Nattakorn Maneerat/iStock via Getty Images

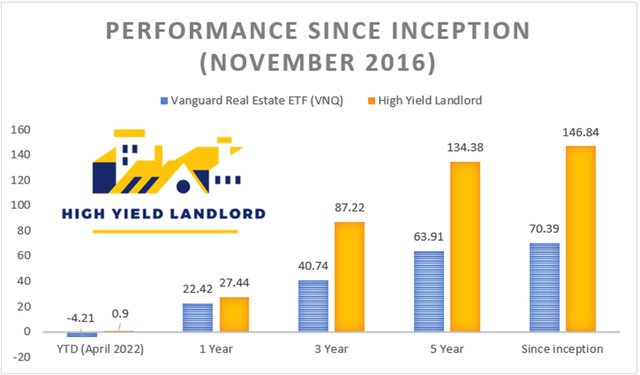

Overall, we have done well over the past few years. Most of our investments have outperformed our benchmark, earning us a 146.84% return vs. 70.39% for the average of the REIT sector (VNQ) since the inception of our portfolio:

High Yield Landlord vs. VNQ (High Yield Landlord)

But every investor has some losers and we are no exception.

We take calculated risks to earn returns, and occasionally, the risk factors play out and our investment ends up underperforming.

This then forces us to make hard decisions: do we sell and accept our loss (like we did with (OHI) ), or do we buy more and hold patiently, hoping that our thesis eventually plays out?

Currently, we have a handful of such problematic investments that are either deep in the red or have simply failed to deliver what we expected. Fortunately, these investments are relatively small in size and therefore, their impact on our portfolio performance has not been significant so far.

As an example, our 3 worst-performing investments in the Core Portfolio are also our 3 smallest positions, representing just around 4.5% of the total. In comparison, our largest single holding, STORE Capital (STOR), represents 9% of the Portfolio and it has been a very strong performer for us.

In what follows, we take an updated look at these underperforming investments and share our outlook for them.

Ladder Capital (LADR)

We are sitting on a small unrealized profit on LADR and we have also earned large dividend payments over the past years. In that sense, it is not a big loser. Nonetheless, it has performed far worse than we had expected in our original investment thesis.

A lot of that has to do with the pandemic of course. LADR, like many other mortgage REITs, suffered permanent damage from the crisis as it was forced to sell assets, pay down debt, extend maturities, and that came at a cost.

For most of 2020 and early 2021, LADR played defense, maintaining a lot of cash or cash-equivalent assets, but today, its financial health is secure and business is finally back to normal. In the last quarter, the company deployed a record amount of capital in new loans, growing the portfolio from $2.8 to $3.5 billion. As such, most of its cash has now been deployed and is again starting to earn interest to shareholders.

That’s good news.

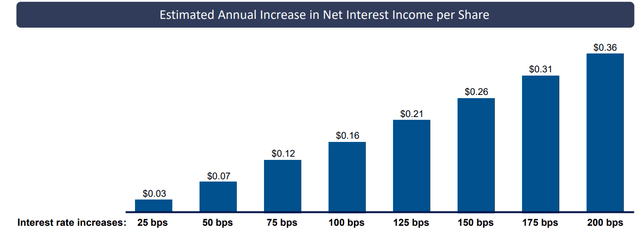

Moreover, because LADR gives floating-rate loans, but uses fixed-rate debt on its own balance sheet, it stands to directly benefit from rising rates. It is expected to earn an additional $0.16 of annual cash flow per share for every 100 basis point hike in interest rates, which is very substantial for a company with a $12 share price:

Ladder Capital benefits from rising interest rates (Ladder Capital)

With the Fed expected to hike rates up to 7 times this year, we like the hedge provided by LADR to our portfolio. Unlike many of our net lease REITs that are perceived to suffer from rising rates (rightfully or not), LADR is a clear beneficiary as it directly increases its cash flow.

But that’s not even the most important news that we have to share.

