ablokhin/iStock Editorial via Getty Images

Introduction

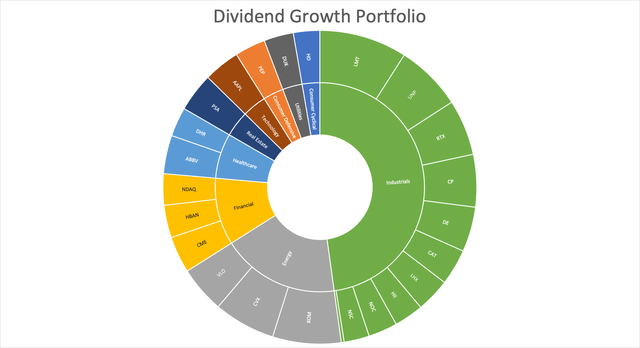

I have to say that the past few weeks have been both challenging and “fun”. On the one hand, my dividend growth portfolio is taking some hits. While I was able to more or less ignore the first signs of weakness in the stock market thanks to my energy and industrial exposure, I’m now experiencing weakness in these areas as well.

However, I’m far from concerned as stocks sell off occasionally. The reason/economic environment is always different, but corrections always happen. I believe that times like these are very important when it comes to achieving long-term success as it allows investors to buy stocks with better yields at better prices. On a long-term basis, this generates a lot of value.

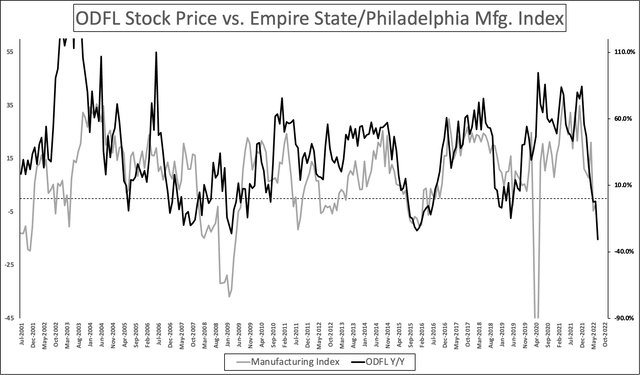

One of the stocks that I don’t own yet but absolutely love is Old Dominion Freight Lines (NASDAQ:ODFL). The stock is experiencing a sell-off not seen since the manufacturing recession of 2014/2015. It’s not entirely unjustified as I will discuss in this article due to severe pressure on the transportation industry from worsening fundamentals. However, Old Dominion remains a best-of-breed trucking company, with rock-solid fundamentals that I consider to be a top long-term dividend growth stock despite its low yield.

In this article, I will walk you through my thoughts.

Market/Industry Weakness

Let’s start with the worst part of this article: a macro discussion based on bad news. In a recently published article on Seeking Alpha, I spent some time discussing the transportation outlook.

Using a great article I read on Freight Waves (no affiliation), I discussed the “bullwhip” effect, which is a direct result of the first COVID lockdowns in 2020.

As I wrote in my transportation article:

“The definition (as seen below) basically describes issues that started after the 2020 pandemic lockdown.

The “bullwhip effect” is a term used in supply chain circles to describe a scenario in which temporary surges in retail demand are magnified and exaggerated by upstream manufacturers and suppliers, who rapidly increase production well beyond the level that can be supported by consumers. Eventually, retailers find themselves with more inventory than they can sell, and what started as a goods shortage ends up as a goods surplus.

Moreover, referring to the chart below (emphasis added):

Before COVID, the ratio of containers per shipment was fairly static and the two indices moved in tandem. Beginning in the summer of 2020, the container-to-shipment ratio exploded as Big Box retailers used their leverage to move more containers into their scheduled shipments. Smaller importers kept their container-to-shipment ratios more static, finding it harder to secure additional capacity on container vessels.”

Now we’re in a scenario where big retailers are reducing orders to deal with inventories. After the start of the Ukraine war, inflation accelerated along with rates, causing a low-demand environment.

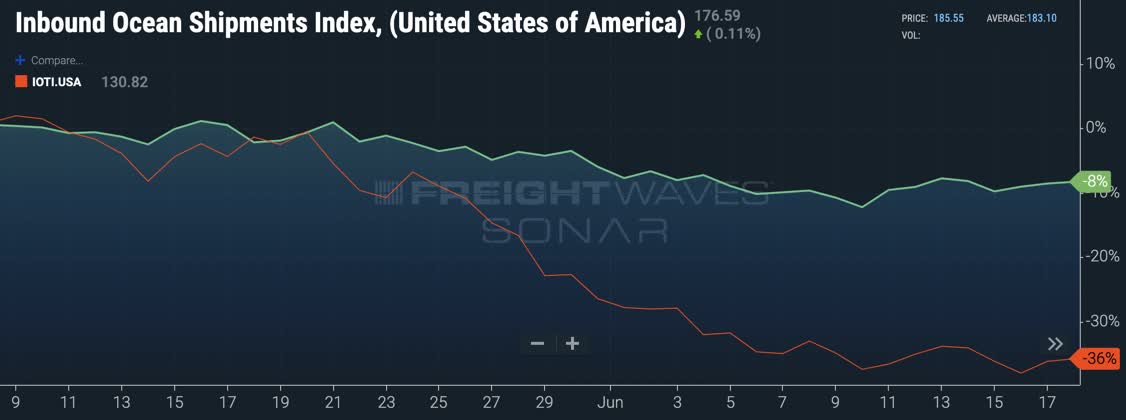

The graph below shows what that means in terms of numbers. Total global shipments are down 8%. Container bookings are down a stunning 36%.

Freight Waves

So, what does this mean for trucking companies? After all, that’s what this article is about.

It’s bad news as trucking companies are losing pricing power. Freight Waves expects weakness to hit the trucking industry in July.

According to Freight Waves:

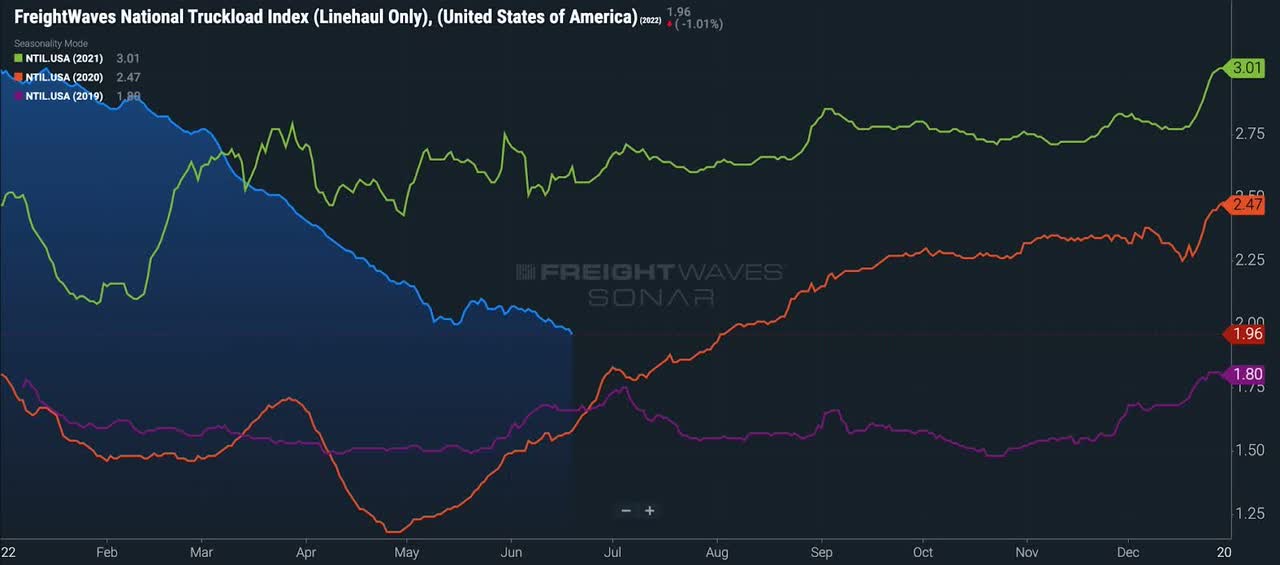

At this point in time, the trucking market continues to weaken. This is very concerning for mid-June (normally one of the hottest months in freight). The national spot index 7-day rolling average dropped from $2.07/mile on June 1 to $1.96/mile on June 20th.

Freight Waves

Tender rejections, an indicator of trucking capacity conditions, declined to a new cycle low of 7.7%. What this means is that trucking companies lose pricing power. That makes sense as fewer goods are now divided over a lot of trucks in the transportation industry – a very competitive industry in general.

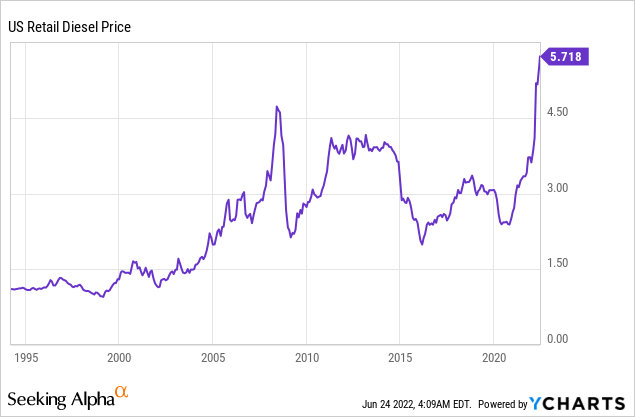

And to make matters worse, there’s another factor hurting trucking companies. Retail diesel prices remain well above prior peak levels, adding pressure to margins.

With that in mind, here’s why Old Dominion Freight Line is on my radar.

Old Dominion – A Top-Tier Shipper

With a market cap of $28.1 billion, Old Dominion is the largest stock-listed trucking company in North America. Founded in 1934 and headquartered in Thomasville, North Carolina, the company has become an LTL staple – LTL standing for less-than-truckload.

According to Investopedia:

Less-than-truckload, also known as or less-than-load (“LTL”), is a shipping service for relatively small loads or quantities of freight. Less-than-truckload services are offered by many large, national parcel services as well as by specialized logistics providers.

These services can accommodate the shipping needs of countless businesses that need to move smaller batches of goods frequently. Less-than-truckload shippers offer economies of scale so that freight costs of individual shipments are minimized.

This is a highly competitive industry. However, because LTL freight is generally speaking not long-distance, it offers better worker conditions, making it easier to find qualified labor in a tight labor market.

The company covers almost every inch of the US through 254 service centers in 48 states. The company employs more than 24,500 full-time employees, it has 10,400 tractors/trucks, and more than 41,000 trailers. Roughly half of its employees are drivers. The average age of its trucks is 5.0 years.

Not only does the company cover all economic hotspots in the US, but it also benefits from its focus on quick and efficient transportation. Roughly 70% of shipments are Next or Second-Day. Moreover, because of its network, the company can grow in longer-haul lanes.

On-time delivery has improved from 94% in 2022 to 99% in 2022. At a time when competitors struggled with labor and material shortages. The same goes for railroads, which struggled to service customers due to highly volatile demand and related issues.

Moreover, the cargo claims ratio has declined from 1.5% in 2002 to just 0.2% in 2022. Hence, it’s one of the reasons why the company has won the Mastio Quality Award 12 years in a row.

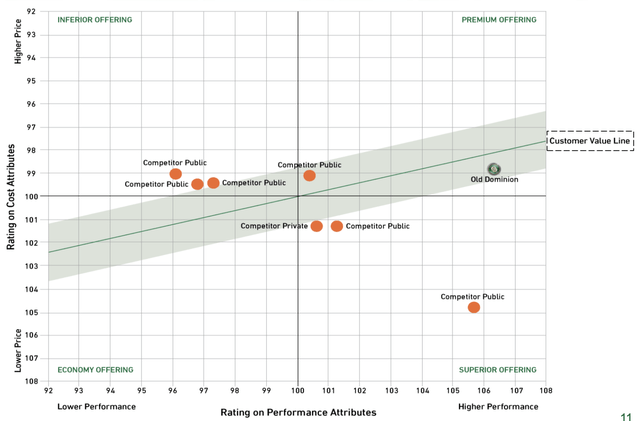

According to the company’s own data, it is in a perfect spot when it comes to offering companies value for their money. The company scores high on performance indicators, yet it is relatively affordable given that its pricing is comparable to less-successful competitors.

