FinkAvenue/iStock Editorial via Getty Images

The COVID-19 pandemic crushed sales and margins for apparel-focused retailers in the first half of 2020. Some such companies were quickly forced into bankruptcy, but many of those that survived the initial downturn came roaring back in subsequent quarters. Cost cuts, a sharp rebound in demand, and industrywide inventory shortages that reduced the need for discounting created a perfect storm that sent retailers’ margins soaring.

Macy’s (NYSE:M) was a case in point. The iconic department store chain rang up an adjusted net loss of $630 million in Q1 2020 and took on expensive debt to shore up its liquidity. But since then, profitability has surged well beyond pre-pandemic levels. As a result, Macy’s stock has made a full recovery and trades roughly in line with its share price from three years ago.

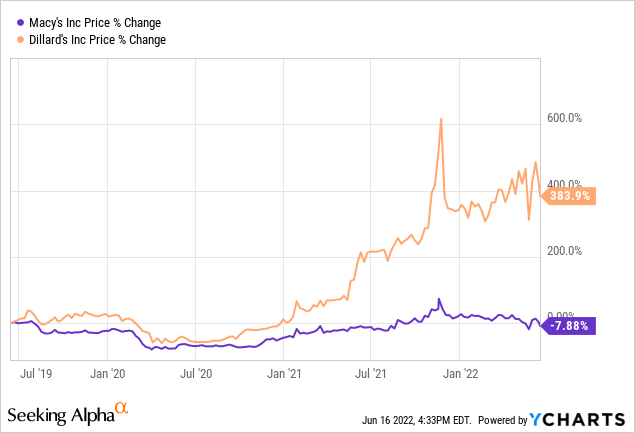

Regional department store chain Dillard’s (NYSE:DDS) represents an extreme case of the same phenomenon. Net income surged ninefold from fiscal 2019 to fiscal 2021. EPS grew even faster due to share buyback activity. Dillard’s posted another big earnings gain in the first quarter of fiscal 2022. As a result, Dillard’s stock has quintupled over the past three years.

As impressive as Dillard’s recent results have been, its buoyant margins aren’t sustainable. A reversion to the mean will likely cause Macy’s stock to dramatically outperform Dillard’s shares over the next 2-3 years.

Departure from a long-running pattern

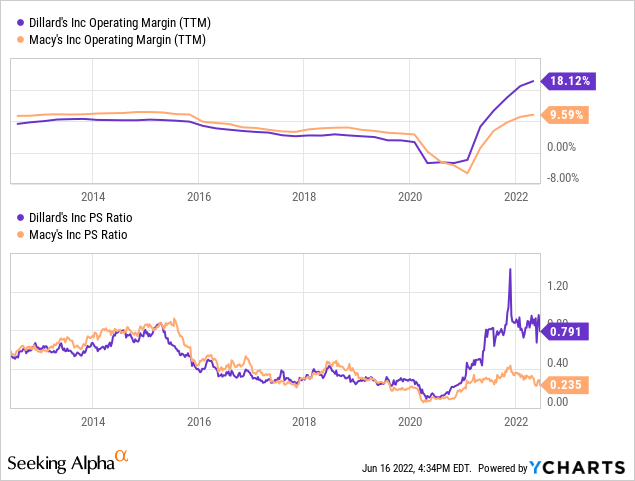

A pair of charts can quickly highlight the key idea behind a long Macy’s/short Dillard’s trade. Over the past decade, Macy’s operating margin consistently exceeded that of Dillard’s, and the two department store operators traded at similar price-to-sales ratios: until the pandemic hit. But in the past two years, Dillard’s operating margin has surged to nearly double that of Macy’s and its P/S ratio is now more than triple that of Macy’s.

In other words, shares of Dillard’s and Macy’s are now priced for Dillard’s to hold a sizable long-term margin advantage over its larger rival. Clearly, investors believe that the COVID-19 pandemic triggered a permanent change in the company’s relative profitability. Whereas Macy’s had a modest margin advantage throughout the 2010s, the current consensus seems to be that Dillard’s will maintain its huge lead going forward.

But if the two retailers’ operating margins return to parity (let alone Macy’s retaking its historical advantage), Macy’s stock should crush Dillard’s stock’s performance. This ought to hold true regardless of the macroeconomic environment.

