Juan Ruiz Paramo /iStock via Getty Images

On our last coverage of Orion (NYSE:ONL) we maintained a sell rating with a $8.50 price target. This was based on 5X funds from operations (FFO), a multiple that seemed a bit on the cheap side. But the risks and similar REIT valuations directed us to that destination.

As we have said before, but it bears repeating, single tenant office buildings tend have a 10X higher risk than multi-tenant office buildings in our opinion. There is little room for the tenant to cut back on space and things are binary, either they stay or they go. Of course,. an alternative is a massive rent reduction where the tenant is effectively paying for less space and we will see that as well. Based on the quarterly results, we are sticking with our $8.50/share target and maintaining our sell rating.

Source: The Good, The Bad, And The Ugly

Q3-2022 results were just released, and we saw a few things that we wanted to highlight as we updated our thesis.

Core FFO Continues To Drop

Everyone loves a guidance bump and we did get that from Orion this quarter.

The Company is raising the lower end of its 2022 Core FFO guidance range to reflect solid performance for the first nine months of 2022 and greater certainty in its estimates for the remainder of the year. The Company’s Core FFO is now expected to range from $1.76 to $1.78 per share, up from $1.74 to $1.78 per share last quarter.

Source: Q3-2022 Press Release

This was of course welcome but appears to be primarily the case of setting the bar a bit low earlier in the year. On a quarterly basis, FFO continues to move lower, and it is rather brisk.

Q1-2022 was at $0.49 per share. Q2-2022 was at $0.47 per share. The most recently reported quarter, Q3-2022 came in at $0.42 per share. At the upper end of the guidance, Q4-2022 should be about $0.40 per share. Do you see a pattern here?

Dispositions Continue

Orion has been busy in all of 2022 closing off property sales and this quarter was no different.

During the third quarter and shortly thereafter, Orion closed six dispositions, representing a total of 434,000 square feet, for an aggregate sale price of approximately $24.8 million. The Company also has agreements currently in place to sell four additional properties, representing 278,000 square feet, for an aggregate sale price of $15.9 million.

Source: Q3-2022 Press Release

This capital recycling is happening wherever there is little hope of immediately finding a tenant or there is a very short-term lease in place with similar issues expected down the line. These asset sales are allowing some pay down of the debt ($40 million in the quarter), but also briskly reducing FFO.

Leasing Activity Remains Weak

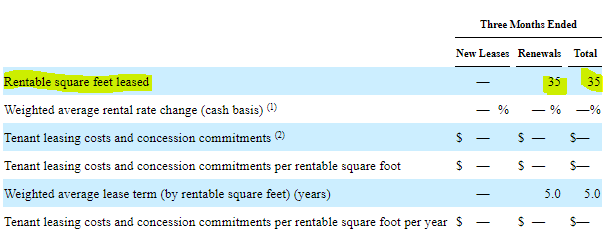

For the 3 months ended September 30, 2020, only 35,000 square feet was leased.

Orion Q3-2022 10-Q

This was a renewal and for a term of 5 years.

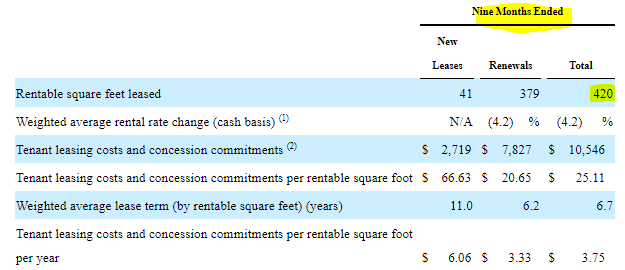

In 2022, a total of 420,000 square feet had new leases or renewals.

Orion Q3-2022 10-Q

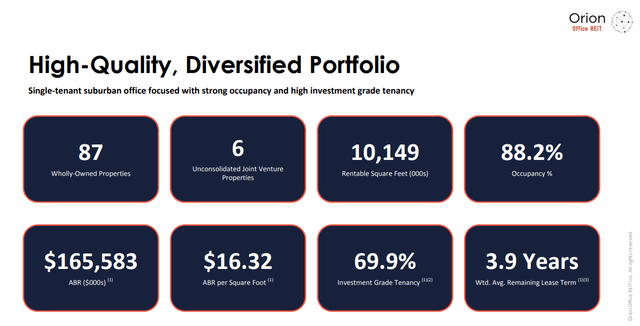

Orion’s total square footage today is about 10.15 million square feet.

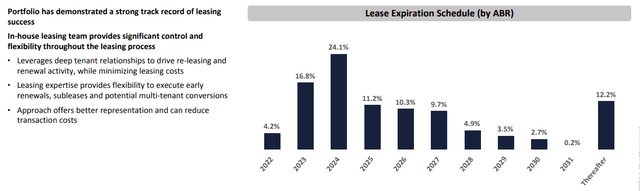

This is after a ton of dispositions conducted in 2022. The weighted average lease term is 3.9 years. So the REIT should be renewing or re-leasing space at a 2.5 million square feet annual rate, to keep things steady. Obviously, we are so far from that that it is even hard to imagine Orion getting there. The 3.9-year lease term is extremely short in this market and will create issues for the company in 2023 and 2024.

Refinancing & Falling FFO Will Keep Things Pressured

As we pointed out above, FFO has declined every single quarter. FFO estimates for next year are at $1.50, which comes to a 37.5 cent a quarter run rate. That is lower than what we can extrapolate for Q4-2022. The risks to these estimates are on the downside.

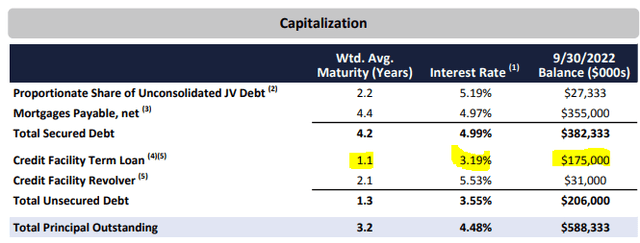

Orion’s 2023 term loan is modestly large in relation to the company’s market capitalization.

We think a smaller portion will be refinanced and likely at a far higher interest rate. This creates additional woes down the line. We will add here that the weighted average maturity is overall quite short and there is a lot of refinancing in the next 3 years to do. The company did authorize a buyback, but we believe activity on that will be minimal and unlikely to move the needle.

Orion Remains A Value Trap

You can have something trade at a low FFO multiple and then things gets progressively worse. Orion remains something of that nature. This is a “show-me” story and we will be happy to admit that we are wrong if Orion starts signing leases in a way that starts extending its weighted average lease term. Until then, we are sticking with a simple rule of not valuing this at more than 5 times FFO. As we roll out to 2023, we think $1.40 looks feasible and that gets us to $7.00 per share. We maintain our sell rating for now.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment