ljubaphoto/E+ via Getty Images

Retail earnings continue next week with several household names reporting. One online direct marketing firm issued disappointing profits in late July. Overstock.com (NASDAQ:OSTK) has an incredibly volatile stock price history, trading between $2.53 in March 2020 to $128.50 later that year, but it is simply rangebound right now.

According to Bank of America Global Research, Overstock is a leading pure-play, online retailer in US home furnishings behind only Wayfair (W). The company has over 3,000 suppliers. Nearly 100% of sales are attributable to the US home furnishings segment, and the company has a small presence in Canada. OSTK has majority ownership of a blockchain investment fund, which was converted into a limited partnership in early 2021.

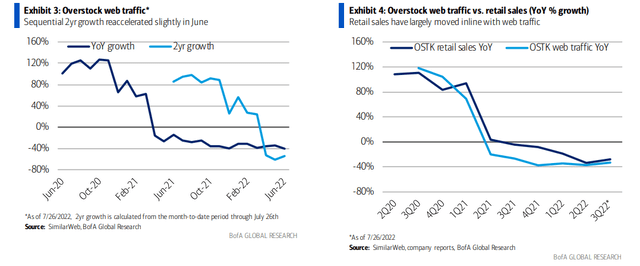

The Utah-based $1.4 billion market cap Consumer Discretionary stock in the Internet & Direct Marketing Retail industry does not pay a dividend and features a high short interest of 16.2%, according to The Wall Street Journal. OSTK missed Q2 earnings estimates that were released on July 28. The current period is vital for retailers like Overstock that depend on a strong back-to-school and back-to-college spending season. Last month’s quarterly report revealed disappointing web traffic data.

Overstock Had Underwhelming Web Traffic

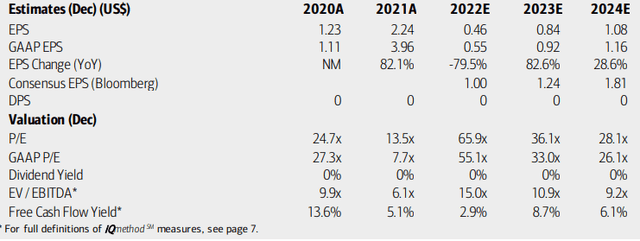

Overstock has exited from some unprofitable retail areas and has deconsolidated its blockchain business, per BofA. Taking that into account, earnings outlooks are better in the years ahead after recent volatility.

BofA sees a sharp EPS decline this year before a strong rebound in 2023 and 2024, but they are less sanguine on the firm’s profitability prospects compared with the Bloomberg consensus estimates. As such, the forecast P/E ratio is not compelling, but its EV/EBITDA multiple is seen as retreating to reasonable levels while free cash flow looks better next year.

OSTK Earnings, Valuation, Free Cash Flow Forecasts

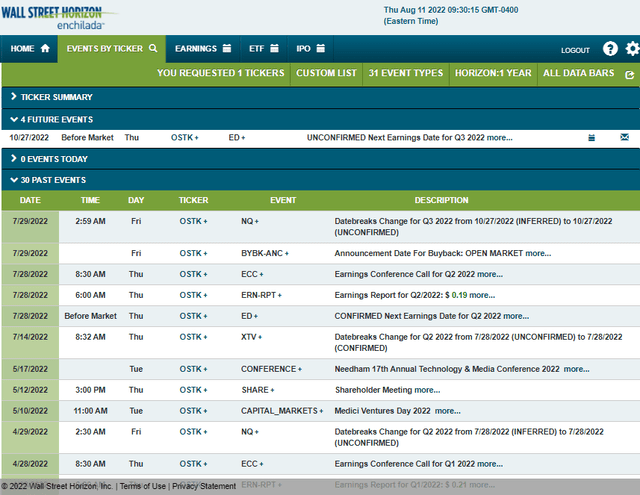

OSTK’s corporate event calendar is light until the next earnings date. According to Wall Street Horizon, the company’s Q3 reporting date is unconfirmed for Thursday, October 27 BMO.

Q3 Earnings Slated For Late October

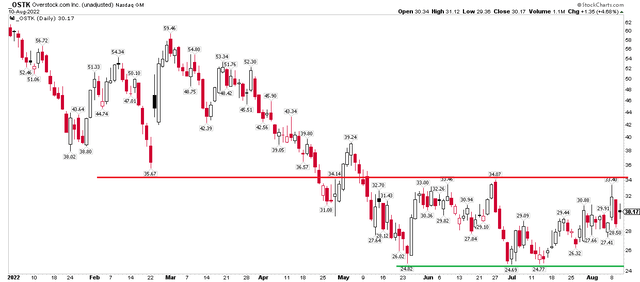

The Technical Take

Overstock shares are in a frustrating trading range over the past three months. There’s clear resistance near $34 while $24 to $25 is support. This is a straightforward technical angle – a bullish breakout above $34 would trigger an upside price objective to near $44 based on the current $10 range. A bearish breakdown would put a measured move to $14 in play. Traders should wait for a decisive move on the charts before putting on a position.

OSTK Is Stuck In A 3-Month Rut

The Bottom Line

OSTK is a volatile stock (to put it lightly). The company has undergone strategic shifts to focus on profitable areas, but its share price has not rebounded accordingly yet. I am neutral on the company right now and prefer to wait for a bullish breakout or bearish breakdown technically.

Be the first to comment