Darren415

This article was first released to Systematic Income subscribers and free trials on July 26.

That the economy will soon enter a recession is quickly becoming the consensus view. Few investors believe that the Fed will be able to engineer a soft landing. Rather, many view that the Fed will, unusually, be forced to keep tightening financial conditions even in the scenario of a sharp macro slowdown to ensure that inflation is wrung out of the system.

In this article we take a look at what the macro indicators are telling us, the different potential recessionary scenarios and which income holdings can make sense in the current environment.

The Macro Environment Is Weakening

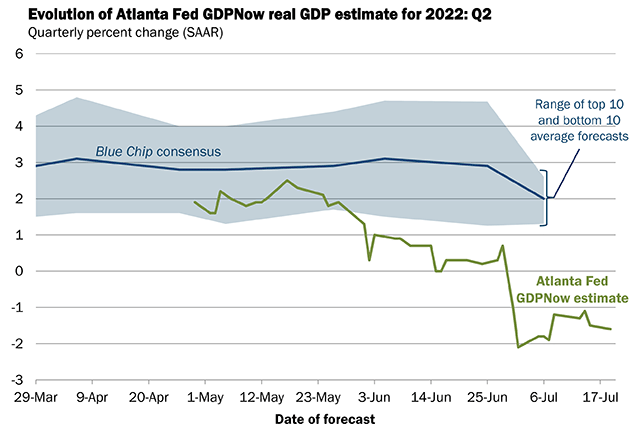

A common heuristic for a recession is two consecutive quarters of negative GDP growth. Although this is not the technical definition of a recession (NBER makes the determination in its sole capacity) it’s useful enough. By this metric we may already be in a recession. GDP fell 1.4% in Q1 and some quantitative GDP forecasts, such as the Atlanta Fed GDPNow, are forecasting another drop for Q2.

Atlanta Fed

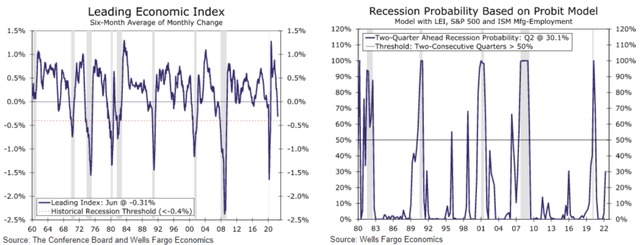

Similarly, various leading indicators are moving lower while recession probability models are moving higher.

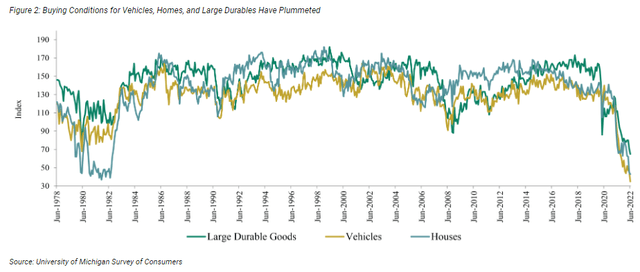

On the consumer side, sentiment has fallen to a 40-year low according to the University of Michigan survey – an unusual and troubling level.

Overall, the picture is clearly one of a weakening macroeconomic environment that is increasingly likely to end up in a recession.

What We Know And Don’t Know

It’s easy enough to say that we are likely heading towards a recession. However, even if this is true, it still leaves a lot of uncertainty around the exact path of the economy and markets.

What we do know is that the labor market is cooling and that payrolls and claims will weaken first, followed by a rise in unemployment. This, along with rising interest costs, will cause corporate margins to compress and earnings to fall. We are already seeing this pattern develop in Q2 earnings releases.

We also know that banks are in pretty decent shape overall with much stronger capital buffers and cleaner balance sheets than they were 15 years ago. This suggests that we are unlikely to suffer a banking crisis. This is important because banking crises tend to be associated with much more severe recessions. If this is true, then the next recession will not be a particularly deep one.

We also know that the Fed is fighting for its credibility and that inflation appears to be sticky. This suggests that if the macro picture weakens considerably but inflation remains high, the Fed will be less able to help by cutting rates. This may cause the next recession to be relatively long.

What we don’t know is what longer-term or shorter-term interest rates will do exactly. This is because it depends on the behavior of the broader market, the path of inflation as well as the specific decisions taken by the Fed.

All in all, we don’t expect longer-term rates to keep rising. This is because a recession will make it less likely for inflation to keep rising due to the sharp drop in aggregate demand. Plus, recessions tend to see a derisking by investors who seek safety in government bonds by selling riskier assets such as stocks and corporate bonds.

On the other hand, short-term rates could either fall or rise. If inflation peaks decisively, the Fed could very well take its foot off the pedal, particularly if the aggregate demand slows sufficiently. However, if the labor market holds up, as it has so far and inflation doesn’t peak, the Fed will be forced to keep hiking in order to further tighten financial conditions.

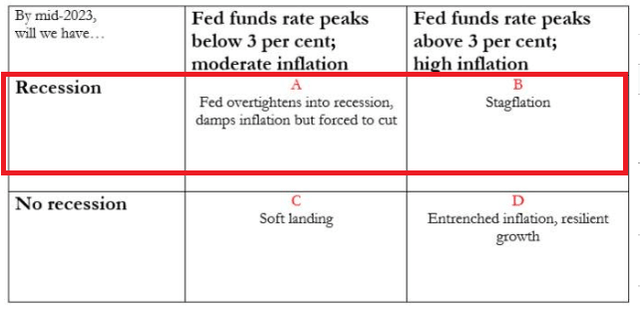

In short, borrowing from the All-Weather matrix below, a recessionary environment could see a moderate level of the Fed Funds rate, say below 3%, if recession moderates or it could see a rise above the current consensus of around 3.5% if inflation remains high. The key takeaway here is that investors ought to be prepared for either outcome, as neither one is preordained.

Some Ideas

In this section we discuss some of the allocation strategies and assets we like in a recessionary environment. Not all of these strategies will make sense for all different types of investors but some will likely make sense for most.

Overall, we like to allocate across the credit quality spectrum at current valuations. This is because a lot of the recession is already priced into credit assets, making them quite attractive at current levels. And two, we don’t know exactly how markets will react – a shallow recession is unlikely to see credit spreads widen substantially from here (they are now about where they were during the 2015 near-recession Energy crash) whereas a deeper one will see further weakness in credit.

A deeper recession is also likely to see significant outperformance by higher-quality assets such as Munis and bank preferreds over corporate high-yield bonds and loans.

On the higher-quality side we like having some Municipal and Preferreds exposure as well as some exposure to BB-rated bonds. Apart from their attractive yields, these types of assets serve two purposes – they provide some duration exposure and they are higher-quality than the broader credit market.

Our view remains that the bulk of the Treasury yield rise has already been done and duration risk is now well compensated. Treasury yields are also more likely to fall than to rise further in a recession – a common pattern we have seen in previous instances. This should favor assets with moderate duration exposure.

Holding some higher-quality assets will allow investors to not only maintain some ballast in their portfolios but also allow them to rebalance into even more attractive higher-yielding opportunities down the road in case we see further market weakness.

In the Muni space we like the BNY Mellon Strategic Municipals (LEO) and Nuveen Municipal Credit Income Fund (NZF), trading at 5.3% and 5.4% yields respectively.

In preferreds we like the Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund (PTA) and the Nuveen Preferred and Income Term Fund (JPI), trading at 7.9% and 8.0% yields respectively.

In the BB-rated corporate bond space we like the iShares Fallen Angels USD Bond ETF (FALN) with a 6.95% portfolio yield (7.2% weighted-average yield-to-worst less a 0.25% management fee) which allocates primarily to fallen angels i.e. BB-rated high-yield corporate bonds that used to be rated investment-grade but were dinged and are now mostly rated with the highest sub-investment-grade rating. The fund’s 4.2% trailing-twelve month yield is well below its underlying yield capacity as it ignores the strong pull-to-par element of the high-yield corporate bond market with the average bond trading around $90.

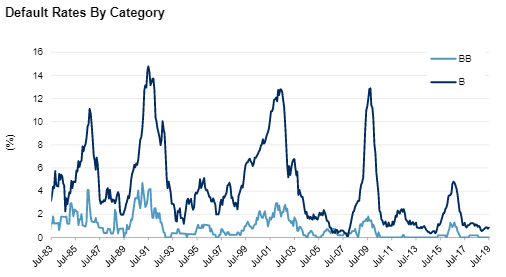

BB-rated bonds tend to be pretty resilient over default cycles, certainly much more than the broader “junk” space. Another advantage of this fund is that it takes advantage of the technical where bonds downgraded into “junk” are often sold by investors with an exclusively investment-grade mandate, causing their prices to be depressed relative to their fundamentals.

S&P

Having lower-beta securities in the portfolio can also make sense to mitigate the impact of market fluctuations on investor wealth. This can help investors maintain conviction in their holdings and mitigate the often disastrous sell high / buyback low cycle of trading.

For example, shorter-maturity corporate bonds deliver a very similar yield as longer-maturity bonds in the current market environment due to the flatness of the yield curve. However, they are less sensitive to changes in interest rates and credit spreads. Here we like the SPDR Bloomberg Short Term High Yield Bond ETF (SJNK), featuring a 8.7% weighted-average yield and trading at a 4.85% distribution yield. The fund’s duration at 2.4 is about half of the typical high-yield corporate bond fund.

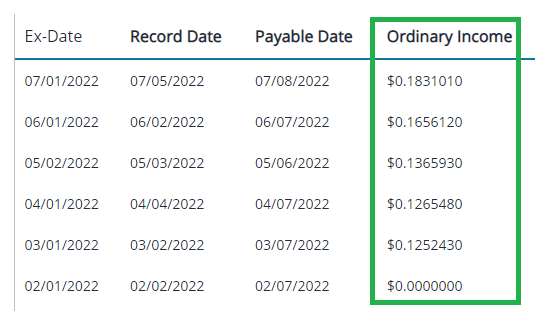

Finally, we like having some exposure to rising short-term rates, particularly in the scenario where the Fed keeps hiking past the current consensus of 3.5%. One higher-quality option is the Janus Henderson B-BBB CLO ETF (JBBB) which primarily holds investment-grade CLO tranches. The fund’s income profile has been growing over the recent months as short-term rates have risen. The fund’s SEC yield is 4.3% as of June and will continue to increase in the coming months.

Janus Henderson

Takeaways And Allocation Mechanics

The obvious question is if, as it seems increasingly likely, recession really does come to pass, why not just stay on the sidelines and allocate only when the worst is over. This approach certainly sounds good, however, in practice it doesn’t always work as neatly as it seems.

First, as we highlighted recently, assets tend to do OK over recessionary periods for the simple reason that markets move ahead of economic releases and a lot of the bad outcomes are already priced into assets by the time the economy actually enters a recession.

Two, timing the entry point is actually quite hard given the uncertainty around both the macro and market picture at any one time. For instance, investors who have stayed on the sidelines so far can pat themselves on the back with the view that they have not incurred much damage so far this year. However, this success can breed failure since investors may remain on the sidelines just as the market starts to recover. This recovery may lead to regret of having failed to allocate at the trough, leading some investors to remain on the sidelines and waiting for the double dip which may never come, as it didn’t come after March of 2020. For this reason we like to allocate through the drawdown to make sure that we have a peak risk allocation at the tough.

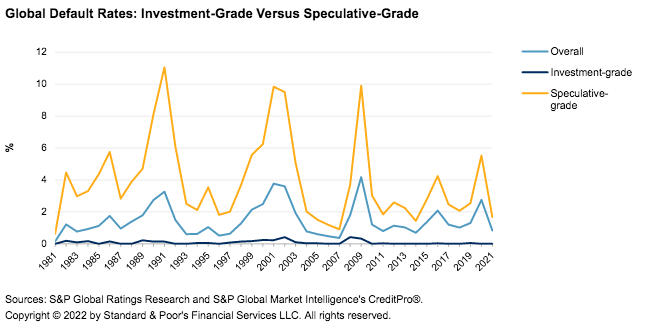

Finally, the credit market is currently offering a significant margin of safety, in effect, making it less risky to allocate to credit today than it was in 2021. For instance, high-yield corporate bonds are now trading at yields of around 8%. During recessions or near-recessions, the range of trailing-twelve-month default rates is 5-10%.

S&P

If we take the higher end of this range with an average historic recovery rate of around 40% we get to an annual loss rate at the recessionary peak of around 6% (i.e., 10% default rate x (1 – 40% recovery)). This nets out to a pretty flat return where the income from the portfolio roughly offsets the incurred losses from defaults, suggesting that locking in yields of around 8% over several years is actually quite attractive even if corporate defaults do increase going forward. This is because default rate peaks tend to be relatively short.

Be the first to comment