What’s going on at Dillard’s?

To understand Dillard’s future sales and earnings prospects, it’s important to recognize the causes of its recent success.

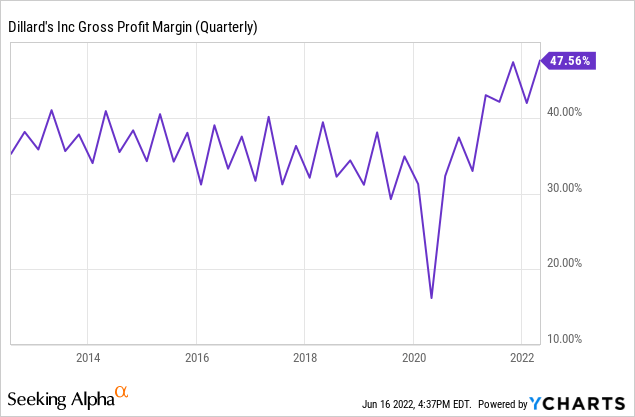

For example, Dillard’s recently reported retail sales of $1.58 billion for the first quarter of fiscal 2022: up 11% from the first quarter of fiscal 2019. Moreover, retail gross margin rose nearly 10 percentage points from 37.8% in Q1 2019 to 47.3% in Q1 2022. This led to adjusted EPS of $13.37 (excluding asset sale gains), compared to $2.77 in Q1 2019.

As one commenter on a recent article of mine put it, “These results look too good to be true. Could they be cooking the books?”

One need not jump to fraud allegations to explain the stunning surge in Dillard’s profitability, though. After all, it is hardly the only retailer to report sales and gross margin well beyond pre-pandemic levels over the past year.

Dillard’s merchandise mix has been perfectly geared towards consumer demand over the past year or so. Apparel and shoes account for roughly two-thirds of its sales. That positioned it to capture sales from customers looking to refresh their wardrobes for a return to the office and/or large social events (like weddings).

Meanwhile, lower spending on travel and entertainment and aggressive fiscal stimulus efforts enabled U.S. households to accumulate roughly $2.5 trillion in excess savings between March 2020 and January 2022. Dillard’s core customer base of upper-middle-class Americans did especially well.

The resulting buoyant demand coincided with lean inventories across the industry, particularly for dressy apparel. As a result, Dillard’s has been able to radically reduce discounting. So far, customers have accepted significantly higher prices.

Indeed, Dillard’s sales growth has been driven purely by higher pricing. While sales rose 11% versus Q1 2019 last quarter, cost of sales actually decreased by 7%. Considering the level of inflation in the broader economy, Dillard’s must be paying more for goods on a like-for-like basis. Thus, a 7% decrease in cost of goods sold hints at an even greater decline in the amount of stuff sold. Revenue is rising because realized prices have jumped more than 20% compared to pre-pandemic levels.

Image source: Author.

A big reversal is coming

Within a quarter or two, I expect to see clear signs of Dillard’s sales growth and gross margin coming back to earth. High inflation is already chipping away at discretionary spending. Consumers are also shifting discretionary dollars back towards travel and experiences. Finally, interest rate increases are reining in asset prices. That tends to make upper-middle-income consumers feel less wealthy and therefore spend less.

Dillard’s may be able to hold gross margin above its 2019 level, simply because unforced errors like carrying too much inventory were weighing on its profitability at that time. It also may be able to squeeze out some operating expense efficiencies by continuing to operate its stores with reduced hours. But Dillard’s adjusted operating margin was just 2.6% in fiscal 2019, compared to almost 18% over the last four quarters. Self-help initiatives might sustainably improve its operating margin by a few percentage points, but not by anywhere near 15 percentage points.

Smaller margin gains at Macy’s

Macy’s has also expanded its margins significantly compared to 2019: just not nearly as much as Dillard’s. Last quarter, gross margin reached 39.6%, compared to 38.2% in Q1 2019. Macy’s also reduced its operating expenses over this period, helping it expand its adjusted operating margin to around 8% from 3% in Q1 2019.

For the trailing 12 months, Macy’s adjusted operating margin has clocked in at 10%: roughly double where it stood in fiscal 2019.

