of acid test) for such stocks. The details are in this earlier article, and the gist is the following hypothetical thought experiment:

If the business freezes its growth now (i.e., if it stops investing in growth CAPEX completely), would its profits turn positive?

And you will see that PLTR passes the test. It actually started passing the test in the Mar 2021 quarter on a TTM basis even though its accounting EPS remains in the red. As you will see in the remainder of this article, such an acid, besides providing a more meaningful valuation, also sheds insights into its profitability and capital requirements. Furthermore, based on this analysis, I anticipate a small positive EPS in the GAAP sense (a few cents to a dime per share) by end of 2022 or in 2023.

Cash flow

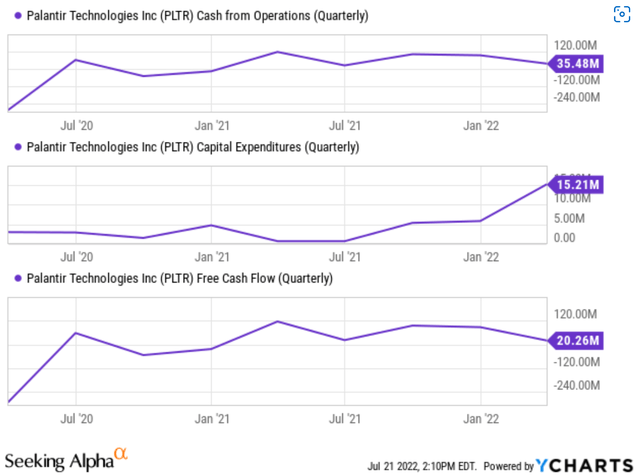

And as you already know, like many early-stage growth stocks, PLTR has been suffering a negative cash flow problem. As seen in the top panel from the chart below, on a quarterly basis, its cash flow from operations (“CFO”) has been hovering around the breakeven point mostly the March quarter of 2021. And then has turned positive since then and remained positive for 5 consecutive quarters up to now.

However, in order to sustain growth, it has to spend a large part of the CFO on capital expenses. And in PLTR’s cash, the CFO is actually not enough and it has been relying on other financing activities (to be elaborated on in the risk section). As you can see from the second panel in the chart, its CAPEX expenditures have been on a rapid rise to the current level of $15.2M during the last quarter. As a result, its free cash flow (“FCF”) turned decisively positive even later than its CFO, and its amount even smaller (only a bit over $20M in the past quarter for a ~$20B market cap).

However, this picture is misleading for high-growth stocks like PLTR as discussed next.

My acid test

As detailed in my earlier article,

- The key of interpreting small or negative FCF for growth stock is to decompose the CAEPX expenses into two parts: the maintenance CAPEX and growth CAPEX. Maintenance CAPEX is the mandatory part to keep the business running. And the growth CAPEX is the optional part.

- The growth part should actually be considered part of the owners’ earnings because it can be returned to the owners if the owners decide not to grow the business anymore – a key insight that investors like Buffett have recognized.

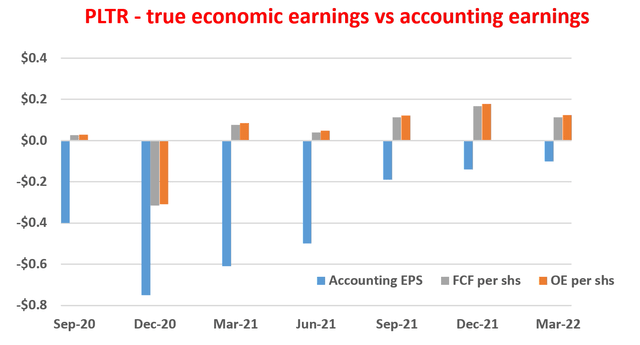

- Under this background, the following chart shows my analyses to delineate the maintenance CAPEX and growth CAPEX of PLTR. This analysis is performed by Bruce Greenwald’s method with details in my earlier article on AAPL and/or Greenwald’s book entitled Value Investing.

The next figure shows PLTR’s owners’ earnings (OE, its true economic earnings) compared to its accounting earnings and free cash flow on a per share and TTM basis. As you can see, its accounting EPS remains negative. But its true economic earnings have been consistently better than its accounting EPS and also its FCF by a good margin. Take the most recent quarter as an example. My analysis shows its true OE in the past trailing 12 months to be about $0.12 per share. In contrast, the accounting EPS is negative $0.10 per share. And the FCF is about $0.10 per share (about 20% lower than its OE). This makes its valuation about 20% below the FCF multiples commonly quoted.

Author based on Seeking Alpha data

Valuation

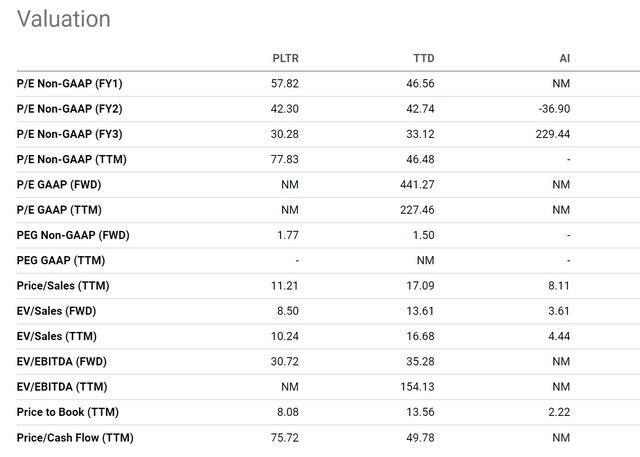

Due to the small profits (such as EPS, free cash flow, et al), valuation comparison in GAAP terms does not provide too many insights as you can see from the following chart. PLTR’s PE based on its EPS 1 year out is about 57.8x, a quite lofty valuation in both absolute and relative terms. For example, The Trade Desk (TTD) is valued “only” at 46x FY1 PE. Similarly, cash flow multiples can be misleading too. PLTR’s price to cash flow multiple is about 75.7x, compared to TTD’s 49.8x. But as analyzed above, its true owners’ earnings are about 20% above its free cash flow, making its adjusted cash flow multiple about 63x. Still quite expensive, but less so than on the surface. And since it has passed the acid test, it is at a much more mature stage compared to stocks like C3.ai (AI) which has not yet.

Business outlook and other risks

Looking forward, I anticipate the company to keep spending most of its CAPEX on growth. And as such, I expect the accounting earnings to keep underestimating its true earnings power. Although the numbers in GAAP accounting terms are also improving rapidly. It has been very successful at inking deals in the past year. During 2021, it has bagged dozens of contracts. A number of them were valued at $10 million or more. A particular highlight is its contracts with prestigious government agencies such as the U.S. Army, U.S. Air Force, the U.S. Coast Guard, and the Centers for Disease Control and Prevention. Its deal-making is also effective outside the U.S. It has signed on the UK Royal Navy (with whom it just closed a £10 million expansion contract) and been awarded a framework agreement in Germany with an initial order from the Bavarian Police.

On the opposite end of the customer spectrum, management also announced initiatives aimed at broadening the customer base to include early and growth-stage companies, such as startups. These initiatives ought to help the customer base and keep revenue growth at a rapid pace.

Finally, risks. High valuation (even after adjusting for the discrepancy between accounting and true owners’ earnings) and price volatility are definitely a top risk for investors. In the past 2 years, the stock price has climbed from the $10 level to above $40, and then come back to the $10 level again.

The company is also coping with elevated operating expenses under the current macroeconomic conditions. Even though sales are growing at a healthy pace, the higher cost could offset the topline growth and keep accounting profits in the red. Finally, if cash flow remains low and CAPEX requirement remains high, the company could face tough financing options. Further dilution to shareholders remains a possibility. And to make things even worse, such dilution could happen under unfavorable stock prices.

Be the first to comment