Michael Vi

Palantir Technologies (NYSE:PLTR) reported Q2 earnings today that were acceptable, but its guidance for the next couple of quarters was quite weak especially regarding its profitability. This seems to be justified by a weaker economic backdrop rather than some structural issues, thus Palantir continues to be a great investment for long-term investors and recent share price weakness is an opportunity to buy more shares.

Palantir’s Q2 2022 Earnings Analysis

Palantir reported earnings, with revenues coming practically in-line with expectations, while its EPS was below estimates.

Revenue in the last quarter was $473 million (up by 26% YoY), a beat of only 0.1% compared to street estimates, while its adjusted loss in the quarter was $21 million, way below the adjusted profit of $91 million expected by analysts.

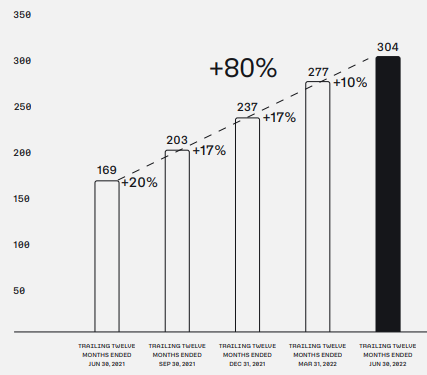

The company achieved a great milestone this quarter, reaching for the first time $1 billion in revenue on a trailing twelve month basis in its U.S. business, showing that its growth strategy is progressing well. Indeed, Palantir’s total customer count increased to 304 in Q2 2022, of which 203 are in the commercial business, considerably up compared to 169 customers one year ago, showing that its commercial push is bearing fruit and revenue growth is expected to remain relatively strong in the near future. In Q2, the company added 27 net new customers, an increase of 10% compared to the previous quarter.

Customer count (Palantir)

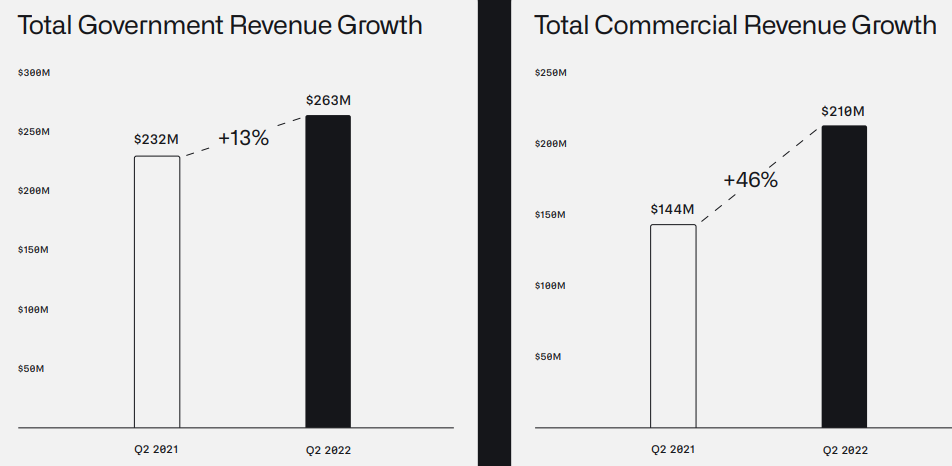

By business segment, government revenues increased by 13% YoY in the last quarter to $263 million, while commercial revenues increased by 46% YoY to $210 million. This means that Palantir’s business mix is gradually becoming more balanced, considering that its business was much more exposed to governments in the recent past. As the company continues to push for growth on the commercial side, it is likely that this segment will become the largest one over the coming quarters, boding well for revenue diversification to a larger number of customers over the medium to long term.

Revenue Growth (Palantir)

Indeed, Palantir continues to add salespersons despite the softer macroeconomic backdrop in developed economies right now, while other technology companies are freezing hires or reducing staff to cut costs. While this strategy may hurt margins in the short term, it is the right approach on a multi-year perspective, as Palantir is still developing its sales team and has great growth prospects ahead despite the economic outlook in its major markets.

Palantir’s annual revenue growth target of about 30% may be challenging in the current macroeconomic environment, but as a growth company Palantir is right, in my opinion, to continue to hire people to scale its business even if that means lower margins in the coming quarters.