Macy’s hasn’t prospered quite as much as Dillard’s for a few reasons. First, Macy’s has much higher e-commerce exposure than Dillard’s. The continued growth of its e-commerce business and rising delivery costs have partially offset the gross margin benefit of reduced discounting.

Second, Macy’s (unlike Dillard’s) typically gets a significant proportion of its sales from a handful of high-volume stores that are heavily reliant on tourist and office traffic. These include its massive downtown flagships in New York, Chicago, and San Francisco, but also mall-based stores near popular tourist destinations like LA, Hawaii, Miami, and Orlando. Sales at these locations have lagged over the past year but are now recovering rapidly.

Downtown flagships represent a key revenue driver for Macy’s. (Image source: Macy’s.)

Third, Macy’s gets over 15% of its sales from the home department, compared to less than 5% for Dillard’s. Growth in home department sales helped Macy’s top line during the pandemic, but the home category tends to have below-average gross margins.

Fourth, seasonality explains some of the recent divergence in business trends. Last month, Kohl’s (KSS) reported that sales trends in northern markets lagged its southern markets by 800 basis points during Q1, which it attributed to unseasonably cool weather in the northern U.S. Dillard’s operates almost exclusively in the Sun Belt, whereas Macy’s store footprint is skewed towards northern markets. The later arrival of spring weather in the northern U.S. likely shifted a significant volume of sales (and earnings) from Q1 to Q2 for Macy’s.

Margin parity coming soon

Rising inflation and other macroeconomic factors are poised to rein in discretionary spending in the coming months, halting Dillard’s recent sales momentum. And as consumers become more price-sensitive, competitive pressures will likely force Dillard’s to ramp up discounting activity, rapidly eroding its operating margin.

The same pressures will impact Macy’s, too. But a number of offsetting factors should mitigate the pressure on its sales and profitability. For example:

- Macy’s is adding Toys R Us shops to its full-line stores this year. That will instantly make it a credible player in the toy market, driving incremental revenue and store traffic.

- The gradual return of office work and international tourism will boost sales at Macy’s downtown flagships and tourist market stores. Sales to international tourists tend to be especially profitable, as the return rate is virtually zero.

- Macy’s has invested aggressively in data analytics tools to optimize pricing and markdowns. This will help it manage volatile supply and demand trends going forward.

- The continuing rollout of Macy’s Backstage off-price stores will help Macy’s retain customers who need to trade down to lower price points.

- Macy’s will soon launch a digital marketplace for a curated group of third-party merchants, capitalizing on the broad reach of its e-commerce sites.

Macy’s current guidance calls for fiscal 2022 adjusted EPS between $4.53 and $4.95, down from $6 for the last four quarters. Thus, management recognizes that some margin erosion is likely. But Macy’s has far more tools to mitigate margin erosion in the remainder of 2022 and 2023 than Dillard’s. By 2023 (or 2024 at the latest), I expect Macy’s and Dillard’s operating margins to converge.

Comparing valuations

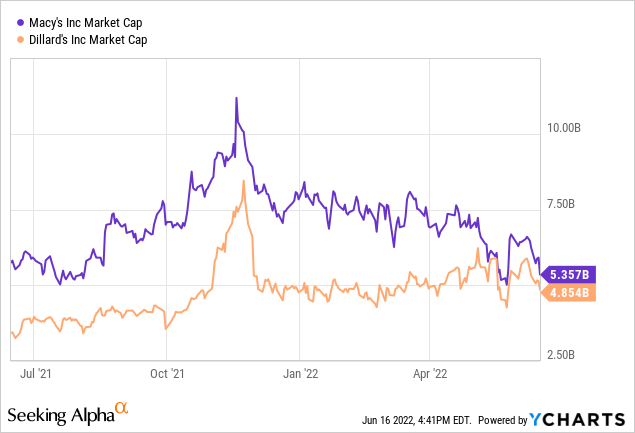

Today, Dillard’s has a market cap of $4.9 billion: almost in line with Macy’s $5.4 billion market cap. As noted above, this gives it a P/S ratio three times that of Macy’s.

On a trailing P/E basis, both companies look extremely cheap. Dillard’s trades for six times trailing adjusted earnings, and Macy’s trades for less than four times trailing adjusted earnings.

That said, both companies (but especially Dillard’s) will experience margin contraction before long. For fiscal 2023, the analyst consensus calls for EPS of $19.58 at Dillard’s and $4.49 for Macy’s. Investors should take these figures with a grain of salt, as department stores tend to have highly volatile earnings results. Adding to the challenges, Dillard’s has minimal analyst coverage. But these figures imply that Macy’s is trading for a little over four times forward earnings, compared to 14 times forward earnings for Dillard’s.

Source: Seeking Alpha.

Dillard’s excellent balance sheet (it ended Q1 with more cash than debt) justifies a valuation premium. But Macy’s balance sheet is in good shape, too. Macy’s now has just $3 billion of debt, down from $6.7 billion five years ago. That means the valuation premium for Dillard’s should be much smaller than today’s level.

Risks to the thesis

The most obvious risk to this pair trade is that Dillard’s maintains a significant margin advantage over Macy’s, particularly in a scenario where industry margins plummet. For example, if Dillard’s operating margin falls by almost 10 percentage points (from nearly 18% today to 8%) and Macy’s operating margin “only” falls by 7 points (from around 10% today to 3%), Macy’s stock could be eviscerated while Dillard’s shares would likely sustain smaller losses.

I view this as a fairly unlikely scenario. If competition and rising costs erode Macy’s profitability to levels not even seen during the “retail apocalypse” a few years ago, Dillard’s is unlikely to keep churning out very strong profits by historical standards.

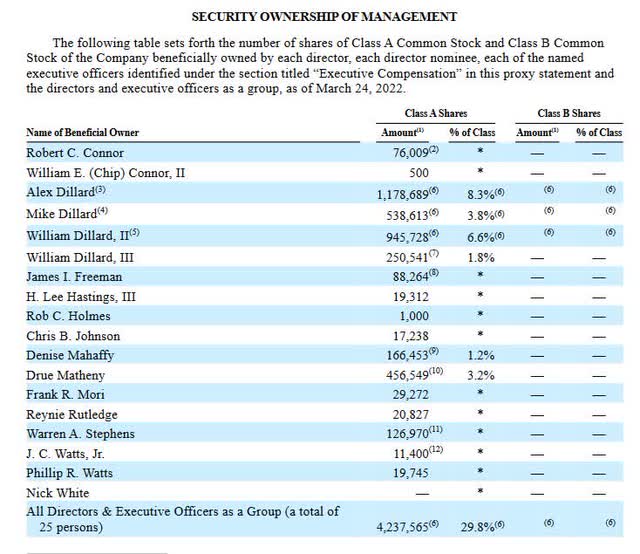

Dillard’s small free float and high short interest pose greater danger. As of late May, Dillard’s had 13.5 million class A shares outstanding. Insiders (mainly members of the Dillard family) hold 4.2 million shares, while the company’s employee stock ownership program holds another 5.5 million shares. That leaves fewer than 4 million shares in independent hands, and more than half of them have been sold short.

Source: Dillard’s 2022 Proxy Statement.

With short interest exceeding 50% of the free float, Dillard’s stock could be subject to a short squeeze. (Indeed, the stock has experienced a number of short squeezes in recent years.) Adding to that danger, Dillard’s ended Q1 with over $1.5 billion of liquidity. At current prices, that would be enough for the company to snap up all of its free-floating shares. This could create the conditions for a so-called “infinity squeeze.” These circumstances call for caution and careful risk management for investors considering shorting Dillard’s.

Nevertheless, I highly doubt that Dillard’s will suddenly become ultra-aggressive about buybacks. For one thing, the board has increased the company’s share repurchase authorization at a moderate pace over time. Additionally, Dillard’s paid out a special dividend totaling nearly $300 million late last year. If management and the board had wanted to shrink the share count as fast as possible, they would have saved that cash for buybacks.

Final thoughts

A long position in Dillard’s today essentially represents a bet that simple changes like managing inventory more tightly and reducing store hours can allow a retailer to sustainably earn margins consistent with a deep moat. It’s not a very plausible investment thesis.

By contrast, Macy’s stock has enormous upside from here even if the company’s operating margin recedes to 6%-7%. Macy’s massive trove of owned real estate in dense metro areas also provides valuable downside protection.

The net result is a very high probability that Macy’s stock will outperform Dillard’s stock over the next 2-3 years, creating an attractive pair trade opportunity.

Be the first to comment