Anastasiia Makarevich/iStock via Getty Images

Realty Income (O) recently spun off its office properties into a separate REIT that it named Orion Office REIT (NYSE:ONL).

We initiated coverage of the company in early December at High Yield Landlord and republished some of our research on the public site of Seeking Alpha in January.

Our main takeaway back then was that the shares of the company should be avoided by long-term-oriented investors. Anything can happen in the short run, but the long-term outlook is bleak.

Don’t get caught holding the bag was our title.

Today, the share price is 25% lower and we want to reiterate that ONL is still unlikely to be a good long-term investment, even despite its now lower share price.

There have been several articles from bullish authors on the company in recent weeks, and I think that they all missed the most important point about Orion Office REIT:

It is a real estate investment at the end of the day, and unfortunately for ONL, it happens to own very bad real estate.

It may be cheap, but cheap can easily get cheaper, and in the long run, you are better off owning wonderful businesses than cigar butts.

In what follows, I will take an updated look at the company and explain why I am still not buying at these lower levels:

Possibly The Worst Real Estate To Own In 2022

ONL crashed recently after it posted results that fell far short of analysts’ expectations and announced a dividend that was up to 3x smaller than what investors had predicted.

I believe that everyone got it wrong because of one simple thing. They didn’t understand the nature of single-tenant office buildings.

I think that single-tenant office buildings are potentially the worst possible properties to own in 2022, and this is why Realty Income wanted to get rid of them.

Single-tenant office building (Orion Office REIT)

They are fine investments as long as the lease has years on them, but as soon as your lease expires, they can become very problematic because they are very costly and difficult to re-lease. Typically, they require substantial capex investments and tenant improvements, and even then, they may be difficult to re-lease. Since tenants know this, they are in a strong position to negotiate lower rents on a now older building and expensive tenant improvement packages.

This was true already before the pandemic and things will likely get much worse in the post-pandemic world as increasingly many companies do not extend long leases on single-tenant office buildings, and decide to instead use office space more sparingly. Remote work technologies like Zoom (ZM) and DocuSign (DOCU) have made this possible.

Knowing this, do you really think that it is a coincidence that Realty Income spun off this portfolio right before they are hit with a huge wave of lease expirations?

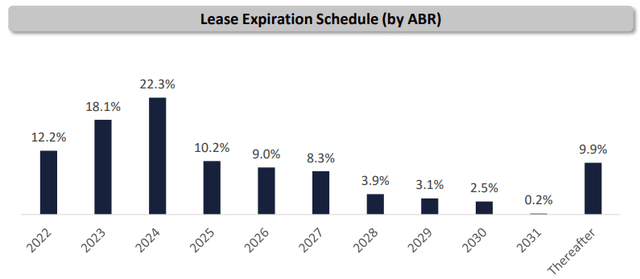

More than half of their leases will expire in the next 3 years alone, and most of the rest will expire in the next 3 years following that:

Orion Office REIT is facing a lot of lease expirations (Orion Office REIT)

And that’s not all.

Most of these single-tenant office buildings were acquired by VEREIT (VER) during the years when it was poorly managed by a conflicted team that was buying assets left and right just to build an empire and charge higher salaries.

Again, Realty Income wanted to get rid of these assets right after having merged with VEREIT.

Coincidence?

Then ONL came out and announced that it was setting its dividend at a level that was a multiple lower than what most investors expected.

Why would they do that? Surely, they knew that investors expected more since their shareholders are mostly income-oriented (owners of Realty Income aka. “The Monthly Dividend Company”). Yet, they decided to set it at a very low level because they know that problems are coming their way and they want to keep as much cash as possible to face those challenges.

This is essentially the same as if they had cut the dividend because it was so out-of-line with expectations and they did it right off the bat, signaling problems ahead, and with 50%+ of their leases expiring in the near term, I don’t blame them.

Don’t Buy The “Growth Opportunity”

Many investors are now suffering large capital losses and attempt to justify their mistake by claiming that the low dividend is a good thing as it will allow the company to invest in its future.

I think that they are wrong.

The lower dividend signals that there will be more problems ahead, and not that the growth will now be more significant than previously anticipated.

The management is obviously incentivized to sell it to investors as a “growth opportunity”, but I think that the reality is very different.

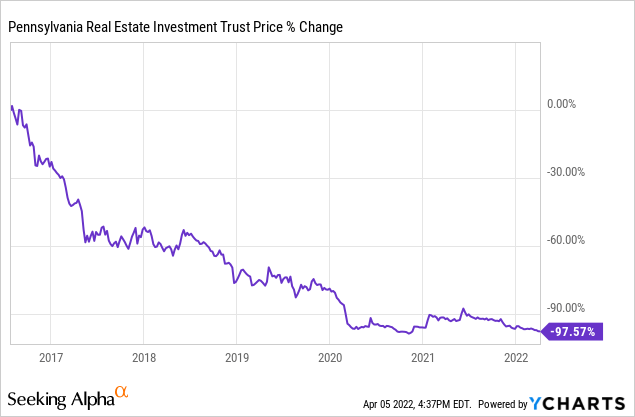

Remember that the likes of Washington Prime (OTC:WPGGQ) and CBL (CBL), and Pennsylvania REIT (PEI) also used to justify dividend cuts as a “growth opportunity” as it allowed them to reinvest in their struggling malls to grow their income and value.

How did that work out for investors?

CBL and WPG went bankrupt and PEI is very close to it right now:

I am not suggesting that ONL is the next WPGGQ, CBL, or PEI, but there is a clear similarity: they all own poor assets that are expected to experience significant challenges and require a lot of capex to keep alive.

This will greatly reduce the cash flow generation potential of the REIT and its ability to pay dividends and grow.

If there is anything to be learned from the Class B mall REITs, it is that their reported cash flow was way overstated once you accounted for the capex, and as a result, their dividend also wasn’t sustainable and their balance sheet was a lot more leveraged than it may have first appeared.

Many did not learn their lesson and will likely keep holding and buying more shares because they refuse to accept their mistake and want to save face.

Bottom Line

I was fortunate to avoid buying ONL despite all the hype thanks to my university and private equity experiences.

One of my university professors was the principal of a multi-billion dollar insurance firm that used to own a lot of single-tenant office buildings and he always used these as an example of what not to buy.

He claimed that once leases expire, single-tenant office buildings turn from assets into liabilities, and that was pre-covid so you can imagine that things are now even worse. The capex needed for these assets will be substantial and with a huge wave of lease expirations coming their way, it is hard for me to buy the growth story, especially in the post-covid world.

While you wait, you earn a very small dividend yield.

Are there better investment opportunities out there?

I think so.

Be the first to comment