MarsBars/E+ via Getty Images

Investing in speculative plays can be fun and exciting , but it’s important to balance these names with reliable ones that an investor can count on in both good times and bad. The recent market volatility supports the idea that it’s not fun to hold only a basket of growth stocks when the music stops.

This brings me to Old Republic (NYSE:ORI), which has provided its investors with long-term reliable returns that’s beaten the market average. This article highlights what makes ORI a good candidate for income and growth at current levels, so let’s get started.

ORI: Higher Dividend And Returns Than The Market

Old Republic is a Chicago-based Fortune 500 company that’s been in business for over 90 years. It offers a variety of insurance products, including property and casualty, title, and surety. ORI’s general insurance ranks among the 50 largest in the U.S., and the title insurance operations are the third largest in the country.

One of the things that’s appealing about Old Republic is its long history of paying and increasing its dividends. The company has increased its dividend for 41 consecutive years, which is an impressive feat in and of itself. Moreover, its dividend payments have been uninterrupted (no cuts or suspensions) for over 80 years.

In addition to being a reliable dividend payer, Old Republic is also a company that has been able to grow its revenue at a healthy pace, with 8.2% compound annual top-line growth over the past 5 years.

This includes continued growth in the period, with 21% and 40% YoY pretax income growth for Q4 and full year 2021, respectively. Also encouraging, book value per share advanced to $22.76 at the end of 2021, representing 21% growth compared to the end of 2020. This also shows that ORI responds fairly well. These results show that ORI responds fairly well to inflation, as general insurance net premiums increased by 7.5% YoY during the fourth quarter.

Moreover, ORI appears to be a company that’s managed for the long run. This is reflected by the conservative investment profile, in which 68% is comprised of highly rated bonds and short-term investments, with the remaining 32% allocated to dividend-paying large cap stocks.

One potential issue for Old Republic is its reliance on the U.S. economy. While the U.S. economy has been doing well, there’s always the risk of a recession, in which case ORI may see its earnings decline. Additionally, the rise in interest rates have resulted in a slowdown in refinancing activity, and this hurts ORI’s title insurance business. Management, however, has noted continued underlying strength in home purchases during the Q&A session of the recent conference call:

Q: I don’t want to diminish the outstanding results for 2021, but we’re always forward-looking. And if I look at the direct orders open, the direct orders closed on a year-over-year basis, the numbers are trending down. Therefore, it seems like 2022 relative to 2021, there could be some erosion in your results, not that an 89 combined ratio for the quarter or for the year is anything to sneeze at. But I’m just curious about your perspective on the 2022 outlook relative to 2021.

A: Well, the drop in orders is mainly because of the mix, the drop in the refi business. And purchase orders are higher fee profile for us. And we recognize that we’re still in a very hot real estate market. And while refi orders are down, the resale market is still really strong. We feel good about the market right now. Commercial is still strong after a difficult 2020. But we also understand hot markets don’t last forever and any one thing can change them. We’re dependent on inventory, interest rates, a strong economy. And I feel like we’re positioned though that really no matter what happens, we’ll be able to perform.

Meanwhile, ORI carries a strong BBB+ rated balance sheet, and it recently grew its dividend by a respectable 4.5%. ORI currently yields 3.5% at the current price, and this sits well ahead of the 1.3% yield of the S&P 500 (SPY). Moreover, ORI’s total return over the past decade has handily beaten that of the S&P 500, with a 370% total return, as shown below.

ORI Total Return (Seeking Alpha)

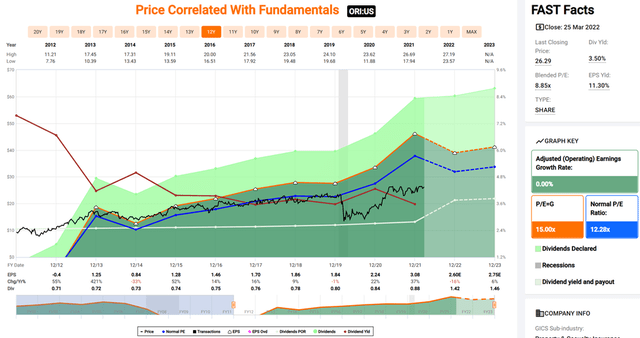

I see value in ORI at the current price of $26.29 with a forward PE ratio of 9.7 (blended PE of 8.9), sitting well below its normal PE of 12.3 over the past decade. Sell side analysts have a consensus Buy rating with an average price target of $30, implying a potential one-year 18% total return including dividends.

Investor Takeaway

Old Republic is a high-quality company that has been able to grow its revenue and earnings at a healthy pace while also paying a dividend that has increased at a respectable rate. The company appears to be well-positioned for the long run, with a conservative investment profile and its total return has handily beaten that of the S&P 500 over the past decade. I see value in ORI at the current price for reliable income and growth.

Be the first to comment