kynny/iStock via Getty Images

Growth stocks have been on a truly wild ride in the past three months, having topped out right at the beginning of this year and seeing significant volatility since then. The semiconductors are a group I watch closely because they are extremely dependent upon economic growth for volumes, and the valuations of the stocks in the group tend to move around a lot as well. This combination means you can see really sizable moves in both directions, which presents great trading opportunities.

In light of this, I was keen to take a look at a lesser known semiconductor company in ON Semiconductor Corp. (NASDAQ:ON). I see a very bullish pattern forming right now that is nearing completion, and the stock is quite cheap all things considered.

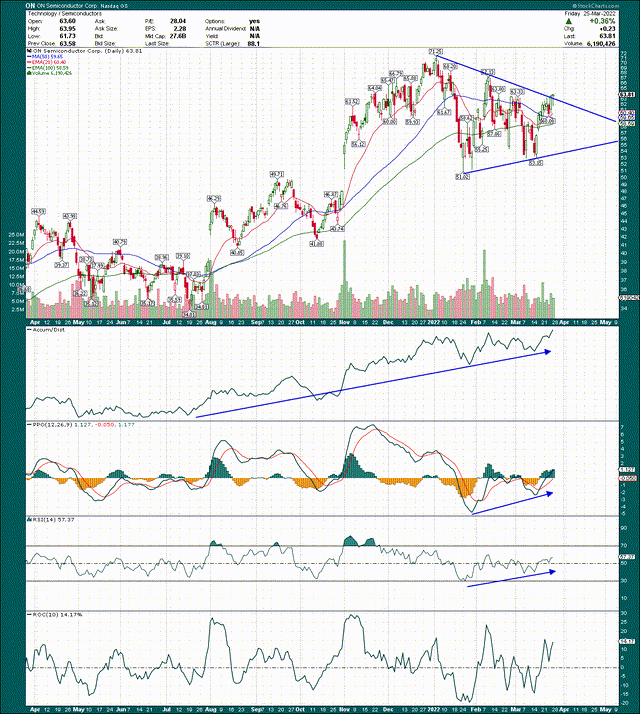

Let’s begin with the chart, and the pattern I referenced is a triangle consolidation pattern. This is one of my favorite patterns because triangles are pretty reliable, and that makes them easier to trade. Triangles are continuation patterns, meaning that when the pattern completes, the odds are that the next move are a continuation of the move prior to the consolidation. In this case, ON had a massive upside move, and I think there’s another one coming in the next several months, provided we get a breakout to the upside.

As you can see, ON is right up against the top line of the triangle, meaning that either the stock is about to breakout, or we’re going to see another move down to help complete the triangle. Which one ultimately plays out is still up for debate, but if we do get another move down, that would be a terrific buying chance to me. You wouldn’t expect a move lower than $56, give or take, to keep the stock within the triangle.

Why do I think a breakout higher is the next move? All the of the other indicators are flashing bullish and that’s why this stock looks great. The accumulation/distribution line has been tremendously bullish throughout the past year, price action notwithstanding. That means institutions are buying dips rather than selling rips, and that bodes well for the future.

The PPO and the 14-day RSI are both showing sustained improvement as well throughout this consolidation period, ending the bearish period ON had in the early parts of this year. None of this guarantees ON is going to breakout higher, but the combination of price action and the momentum indicators makes me quite bullish on this one.

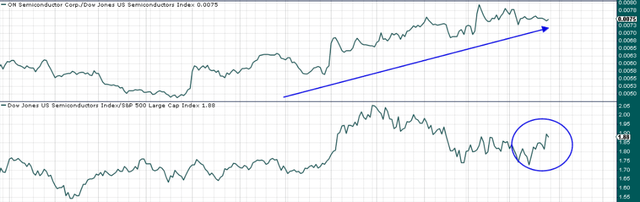

Finally, let’s take a look at relative strength, which adds yet more credence to the bullish argument.

ON has vastly outperformed its peers in the past several months, which has been a weak period for the group. The past two weeks have been very bullish for semiconductors and whether or not that continues, one thing I’m confident of is that ON is likely to continue to outperform the rest of the group, which is exactly what you want from a stock you own.

Now, let’s take a look at ON’s fundamentals to see why I also think the stock is cheap.

Growth opportunities abound

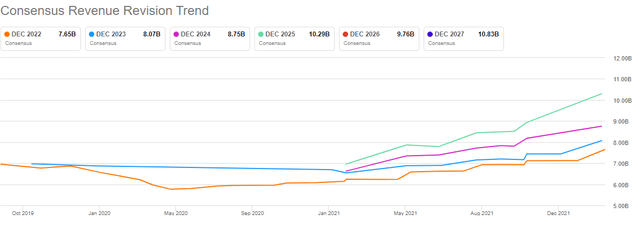

ON is not just a pretty chart; there’s a great business behind all of this positive price action, and it makes me even more confident the next big move we see in the stock is higher. Let’s begin with revenue to ground us on volumes and pricing.

We can see that not only are revisions extremely bullish, having made massive moves higher since the pandemic began, but there is significant space between the years, meaning year-over-year growth is strong. This is exactly the type of behavior you want from a growth stock because it means the company continues to outperform analyst expectations, and until that stops for ON, I’ll be bullish on the stock.

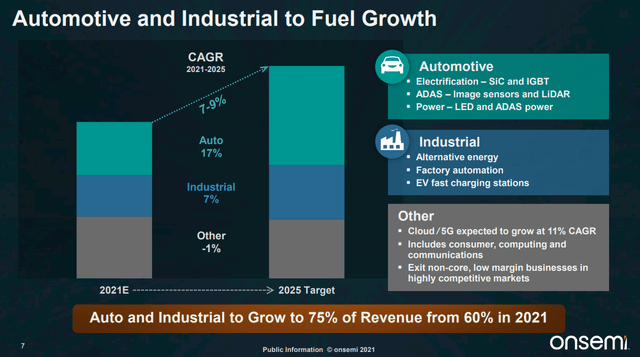

This growth is coming from a variety of areas for ON, but its focus on automotive and industrial customers has served it well, and should continue to do so in the years to come.

ON is leveraged to electric vehicle production, which we know is ramping across the world in the years to come. It is also heavily involved in helping produce things like automation in production facilities, clean energy initiatives, and even communications applications. The point is that ON is present in all the right places for mega-trends that should serve it well in the years to come in terms of volume, which is what is driving those higher revenue revisions.

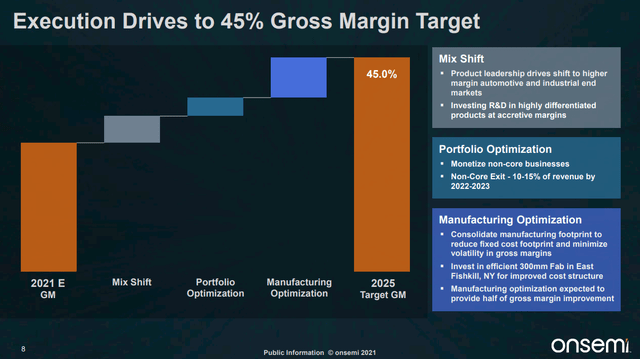

In addition to much higher revenue, ON has been on a margin improvement journey that has already yielded strong results. However, ON believes there is more on the table.

The company sees mix shift in its customer base, as well as exiting less profitable businesses to yield margin improvements. In addition, the company has been divesting manufacturing facilities to help this effort along. The company sees these initiatives as combining to drive sustainable gross margin improvements in the years to come, helping to boost profitability over and above the rate of revenue growth.

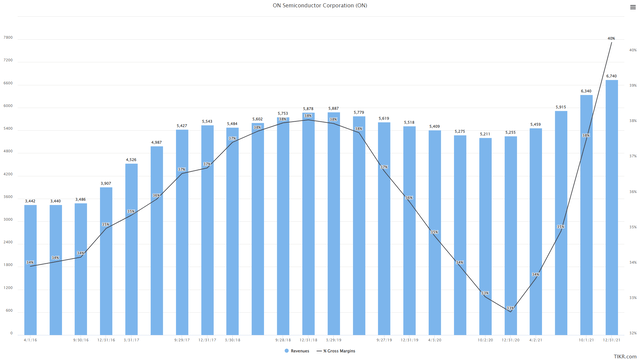

Below, we have trailing-twelve-months gross margins and revenue for the past few years to illustrate how it’s going so far.

ON’s gross margins have been extremely volatile, hitting low-30s in the early part of 2020, but racing higher to 40% in the most recent TTM. That has helped drive significant earnings improvements and that’s a big reason why the stock has raced higher.

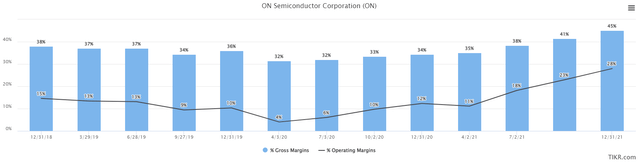

But when we talk about operating margins, the gains are even more than what we see because ON’s expenses have risen much more slowly than the company’s combination of revenue and gross margin growth, producing enormous gains in operating margins.

Below, we have gross margins in blue and in black, we have operating margins on a TTM basis.

Operating margins were just 4% on a TTM basis in the April 2020 quarter, but last quarter, operating margin was seven times that level at 28% of revenue. This is the impact of higher revenue and the margin improvement initiatives the company has put into place, and I’m not convinced this is priced into the stock. That means that if we do get the breakout higher I’m looking for, the move could be quite sustained.

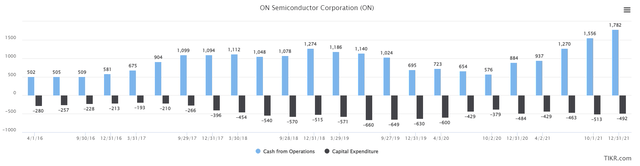

Let’s now turn our attention to free cash flow, which is simply the difference between operating cash flows and capex, both of which we have below on a TTM basis.

You can see a clear inflection point where the margin improvement we looked at took place, and operating cash flow has ramped higher ever since. That has afforded the ability for ON to increase its capex without undue stress on the financials, and as this plays out, ON can either go acquire more growth, invest more in capex, and/or buy back its own shares. All of these things should theoretically help ON grow EPS in the years to come, so I see this as supporting ON’s path forward as well.

The sum of all parts

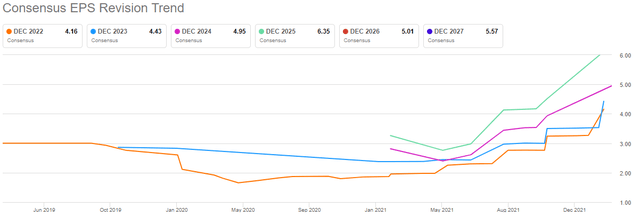

Finally, let’s take a look at EPS revisions, as well as the valuation to wrap this up.

We can see that EPS revisions look similar to revenue, with the key difference being the slope of EPS being much steeper. That’s the product of the margin improvement efforts we looked at, as the amount of profit ON is generating per dollar of revenue has moved steeply higher in recent quarters. While this pace of improvement isn’t sustainable forever, I still think there’s more to come, as mentioned above. And just like revenue, this is exactly the sort of behavior you want from a stock you own as analysts try to keep pace with the company’s excellence.

Now, let’s take a look at the valuation, as represented by the forward P/E ratio.

This is where the fundamental case is even more exciting, as the company is ramping revenue and margins higher while the valuation declines. We’re at just 15X forward earnings, which is what ON traded for pre-pandemic. The stocked peaked at 35X forward earnings, and while you can argue that was too high, there are plenty of semiconductor stocks that trade for more than that. ON spent most of 2020/2021 in the mid-20s or higher, so you can debate what fair value is. But my point is that fair value is something a whole lot higher than 15X earnings, so I see this stock as very attractive on a fundamental basis, as well as with the valuation, and the chart. If we say 25X forward earnings is fair value, for instance, that would be a -65% move higher just on a valuation basis, irrespective of what EPS does.

If you want to own a semiconductor stock, I think you have to consider ON, because it has a tremendously attractive combination of outlook, valuation, and technical picture. I’m very bullish and think ON will be much higher later this year.

Be the first to comment