Michael Vi

I first initiated a “Buy” rating on Palantir (NYSE:PLTR) on the back of its horrendous earnings call in Q2. Back then, there was much controversy, with bulls and bears battling it out on who was in the right. Almost all of my predictions, particularly regarding commercial revenue, came true. In venture capital, a famous saying is that if an idea does not provide at least some level of skepticism, it means the business model is not disruptive enough to challenge the status quo. Certainly, Palantir is not a venture case anymore.

However, at minimum, the difference in opinions on both ends of the spectrum suggests a sizeable problem and market – in this case, “actionable data” – and whoever can provide a solution will be rewarded by the market. While facing plenty of challenges, ranging from dilution to governance to growth, the inherent potential of making data actionable is monumental, which is ultimately why I rate Palantir as a “Buy.” I will extend my discussion from my initial rating by laying out the positive and negative facets of Palantir’s recently reported Q3 2022 figures.

The Good

Stock price

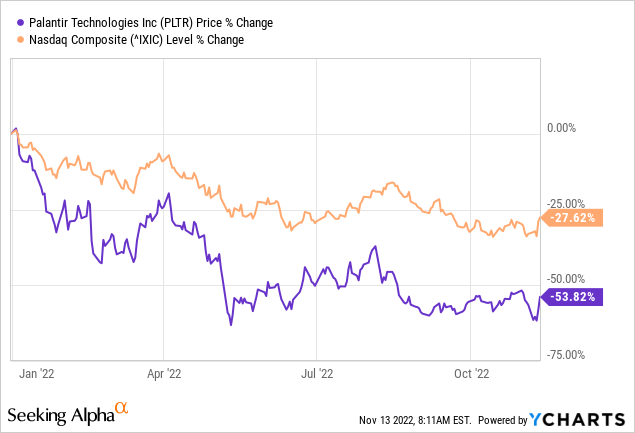

Any company can execute however well and have a great product. Still, I would not consider investing in such a company if the valuation is fundamentally decoupled from its probabilistic financial return. Over the last 12 months, Palantir stock has dropped by more than ~70%. While any statements in hindsight are easy to make, this drop was due in time. Currently, the stock trades at 8.5x its TTM revenue compared to an average in the software industry of 14x. Obviously, in isolation, that will not tell us much; however, at first sight, it appears odd due to the above-average growth and expected growth for the future, which likely will be above 20-25% for the coming years, compared to the average in the software industry that lies around 9%.

Scalability and Deployment

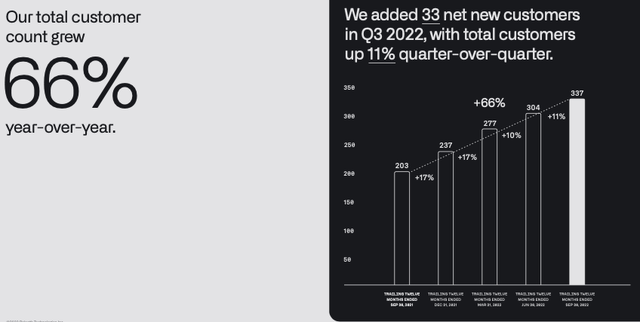

One major issue I have had with Palantir is the missing element of scalability. Since its inception, Palantir’s growth has shown sizeable volatility, which stems from its ability to acquire new customers and expand its contracts with existing customers. The increase in net new customers is hidden in the otherwise unspectacular Q3 figures and linked to the remaining performance obligations. QoQ Palantir added 33 net new paying customers, of which 25 are commercial. More importantly, growth in outstanding deal value reaccelerated after being almost flat for the last couple of quarters, adding $600 million in deal value in Q3 alone. Remaining performance obligations outpaced this growth growing 41% YoY. The reason why I emphasize these two figures is that they emphasize the growth that is to come. The revenue slowdown we are seeing is a direct result of Palantir’s lack of increase in outstanding deal value over the last 12 months. You can only realize so much revenue that you have signed revenue. For Palantir to outgrow its current valuation, it must shorten its sales and onboarding cycles. While I am convinced that Palantir is superior technologically compared to the likes of Snowflake (SNOW), after talking to several people who have used both products from a sales angle, Snowflake delivers what you expect from a modern SaaS company with almost instant onboarding. While, at least for the foreseeable future, it is unlikely that the deployment can be standardized to match SaaS levels, it will be fundamental for Palantir to address a more extensive market further and acquire customers fast than it does today.

Customer Growth (Palantir Investor Presentation)

Market

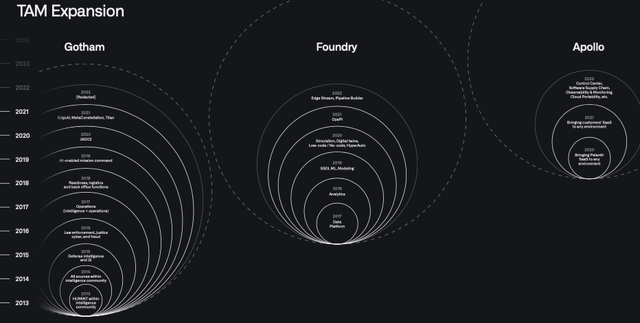

The global market for machine learning is still relatively small, valued at $25 billion. However, it is expected to grow by 38.8% CAGR until 2029. While public perception is mainly that of complicated algorithms coming up with a prediction, in reality, ~80-90% of the time is spent collecting and preparing the data for machine learning or general data analytics. According to McKinsey, ~90% of companies have already gathered sufficient data. Still, integration and accessibility of this data are not yet guaranteed. This is the exact problem Palantir is solving for companies: making data actionable! While it remains to be seen whether the company can deploy its solution in a scalable and, thus, financially beneficial way, Gotham and Foundry offer the best solution to the above-stated problem.

TAM Palantir (Palantir Investor Presentation)

The Bad

In Q3, revenue growth slowed to 22% YoY to $478 million. Government revenue came in at $274 million, and commercial at $204 million. While the Q3 results are not much of a surprise, if you look at my previous analysis, I was surprised by the negative QoQ growth in commercial revenue of 6 million. The slowdown in commercial growth is particularly problematic as the value case for Palantir’s stock largely rests on the commercial segment as the driver of future growth. In addition, while I do not see this being as much of an issue as commercial slowdown, Palantir’s margin profiles have worsened YoY. Adjusted gross margin is at 80%, the lowest in 4 quarters, and adjusted operating income is down ~30% from a year ago. Bear in mind that the reported adjusted profits exclude stock-based compensation. On a GAAP basis, the company remains unprofitable. The troublesome part does not lie in the numbers per se but in management outlining profitability as a strategic target. If that is the correct path to go down at this stage is beneath the point. I wouldn’t say I like this because it either attests to management’s inability to control costs or poor communication with investors. However, I see that being less of an issue than the decline in commercial revenue. Palantir’s contrarian and anticyclical decision-making can even be seen as a positive aspect. This is illustrated by the company’s cash management and its hiring strategy. In 2021 when most companies went over the top with hiring and investing in growth, Palantir remained reasonable. Now that major tech companies have fired a significant share of their employees, it allows long-term thinking companies to hire this talent at a discount.

Concluding Thoughts

The above shows that both sides of the argument have a valid case for bullish or bearish sentiment about the stock. I expect now to be the ideal starting point to pick up shares in Palantir if, and that’s a big if, you believe the company provides a scalable solution to the problem of actionable data. Q4 business results should be a bit better, based on the numerics discussed above. Suppose the growth trends above continue to accelerate. In that case, I expect results to bear fruits in early 2023, hence the argument to invest now or never. The current times are perfect for Palantir, with several global crises and supply chain constraints. Any interested investor should closely monitor customer growth, net dollar retention rates, and commercial QoQ growth for the Q4 earnings results. Palantir stock at current price levels is an excellent pick to drive alpha. Still, I would not recommend that the store make up more than 5% of your portfolio, as there is a more realistic scenario that Palantir will be unable to overcome its commercial hurdles fully.

Be the first to comment