CHUNYIP WONG

There’s a lot to think about when it comes to the oil markets in 2022. It’s been one of the most complex years for the market, both to show how essential it is, and to show the risks of relying on it. Europe is moving away from fossil fuels, car companies are adjusting for a new market, and with impacts such as half of all coral reefs lost since 1950, climate change has moved to the forefront of decision making regardless of fossil fuel prices.

Oil and Time

The timeline of new technology, discussed in the famous book the Innovator’s Dilemma, is convoluted. For many years, renewables were too expensive and largely subsidized. In the last decade they’ve become cheaper than conventional sources of electricity. The rate of improvement continues to grow.

Despite being long-term oil investors, and believing that oil companies are well positioned to adjust to a new market, we view the 2020s and the 2030s as being the last decades of oil’s dominance in the oil market. Our view is that OPEC+ nations and the environmentalists they hire know that as well. It’s clear to them.

In our view, an example of this is OPEC+’s recent 100k barrel / day production cut. It was a minimal production cut, however, it was also a clear sign, in a high oil price environment, that OPEC+ is willing to protect its pricing power and maintain oil prices. During a war with Russia, when Europe needs cheaper oil more than ever, OPEC+ is maintaining higher prices.

OPEC+ has now announced a production cut of 2 million barrels / day, that could drive prices above $100 / barrel by most estimates. The argument is spare capacity needs to be maintained, but realistically less production now is less supply that pushes prices up now anyway. It’s worth noting that given smaller OPEC+ members struggle to maintain quotas the actual volume decline is closer to 1 million barrels / day.

That will encourage, combined with reduced renewable prices, European and other powers to move away from oil. Renewables aren’t nearly as susceptible to geopolitical events.

This time is different.

With massive centrally organized economies like China indicating a net-zero emissions target of 2060, we see this time as different. Why? The shift to renewables is no longer driven primarily by fossil fuel prices. It doesn’t stop as prices drop.

Oil Supply and Demand

Looking in the short-term, we do expect demand and supply side both to be volatile. OPEC+ is clearly indicating that they view fair prices as close to $100+ / barrel, something I’d be doing too if my largest customers were building their fastest to move away. Might as well collect the money as long as you can.

Global oil demand set to rise 2% to new high in 2023, says IEA | Reuters

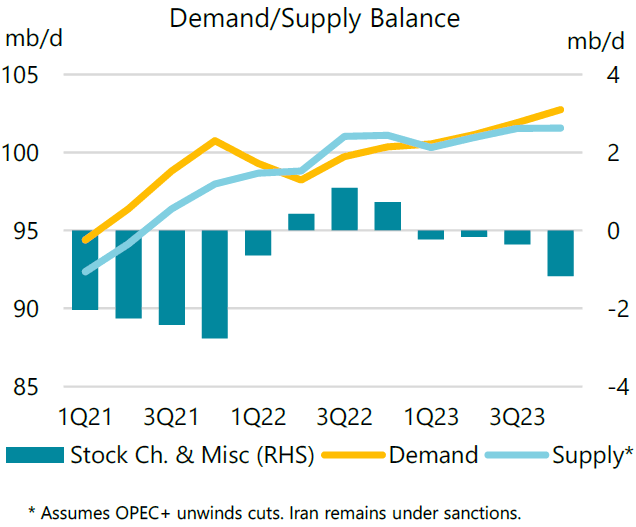

The demand / supply balance in the market shows an incredibly tight market. Even ignoring the potential for roughly 2 million barrels / day in production cut from OPEC+ demand and supply are expected to move in lock step in the back half of the year through 2023. With minimal capital investment going on, that dynamic could become even worse in the back half of the year.

That doesn’t count any unexpected new sources of demand such as China completely reopening. That tight spread shows the potential volatility in the markets.

Investment Opportunities

For us, the single most interesting investment opportunity we see is Exxon Mobil (NYSE:XOM) The company’s share price has remained volatile, however, it’s recovered by almost 14% over the last few days.

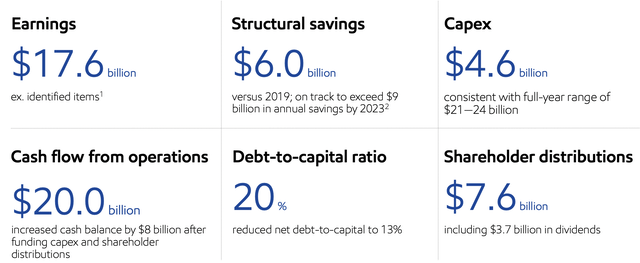

Exxon Mobil Investor Presentation

The company has a dividend yield of almost 4% and incredibly strong cash flow based on its $400 billion market capitalization. That cash flow will support substantial shareholder returns. The company’s cash flow from operations in the most recent quarter was $20 billion and the company remains one of the largest capital investors in the industry.

That means the company is continuing to invest almost $5 billion per quarter or almost $20 billion annualized. The company’s annualized FCF yield is roughly 15%. The company’s annualized shareholder distribution rate has been almost 8%. That combination of cash flow and investments, when prices can increase from here, makes the company a valuable investment.

Exxon Mobil is a unique investment opportunity that we recommend purchasing. Cash flow should increase substantially over the upcoming years as the company streamlines its operations and grows production from new discoveries such as Guyana.

Thesis Risk

The largest risk to the thesis in our view is two-fold, one on the supply side and one on the demand side.

On the supply side, new sources of supply could continue to emerge. Guyana is becoming a major oil producer with no OPEC+ production restrictions. Nigeria’s structural issues result in it producing substantially below its OPEC+ allocations. That could change over time and result in production increasing dramatically.

On the demand side the world is balancing on the brink of a recession. By most estimations, depending on your personal definition, major economies might already be in one. The United States is based on the definition of two consecutive quarters with negative GDP growth. A recession could substantially decrease demand and hurt investors.

Conclusion

Expect oil markets to be very volatile over the upcoming months. The market is incredibly tight and OPEC+ has announced a 2 million barrel / day production cut. Given the increased popularity of renewables, we see this as very likely being the last bull market for oil, and OPEC+ is taking advantage.

Exxon Mobil has seen a strong share price recovery over the past several weeks. The company has an almost 4% dividend yield, however, the company’s cash flow is much stronger than that. The company has a strong and growing portfolio and it’s focused on debt pay down, dividends, and shareholder returns. All of this together makes Exxon Mobil a valuable investment.

Let us know your thoughts in the comments below.

Be the first to comment