Palantir is expected to increase its headcount by about 25% during 2022, reaching around 3,700 by year end compared to 2,920 at the end of 2021. While Palantir is not immune to economic trends, its long-term strategy continues to be focused on business growth, and headcount growth in the software and sales departments are key to reach its goals. While in the past Palantir didn’t have a dedicated sales team of its own, its strategy has changed and is gradually building this team, of which it plans to hire more 175 sales persons this year to scale its business, especially on the commercial side.

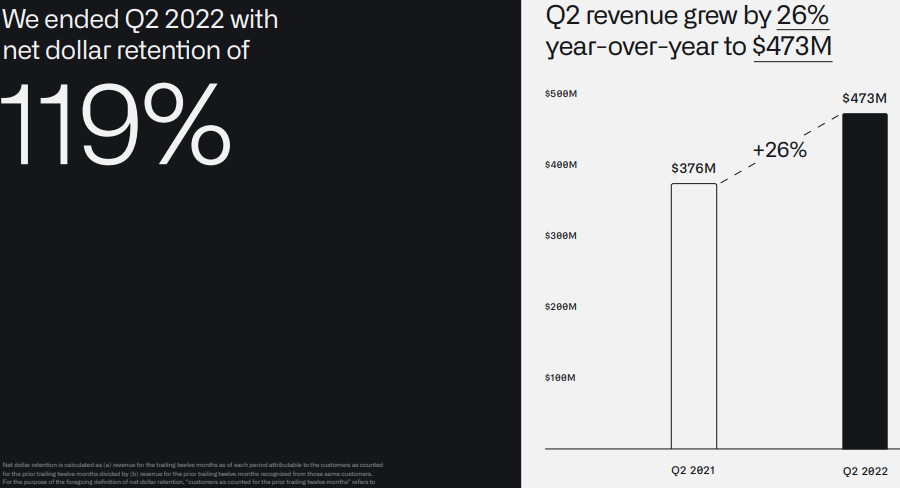

Considering that Palantir has consistently gained new customers in recent quarters, the company’s hiring strategy seems to be the right one, even if revenue is increasing at a slower rate than net new customers. As new customers try its data software, future revenue growth should be higher, as current customers use it and expand their relationship with Palantir over time, explaining why its net dollar retention is above 100% (119% in Q2 2022).

Retention (Palantir)

However, its total remaining deal value only increased by 4% YoY to about $3.5 billion, which represents close to 2 years of annual revenues, but it is a clear slowdown from the previous quarter when the total remaining deal value increased by 26% YoY. This shows that customers are not willing to enter medium to long term service commitments as much, which is natural in the current uncertain economic environment and overall cost reduction efforts from commercial customers.

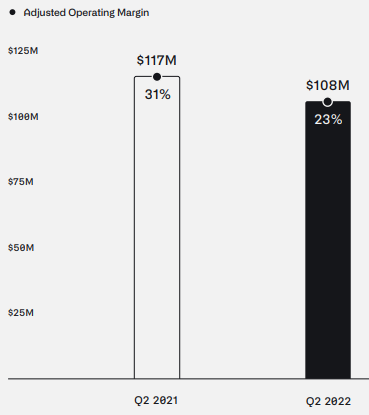

Despite that, Palantir’s growth strategy is not being scaled down, which in the short term has a negative impact on its margins, but should bear fruit in the future when economic activity and confidence increase compared to current levels. Moreover, Palantir’s business is still in an early growth phase and the company only expects to reach profitability (bottom-line) by 2025, thus at this moment growth seems to be more important than business margins. Financially, this can be seen in its adjusted operating margin, which declined to 23% (vs. 31% in Q2 2021), justified by rising costs.

Operating margin (Palantir)

Regarding its balance sheet, Palantir ended Q2 with some $2.4 billion in cash and no debt, thus its financial position is quite strong and its cash flow generation is more than enough to finance its growth ambitions without raising new equity in the short to medium term.

Regarding its guidance, it was a disappointment, as the company expects Q3 revenue to be about $475 million (vs. $506 million expected), while for the full year Palantir is now expecting to generate $1.9 billion in revenue (compared to close to $2 billion expected by the street) and adjusted operating income of about $340 million, way below expectations of around $527 million. While Palantir’s results in Q2 were relatively good, its guidance was not and this seems to be the main reason why Palantir’s share price is dropping considerably today.

However, as Palantir’s CEO said during the conference call they are managing the company for the long term and not from a quarter to quarter perspective, which means that its long-term growth strategy is not expected to change much in the near future, even if it is hurting its profitability in the short term.

Valuation

Like many growth stocks, Palantir’s valuation has de-rated considerably over recent months, as the market has been quite negative for companies that aren’t profitable right now and are showing some slowdown in their top-lines. While Palantir’s growth is still quite good, it is indeed slowing from a few quarters ago, justifying a lower valuation multiple.

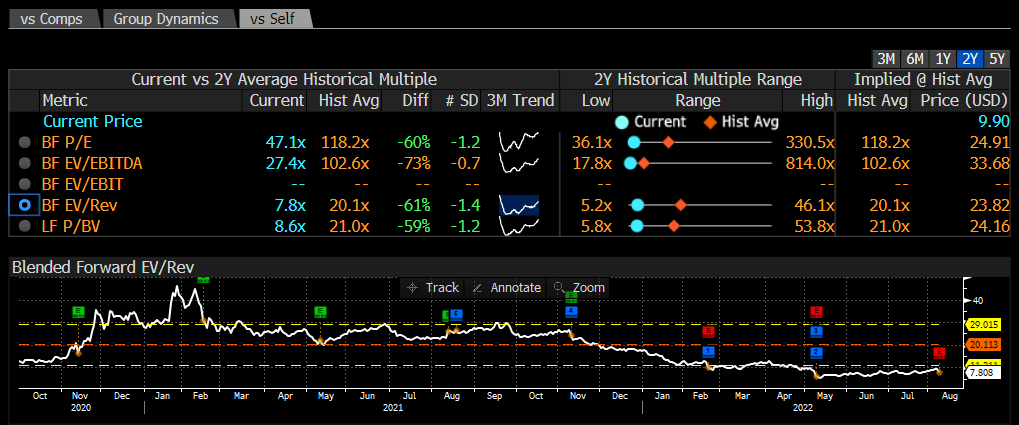

While Palantir was valued at more than 30x forward revenues at the end of 2021, its valuation has dropped considerably in the past few months as shown in the next graph, and is now trading at less than 8x forward revenues.

Valuation (Bloomberg)

This means that Palantir’s de-rating has been quite fast and is now trading at half its historical valuation over the past year (about 15.5x forward revenues) and much lower than its historical valuation since its direct listing in 2020 (historical valuation of 20x revenues). Therefore, compared to its historical average Palantir seems to be undervalued, a view that is confirmed using an absolute valuation method.

While Palantir’s share price has collapsed in recent months, its growth prospects have not deteriorated that much and revenue growth is expected to remain strong in the coming years. According to analysts’ estimates, Palantir should grow revenues by around 26% per year over the next three years, while for 2025 it is expected to reach about $4.3 billion in revenues.

As I’ve said in previous articles, I don’t expect Palantir to reach those revenues by 2025, as I’m being more conservative and expect growth to slow down due to a higher base and less operating leverage as the company’s size increases. Thus, I’m projecting revenues of around $3.9 billion by 2025, or 10% below consensus estimates.

Using my revenue estimate and a valuation multiple of 15x (in-line with its recent historical average), my price target for end-2024 is $32 per share, which means that Palantir has plenty of upside over the next two years.

Conclusion

Palantir reported a decent quarter today, but on the other hand its guidance was poor, showing that its business is not immune to economic cycles. Despite that, Palantir is maintaining its business strategy unchanged as management is running this company with a long-term view, something that is quite rare for public companies.

I think this is the best approach for shareholders and, personally, I continue to see Palantir as a good investment in the big data investment theme and I’m still confident in its business model over the long term.

Palantir’s current valuation is attractive for a high-growth company, which means that future growth is not priced-in to Palantir’s share price, and its risk-return proposition seems good right now for long-term investors who are willing to wait and don’t worry about short-term price volatility.

Be the first to comment