tulcarion/iStock via Getty Images

Thesis

Otis Worldwide Corporation (NYSE:OTIS) produces good operating cash flow, while its CapEx requirement is relatively low at around $160M. Despite the competition, OTIS is one of the constant players with a low probability of declining market share due to its brand value and technology.

Although OTIS continued to deliver good financial results, the low-digit growth and the inflationary pressure will be something to monitor this year. In the short term, I predict that the lock-down or project delays (both in the USA and China and globally) may create a shortfall of earnings for the upcoming one or two quarters this year. Given the nature of its business, these slower performances would all translate back to the increase in their backlog.

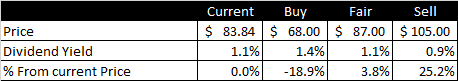

My valuation suggests that the company’s current price is fair, with a 3% to 5% sales growth rate and an average 15% operating income. I am sure that most value investors would agree on the price point. However, I like how the company’s revenue is translated into cash flow, which helps them in debt deleverage, dividend rate increase, and share buybacks.

Looking at the short-term and long-term dynamics, I would monitor the company’s performance to enter the position.

Introduction

Otis Worldwide Corporation, formerly known as Otis Elevator Company, is an American company that does elevator and escalator manufacturing, installation, and service. The company operates through two segments – New Equipment and Service – which make up 45% and 55% of the 2021 net sales and 21% and 79% of the operating profit, respectively.

In the New Equipment segment, the company designs, manufactures and installs elevators, escalators, and moving walkways for residential, commercial, and infrastructure projects. OTIS sells its equipment in America, China, and globally, with China and the Americas each making about one-third of their new equipment net sales.

In the Service segment, the company does maintenance, repair works, and modernization services to upgrade the equipment. The company provides services for OTIS equipment and equipment from other manufacturers.

OTIS’s major competitors include Schindler Holding (OTCPK:SHLAF), KONE Oyj (OTCPK:KNYJF;OTCPK:KNYJY), and thyssenkrupp AG (OTCPK:TYEKF;OTCPK:TKAMY).

Main updates for FY2021 Q4

1. Sales Growth

Organic sales grew for the fifth consecutive quarter and were up 2.8%, with growth in both segments.

China is an important region to focus on as that is where the market growth is. China is currently OTIS’s largest end-market for new equipment sales, representing approximately 35% of their global New Equipment net sales and over half of their global New Equipment unit volume. However, at the same time, pricing in China is very competitive among the international and domestic players.

OTIS expects China to be flat in 2022 due to a slowdown in the property market.

Energy-efficient and Smart Elevators will bolster market growth. Elevators consume approximately 2% to 7% of the total energy consumption in the whole building. Although the energy consumption is relatively small, it is considered significant when aggregated, and it presents an opportunity for manufacturers to develop energy-efficient lifts.

OTIS launched the Gen3TM and Gen360TM, connecting to its OTIS ONETM IoT Digital Platform. OTIS uses Standby ETA+, LED lighting, and ReGenTM drives, which reduces the energy consumption up to 75% compared to systems without regenerative technology. In addition, they can minimize annual lubrication oil consumption by up to 98% less than the conventional system, making their elevators much eco-friendly and cost-efficient in the long run.

2. Cash acquisition on the remaining interest in Zardoya Otis and its impact

In September 2021, OTIS announced a tender offer to acquire the remaining interest in the Spain-based company Zardoya Otis (OTC:ZRDZF). Given that OTIS already has a majority stake and operational control, OTIS’s current revenue and income statement already include this subsidiary’s financial impact. The further ownership increase can potentially change the dividend income from the subsidiary, while OTIS has to increase its debt to acquire. The tender offer value is €1.66 billion, and in November 2021, the company issued €1.60 billion ($1.8 billion) Euro Notes to fund the Tender Offer.

The transaction is expected to close in Q2 2022 and boost OTIS’s EPS in 2022 (by $0.03-$0.05) and 2023 (by a mid-single-digit percentage).

Conceptually speaking, the acquisition will create an annual value of EUR113M in EBITDA (which is 50% of the current EBITDA of Zardoya Otis) and a positive impact from further management streamlining by OTIS (I assume to be about $20M from the synergy effect). This roughly adds to $150M (USD equivalent) in annual income. The financial yield is roughly estimated to be 8% ($150M / $1.8B), while it pays an average interest expense of 2.3%.

3. Headwind is expected, but OTIS’s performance remains stable

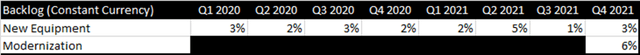

Although the company did not give clear guidance about wage inflation or the potential labor shortage, I question whether there will be a timing delay on the projects. The table below shows OTIS’s backlog data for 2020 and 2021, coinciding with the COVID-19 period. In Q2 2021, the backlog was at 5%, and it dipped in Q3 2021 to 1% before picking up again in Q4 2021 at 3%. The labor shortage may impact the upcoming Q1 and Q2 of 2022, and the backlog may shoot up higher than what we have seen in Q4 2021.

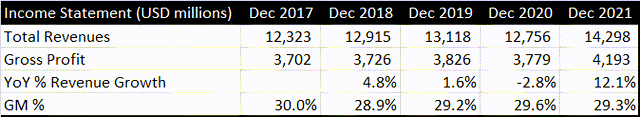

From the table below, the YoY revenue growth was doing very well for FY2021. Despite the pressure from the commodity and wage inflation, its gross margin has proven stable over the years. The company has mentioned that it will continue to face inflationary headwinds in 2022 and will be the chance to monitor the resilience of the company’s performance.

4. Cash flow – assessment

The company also seems prudent with cash, having achieved deleveraging $400M of the $500M debt target for FY2022. There is also potential share buyback in 2022 after the deleveraging has been completed. While it is great that the company is clearing debt and shares with their free cash, I think the cash balance will be kept lean and may impact future M&A considerations.

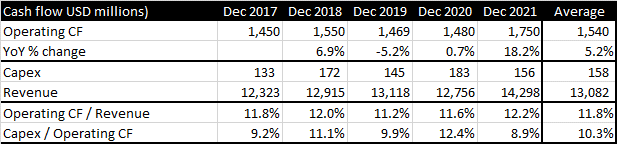

The OCF/Revenue has been steadily increasing, showing the company’s ability to turn sales into more available cash. The company’s operating cash flow is starting to pick up after the COVID-19 pandemic. The table below shows that the OCF to CapEx cost pressure is low, with the CapEx averaging around $158M.

Author’s financial model

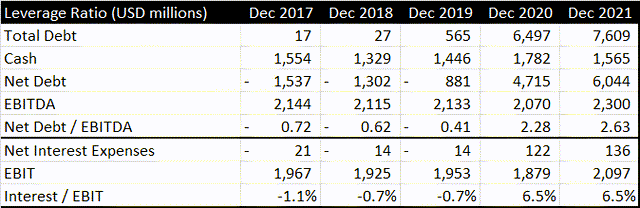

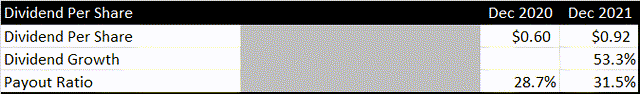

In the table below, OTIS’s debt increased significantly around 2019 to 2020 and is currently at $7.6B.

Given that the OCF net CapEx is around $1.6B, the high debt balance should not cause worry. I believe OTIS’s healthy operations make the debt deleveraging possible and allows them to consider and sustain the dividend increase and the share buyback program.

OTIS’s dividend payment has increased by over 50%; the payout ratio at 31.5% is still looking very healthy and is well covered by its earnings.

Conclusion

This is my price range for OTIS:

Author’s financial model

The current trading price is fair with a 3% to 5% sales growth rate and an average 15% operating income. OTIS has a valuable brand name and a strong market position with a high market barrier. It has proven to have resilient finance performance even during the COVID-19 era. I like this company for its solid financial health and ability to generate healthy cash flow .

Continue to monitor the company’s performance and plans, and look for opportunities to enter in the meantime.

Be the first to comment