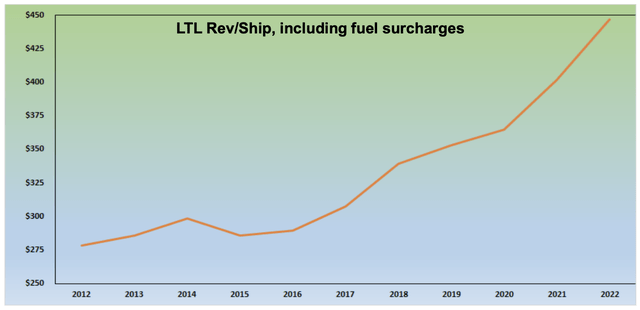

Speaking of pricing, the company excels at incorporating costs into its pricing. Target LTL revenue per shipment is exceeding the cost per shipment each year to support new investments in its business. If that were not the case, it would be much harder to grow as financing conditions would be worse.

What’s interesting is that on June 7, Bank of America boosted ODFL EPS estimates based on pricing (among other reasons):

The firm boosted its 2022 EPS estimate on ODFL to $11.60 vs. $11.63 consensus and raised its 2023 EPS estimate to $13.15 vs. $12.34 consensus.

The increased targets are said to reflect slightly lower tonnage, yet stronger than targeted all-in yields and higher fuel costs. Stronger ex-fuel yields are also anticipated, although some moderation is likely.

BofA increased its price objective to $273 from $264 as it kept its 23.5X target on 2022 EPS, which is noted to remain within the 13X to 26x historic range. An Underperform rating is held in place with the stock’s multiple decline also lining up with a decelerating growth rate.

With that said, there’s more to it.

ODFS’ Shareholder Value

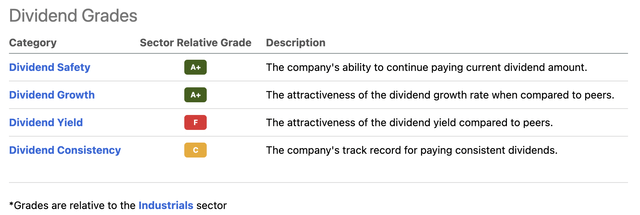

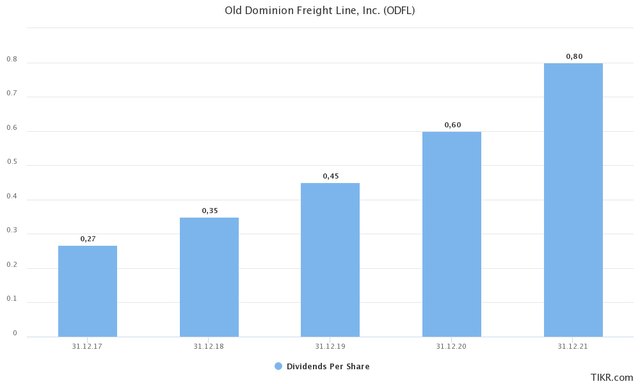

Thanks to its ability to grow, the company is scoring very high on dividend safety and dividend growth – compared to its industrial “peers”. The company scores very low on its dividend yield, which isn’t a surprise as the company pays a $0.30 per share per quarter dividend. That’s $1.20 per year or 0.48% of its stock price.

The dividend consistency score can be ignored as the company paid its first dividend in 2017. Since then, it hasn’t suspended nor lowered its dividend once. So, consistency – so far – is quite good.

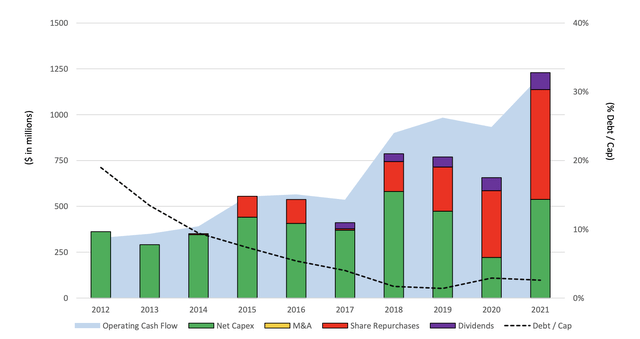

One issue is that trucking companies are extremely capital intensive. After all, new trucks, trailers, employees, maintenance, and fuel, all add up. Hence, a big part of operating cash flow goes towards net CapEx each year (which accounts for divestitures).

Next year, the company is expected to do $1.0 billion in free cash flow. That’s roughly 3.6% of the company’s market cap. In other words, it supports the rising trend in buybacks as seen in the graph above.

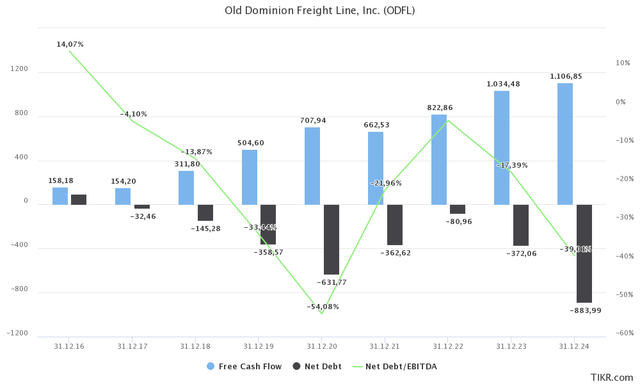

Unlike a lot of other, smaller, trucking companies, ODFL isn’t dealing with a lot of debt. As a matter of fact, the company hasn’t seen positive net debt since the end of 2017. Next year, analysts expect that net debt could be negative $372 million. That’s a big deal as it gives the company a big margin of safety in a high-rate environment and economic declines as available lending options will “always” be good. At least relative to other options that banks have.

Hence, dividend growth and buybacks are aggressive. Buybacks usually fill the gap between CapEx, dividends, and operating cash flow. Over the past 5 years, the average annual dividend growth rate is 71.2%.

The most recent dividend hike was announced on February 2, 2022, when the company hiked by 50%. While I find it hard to predict future growth rates, I have little doubt that dividend growth will remain high as there’s simply too much free cash flow available to ease up on dividend growth.

By now, some people are probably upset that I call a 0.50%-yielding stock a dividend opportunity. After all, a $10,000 investment will yield $50 per year. That’s a dinner for one at current prices at a mid-range restaurant – depending on where you live.

However, my point isn’t that the dividend will allow you to retire. At least not in this case. High-quality dividend stocks tend to outperform the market as I explained in a recent article. It shows that companies are well-run businesses able to let shareholders benefit from their success.

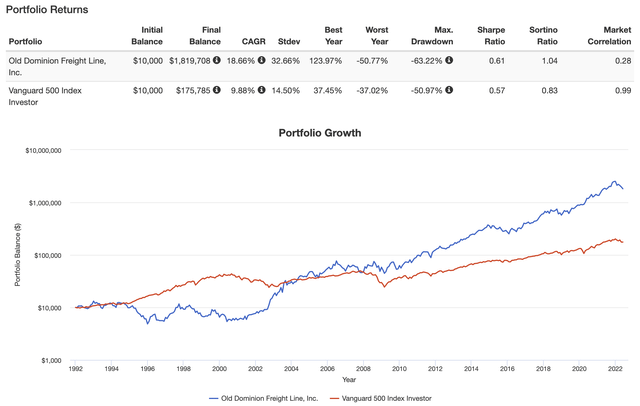

In this case, facts support this thesis. Going back to the early 1990s, ODFL has returned 18.7% per year. The S&P 500 has returned 9.9%. The standard deviation of ODFL was 32.7% during this period. While this is stunning, it includes the company’s volatile time in the early 2000s and late 1990s when the market wasn’t sure what to make of ODFL – it also didn’t keep the company from outperforming the S&P 500 on a volatility-adjusted basis according to the Sharpe ratio.

Over the past 10 years, the compounded annual growth rate has increased to 29.8%. The standard deviation is down to 27.6%. That’s still elevated, so please take that into account when considering buying ODFL.

So, what about the valuation?

Valuation

The valuation is the reason I’m writing this article.

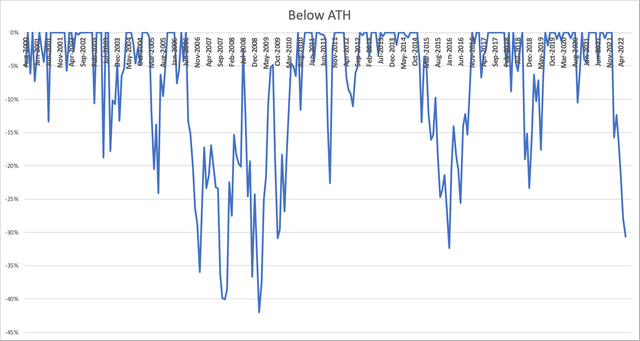

The market value of the company’s equity has lost roughly 30% from its highs. This is now making this sell-off the worst since the 2014/2015 manufacturing recession. The sell-off is worse than the one caused by the pandemic. Only the Great Financial Crisis was worse, which resulted in a loss of more than 40% of the market value.

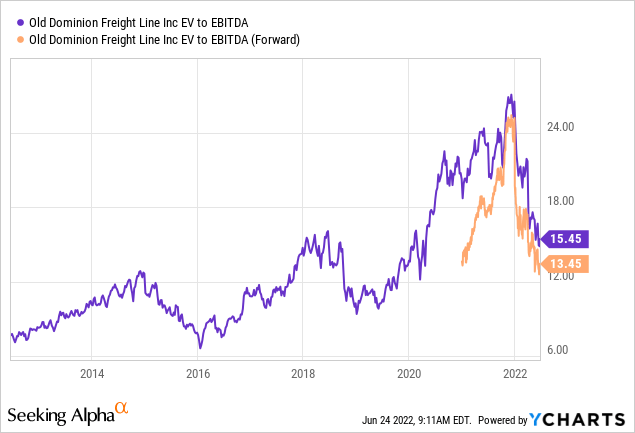

Given the bad transportation outlook I gave in the first half of this article, it’s good that a lot has been priced in. The graph below visualizes this a bit better than the chart above.

Using the company’s $28.1 billion market cap and $370 million in expected net cash give the company an enterprise value of $27.7 billion. That’s 13.0x next year’s expected EBITDA of $2.14 billion.

This valuation erases the entire post-COVID surge, putting investors in a good spot to pay a decent price for a company growing EBITDA by double-digits on a long-term basis.

Needless to say, I don’t know if the stock is bottoming. It’s impossible to tell. What I do know is that I like the risk/reward. I have been adding stocks to my portfolio in recent weeks as I believe that buying a favorable risk/reward is a better strategy than trying to buy the bottom. At least when it comes to dividend (growth) investing.

Nonetheless, if you’re interested in buying ODFL, I would suggest breaking up an initial investment, i.e. buy 25% now and add gradually over time. If the stock continues to drop, investors can average down. If the stock suddenly takes off, investors have a foot in the door.

Takeaway

In this article, I started by explaining why transportation companies are in a tough spot. The post-pandemic “bullwhip” effect is causing companies to focus on reducing inventories to deal with lower demand. This is lowering transportation demand, resulting in lower pricing power in an environment of high inflation.

The good news is that ODFL has priced in a lot. The company has lost almost a third of its market value, despite remaining in a solid spot to deal with input inflation.

Despite high competition, ODFL remains in a fantastic spot to further penetrate the market. It has a top-tier network, no positive net debt, double-digit EBITDA growth, and the benefit to withstand high inflation in an extremely tough environment.

While the dividend yield is low, ODFL has high dividend growth and aggressive stock buybacks that result in outperforming total returns despite high volatility.

If I didn’t have so much industrial and transportation exposure, I would have added the stock by now.

(Dis)agree? Let me know in the comments!

Be the first to comment