petekarici/E+ via Getty Images

Introduction

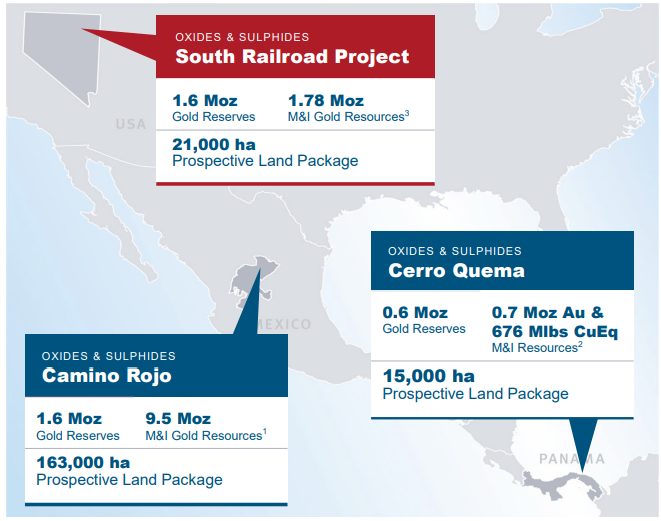

On June 13, Latin America-focused gold miner Orla Mining (NYSE:ORLA)(OLA:CA) announced that it’s buying Nevada-focused sector player Gold Standard Ventures (NYSE: GSV) in a C$242 million ($188 million) all-stock deal.

In July 2021, I wrote a bullish article on Gold Standard and I think that this is a good purchase for Orla despite somewhat underwhelming figures from the updated feasibility study on the South Railroad project. Let’s review

Overview of the transaction

Gold Standard shareholders will receive 0.1193 Orla common stock for each share they own, which implies a purchase price of C$0.655 ($0.51) per share. This represents a 35% premium based on the closing price of Gold Standard’s shares on the Toronto Stock Exchange on June 10. Overall, Gold Standard shareholders will get a 13% stake in Orla.

Gold Standard owns the South Railroad gold project on the Carlin Trend in the US state of Nevada, which is ranked as the best mining investment in the world by the Fraser Institute.

South Railroad seems similar to Orla’s Camino Rojo gold mine in Mexico, which reached commercial production on April 1 – it’s an open pit heap leach property with low capital intensity.

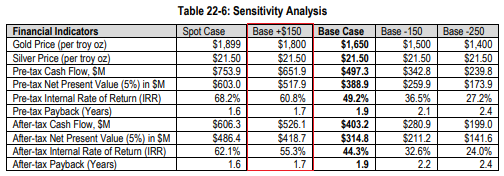

Orla Mining

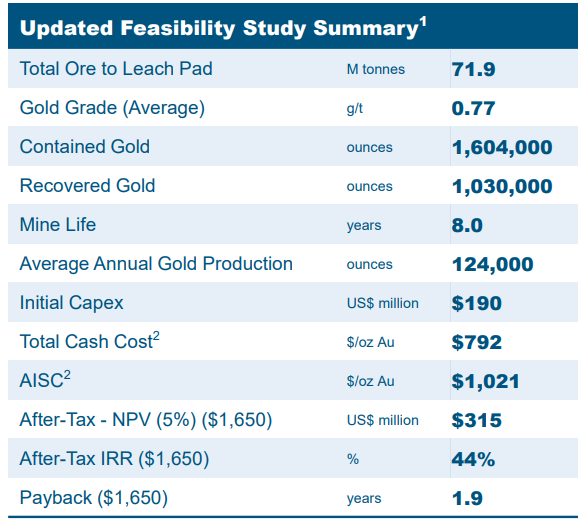

In February 2022, Gold Standard released the results of an updated feasibility study on South Railroad which showed that the project has a $315 million after-tax net present value (NPV) at a 5% discount rate. The after-tax internal rate of return (IRR) stands at 44% and the initial capex is $190 million, which I think is low for a gold project of this caliber as the payback period is below 2 years. Overall, South Railroad is expected to produce an average of 124,000 ounces of gold over eight years at all-in sustaining costs of $1,021 per ounce.

Orla Mining

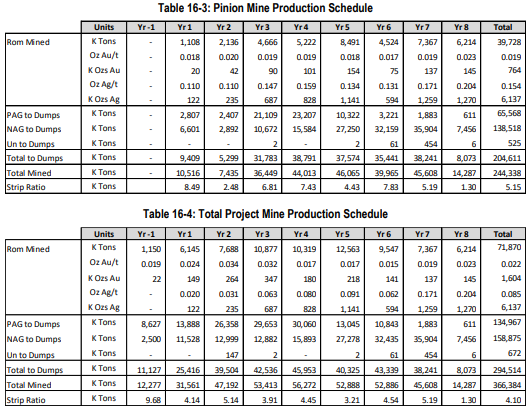

Back in July 2021, I said that it doesn’t look likely that the project can become larger than 2.5 million ounces and that the short-term aim was to convert as much as possible of the over 300,000 ounces of resources at the Pinion deposit into reserves. I was expecting reserves to increase to about 1.5 million ounces when the updated feasibility study was published. Well, the South Railroad now has reserves of 1.6 million ounces of gold, so it seems I was conservative. Compared to the 2020 feasibility study, the reserves at Pinion rose by 400,000 ounces but the reserves at the Black Star deposit declined by 43,000 ounces, mainly due to a 4.3% decrease in the average grade.

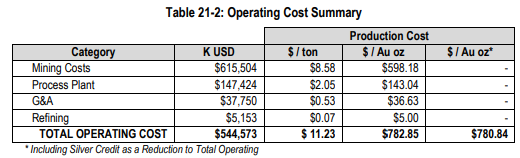

The net present value, in turn, has grown from $265 million in 2020 to $315 million today. However, I find the new figure disappointing. You see, the 2022 feasibility study is based on gold prices of $1,650 per ounce. And the one from 2020 is based on gold prices of $1,400 per ounce. This means that we aren’t comparing apples to apples. If the base case gold price was kept at $1,400 per ounce, the NPV would have decreased to just $142 million. The main reason behind this slump is an increase in production costs from $579 per ounce of gold in the previous study to $782 per ounce of gold in the new study as mining costs have increased by over 63% in two years.

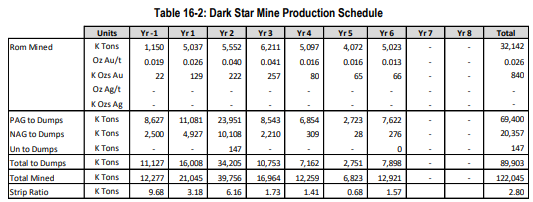

Gold Standard Ventures

The reason behind this rise in mining costs is a 90% increase in material mined, which is coming mainly from the Pinion deposit. The amount of gold ore that is expected to be mined has increased by 53% between the two feasibility studies but the amount of waste mined has soared by 103%. Overall, I think that Pinion is a disappointment – it has low grades and a high strip ratio, which means that mining it makes little sense at $1,400 per ounce of gold. However, Dark Star still looks like a compelling deposit.

Gold Standard Ventures Gold Standard Ventures

So, is Gold Standard a good buy for Orla despite the disappointing numbers for Pinion? Well, unless gold prices decrease substantially, it seems so. The yellow metal is trading at $1,822 per ounce as of the time of writing, which means that the NPV for South Railroad is currently over $400 million while the IRR is above 50%.

Gold Standard Ventures

On top of that, the technical risk seems low as ROM ore is the best material you can have in a gold project. There is little that can go wrong until reaching commercial production and strong gold prices make this a compelling purchase. In my view, South Railroad can play a crucial role in Orla’s plan to become a 500,000 ounce per year gold producer. Overall, this deal seems like a good strategic fit at a reasonable price.

Investor takeaway

I think that the updated feasibility study on South Railroad didn’t impress investors due a lower NPV as a result of the high strip ratio at Pinion. As a result, the share price of Gold Standard Ventures wasn’t performing well over the past several months. Yet, it’s still a good gold project with compelling key financials and I think that it’s a good fit for Orla.

In my view, Orla can use the cash flow from Camino Rojo to fund the development of South Railroad and if gold prices drop, it could just delay mining Pinion. I think the company looks cheap at the moment and that its market valuation could surpass $1.6 billion by the end of 2022 unless if gold prices remain at around $1,800 per ounce.

Be the first to comment