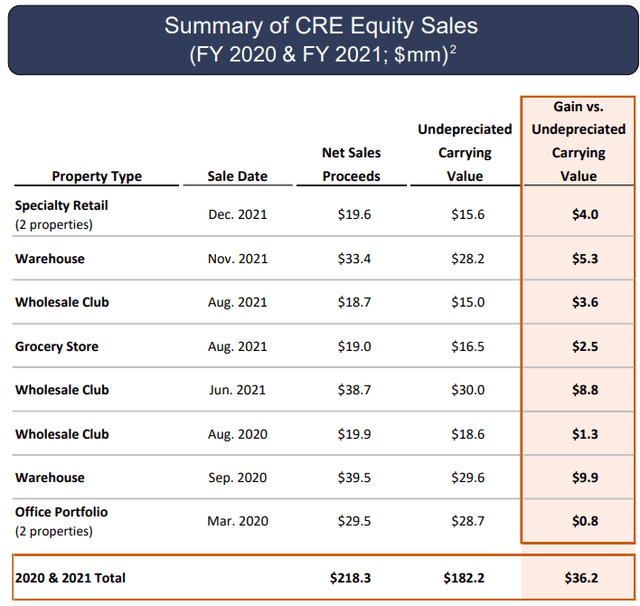

In late 2020, we had speculated that LADR could unlock substantial value for shareholders by selling its net lease portfolio. Cap rates have compressed considerably for high-quality properties occupied by investment-grade tenants and that’s precisely what LADR owns. It is one of the few REITs that reported a 100% rent collection rate throughout the pandemic.

The NOI of its net lease portfolio is around $47 million, which is worth $940 million if you use a 5% cap rate. Deducting the debt that’s on these properties, the equity should be around $470 million. That’s nearly a third of its market cap, which is far more than what the market is giving them credit for. The CEO agrees that their net lease assets are undervalued:

We continue to believe that our real estate portfolio is not properly reflected in our stock price, even after we sold a small portion of our holdings at attractive gains. We believe the bigger gains in this book of business are not yet realized.

They have begun selling some, each time locking nice gains over their undepreciated carrying value:

Ladder Capital owns valuable net lease properties (Ladder Capital)

But even with these sales, the market isn’t waking up to the opportunity, and perhaps out of frustration, the CEO made the following comment:

The sale that iStar (STAR) conducted of their net lease portfolio, certainly caught my eye and a few of our shareholders have even indicated to us perhaps, if we thought we could replace it in, we do think we can replace it by the way. Perhaps we should sell our entire portfolio or else put it off balance sheet in a net lease REIT that we manage externally. So these are all scenarios that we occasionally look through.

For reference, iStar recently sold all its net lease assets in a major transaction that unlocked substantial value for shareholders.

LADR is considering doing the same. LADR actually owns far better assets that would attract a lot more potential investors and unlock even greater value.

It would also simplify LADR’s business model, which is always welcomed by REIT investors. That alone could add even further upside.

Today, LADR’s undepreciated book value is $13.79, and if you adjust for the compressing cap rates, the real NAV is likely closer to $15 per share.

Yet, you can buy it today at $11.65. That’s a nice discount on a high-quality mortgage REIT that benefits from rising interest rates and has other additional catalysts to unlock value. While you wait for upside, you also earn a 6.7% dividend yield.

I did not even mention this, but LADR could soon also earn an investment-grade rating. That’s yet another catalyst.

We remain bullish and still expect our original thesis to play out, despite the delay.

Invesque is a highly leveraged bet on primarily senior housing communities, but also skilled nursing facilities and medical office buildings.

We knew from day 1 that it was a speculative bet because of its high leverage and the oversupply of senior housing, but we still decided to initiate a small position back in February of 2020 because:

- Its valuation was discounted.

- Its portfolio had many desirable characteristics.

- Its management had a history of successful M&A.

- Its 11% dividend yield appeared to be sustainable.

- And the US healthcare sector had recently recovered, but Invesque didn’t due to non-fundamental reasons (listing in Canada & not officially a REIT).

Senior housing community (Invesque)

In hindsight, the timing of our investment couldn’t have been worse. One month later, the entire world closed down and everything collapsed.

Invesque was hit particularly hard because senior housing suffered significant pain and its balance sheet couldn’t take it.

It forced Invesque to suspend its dividend, renegotiate with lenders, and look for ways to raise capital by selling assets. Despite the dire situation, we decided to hold on to our position and even made small additions to it. We thought that the company had a good shot at making it to the other side of the crisis and the share price had dropped so low that the upside potential could be substantial.

This brings us to today.

Invesque is still selling assets in an effort to deleverage and lower risks. Throughout 2021, it sold $200+ million of assets, which is very substantial for a company that used to own a $1.5 billion portfolio. It used these proceeds to pay down debt, lowering its leverage by about 300 basis points.

Such transactions hurt Invesque in the short run by lowering its FFO per share, but they strengthen its path to a long-term recovery by reducing the risks of bankruptcy.

Since that’s the primary concern of the market, we view these dispositions as a net positive. This is particularly true since they appear to be getting very decent cap rates. Nearly half of the assets sold was a skilled nursing portfolio that was sold at a 7.2% cap rate. Net of debt repayments, it netted the company $22 million, which was then used for further deleveraging.

Invesque has also made good progress in restructuring its convertible debt. It repaid some of it and extended the rest in exchange of a higher interest rate. Again, this hurts cash flow, but lowers the risk of a near-term bankruptcy.

Finally, they paid off $10 million of preferred equity, further deleveraging the company, and extended its credit facility and reduced its fixed charge ratio requirement.

This is all good progress, but Invesque is still not in a safe place. Even after paying off a lot of debt, its debt ratio remains 57%; down from 60% one year ago. That’s a lot of debt for a company operating in a struggling sector, and it explains why the market is so concerned about its financial health.

Right now, most of its triple net lease tenants operate at a rent coverage of right around 1x, which indicates that they are barely or not even profitable. There are signs that rental and occupancy rates are starting to recover and Invesque is receiving timely payments so far, but this could change if the pandemic lingers around for longer. Fortunately, nearly all of Invesque’s triple net leases are in cross-collateralized master lease structures, which reduces the likelihood of lease delinquencies.

Can Invesque survive?

We continue to think that they will. They have already made good progress, have less than 1.5% of debt maturing in 2022, retain 100% of their cash flow to pay down debt, and the fundamentals of their underlying assets appear to be now recovering. The CEO also clearly explains in the conference call that they are in no rush to sell anything and will only consider selling if they can get a fair price. In fact, they actually even made a small acquisition earlier this year, which indicates that they are not in such a dire situation anymore. Otherwise, every penny would need to go towards debt repayment.

Invesque survival is still not assured, but its likelihood is increasing, which is a good reason to be optimistic about future returns. But unfortunately, I am growing increasingly skeptical about the management’s alignment with shareholders. Why would they acquire a new property when they could have used this capital to buy back shares or pay down debt, which should be their main priority? Why haven’t insiders stepped up to make purchases with their personal money? Why don’t they communicate more clearly their path to unlock value for shareholders when the share price is seemingly so enormously discounted relative to peers?

If you use Invesque’s last quarter FFO as a run-rate, it is currently priced at just around 3x FFO.

Clearly, that’s very cheap for senior housing. Ventas (VTR) is priced at 20x FFO and Welltower (WELL) at 25x FFO. Invesque deserves to trade at a material discount due to its high leverage, past missteps, and higher allocation to skilled nursing properties, but is such a huge discount really warranted?

If you think that it is likely to face bankruptcy, then any price over $0 is too high, but if like us, you think that the company is likely to recover from here, then, it is hard to justify the current valuation.

If it recovered to just 5-6x FFO, we would break even on our losing investment. If it recovered to 10x FFO, we would earn a large gain, despite our large current unrealized loss.

The only reason why I am not doubling down is that I am losing confidence in the management and its alignment with shareholders. Maybe I will be reassured in the future, but for now, I will only consider making small additions, keeping my position size very small. We maintain a Buy rating and a High Risk rating. We are currently enquiring for an interview with the management and the outcome of this interview (if we get it) could then change our opinion. We keep you posted as soon as we learn more.

Tallinna Sadam (TSM1T)

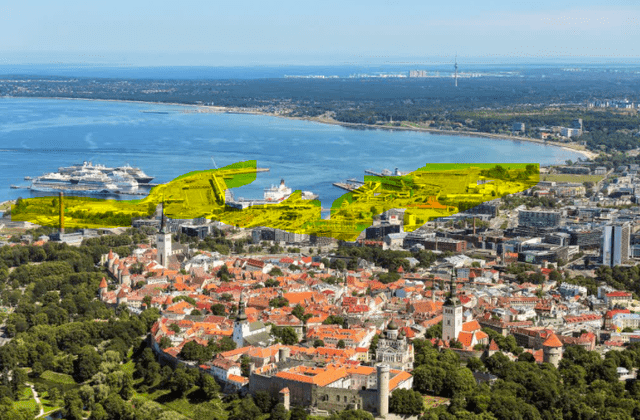

Tallinna Sadam is the owner of the Port of Tallinn (capital of Estonia) and all the land surrounding it.

The port of Tallinn (Tallinna Sadam)

It is currently the worst performer of our International Portfolio. This is of course largely because of Russia’s invasion of Ukraine.

The crisis hurts Tallinna Sadam (OTCPK:TSMTF) in four ways:

1) Lower investor confidence: While Estonia is a safe member of NATO, international investors may not see it that way and fear investing in Estonia because of Russia’s behavior.

2) Less international tourism: Tourists may also fear visiting Eastern Europe, reducing the traffic of cruise ships that dock at the Port of Tallinn.

3) Lower consumer confidence and risk of recession: The tragedy may also cause consumers to save more and spend less due to lower confidence and possibly even cause a recession.

4) Less traffic between the Tallinn – St Pete route: As sanctions are imposed on Russia, the Tallinn – St Petersburg cargo and passenger route is expected to suffer significantly. The passenger route has been closed since the beginning of the pandemic, so there is no impact there, but the impact on cargo could be substantial in the near term.

Obviously, that’s all bad news and it warrants a lower share price, but does it break our long-term thesis?

No, it doesn’t.

We think that this crisis is a case of short-term pain for long-term gain for Tallinna Sadam. Here are four reasons why:

1) West/NATO more united than ever: If there were any doubts about the West/NATO’s unity before this crisis, these doubts are now gone. NATO is more united than ever, which is very positive for Estonia and its safety. NATO will now deploy significantly more troops and equipment in Eastern Europe, including Estonia. As an example, the UK will double its troops in Estonia. This does not only increase security, but it also benefits Estonia’s economy.

2) Russian cargo will be rerouted: Most of the cargo coming from Russia are essential things like fertilizers and liquid bulk. These things cannot just be eliminated and removed from the market. Instead, they will need to be replaced by other sources. It creates near-term disruption in cash flow but there shouldn’t be a significant long-term impact on profitability. It will only accelerate the transition away from Russian trade, which was happening anyway.

3) Rapid population growth from refugees: So far, Estonia has already taken 25,000+ refugees from Ukraine. This is one of the highest numbers relative to the small population of Estonia. Some estimate that Estonia could take up to 50-100k refugees in total. That’s very significant population growth for a country of just 1.3 million people. Moreover, a large portion of these people will likely move to the capital, Tallinn, which only has 400k people. This rapid population growth benefits Estonia’s economy, its main port, and its real estate market. There are already reports of rising rents due to the sheer number of refugees arriving in the country.

4) Estonia’s long-term economic prospects are brighter than ever: Last year, Estonia celebrated its 7th unicorn (tech start-up valued at over $1 billion), which made it the country with the most unicorns per capita in the world. Just the other day, it celebrated its 10th unicorn, widening its lead in unicorn production. This is huge for a country of this size. The growth in the start-up scene is only accelerating and the Ukrainian refugees will help keep the momentum going. One of the main issues that Estonian start-ups have faced over the past years is that they could not find enough trained people. Ukraine is famous for its IT talent, bringing more potential workforce to Estonia.

So the long-term thesis is intact. More near-term uncertainty, but quite possibly an even brighter long-term outlook. We have reduced our Buy Under Price to €2 to account for these risks, but we remain bullish and would gladly buy more shares at these levels.

Closing Note

We will continue to closely monitor all our investments and will update you in real-time as major changes occur. From this list, our favorite pick is Ladder Capital (LADR) at this time.

Be the first to comment