Welcome to the treadmill edition of Oil Markets Daily!

Picture yourself running on a treadmill. But now imagine it being a manual one (I have one at home and it is amazing).

The problem with the manual treadmill is that the faster you run, the harder you have to keep running just to keep yourself at that pace. But if you come to an abrupt stop, the treadmill will too. Unlike a mechanical treadmill, the speed of the increase is set, and similarly, when you stop the treadmill, it slows down slowly as well.

The shale treadmill here is very much like the manual treadmill we described. During the last shale boom-bust (2014-2016), shale producers were growing at a more moderate pace and with the oil bust, they trimmed a lot of fat to keep the production profile going. Permian was also just getting started with multi-pad drilling in 2016 and a flood of private equity capital waiting to enter. The capital was readily available back then giving shale producers a lifeline to continue. You can almost think of this as doping for runners.

But today you have the side effect of the doping part running out (no credit) and the shale treadmill going at an insanely fast clip (+2 mb/d in 2018).

We are now entering the real decline phase of the US shale treadmill as evidenced by last week’s monster 64 rig count decline and 40 frac spread decline.

As long as WTI is below $35/bbl, frac spread count will continue its decline towards zero. Operators won’t complete a new well today with the amount of uncertainty left in the market. Combine that with local basis differentials blowing out, companies will start paying early penalty fees to get rid of rigs and contracts before plowing more money into drilling.

This will leave the US shale production profile extremely vulnerable to basin declines especially at a time when US shale productivity overall was already in decline.

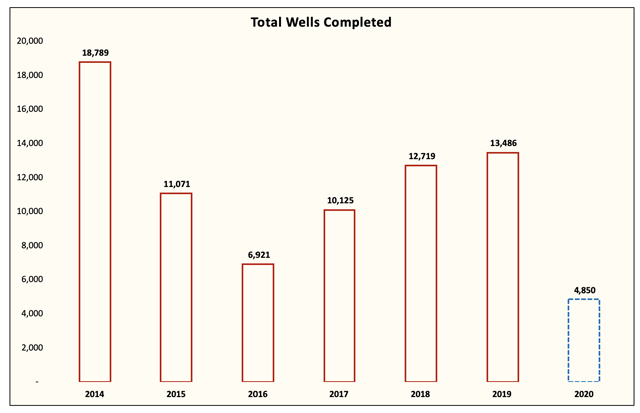

Combine a lower productivity profile with a new record low in well completions and the combo results in a monstrous decline in US oil production.

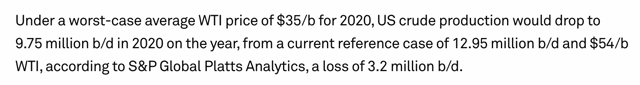

We estimate that US oil production could fall below ~10 mb/d if prices remain below $35/bbl WTI. Kudos to Platts for first bringing this up over a month ago when it predicted a drop to ~9.75 mb/d by the end of the year.

Source: Platts

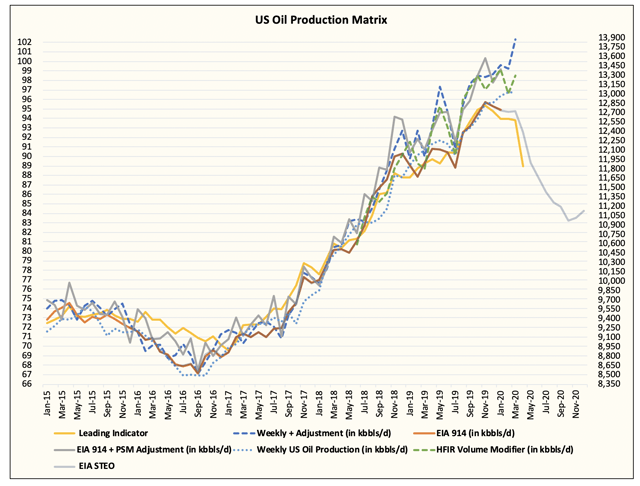

EIA also published its latest STEO today and it materially revised lower US oil production going forward. Although we applaud their revision, it is still too high.

There’s a serious risk that US oil production could fall over ~30% in just April alone from production shut-ins. Continental Resources (CLR) has already announced that it is shutting in ~30% of its production for April, and we expect more producers to follow suit.

Low prices lead to higher prices

For reference, we have said before that 2021 balances at the start of the year used ~13.4 mb/d for US oil production.

Any number below this by the end of this year will be the equivalent market deficit going into 2021+. The larger the number, the higher oil prices have to be to incentivize production and destroy oil demand.

At 9.75 mb/d, this would leave the market undersupplied by 3.65 mb/d, a clearly unsustainable balance.

So the takeaway is that the longer demand is impacted by the coronavirus, the longer prices stay low. And the longer prices stay low, the reversal will be that much more extreme.

We are now entering one of the craziest periods in the energy sector. Valuations have gotten so out of hand that we believe this is the final washout. We are now offering a 2-week free trial and if you wish to read our WCTWs this week, please see here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment