AlbertPego

Introduction

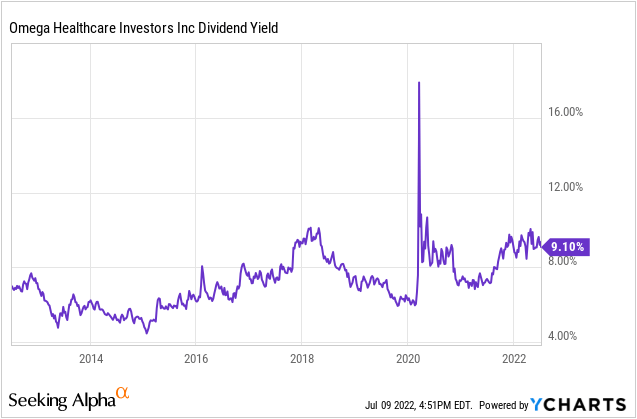

The last twelve months have not been enjoyable for the shareholders of Omega Healthcare Investors, Inc. (NYSE:OHI), with the share price sliding near 20% lower despite the economy largely recovering from the Covid-19 pandemic. Whilst any investor would have noticed this, sending their dividend yield surging to a high 9%, I suspect quite a few have not noticed the accompanying selloff in their debt. This sees their bond yields surging, spelling trouble as they are constantly reliant upon external capital.

Detailed Analysis

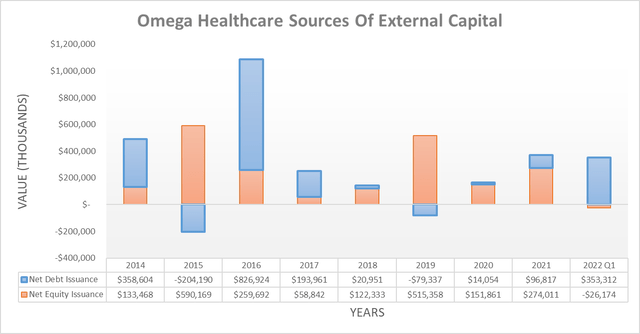

Whilst there is nothing necessarily unusual nor inherently wrong with utilizing external capital to fund growth, the extent they are required to utilize this operating model creates a unique situation. Even though the amount of external capital they raise varies each year along with whether it comes from debt or equity, every year saw more raised than was returned, thereby seeing a constant demand for capital. This is similar to other real estate investment trusts (“REITs”), but regardless, it nevertheless still creates risks when capital markets become less supportive.

It should be remembered that nothing is free. As a result, the greater the risk, the greater the reward investors seek, regardless of whether debt or equity. Since they constantly require external capital, this risks creating a self-reinforcing cycle, with tough times leading to higher risks, which leads to higher borrowing costs that subsequently hurts financial performance and leads to further risks, and so forth until there is a circuit breaker such as a dividend reduction. Now that the risks of the Covid-19 pandemic are seemingly subsiding, many investors may feel this has put an end to this cycle, but sadly, this could not be further from the truth. The bond yields are climbing rapidly during 2022, as the graphs included below display.

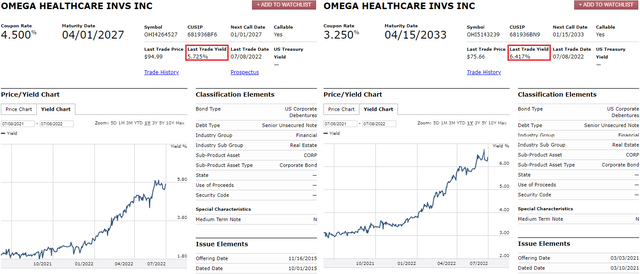

It should be safe to assume that by this stage, everyone knows that inflation has become a problem. The consumer price index (“CPI”) is rising to the highest level since the 1980s, thereby seeing the Federal Reserve rush to raise interest rates at the fastest pace in decades. Unsurprisingly, tighter monetary policy is not being kind to their bond prices, with the yield on their 2027 maturity surging from only circa 2% one year ago to already 5.73%. Meanwhile, their longer-dated 2033 maturity has also not fared much better, with its yield climbing from circa 3% to 6.42% during this same period of time. Whilst these are only two of their bonds, the same story is shared elsewhere at other maturities.

Since Omega is constantly reliant upon external capital, this is problematic. Even as it stands right now, their borrowing costs have more than doubled, and thus borrowing another $100m will cost as much as borrowing more than $200m would have only twelve months ago. This further erodes earnings and cash flow performance, which not only strengthens this self-reinforcing cycle at quite possibly the worst time, at least from a monetary policy perspective, but also increases the risks for their dividends. As a REIT, they see a very high payout ratio with 2021 seeing their dividend payments of $637.6m consuming almost 90% of their operating cash flow.

Regardless of what metric an investor prefers, it does not change the fact that no company nor REIT can safely return more cash to shareholders than they generate via operating cash flow. This effectively imposes an unavoidable hard ceiling that higher interest rates will push them towards. Given their only minimal margin of safety, it makes for a risky outlook for Omega’s dividends.

Whilst the vast majority of their debt has fixed interest rates and thus provides shelter, this is only temporary because they require routine refinancing that progressively exposes them to higher interest rates on their existing debt structure, plus additional borrowings. If looking ahead, their bond yields are likely to continue climbing even higher with the Federal Reserve widely expected to push interest rates significantly higher in the coming months.

This already undesirable outlook could be thrown into overdrive because Standard & Poor’s (SPGI) only assigns them a credit rating of BBB- and thus the lowest investment grade rating. This leaves them particularly vulnerable for a downgrade as monetary policy tightens and their credit metrics deteriorate. If their credit rating is downgraded to the junk territory of BB+ or lower, their bond yields will almost certainly surge way higher as more investors turn away and they lose inclusion into various ETFs and mutual funds that have a mandate to only hold investment-grade debt.

Whether inflation and by extension, interest rates can be brought under control in the short-term remains to be seen but given the energy and food shortages, plus war in Europe and supply chain disruptions since 2020, the outlook for the foreseeable future does not appear too promising. Since this makes raising debt unattractive, in theory, this would leave them more reliant upon raising equity but sadly, apart from higher interest rates threatening to erode their financial performance and dividends, they also stand to levy more downwards pressure upon their share price. Equity always carries more risk than debt, which means that as bond yields increase, the yields on equities increase in tandem and by extension, this means a lower share price that makes sourcing external capital via equity even more costly than already, as the graph included below displays.

Y-Chart

Following the discussion thus far, it should not be too surprising to see their dividend yield is near its highest level in the last decade, excluding the freak spike during the initial Covid-19 pandemic sell-off in early 2020. It should be fairly intuitive to understand that issuing new shares effectively costs whatever their prevailing dividend yield is at the time, which at the moment is a high 9%+ and thus turning to equity markets will prove more dilutive than normal, thereby placing further pressure upon their dividends.

Conclusion

When it comes to income investing, I feel it prudent to monitor where a company or, in this case, a REIT sources capital and by extension, its cost. Since Omega Healthcare is constantly reliant upon external capital, the prospects of higher interest rates risks creating a self-reinforcing cycle that erodes their financial performance and increases the probability of a dividend reduction. Even if Omega Healthcare manages to sustain their dividends, I still expect their share price to be weighed down by tightening monetary policy, with little scope to rally until inflation is brought under control. Thus, I believe that a hold rating is appropriate, as this counteracts the desirability of Omega Healthcare’s high 9% dividend yield.

Notes: Unless specified otherwise, all figures in this article were taken from Omega Healthcare’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment