spooh/E+ via Getty Images

High-yielding stocks continue to be a good way for retail investors to gain financial independence in a quicker fashion. That’s because some won’t or can’t afford to wait for low yielding dividend growth stocks like UnitedHealth Group (UNH) to reach a meaningful yield that they can lean more heavily on.

This brings me to energy midstream companies like ONEOK (NYSE:OKE), which is now yielding close to 7%. This article highlights what makes OKE a good high yield to own at the current valuation, so let’s get started.

Why OKE?

ONEOK is a midstream company that owns a premier collection of natural gas liquids systems, connecting suppliers in the Rocky Mountains, Mid-Continent, and Permian Regions of the U.S. with key markets. It also owns an extensive network of natural gas gathering, processing, storage and transportation assets.

This vertically integrated asset base enables ONEOK to capture profits across the midstream value chain. ONEOK is also incorporated as a C-Corporation, and therefore does not issue a schedule K-1 during tax season.

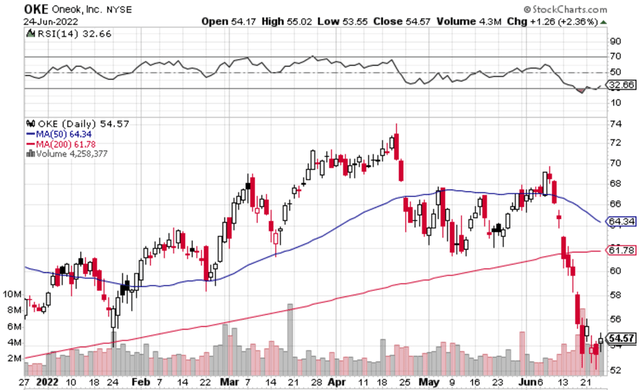

ONEOK’s stock price has taken a beating in recent weeks, falling near-$70 level reached as recently as earlier this month. As shown below, OKE is now trading well below its 50 and 200 day moving averages of $64.34 and $61.78, with a current share price of $54.57. It also carries an RSI score of 32.7, indicating that it’s getting close to being in oversold territory.

OKE Stock Technicals (StockCharts)

Perceived headwinds to NGL include the recent rout in natural gas prices. The price weakness continued last week, as the Energy Information Administration reported a much larger than expected 74 billion cubic feet injection into natural gas inventories for the week ending June 17th. As shown below, natural gas has fallen to $6.15 per MMBtu, down from above $9 earlier this month.

Natural Gas Prices (Trading Economics)

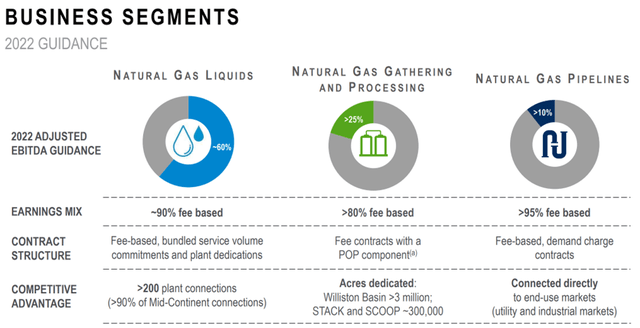

While this may impact the profitability of ONEOK’s customers, its own core business remains rather insulated. This is reflected by the fact that 90% of ONEOK’s NGL segment is fee based, while its natural gas & processing and pipelines businesses are more than 80% and more than 95% fee based, as shown below.

OKE Earnings Mix (Investor Presentation)

Meanwhile, OKE is demonstrating impressive growth, with adjusted EBITDA growing by 11% YoY to $864 million in the first quarter, excluding the impact of Winter Storm Uri in Texas last year, which was a boon for OKE and other natural gas providers.

Even including the positive financial impact of Uri, OKE’s adjusted EBITDA was down by just $2 million from $866 million last year. These strong results were driven by 11% volume growth in OKE’s natural gas volumes in the Rocky Mountain region, and by a 17% increase in OKE’s NGL raw feed throughput volumes.

Looking forward, OKE is in position to benefit from the growing demand for NGLs, given the burgeoning demand from petrochemical plants along the U.S. Gulf Coast. Additionally, worldwide energy shortages resulting from the Russian-Ukraine war should continue to drive demand for natural gas.

For example, Germany has now resorted to firing up coal plants in an effort to save natural gas supplies. Management sees the capacity for OKE to build upon momentum with attractive uses of capital for bolt-on expansion projects, as noted during the recent conference call:

Our built-in operating leverage and proven track record of disciplined and intentional growth have positioned us well to support increasing producer activity levels. Our systems have significant capacity to grow alongside the needs of our customers. And because of our large infrastructure projects are complete, we now have opportunities for bolt-on expansion projects with quicker in-service dates, attractive returns and minimal capital requirements.

Not only are we expecting strong activity going forward, but our position in the key U.S. shale basins provides us a long runway to continue our efforts to help address increasing domestic and international energy demand. Current events continue to demonstrate the importance of natural gas and natural gas liquids and a long-term energy transformation and highlights the critical role that ONEOK plays in providing essential energy products and services.

Morningstar also sees capacity for increased shareholder returns, as OKE has reached material levels of excess free cash flow. This was highlighted in its recent analyst report:

Oneok brings together high-quality assets, some of the strongest near- to medium-term growth prospects in our coverage as Rockies volumes continue their ongoing rebound, a C-Corporation structure, and a well-respected management team in a compelling package. With the reduced capital program, Oneok does finally have material levels of excess cash flow in 2022, perhaps 18 months behind other U.S. midstream peers to buy back more stock. We estimate there could be up to $525 million in buybacks in 2022, though knowing Oneok’s penchant for finding accretive growth projects, this is also equally likely to be plowed back into attractive growth assets.

Meanwhile, OKE sports a strong BBB rated balance sheet with a net debt to EBITDA ratio of 3.97x, sitting just below the 4.0x mark that’s generally deemed safe for energy midstream players.

It’s also paid an uninterrupted dividend for over 25 years, and has a 5-year dividend CAGR of 8.7%. Moreover, the dividend is well-protected by a 67% payout ratio, based on the $1.666 billion in dividend paid divided by the $2.475 billion in operating cash flow over the trailing 12 months.

Lastly, I see value in OKE at the current price of $54.57 with an EV/EBITDA of just 12.0, sitting at the low end of its trading range over the past 1.5+ years. Sell side analysts have an average price target of $71.47, implying a potential one-year 38% total return including dividends.

Investor Takeaway

ONEOK is a high-quality energy midstream player with strong growth prospects and a C-Corporation structure for those who don’t want schedule K-1s. The company has reached material levels of excess free cash flow, and sports a strong balance sheet. With a dividend yield of 6.9%, ONEOK looks like an attractive income play at the current price.

Be the first to comment