Quick Take

OrthoPediatrics (KIDS) has announced the acquisition of ApiFix Ltd. for up to $69 million (or more) in cash, stock and contingent consideration.

ApiFix has developed a spinal deformity correction system for the non-fusion treatment of progressive adolescent idiopathic scoliosis [AIS].

With the deal, KIDS bolsters its scoliosis treatment offerings. The stock appears unnecessarily beaten down and will quickly bounce back upon the retreat of the Covid-19 pandemic’s effects over the next few quarters, so I’m Bullish on KIDS at its current level.

Target Company

Misgav, Israel-based ApiFix was founded to develop a less invasive surgical solution to treat scoliosis in adolescents.

Management is headed by CEO Paul Mraz, who has been with the firm since 2018 and was previously Managing Partner of Business Strategy at OnPoint Advisors and president and CEO of Cerapedics.

Below is an overview video of the ApiFix system:

Source: ApiFix

Market

According to a 2019 market research report by Market Research Future, the market for scoliosis treatments was valued at $2.6 billion in 2018.

This represents a forecast CAGR (Compound Annual Growth Rate) of 3.9% from 2019 to 2024.

The main drivers for this expected growth are a growing number of cases of cervical thoracic lumbar sacral orthosis and increasing per capita healthcare expenditure and rising number of scoliosis cases in the U.S. and Canada.

Major vendors that provide spinal treatment products include:

-

Nuvasive (NUVA)

-

Optec USA

-

Spinal Technology

-

Aspen Medical Products

-

Spineform

-

UNYQ

Source: Research Report

Acquisition Terms & Financials

OrthoPediatrics disclosed the acquisition price and terms as follows:

-

$2 million in cash

-

934,783 shares of common stock

-

Contingent payment of $13 million on 2nd anniversary

-

Contingent payment of $8 million on 3rd anniv.

-

Contingent payment of $9 million on 4th anniv.

-

Additional potential consideration based on overage amounts in 3rd and 4th years

Total consideration would be up to $69 million plus additional overage consideration as earned.

In its press release, management did provide a change in financial guidance as a result of the transaction.

A review of the firm’s most recently published financial results indicate that as of December 31, 2019 OrthoPediatrics had $70.8 million in cash and equivalents and $52.2 million in total liabilities, of which long-term debt represented $26.1 million.

Free cash flow for the twelve months ended December 31, 2019 was a negative ($29.6 million).

In the past 12 months, OrthoPediatrics’s stock price has fallen 4.0% vs. the U.S. Medical Equipment industry’s drop of 8.2% and the U.S. overall market index’ fall of 14.9%, as the KIDS chart indicates below:

Source: Simply Wall St.

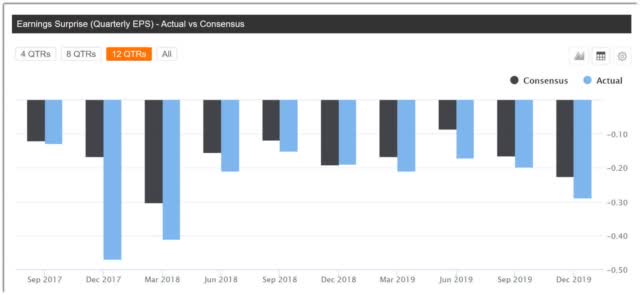

Earnings surprises versus analyst consensus estimates have been negative in nine of the last ten quarters, as the chart shows below:

Source: Seeking Alpha

Valuation Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$669,170,000 |

|

Enterprise Value |

$624,650,000 |

|

Price / Sales |

7.99 |

|

Enterprise Value / Sales |

8.61 |

|

Enterprise Value / EBITDA |

-131.97 |

|

Free Cash Flow [TTM] |

-$29,040,000 |

|

Revenue Growth Rate |

26.05% |

|

Earnings Per Share |

-$0.94 |

Source: Company Financials

As a reference, a public comparable to KIDS would be Nuvasive (NUVA); shown below is a comparison of their primary valuation metrics:

|

Metric |

Nuvasive (NUVA) |

OrthoPediatrics (KIDS) |

Variance |

|

Price / Sales |

2.25 |

7.99 |

255.1% |

|

Enterprise Value / Sales |

2.68 |

8.61 |

221.3% |

|

Enterprise Value / EBITDA |

12.72 |

-131.97 |

-1137.5% |

|

Free Cash Flow [TTM] |

$79,110,000 |

-$29,040,000 |

-136.7% |

|

Revenue Growth Rate |

6.0% |

26.1% |

332.7% |

Source: Seeking Alpha

Commentary

KIDS acquired ApiFix to enter the non-fusion scoliosis treatment market.

As KIDS CEO Mark Throdahl stated in the deal announcement,

We believe that ApiFix fills a major treatment gap that could potentially allow patients to avoid fusion surgery. We estimate that non-fusion procedures will grow significantly as patients, their families, and surgeons recognize non-fusion’s benefits.

The company is expanding the total addressable market for its scoliosis treatment products.

The technology supports the firm’s goal to provide a treatment to intervene with patients earlier in the scoliosis condition progression.

ApiFix’ system is one of only two non-fusion systems to receive a Humanitarian Device Exemption in the U.S., which allows up to 8,000 procedures per year.

So, the deal represents a desire by KIDS to continue filling out their offerings as the firm believes the ApiFix system is an excellent example of a non-fusion approach which results in numerous other benefits to the patient, including reduced recovery times and potential complications.

The deal was valued on a technology basis with significant milestone & earnout provisions and uses little in the way of cash.

With a challenging economic environment, conserving cash is paramount to being able to survive and thrive until the U.S. economy exits the hopefully sharp but short-term downturn as a result of the Covid-19 coronavirus outbreak.

The acquisition makes strategic sense as the firm bolsters its scoliosis treatment options and will add to the firm’s growth trajectory.

While the pandemic will impact the firm’s operations as it will other companies, the firm’s medium term growth trajectory is not fundamentally altered.

As the U.S. enters the summer period, my thesis is that the Covid-19 outbreak will abate and healthcare stocks such as KIDS may have a quiet strong bounce back and business returns to normal quickly.

I’m bullish on KIDS over the medium term as I believe the stock has been beaten down from the market selloff due to the Covid-19 coronavirus pandemic.

I research IPOs and technology M&A deals.

Members of my proprietary research service IPO Edge get the latest IPO research, news, market trends, and industry analysis for all U.S. IPOs. Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment