onurdongel/E+ via Getty Images

ONEOK, Inc. (OKE) is a fairly large midstream company that operates primarily in the central part of the United States. This is a sector that was significantly affected by the decline in crude oil prices that accompanied the outbreak of the coronavirus pandemic last year, although the cash flows of most midstream companies held up reasonably well. Fortunately, though, most of the companies in the sector have recovered and ONEOK is no exception as the stock is up 41.69% over the past year. The stock still boasts a reasonably attractive 6.07% yield at the current price, though. This is likely to just be the start though as the company still has some growth potential due at least in part to the strong forward fundamentals for natural gas and natural gas liquids, which are the two primary products that ONEOK handles. Overall, there certainly could be some reasons to consider an investment in ONEOK.

About ONEOK

As stated in the introduction, ONEOK is one of the largest midstream companies in the United States, boasting a network of pipelines that covers much of the central United States.

The company owns 40,000 miles of pipelines that carry both natural gas liquids and natural gas. This network is capable of carrying more than ten billion cubic feet per day of natural gas, which is approximately 10% of the nation’s natural gas consumption. This truly highlights the scale of ONEOK’s operations as only Kinder Morgan (KMI), Enbridge (NYSE:ENB), and The Williams Companies (WMB) handle a higher proportion of America’s natural gas consumption.

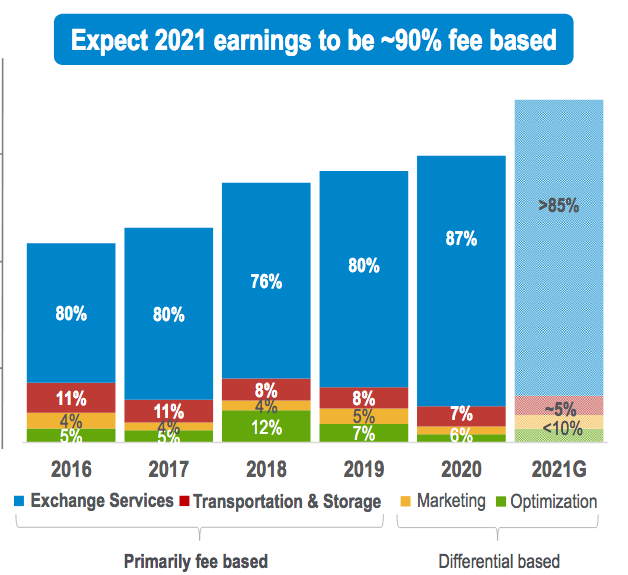

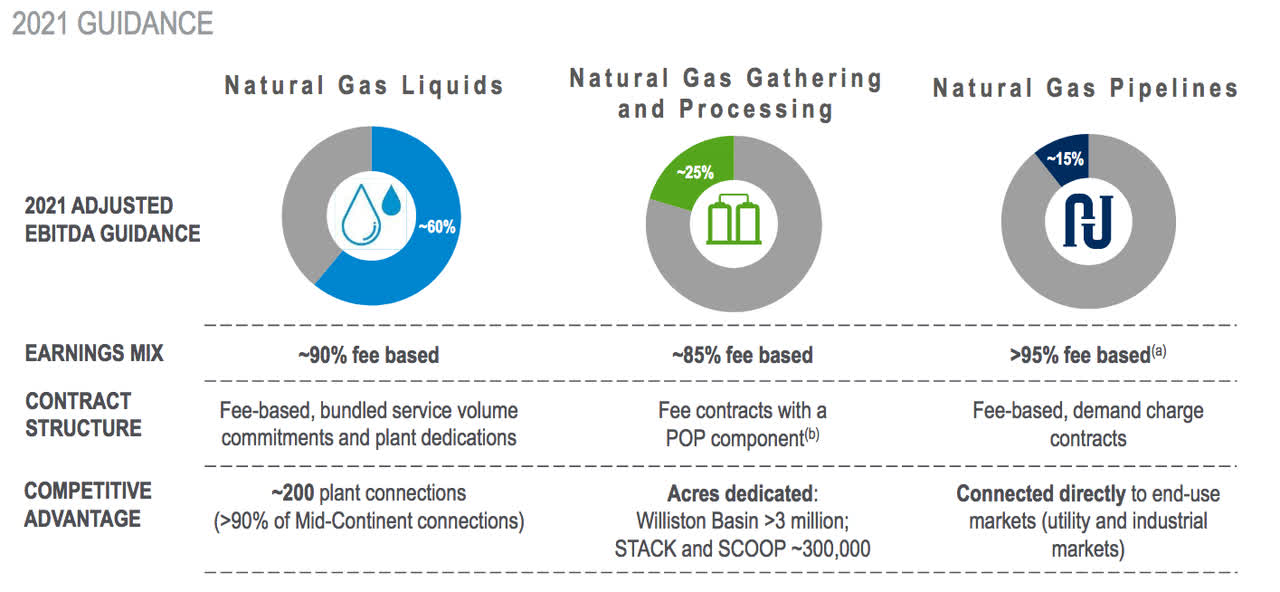

Last year, we saw the stock prices of many midstream companies plummet along with crude oil prices following the outbreak of the coronavirus pandemic and the ensuing lockdowns. However, the cash flows of most of these companies held up reasonably well. This is because of the business model that these companies utilize. In short, they enter into long-term contracts with their customers for the provision of services. The fact that these contracts are typically between five and ten years in length ensures that they should be able to outlast and short-term economic problems, like what happened last year. The counterparties to these contracts compensate ONEOK based on the volume of resources that it transports and not on their value, which provides the midstream company a great deal of protection against declines in energy prices. With that said, some readers may point out that upstream companies frequently reduce their production whenever energy prices decline and this can be expected to reduce the volumes that the midstream company transports. However, the company has a way to protect itself against this as well. Basically, these contracts contain what are known as minimum volume commitments, which specify a certain minimum quantity of resources that must be sent through the company’s pipelines or paid for anyway. Overall, this business model ensures that midstream companies enjoy very stable cash flows through any economic conditions. Fully 90% of ONEOK’s earnings come from these contracts:

Source: ONEOK

ONEOK operates three separate business units. These are natural gas liquids, natural gas gathering & processing, and natural gas pipelines. The natural gas liquids segment is the largest as it accounts for about 60% of the company’s cash flows:

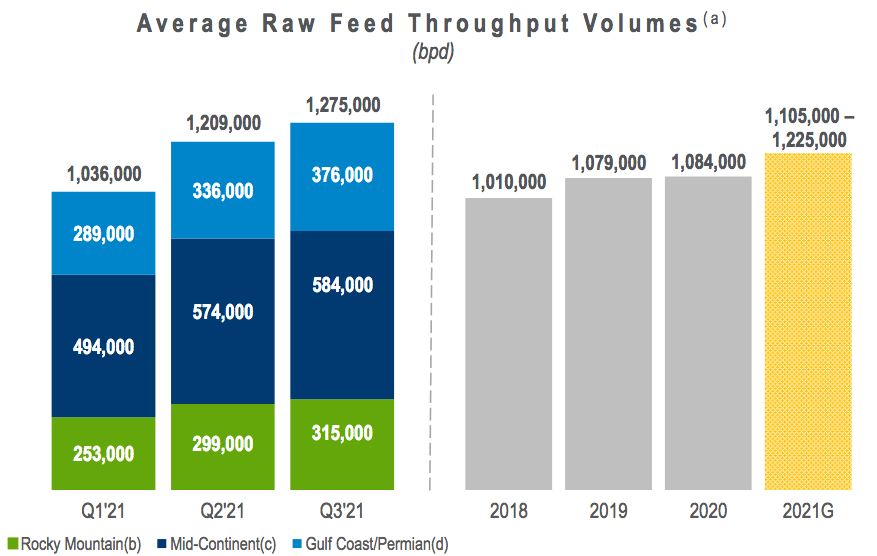

Fortunately, the volumes flowing through the company’s natural gas liquids pipelines have been consistently increasing over the past few years. Indeed, there was even an increase in 2020 despite the troubles in the industry:

Source: ONEOK

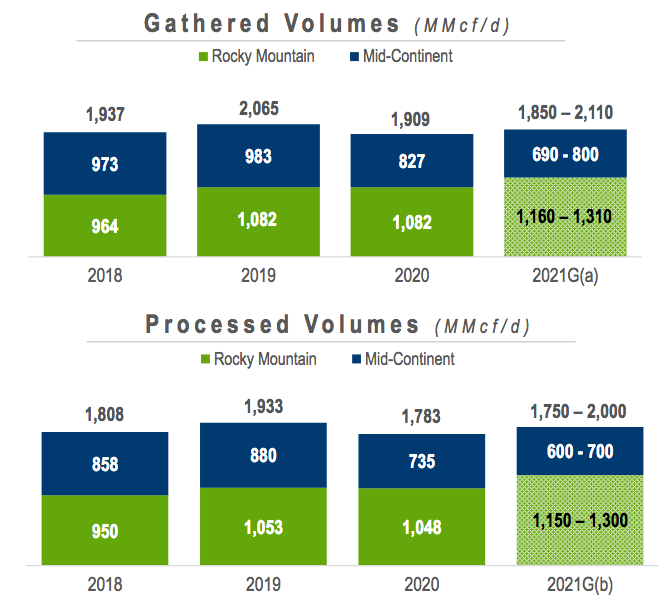

Unfortunately, the company’s two ordinary natural gas units have not been performing quite as well. We did see some volume declines here in 2020 but maybe not as large as might be expected:

Source: ONEOK

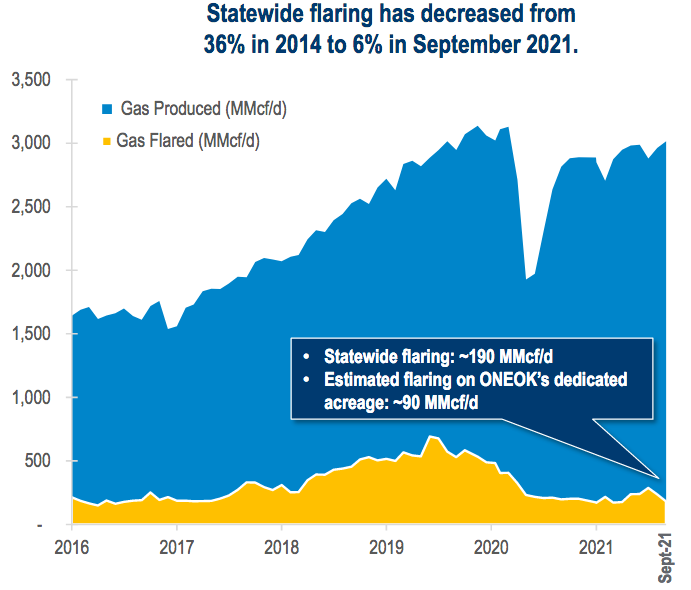

The biggest reason for this is the production cutbacks that came along with the energy price declines last year. Unlike in an area like the Marcellus shale, natural gas is generally produced as a byproduct of crude oil production in most of the areas in which ONEOK operates. As a result, when the production of crude oil is reduced then the production of natural gas also declines. Although the minimum volume commitments do provide ONEOK with a certain amount of protection against this, the company’s volumes in 2019 were well above the minimums so there was still room to decline. Fortunately, we can see that volumes have started to recover. There are two reasons for this. The first is the obvious one and that is upstream producers have begun to return previously shut down wells to a production state as well as begun to drill new wells. The company expects that approximately 300 wells will be connected to its network during 2021 (but it has not released the final number yet). The second thing that has helped to boost volumes is something that I discussed in a recent article, which is that upstream companies have begun to reduce their flaring activity. This results in less wasted gas and thus more available to collect into ONEOK’s network:

Source: ONEOK

It seems likely that flaring will continue to decline over the coming years, particularly since the takeaway capacity in the basin has increased. This could present further opportunities for the recovery of the company’s volumes and even eventual increases. This would be beneficial for the firm’s cash flows.

Fundamentals Of Natural Gas

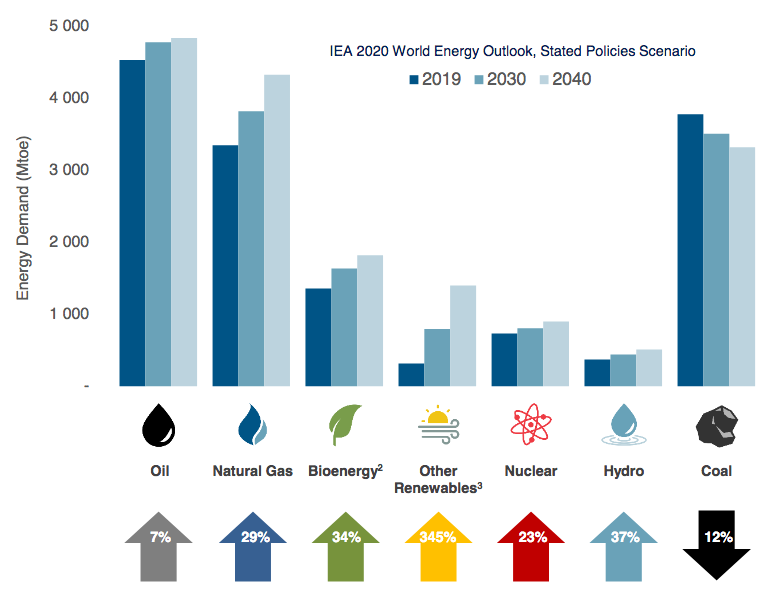

As ONEOK primarily transports natural gas and natural gas liquids, it would behoove us to have a look at the fundamentals of these two compounds. Fortunately, the fundamentals of both of them are quite good. According to the International Energy Agency, the global demand for natural gas will increase by 29% over the next twenty years:

Source: International Energy Agency, Pembina Pipeline

Perhaps surprisingly, this demand growth is driven by the global concerns about climate change. These concerns have caused governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most popular of these strategies is to encourage the retirement of old coal-fired power plants, which are replaced with natural gas ones. This is because natural gas burns much cleaner than coal and is more reliable than renewables. As such, natural gas plants offer a way to reduce carbon emissions while still maintaining the reliability that we have come to expect from a modern electrical grid.

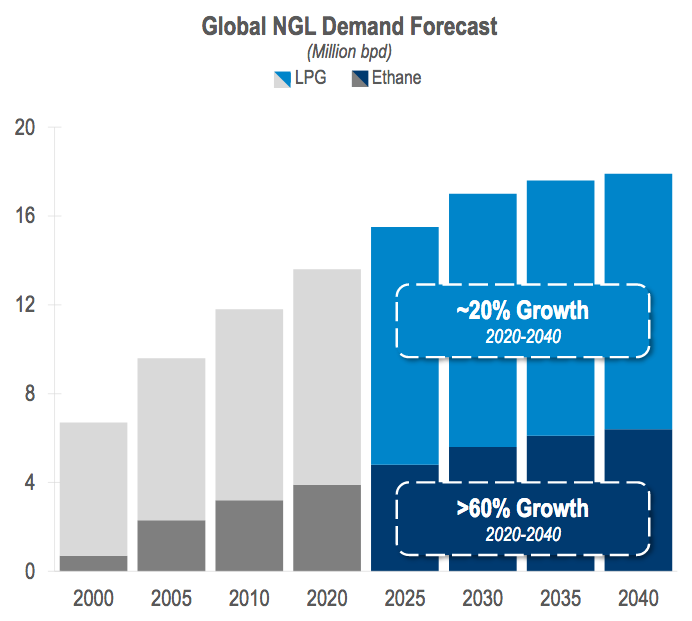

The global demand for natural gas liquids is also expected to grow over the coming years, increasing by about 20% over the next twenty years:

Source: S&P Global Platts, ONEOK

The reason for this is mostly being driven by what natural gas liquids are used for. In particular, ethane is used in the production of many types of plastics and vehicle batteries, including those used in electric cars. Propane is often used as a cooking and home heating fuel, especially in third-world nations and rural areas that do not have access to a utility-scale natural gas distribution network. In some of these areas, the residents currently use coal, wood, or oil for some of these tasks and all of these substances are much dirtier when burned than natural gas liquids.

ONEOK is poised to benefit from this growth even though it does not actually produce any resources. This is because the United States is one of the only areas in the world that is capable of increasing its production of resources due to the wealth of areas like the ones in ONEOK’s footprint. It therefore makes sense that the nation’s producers will boost their production in order to take advantage of this demand growth. These newly produced resources will need to be transported to the market in order to be sold and this is exactly what ONEOK does. This demand and production growth should therefore result in rising volumes on ONEOK’s system, which should boost its cash flows as already discussed. The firm will likely grow its dividend as this story plays out.

Financial Considerations

It is always important to have a look at the way a company finances itself before making an investment in it. This is because debt is a riskier way for a company to finance itself than equity. After all, debt must be eventually repaid. In addition, a company must make regular payments on its debt if it is to remain solvent. As such, should the company’s cash flows decline for some reason then these mandatory payments may push it into insolvency if the company has too much debt. Although midstream companies like ONEOK tend to have relatively stable cash flows, bankruptcies are certainly not unheard of in the sector.

One method that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us to what degree the company is funding its operations with debt as opposed to wholly-owned funds. It also tells us to what degree the company’s equity will cover its debts in the event of a bankruptcy or liquidation, which is perhaps more important. As of September 30, 2021, ONEOK had a net debt of $14.1907 billion compared to total shareholders equity of $5.8409 billion, which gives the company a net debt-to-equity ratio of 2.43. This is unfortunately one of the highest ratios in the midstream industry, as we can clearly see here:

|

Company |

Net Debt-to-Equity Ratio |

|

ONEOK |

2.43 |

|

Kinder Morgan |

1.03 |

|

The Williams Companies |

1.59 |

|

Enbridge |

1.09 |

|

Enterprise Products Partners (EPD) |

1.06 |

|

Energy Transfer (ET) |

1.27 |

This could be a sign that ONEOK is too aggressively financed and is overly reliant on debt to fund itself. This could pose a very real risk to investors in some sort of long-term economic calamity.

The company’s ability to carry its debt load is of course more important than the raw proportion of debt in its financial structure due to the need to make regular payments on its debt in order to remain solvent. In order to judge its ability to carry its debt, we look at something called the leverage ratio, which is also known as the net debt-to-EBITDA ratio. ONEOK certainly looks much better here as evidenced by its 4.0x ratio. This is much better than the 5.0x ratio that analysts typically consider to be reasonable and sustainable. I am more conservative than most analysts though and like to see this ratio under 4.0x in order to add a margin of safety to the investment. Obviously, ONEOK is in line with this so the company appears able to carry its debt without any significant problems.

Dividend Analysis

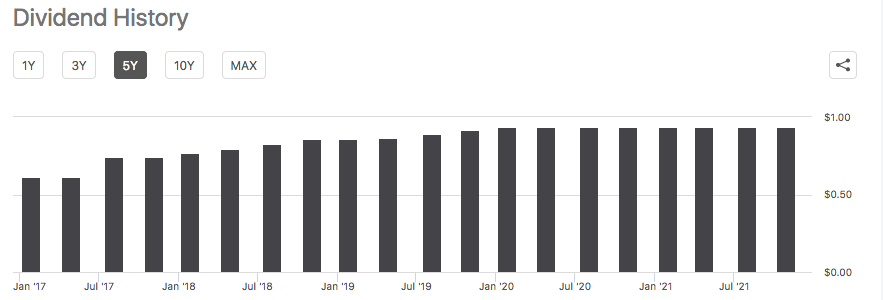

One of the biggest reasons why investors purchase shares of a company like ONEOK is because of the incredibly high dividend yield that they typically boast. The company currently has one of the highest yields in the S&P 500 index (SPY) at 6.07%, although it admittedly is not as attractive as what some other midstream firms offer. The current dividend of $0.935 per share quarterly is the result of a steady history of dividend growth, although ONEOK failed to increase its dividend since 2020:

Source: Seeking Alpha

Naturally, though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to have to suddenly reverse course and be forced to cut as this would both reduce our income and likely cause the stock price to decline.

The usual way that we determine a midstream company’s ability to cover its dividend is by looking at the distributable cash flow, which is a non-GAAP measure that theoretically tells us the amount of cash that was generated by a company’s ordinary operations that is available to be paid to the common stockholders. Curiously, ONEOK has stopped announcing this figure. We can calculate it, though. The formula that the company has used in past quarters was adjusted EBITDA less interest expense, maintenance capital expenditures, and equity earnings from investments. In the third quarter, this figure would be $794.3 million. The company only pays out about $416.7 million per quarter in both common and preferred stock dividends. This would give it a coverage ratio of 1.90x, which is well above the 1.20x that analysts usually consider to be reasonable and sustainable. It is also well above the 1.30x that I typically like to see in order to add a margin of safety to the investment. Overall, the dividend thus looks to be reasonably safe.

Conclusion

In conclusion, ONEOK is a giant natural gas-focused midstream company with a strong future ahead of it due to the solid fundamentals for natural gas and natural gas liquids. This would represent a continuation of the company’s historical track record for growth and could offer a reasonable chance of growing the dividend. The company’s current 6.07% yield is certainly not unattractive, however. This one could be a buy at the current price.

Be the first to comment