Hulton Archive/Hulton Archive via Getty Images

When we last covered Orion Office REIT Inc. (NYSE:ONL) we gave it your straight. There was no mollycoddling or selling of belief in pixie dust and tooth fairies.

For worse or for better, we are going to give it to you in capital letters. Single tenant office properties are the worst asset class among REITs in this environment. If a tenant requires even 10% less space for hybrid work, they can abandon the building and look for other solutions. We don’t like the stock here and are maintaining our Sell rating with a $8.5 price target (5X FFO).

Source: Blood In The Constellation

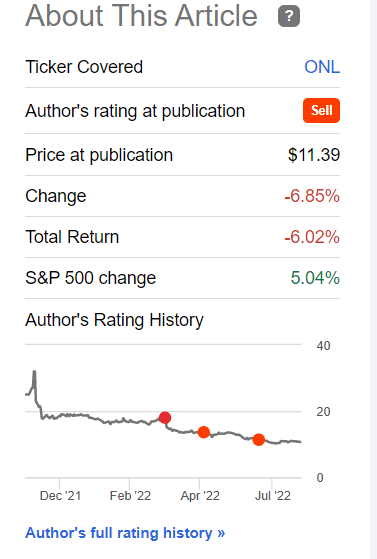

Directionally, there was nothing wrong with that call, or the string of sells which would save you a lot of money.

Seeking Alpha

The stock has still held up better than we expected. Is the tide turning? We examine the Q2-2022 report for clues.

The Good

Orion’s strongest point in Q2-2022 results was how it tightened up its guidance. Post Q1-2022, debt to EBITDA expectations were rather wide and wild.

Our net debt-to-adjusted EBITDA was 4.51x at quarter-end. And we expect to remain within the estimated range of 4.7x to 5.5x as of December 31, 2022 that we guided to on the last call.

Source: Orion Q1-2022 Transcript

Funds from operations (FFO) were expected at $1.70 (midpoint).

We believe our first quarter performance keeps us on track with the full year 2022 guidance we provided with an estimated core FFO range of $1.66 to $1.74 per share.

Source: Orion Q1-2022 Transcript

Orion improved both metrics and the debt to EBITDA drop was exceptionally good.

The Company expects its 2022 Core FFO per diluted share to be in a range between $1.74 and $1.78. This guidance assumes:

General & Administrative Expenses: $16 million to $16.5 million

Net Debt to Adjusted EBITDA: 4.7x to 5.0x.

Source: Q2-2022 Press Release

This was good.

The Bad

Orion is selling properties actively.

During the quarter and shortly thereafter, Orion closed two dispositions, representing a total of 210,000 square feet, for net proceeds of approximately $9.2 million. The Company also has agreements in place to sell six additional properties, representing 338,000 square feet, for an aggregate purchase price of $18.9 million.

Source: Q2-2022 Press Release

This can be called “capital recycling” or “portfolio improvement” or pretty much anything that spins it in a good light by the bulls. At the end of the day, this happening because those properties are already vacant or because vacancy is expected, with no immediate potential for a new tenant.

On April 1, 2022, the lease at Orion’s Dublin, Ohio property expired as scheduled, and this property is now vacant and scheduled to be sold this month.

Source: Q2-2022 Press Release

We also got confirmation of this on the conference call.

Edward Reilly

Good morning, gentlemen. A bunch of housekeeping. You had three properties under LOI for an aggregate sale price of $13.8 million?

Paul McDowell

I think we have two under LOI 13.9 – $13.8 million. I’m sorry, $13.8 million, Eddie.

Edward Reilly

Okay. And – so there’s eight properties in the queue right now to be sold. Could you tell us how many of these are currently vacant?

Paul McDowell

About half of them are vacant. And the remainder, as I mentioned in my prepared remarks have short lease terms, where we expect the tenant will not renew.

Source: Q2-2022 Transcript

To some extent, this is also immediately visualized by investors. Orion’s sales would total about 548,000 square feet for $28.1 million. Assuming it sold its entire portfolio at that price per square foot, it would get less than $550 million. That is not enough to even pay off the debt on the balance sheet. Obviously, each property is different and we cannot extrapolate the price of these across the board. But we can conclude that these are the weaker assets and those fetching poor prices per square foot today.

The Ugly

One could argue that the capital recycling is good and the asset base improves after the sale. We think this is likely true to an extent. But this capital recycling has done nothing to help the number we are worried about.

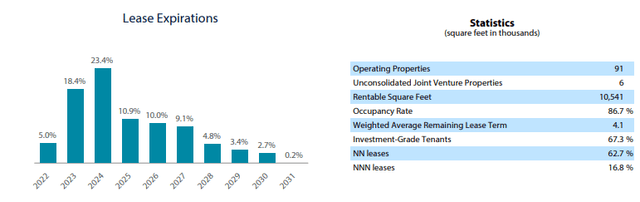

As of June 30, 2022, Orion’s real estate portfolio consisted of 91 properties as well as a 20% ownership interest in a joint venture comprising six properties. As of June 30, 2022, the Company’s portfolio occupancy rate was 86.7%, with 67.3% of annualized base rent derived from tenants with an investment grade credit rating, and the portfolio’s weighted average remaining lease term was 4.1 years.

Source: Q2-2022 Press Release

March 31, 2022 showed this a little higher.

The Company has 92 office properties with an aggregate of 10.5 million leasable square feet located in 29 states and Puerto Rico, with an occupancy rate of 88.1% and a weighted-average remaining lease term of 4.0 years as of March 31, 2022.

Source: Orion Q1-2022 Results

In December, we were at 91.9%.

Remember that occupancy can only be calculated on existing properties. So selling vacant properties, improves the number. The fact that we have dropped 5.2% in 6 months while working on existing properties, is alarming.

Verdict

Some of those asset sales will hit in Q3-2022 and that likely bumps the occupancy a tad higher. The real challenge now lies in 2023 and 2024.

42% of occupied leases mature in two years and they will test the quality of the asset base.

Edward Reilly

Sorry. No, I was just wondering if there is a strong probability of re-leasing to the tenants that have lease expirations in 2023 and 2024.

Paul McDowell

Yes. We’ve got – I would say that – our – last quarter I think our recapture or – was about 55%, 56% of tenants; about half renewed half terminated. I think looking forward we don’t know exactly where that’s going to come out. But quarter-to-quarter will be very, very volatile. So we may have one quarter where we have very strong renewal because if you have two leases expire and they both renew you’re at 100% renewal. And then if you have two leases and they both don’t renew, you’re at 0%.

But we think over time, we’ll have strong renewal in the portfolio but there will be some volatility quarter-to-quarter. Next looking into the coming periods, the coming two quarters – remaining two quarters of this year and then looking into next year, it will be a mixed bag like it has been this year. We’ll have some very good renewals. We’ve got some good new leasing visibility on properties that are going vacant. And we’ll have some departures and additional vacancy.

Source: Q2-2022 Transcript

As we have said before, but it bears repeating, single tenant office buildings tend have a 10X higher risk than multi-tenant office buildings in our opinion. There is little room for the tenant to cut back on space and things are binary, either they stay or they go. Of course,. an alternative is a massive rent reduction where the tenant is effectively paying for less space and we will see that as well. Based on the quarterly results, we are sticking with our $8.50/share target and maintaining our sell rating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment