blackCAT/E+ via Getty Images

Organon (NYSE:OGN) is a leading pharmaceutical company in the development and commercialization of medicines for the treatment of women’s diseases. Whereas Viatris (NASDAQ:VTRS), formed from the merger of Mylan with Upjohn, is a global healthcare company focused primarily on generics and biosimilars. Both companies have an extensive portfolio of approved medicines, higher-than-average dividend yields for the pharmaceutical industry, and high revenues. However, despite this, one of these companies is more promising in the long term due to a more effective business development strategy and a diversified pipeline of product candidates, which increase the likelihood of a 50% increase in capitalization relative to the second asset.

Financial position of Viatris vs. Organon

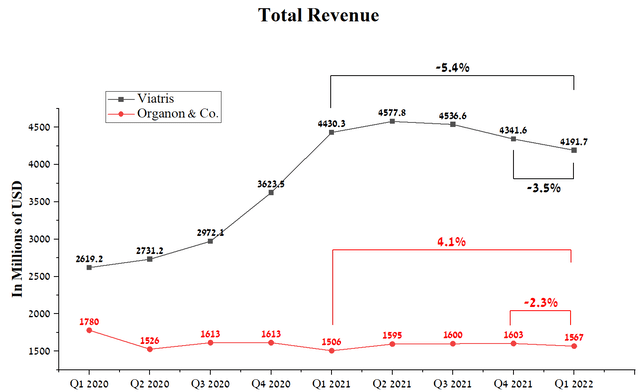

Viatris’ revenue was $4191.7 million in Q1 2022, down 5.4% year-on-year. At the same time, Organon & Co. showed the opposite dynamics, which earned $1,567 million in Q1 2022, up 4.1% compared to Q1 2021.

Source: Author’s elaboration, based on Seeking Alpha

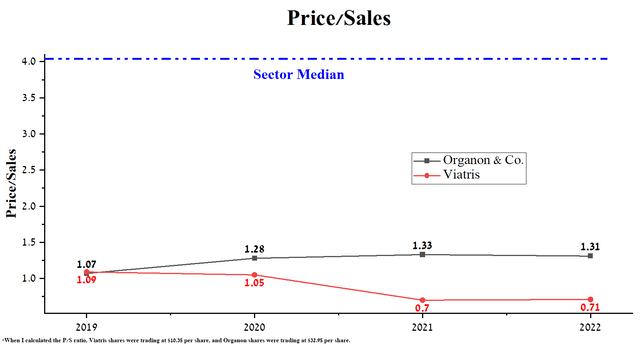

It should be noted that the Price / Sales ratio of both companies is significantly lower than that of the pharmaceutical industry, which indicates that they are underestimated by Wall Street. Currently, Viatris has a ratio of 0.71, which is 45.8% lower than Organon, showing that Viatris is an even more undervalued asset in the industry.

Source: Author’s elaboration, based on Seeking Alpha

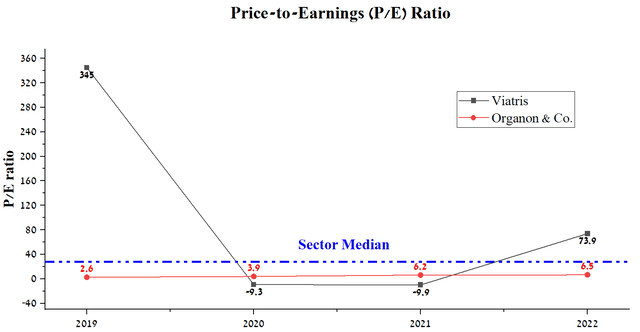

Another important financial indicator is the P/E ratio, which shows the number of years that it will take for the accumulated net profit to equal the cost of investments. This ratio has a smooth dynamic of change for Organon and was 6.5 at the end of Q1 2022, which is significantly lower than the industry average. However, Viatris is performing worse, with a negative net income from 2020 to 2021, mainly due to increased capital expenditures and the need to pay interest on senior notes.

Source: Author’s elaboration, based on Seeking Alpha

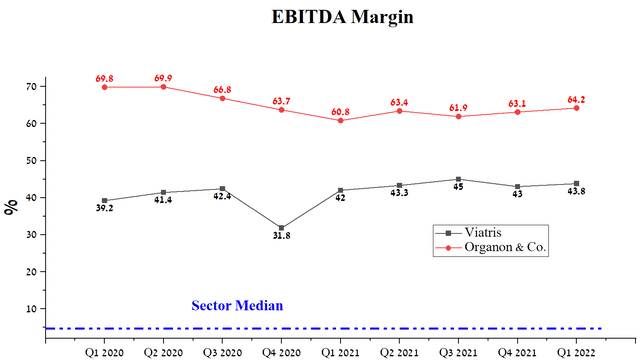

The EBITDA margin of both companies is at a relatively high level. However, thanks to its continued leadership in the development of medicines for the treatment of women’s diseases and favorable trends in the sale of biosimilars, Organon has a significantly larger EBITDA margin, which is 64.2%.

Source: Author’s elaboration, based on Seeking Alpha

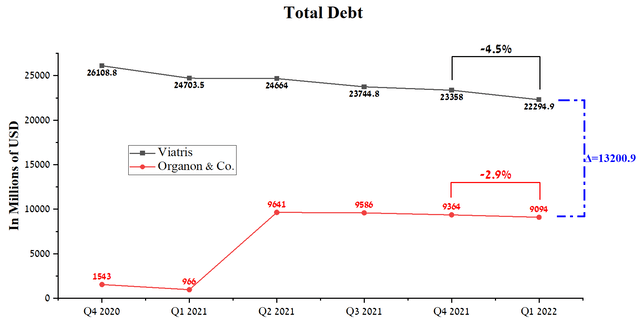

While Viatris’ EBITDA margin is 43.8% at the end of Q1 2022, which is lower than Organon’s, and there is no progress in improving it compared to previous quarters. In my estimation, this is primarily due to the significant share of generic versions of drugs or patent drugs whose patents have expired from the company’s total revenue. Given the fact that Viatris faces competition from other pharmaceutical companies, the company’s management has to reduce drug prices in order to remain competitive. Thus, due to the preservation of the volume of expenses and the decrease in revenue, this leads to a lack of progress in improving the marginality of the company’s business and, in addition, increases the risks associated with debt servicing. Viatris’ total debt is $22,294.9 million at the end of Q1 2022, down 4.5% QoQ. While Organon’s total debt is $9094 million, down 2.9% from Q4 2021. At the same time, the difference in total debt between the two companies is about $13.2 billion, which increases Organon’s investment attractiveness due to lower risks and losses in net income, part of which is used to pay interest on bonds.

Source: Author’s elaboration, based on Seeking Alpha

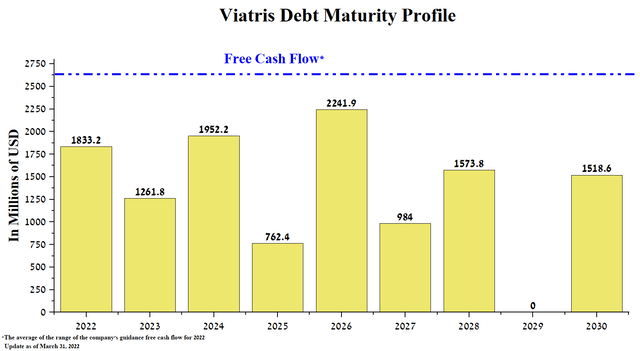

After Upjohn’s spin-off from Pfizer and its merger with Mylan, what appeared to be Viatris’ policy of issuing senior notes needed to fund its operations was seemingly justified. However, payments on them make up a significant share of free cash flow, which, in the face of declining revenue, will most likely lead to a decrease in dividend payments or a reduction in R&D spending, which is a critical condition for the development of the pharmaceutical business.

Source: Author’s elaboration, based on 10-Q

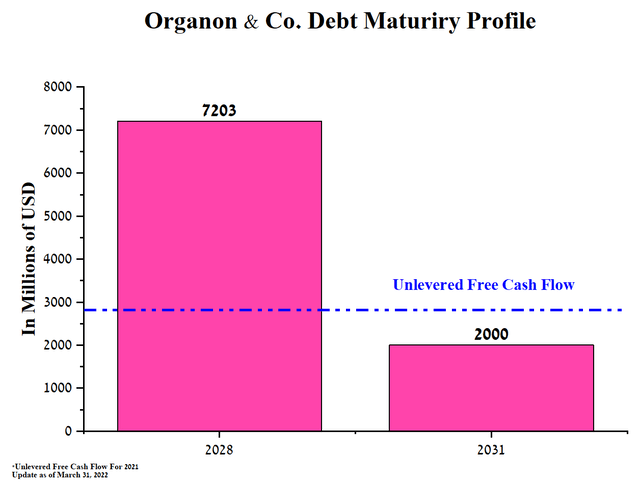

Redemptions of Organon’s senior notes will take place only in 2028 and 2031, which contributes to a more flexible financial policy by the company’s management, according to which a certain share of free cash flow is allocated to early debt repayment.

Source: Author’s elaboration, based on 10-Q

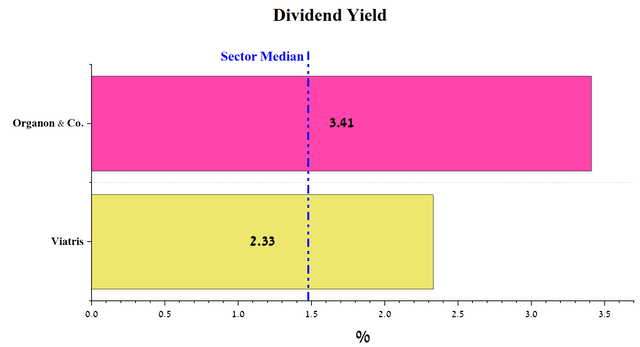

Viatris’ dividend yield is 2.33%, which is below Organon’s 3.41% dividend yield. It should be noted that this indicator is higher for both companies than the average value for the pharmaceutical industry, which is about 1.49%, thereby creating prerequisites for increasing investment interest among institutional investors with a long-term strategy.

Source: Author’s elaboration, based on Seeking Alpha

Comparison of a portfolio of approved medicines

Both companies are leaders in the commercialization and development of generic versions of medicines or biosimilars and, to a lesser extent, have patent medicines in their portfolios. This part of the article will analyze the key divisions of Viatris and Organon, which bring in billions of dollars in revenue per year.

Viatris

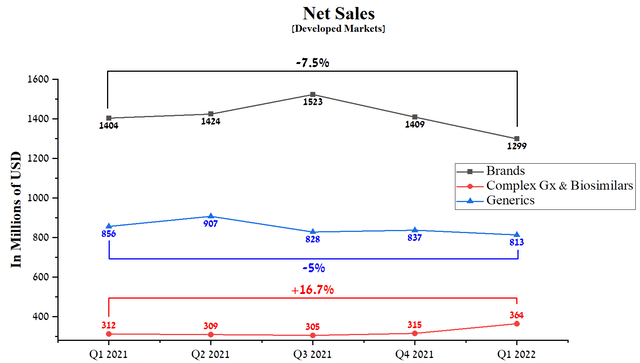

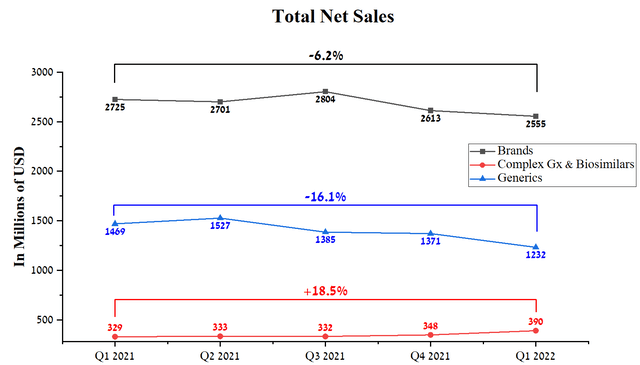

Viatris is one of the largest drug suppliers in North America and Europe. Despite the leading positions, the sales of medicines in developed countries, with the exception of biosimilars, are declining. It should be noted that there is a tendency to reduce revenue from quarter to quarter, which, given their sale in high-margin markets, signals that the Viatris business model is not working effectively.

Source: Author’s elaboration, based on quarterly securities reports

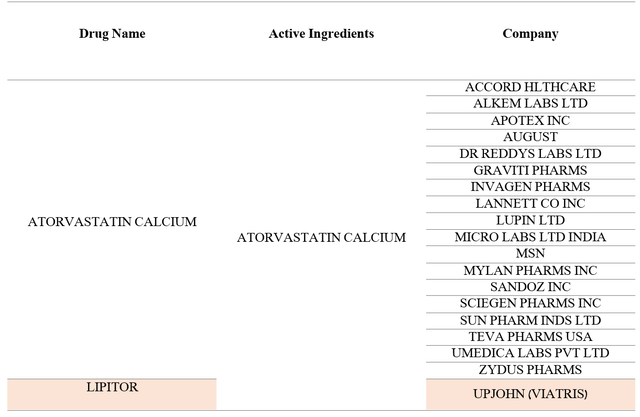

I believe that the main reason for this is Pfizer’s (NYSE:PFE) desire to replace the portfolio of former drugs that were managed by Upjohn with new medicines that can regain their share in various therapeutic areas. In addition, other large pharmaceutical companies are creating medicines that have positive cost-effectiveness in the treatment of various diseases. As a result, physicians are trying to prescribe more modern drugs that justify the high price due to their ability to significantly improve the quality of life of patients relative to cheaper generics. In addition, the decrease in Viatris’ revenue is also associated with increased competition from other generic manufacturers, which have relatively low production costs and thus can pursue a more flexible pricing policy. So, for example, take Viatris’ best-selling patent drug, namely Lipitor (atorvastatin calcium), which is a statin for lowering triglyceride and low-density lipoprotein levels in the blood and increasing HDL, thereby being able to reduce the risk of cardiovascular disease. Peak sales of this medicine were $12.9 billion in 2006, but due to patent expiration, revenue fell to $1.66 billion in 2021. At the moment, about 18 pharmaceutical companies produce generic versions of Lipitor, which creates big challenges for Viatris.

Source: Author’s elaboration, based on FDA

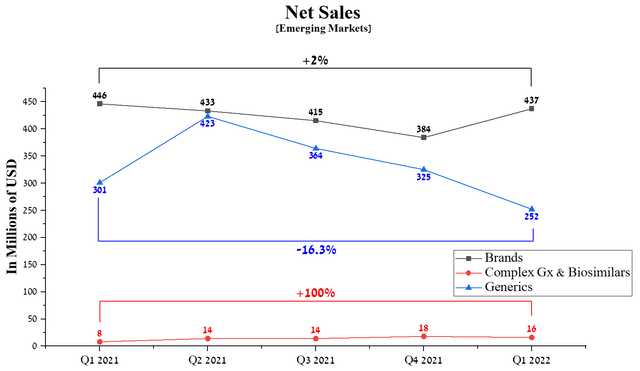

However, despite the challenges, Viatris has continued to launch new drugs over the past two years, including a generic version of Biogen’s (NASDAQ:BIIB) flagship drug, TECFIDERA (dimethyl fumarate), which is used to treat multiple sclerosis. Emerging market revenue, which includes about 82 countries, brought in $705 million in Q1 2022. Many of these countries are more focused on the company’s branded drugs, which reduces demand for Viatris’ generic portfolio. As a result, branded medicine sales totaled $437 million, up 2% year-on-year. However, generics continue to show unsatisfactory sales figures, which amounted to only $252 million.

Source: Author’s elaboration, based on quarterly securities reports

Despite the fact that the company strives to launch new drugs, however, only the portfolio of biosimilars, whose share of total revenue is extremely small, shows positive sales dynamics. Sales of the company’s generic products continue to stagnate, disappointing many investors.

Source: Author’s elaboration, based on quarterly securities reports

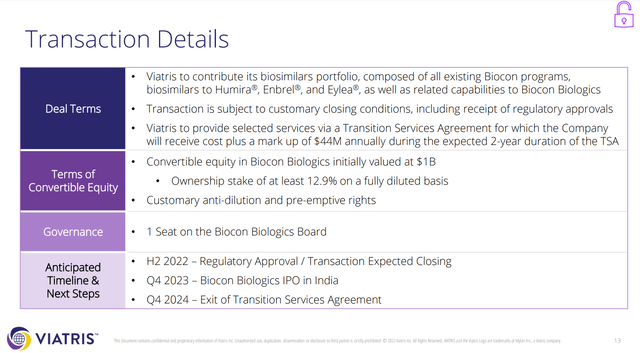

Despite the growing biosimilar business, Viatris management sold it to Biocon Biologics at the end of February 2022 for $3.335 billion.

Source: Investor Event Presentation

In my opinion, the company’s management made a mistake, as other Viatris products have lower margins, and their sales are declining. In addition, the company will not have a share in future sales of biosimilars, which limits the number of sources of revenue, which is extremely important in the conditions of high leverage of Viatris.

Organon

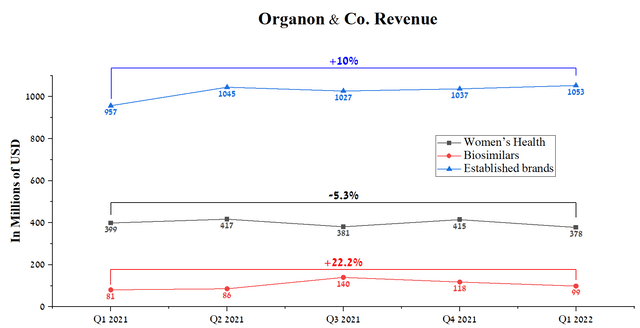

Organon has over sixty medicines and products that are commercialized in 140 countries around the world. Biosimilars and established brands portfolio sales continue to grow year on year, while women’s health portfolio revenue shows a smoother trend.

Author’s elaboration, based on quarterly securities reports

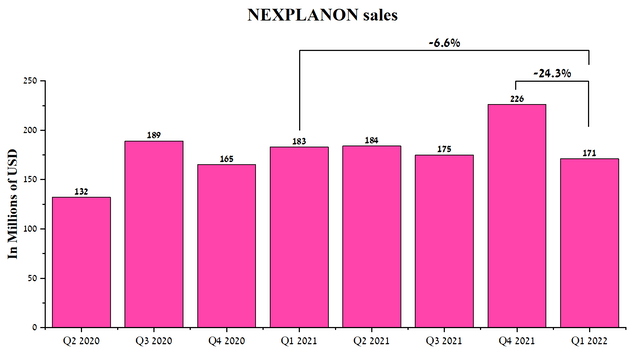

Sales of Nexplanon (etonogestrel implant), one of Viatris’ top-selling birth control medications, were $171 million, down 6.6% from the previous year. This was mainly due to lower demand in the United States, but this decline was partially offset by higher international sales of $55 million, up 31% year-over-year.

Author’s elaboration, based on quarterly securities reports

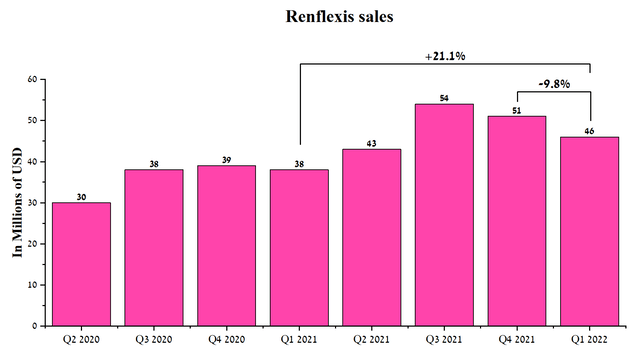

However, thanks to Organon’s diversified portfolio, the double-digit revenue growth continues to feature biosimilar products. This is mainly due to increased demand for Renflexis, which is a biosimilar of Johnson & Johnson’s (NYSE:JNJ) patent drug and is used to treat autoimmune diseases.

Author’s elaboration, based on quarterly securities reports

In my opinion, sales of biosimilars will continue to grow due to Organon maintaining its leading position in this market, expanding the geography of application, and launching new medicines in the next five years. Thus, comparing the Viatris drug portfolio with Organon, in my opinion, the Organon portfolio looks more attractive. The reasons for this are a more diversified portfolio, and the presence of both patented medicines and biosimilars, while Viatris has only generics or drugs whose patents have expired. As a result, this leads to the lack of competitive advantage for Viatris relative to other pharmaceutical companies, which will negatively affect revenue growth in the future.

Comparison of product candidates in development

One of the companies is more focused on generics, while the other has a more diversified strategy that includes the development of biosimilars and patent medicines.

Viatris

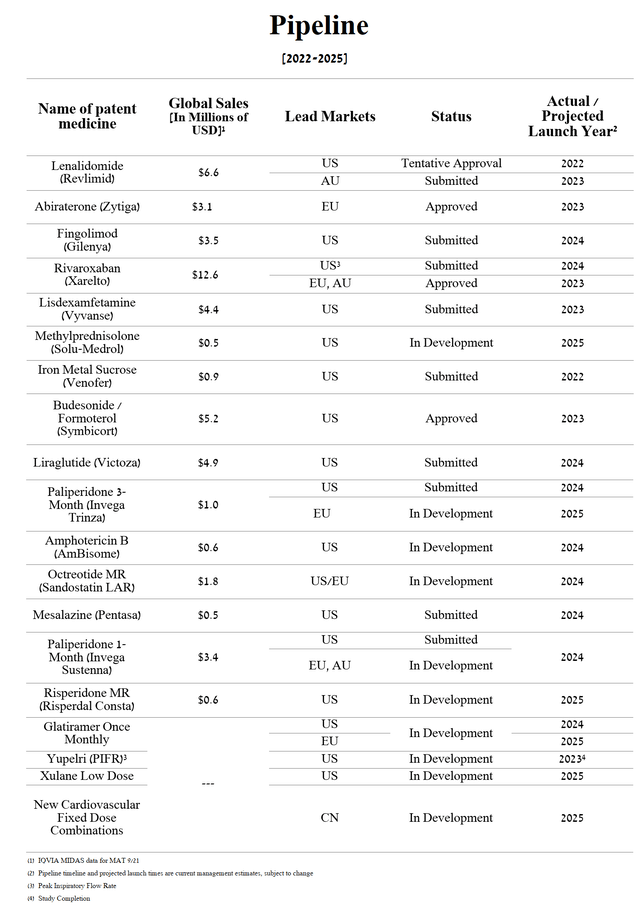

At first glance, the Viatris pipeline appears to have a larger number of product candidates, which in theory should result in a significant boost to the company’s revenue growth.

Author’s elaboration, based on Q1 2022 Earnings Presentation

In my opinion, this is a misleading impression, as Viatris maintains a business model that is primarily focused on the production of generics. However, these medicines can be produced by many pharmaceutical companies that have manufacturing capabilities. As a result, several dozen companies will share the patent drug pie, and as a result, only a small part of it will go to Viatris. Thus, Viatris does not have unique, patented drugs that could interest investors and create preconditions for a significant increase in net profit. In contrast to this is the strategy of Organon, which also has a portfolio of generics, but continues to enter into partnerships to develop next-generation patent medicines and biosimilars.

Organon

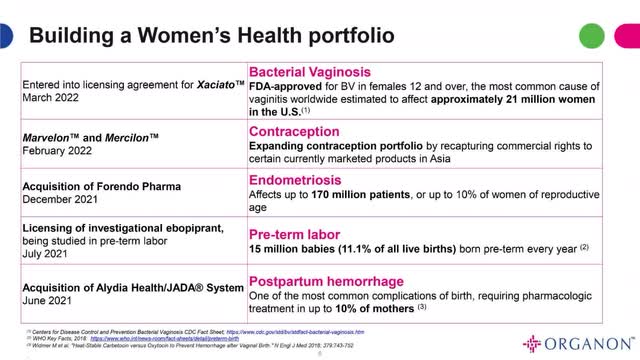

Organon’s strategy is to expand the pipeline by partnering or acquiring companies whose product candidates are at an early or late stage of development. In 2021, Organon entered into an agreement with ObsEva and acquired Forendo Pharma, specializing in the treatment of women’s diseases.

Source: Investor presentation

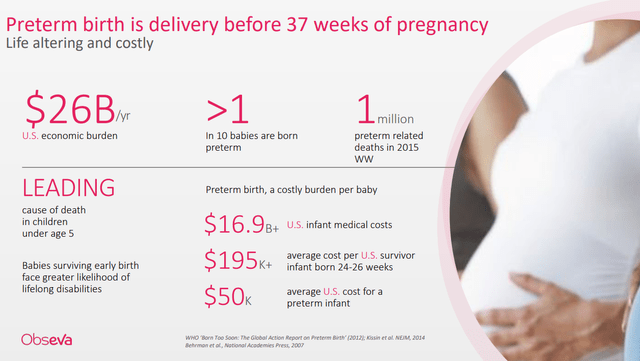

One of the most advanced clinical programs among Organon’s M&A deals is ebopiprant (OBE022), which is being developed with ObsEva (NASDAQ:OBSV). ebopiprant is a candidate product that is a selective prostaglandin F2α receptor antagonist and is being developed for the treatment of preterm labor by reducing inflammatory responses and uterine contractions. The company estimates that one in 10 babies is born prematurely, and due to the lack of FDA-approved drugs for the treatment of preterm labor (PTL), there are huge opportunities for the commercial success of ebopiprant if approved by regulatory authorities.

Source: Investor presentation

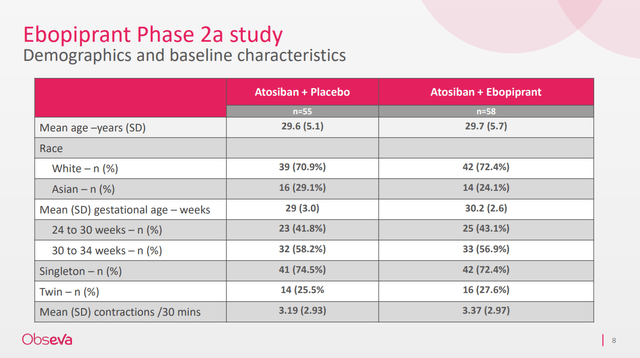

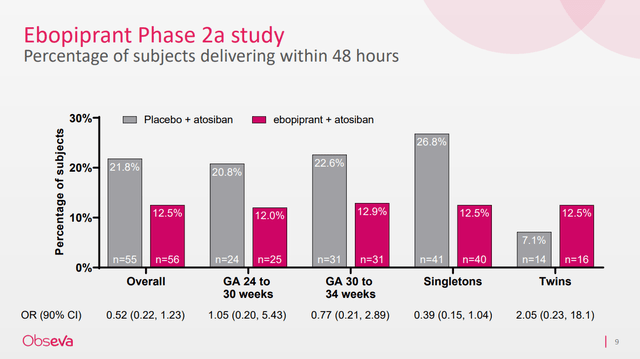

In November 2020, ObsEva announced positive results from a phase 2a clinical trial involving 113 preterm birth patients.

Source: Investor presentation

This study showed the first data on the effectiveness of ebopiprant, namely, the addition of ObsEva’s product candidate to atosiban reduced the rate of delivery in singleton pregnancies by 53.4% compared with the placebo + atosiban group. Overall, 12.5% of women who received ebopiprant gave birth within 48 hours of starting treatment, compared with 21.8% of patients who took the placebo.

Source: Investor presentation

The safety profiles between subjects in the ebopiprant group and those in the placebo group were similar. In addition, there was no evidence in the phase 2a clinical trial that the use of ebopiprant in pregnant women results in negative effects on the development of the child compared to those taking placebo.

Conclusion

Organon is a leading pharmaceutical company in the development and commercialization of medicines for the treatment of women’s diseases. Whereas Viatris, formed from the merger of Mylan with Upjohn, is a global healthcare company focused primarily on generics and biosimilars. Both companies have an extensive portfolio of approved medicines, high dividend yields, and revenues. However, thanks to a more efficient business development strategy, a diversified pipeline of product candidates, and significantly lower multiples, I believe Organon is more promising in the long run. At the same time, the Viatris business is likely to stagnate due to the sale of the biosimilar portfolio.

Be the first to comment