Rio Tinto (RIO) is one of the world’s largest mining companies and as such is a leading expert that understands mining values better than most.

In spite of the fact that Rio Tinto is the largest shareholder of Minera IRL (OTCQB:MRLLF) (MIRL: CSE) (MIRL: BVL), Minera remains relatively unknown. Based on industry cash flow comps, Minera is an exceptionally undervalued gold producer operating in prolific gold producing regions in Peru. An initial 43-101 was completed in 2006 and indicated a mine life of only 4 years, yet here we are 16 years later and Corihuarmi continues to produce gold far in excess of original estimates. Since 2008, Minera has produced over $500 million in gold sales from their Corihuarmi open pit mine with low grades of about .021 gpt.

Recent drill results in the Corihuarmi mine showed substantially higher grades that suggest future production from increased grades could increase gold production from 2 to 4 times current production levels.

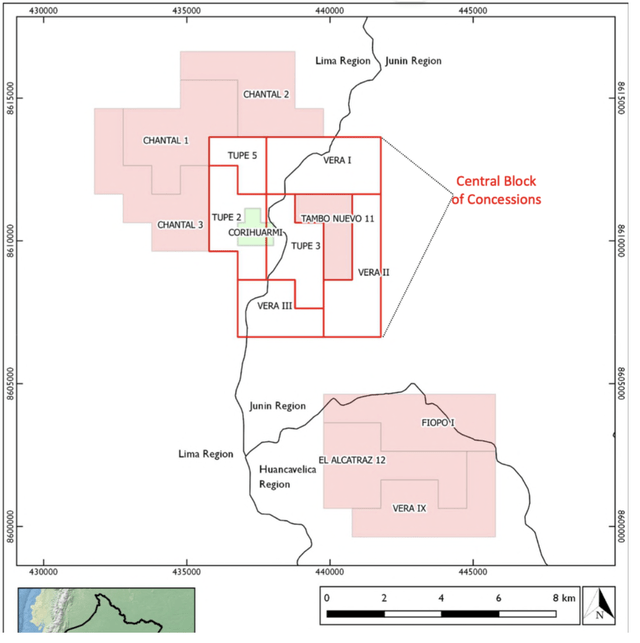

The following map illustrates the potential to explore and produce substantial gold and other valuable resources far beyond resources identified to date and potentially for decades to come.

Corihuarmi mine (Minera web site)

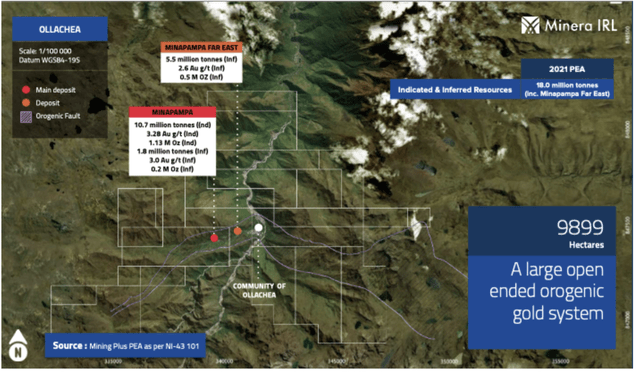

Ollachea is another large group of claims with a recent Preliminary Economic Assessment reporting 1.3 million ounces of indicated gold and .6 million ounces of inferred gold.

Ollachea is one of very few “shovel ready” mines with all necessary permits, roads, utilities and infrastructure in hand and available. Minera is planning to build a 1,500 ton per day processing facility for Ollachea with expansion plans to increase to 3,000 tons per day. Recently the company announced active discussions to finance the large new processing facility.

“We remain in discussions with potential parties as a result of the roadshows, where it is recognized that Ollachea is one of the few shovel-ready projects in South America.

While we remain open to traditional financing or a strategic alliance, we have also begun to consider the possibility of gold streaming as a potential alternative or ‘add-on’. A streaming deal could provide the company with some significant portion of the required finance, reducing the debt required to a level that might prove easier to obtain.”

A map of Ollachea shows the potential for additional resources beyond the 2021 PEA conducted by Mining Plus.

The Bullish Case for Gold

With inflation beginning to ease and the Fed signaling that interest rate hikes may be peaking and slowing, the expectations for higher gold and metals prices are increasing. Another potential factor is the controversy surrounding China’s reopening from Covid which could lead to even more growth if China begins reopening their economy. China’s population is expressing growing unrest from long continuing confinement and could result in China expediting reopening.

If you think the price of gold and metals is heading south for the long term, it is probably best for you to avoid these stocks. On the other hand, if you are bullish on the price of gold and metals, then this could be a timely opportunity to invest in stocks like Minera.

Industry Valuation Comps Based on Cash Flow

The annual cash flow of five well-known mining companies is examined below and compared to their market caps and then compared to Minera. The conclusion supports my belief that Minera is highly undervalued. Low trading volume and almost no social comment on message boards of Yahoo Finance, StockTwits, IHUB, Reddit and Twitter further reinforce this conclusion.

Rio Tinto (RIO: NYSE) current market cap – $106.5 billion

Rio Tinto 2021 operating cash flow – $25.345 billion

Valuation ratio – 4.2

BHP Group (BHP: NYSE) current market cap – $214.5 billion

BHP Group 2021 operating cash flow – 32.174 billion

Valuation ratio – 6.7

Barrick Gold (GOLD: NYSE) current market cap – $28.4 billion

Barrick Gold 2021 operating cash flow – $4.378 billion

Valuation ratio – 6.48

Agnico Eagle Mines (AEM: NYSE) current mkt cap – 22.738 billion

Agnico Eagle Mines 2021 operating cash flow – 1.316 billion

Valuation ratio – 17.27

Newmont (NEM: NYSE) current market cap – 36.393 billion

Newmont 2021 operating cash flow – 4.279 billion

Valuation ratio – 8.5

AVERAGE PRICE TO CASH FLOW RATIO – 8.63

MINERA

Minera (MRLLF: OTC) (MIRL: CSE) current market cap – 6.931 million

Minera 2021 operating cash flow – 14.499 million

Valuation ratio – .5

Financials

Minera reports continued rising gold shipments which translate into cash flow for operations and growth. The Company reported Q2 2022 revenue of $9.7 million compared with revenue of $10.8 during Q2 2021 with a slight decrease due to the combined effect of a 3% increase in the average price of gold sold and a 13% decrease in the number of gold ounces sold. The most recent financial statement for the period ending September 30, 2022 reported cash of $2,485,000. Current assets reflected about a $5 million increase in lease liabilities leading to an inverted current ratio for the quarter. Rising fuel, labor and explosives costs added to the inversion. Minera is in active capital raise negotiations to fund their new Ollachea 1,500 ton per day processing facility. The company appears well positioned for this funding and is healthy and poised for significant financial improvements in the near term.

Risk Factors

Financial prosperity of all gold miners is directly tied to the price of gold which can be an enormous lever on the top and bottom lines. Minera has consistently demonstrated the ability to generate formidable gold sales and free cash flow for years and management appears to be well seasoned and thoroughly immersed in the all-important local politics as well as the operation, the cash flow to meet obligations and growth, and the necessary new capital for growth.

In the third quarter of 2022, the Company’s performance and results have continued to be impacted by rising prices of fuel and other consumables used in the mining industry. Diego Benavides, Minera CEO said, “Similar to a number of large and medium operators and producers worldwide, our production costs have significantly increased since the beginning of 2022 as a result of this irregular situation. In addition, the consistent decline in gold prices seen during the quarter and driven by geopolitical tension and inflation, have had a direct effect on our financial position.”

“Management anticipated this and started different initiatives in the second quarter of 2022 aimed to mitigate this temporary situation and ultimately revert it. Positive efficiencies have already been achieved to date in the Corihuarmi Gold Mine and further results are expected in the upcoming months.” Notes to Consolidated Financial Statements elaborate on measures undertaken by management to effectively deal with market changes.

Conclusion

I believe Minera is a strong buy for several reasons. Based on 2021 cash flow, Minera appears undervalued by a factor of 17. Minera’s operations have consistently delivered over $500 million in gold since 2008 and now projections are increasing sharply due to increased grades indicated by recent drilling in the Corihuarmi open pit operations. Projected production for Ollachea also increased dramatically by the PEA by Mining Plus.

I believe it is significant to understand that Rio Tinto is the major shareholder of Minera. Minera’s ongoing production and cash flow greatly reduces potential risk of inadequate capital and I believe management is well seasoned and experienced in all aspects of their operations, as well as politically aligned with their immediate and interested community.

Financing the new processing facility for the high-grade Ollachea mine is not expected be challenging because the Corihuarmi operations should be more than adequate to finance the new 1,500 ton per day facility and Minera has certainly proven their capabilities and their claims as a seasoned and successful gold miner.

Minera may not be known by many investors today, but with production this large and consistent, and now with the new prospects of dramatically increasing production, word is sure to get out. Rio Tinto and other large and savvy miners are likely to be watching Minera and could be ready to move quickly to acquire an asset that in my view is currently undervalued and that could greatly increase in value in the near future as Ollachea readies to substantially ramp up gold production.

scyther5

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment