zhz_akey/iStock via Getty Images

Introduction

I sometimes neglect my readers who want high-yielding investments as I have bought mainly low-yielding dividend growth stocks in the past few months. In this article, I am going to present a higher-yielding stock that I believe makes sense to own. Not only does the Packaging Corporation of America (NYSE:PKG) offer a 3.7% dividend yield, but it also comes with fantastic financials, a well-diversified business model, very satisfying dividend growth, and historically outperforming total returns, which I expect to continue. Moreover, the company is now trading at a discount thanks to ongoing macro difficulties.

In other words, investors do not have to sacrifice long-term outperformance for the sake of a higher yield. By buying this somewhat boring (which is a good thing in this case) packaging stock, they get both.

Let me walk you through the details!

When Boring Is Good, Really Good

When I call a dividend (growth) stock boring, that’s often a compliment. While calling any person, movie, or food “boring” is a bad thing, owning boring stocks is often the key to success.

PKG is very boring and most people haven’t heard of it.

The company has a $12.8 billion market cap and it employs more than 15,000 people. It officially operates in the consumer cyclical sector, which includes the packaging & containers industry. However, due to its operations, it is sometimes placed in the materials sector, which tends to happen when companies fit in multiple categories.

Located in Lake Forest, Illinois, the company has become the third-largest producer of containerboard products and the leading producer of uncoated freesheet paper in North America.

I had to look up what that is, but according to Wiktionary, it is:

A grade of paper containing little or no mechanical wood pulp that is often used in the production of office papers.

The company operates eight mills and 90 corrugated product plants and related facilities. Most of its business is done in the United States as its geographic footprint may suggest.

Packaging Corp. of America

In its packaging segment (91% of total sales), the company produces corrugated packaging products including conventional shipping containers used to protect and transport manufactured goods. The company also produces packaging for meat, fresh fruit, vegetables, processed food, and beverages.

Roughly 18% of used materials are recycled materials in this segment.

In its paper segment, the company produces and sells papers, including commodity and specialty papers, which may have custom or specialized features such as colors, coatings, high brightness, and recycled contents.

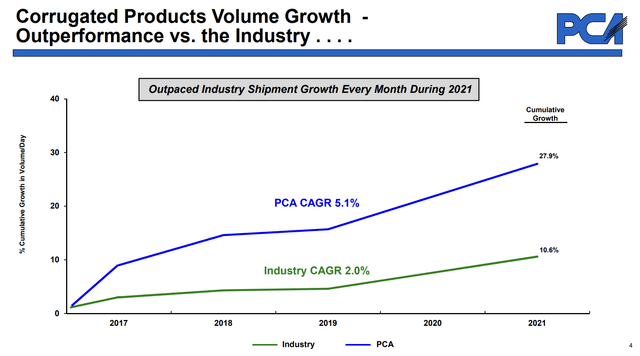

With that said, the company is an outperformer as its shipments have outpaced competitor shipments on a long-term basis, achieving 5.1% compounding annual growth since 2016.

The company’s stock price is also outperforming.

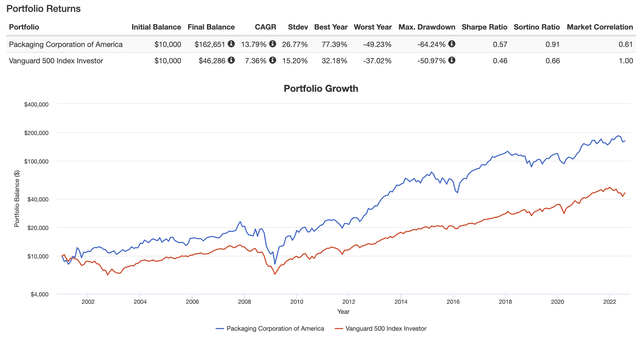

Since January of 2001, PKG has returned 13.8% per year including dividends. The S&P 500 returned 7.4% during this period. The standard deviation of PKG was roughly 11 points above the S&P 500 standard deviation, which means that the company was also more attractive on a volatility-adjusted basis.

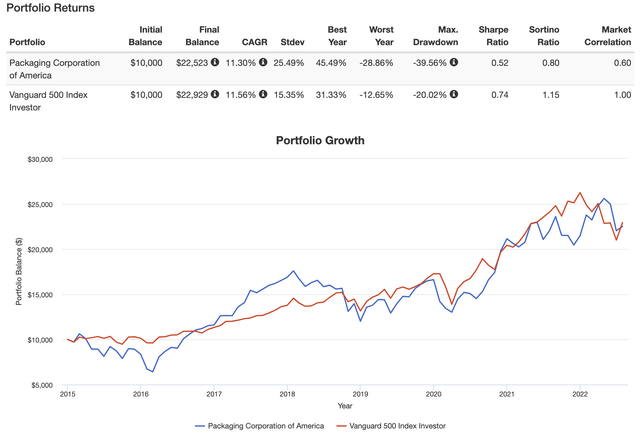

At this point, it is extremely important to mention that the company’s performance has remained very strong in the past years. In a lot of cases, slow-growing high-yield stocks outperform because they did so well 10-20 years in the past.

For example, going back seven years, the company has returned 11.3% per year. This is slightly below the S&P 500, but anything but a poor performance given that this period includes the pandemic, which favored tech/growth, of which the S&P 500 has a lot.

I’m extremely pleased to see how well PKG is doing versus the market and it’s no surprise once investors dig a bit deeper.

Which is what we are going to do now.

The PKG Dividend

The Packaging Corporation of America pays $1.25 per share per quarter. That’s $5.00 per year, which translates to 3.7% of the company’s stock price.

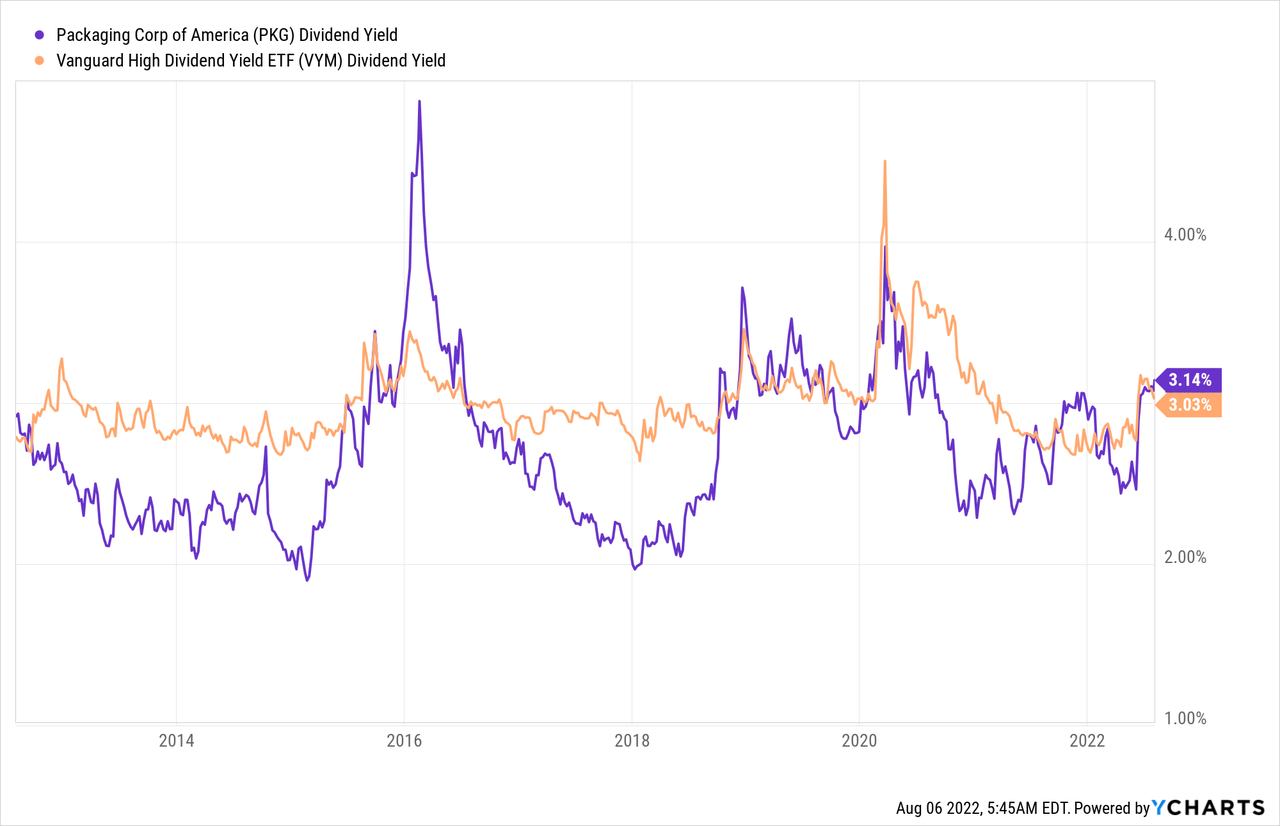

Please note that the company’s yield has NOT been updated by YCharts yet (the graph below). However, I’m still using it as it shows that the implied 3.7% yield is one of the highest in the company’s recent history if we ignore the spikes in 2016 and 2020. The yield is also 70 basis points above the Vanguard High Dividend Yield ETF (VYM).

The reason why the yield is so high is not that the stock price is doing so poorly (it’s not, as we just discussed) but because dividend growth is fantastic.

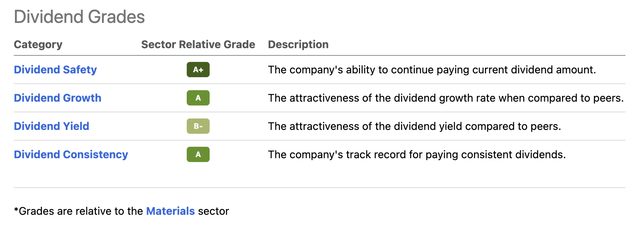

The company has an impressive dividend scorecard – provided by Seeking Alpha. This scorecard shows grades relative to the materials sector. We’re dealing with very high scores across the board. The yield is a B minus despite being close to 4%. That’s solely based on the fact that material companies include mining companies and related, which tend to have rather high yields.

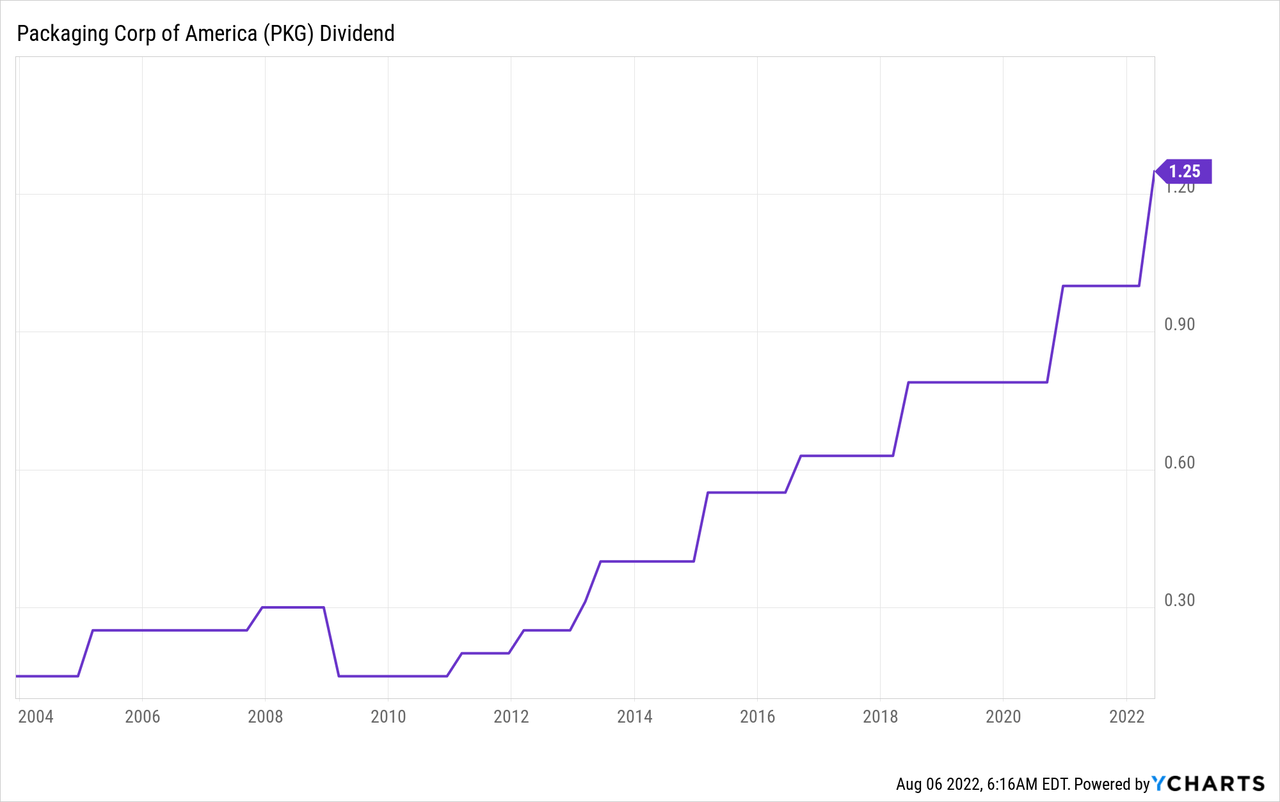

As the dividend history graph above shows, PKG cut its dividend in 2009, but hiked it consistently ever since, erasing the cut in 2013.

What’s impressive is that PKG’s dividend growth is far from slow. In other words, it’s not what one would expect from a company with a yield of more than 3%.

Over the past 10 years, annual dividend growth has averaged 16.8%. That number has declined to 10.4% over the past three years.

These are the most “recent” hikes:

- May 2022: 25.0%

- December 2020: 26.6%

- May 2018: 25.4%

In other words, consistency isn’t that great, yet these numbers are something to write home about.

The company does not engage in net buybacks, so investors solely benefit from direct distributions in the form of dividends.

Moreover, the fact that dividend growth isn’t very consistent but very high shows that management is very dedicated to letting investors benefit from its success – the way it should be.

While these numbers are absolutely fantastic it’s important to look beyond these numbers. In the case of PKG, we’re dealing with a company that generates high and rising free cash flow, which makes the high yield and aggressive hikes very sustainable.

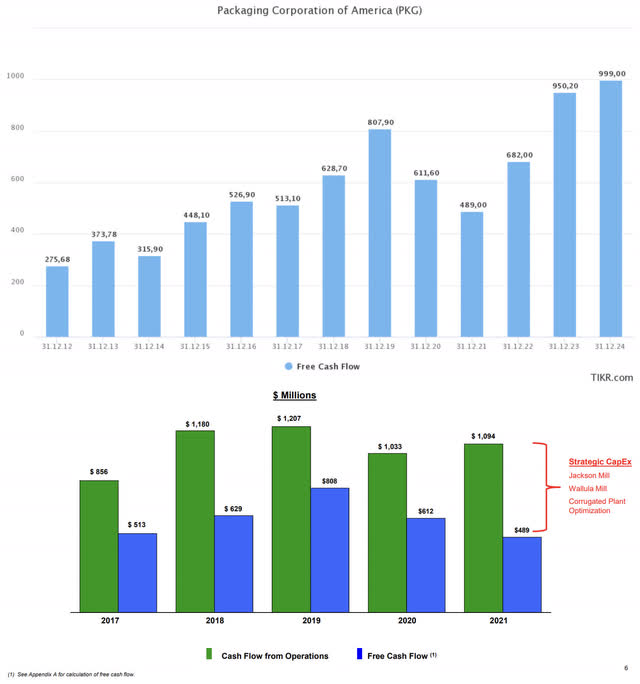

Below, I combined the company’s own presentation slide and my data showing its free cash flow (including more history and the outlook). Free cash flow is basically operating cash flow minus capital expenditures. It’s cash a company can spend on dividends, buybacks, and debt reduction.

What we see is a long-term uptrend in free cash flow. Between 2012-2024E, free cash flow is expected to grow by 10.4% per year, which is a tremendous number and supportive of high dividend growth. This includes three years based on expectations and two years with rather steep declines in FCF. However, as the lower part of the chart below shows, the company’s lower free cash flow was caused by new investments in various production plants.

This is what the company commented on that in its 2Q22 earnings call:

Our operations improvement and capital spending strategies in the corrugated plants have been extremely successful and put us in a position to serve our customers better than ever before, even against the backdrop of unprecedented supply chain and logistical challenges. Improving the processes, technology and equipment in our plants and optimizing our geographical footprint is driven by our customers’ needs and improving our capabilities to grow with them. This strategy also improves our operating and converting efficiencies and delivers cost savings in several areas throughout our facilities.

Moreover, if we assume that assumptions are right and the company is doing $950 million in free cash flow next year, we’re dealing with an implied free cash flow yield of 7.4% using its $12.8 billion market cap. That not only makes the 3.7% dividend yield safe but also provides a lot more room for aggressive hikes.

Bear in mind that aggressive dividend hikes are only possible because balance sheet health is no issue. Otherwise, the company has to prioritize debt repayment. This year, the company is expected to end up with $1.6 billion in net debt. Next year, that number is expected to be $1.1 billion, or just 0.6x EBITDA.

Hence, the company has a BBB debt rating, which is one step below the A range.

Valuation

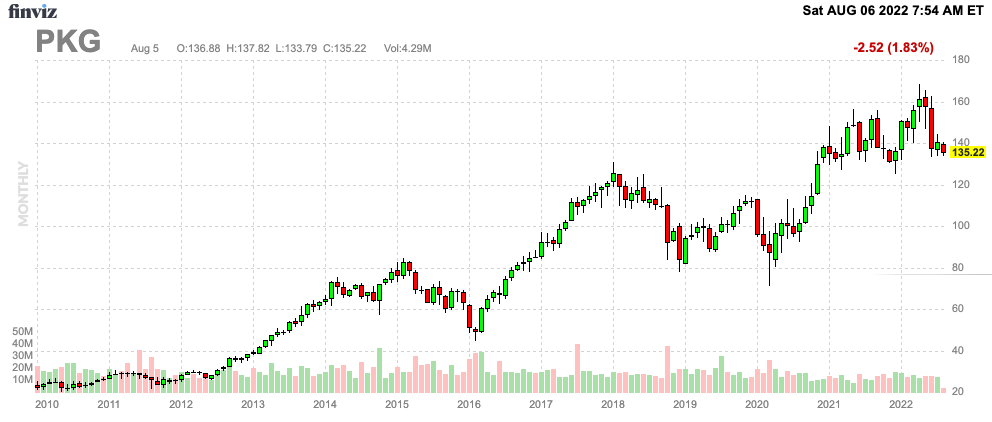

PKG is down just 0.7% year-to-date.

FINVIZ

That’s an outperforming performance. Yet, PKG is suffering too. The company is essentially facing two major headwinds.

These headwinds are inflation and customer inventory adjustments. In an article in June, I explained that consumer-related companies are reducing inventories after over-ordering as a result of the pandemic. After lockdowns, inventories were not prepared for accelerating demand. Companies had to accelerate new orders. Now, economic demand is weakening and a lot of inventories are full.

Inflation consists of higher chemical, labor, and energy prices.

This is what the company commented on that, as reported by Seeking Alpha:

With economic conditions continuing to be negatively impacted by broad-based inflation and aggressive interest rate increases, we see corrugated products growth as softening in the quarter but demand still-firm as certain end markets work through their current supply of inventory,” he said on Tuesday. “We expect continued inflation in most all of our operating and converting costs to be the primary driver of our third quarter results. Higher gas, purchased electricity, and chemical prices along with higher labor costs are expected to be the key areas during the quarter.

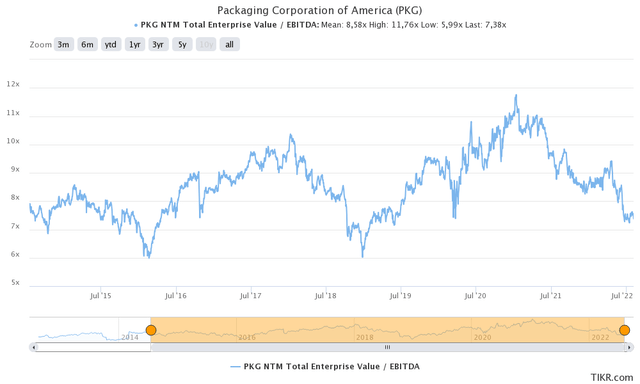

The good news is that a lot has been priced in. The company is trading at 7.3x 2023E EBITDA using its $14.1 billion enterprise value, consisting of the $12.8 billion market cap, $1.14 billion in expected net debt, and $130 million in pension-related liabilities.

This valuation is one of the lowest in recent history. The median valuation is closer to 8.5x (next twelve months) EBITDA, which would imply that the company is about 18% undervalued – conservatively speaking.

Takeaway

I’m extremely happy that I found the Packaging Corporation of America as I believe that it offers great value for income-oriented investors without taking away the chance to generate great long-term capital gains.

PKG has a rather straightforward business model as it produces packaging materials and paper. However, the company does this very efficiently and in a way that allows it to outgrow its average peer.

On top of that, the company generates a lot of free cash flow while doing so, which it uses to aggressively hike its dividend while keeping a close eye on financial health.

The current dividend yield is 3.7%, which is made sweeter by the aforementioned dividend hikes, which should turn this into an ever-juicier yield (yield on cost) in the years ahead.

Moreover, because growth is high, the company is not only able to keep up with the S&P 500 but is even able to outperform the index on a long-term basis, which isn’t that common among high-yield stocks.

Adding to that, current market turmoil and economic headwinds are proving investors with a decent valuation as I believe that the company is trading roughly 20% below its current fair value.

(Dis)agree? Let me know in the comments!

Be the first to comment