David Silverman/Getty Images News

Introduction

Most of my readers know that I’m a big fan of L3Harris Technologies (NYSE:LHX), as I have written a number of articles on its ability to distribute dividends. Now, there are new developments, and I couldn’t be more excited. On the one hand, the stock is underperforming its larger defense peers due to supply chain and cost issues. On the other hand, the company is making tremendous progress. After two years of (post-merger) divestitures, the company is buying new businesses. After buying Viasat’s (VSAT) Tactical Data Links product line, it is now in the process of acquiring advanced rocket engine producer Aerojet Rocketdyne (AJRD).

L3Harris is positioning itself as an even stronger first-tier supplier of America’s defense giants. As supply chain problems are rapidly easing, I’m using any major weakness to expand my position in this dividend growth beauty.

Now, let’s dive into the details!

From Divestitures To Acquisitions

While I am writing this, I have exactly 25.0% defense exposure in my long-term dividend growth portfolio.

One of the reasons why I made L3Harris Technologies part of my portfolio is its position in the defense industry. Unlike Lockheed Martin (LMT) and Northrop Grumman (NOC), it is not a company known for major defense products like the B-21 Raider or the advanced F-35 jet.

L3Harris is different. After the merger of L3 Technologies and the Harris Corporation in 2019, the world got a new company delivering end-to-end solutions for the defense industries.

The company has three business segments:

- Integrated Mission Systems

[…] including multi-mission intelligence, surveillance, and reconnaissance (“ISR”) and communication systems; integrated electrical and electronic systems for maritime platforms; and advanced electro-optical and infrared (“EO/IR”) solutions.

[…] including space payloads, sensors, and full-mission solutions; classified intelligence and cyber defense; avionics; and electronic warfare.

[…] including tactical communications; broadband communications; integrated vision solutions; and public safety radios; global communications solutions.

Moreover, this year, it went from four to three business segments, which means the company also still includes commercial aviation products, commercial pilot training equipment, and mission networks for air traffic management. These were formerly part of its Aviation Systems segment.

In other words, while the company does sell directly to the government, it also supplies major defense contractors as a tier 1 supplier of electronic equipment and everything related to that.

Now, the company is taking that to the next level.

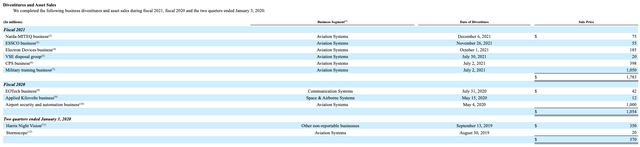

As the overview below shows, the company generated billions from the sale of business segments after its merger. As part of streamlining the business, it sold everything not needed to achieve its long-term goals. This includes a number of aviation system companies worth close to $2 billion.

L3Harris Technologies (Via SEC)

Thanks to these divestitures, the company can now reshape its business again. This is done using organic growth and acquired capabilities.

Viasat’s Tactical Data Links Product Line

In October of this year, the company announced the acquisition of Viasat’s Tactical Data Links product line.

The deal worth $1.96 billion will add the product line to the communication system segment.

The transaction allows the company to directly compete with large defense contractors when it comes to networking. This platform covers airplanes like the B-2, C-130, F-16, and F-18, missiles like the JASSM, LRASM, and defense products like the THAAD and Patriot systems.

The installed base is currently more than 20,000 airplanes. Adding these capabilities boosts L3Harris’ ability to benefit from multi-domain warfare demand.

According to the company:

The acquisition aligns with L3Harris’s Trusted Disruptor strategy to provide customers with innovative and alternative solutions. TDL technology will improve the company’s JADC2 capability and provide immediate access to Link 16 waveform, platforms, prime contracts, and a path to Advanced Tactical Data Links (ATDL) for future, integrated solutions.

TDL will expand the company’s commercial pricing portfolio focused on defense applications across all domains for DoD and U.S. allies as a prime contractor.

The deal was valued at 14x EBITDA.

I have to say that I believe that this deal is impressive. The best thing is that the next deal would make L3Harris even more powerful.

Aerojet Rocketdyne

When I started writing this article, it was highly likely that LHX would buy Aerojet Rocketdyne. However, it was still largely based on unnamed sources who made the case that it was a done deal.

Now, the company has come out saying it’s a done deal (regulatory approval pending) as both LHX and AJRD have agreed to the deal.

AJRD is a world-recognized defense company producing propulsion systems and energetics for space, missile defense, and strategic systems, as well as tactical system areas.

Or to put it differently, it is the number one supplier of advanced propulsion systems for the world’s most advanced missiles and rockets.

In December 2020, AJRD agreed to be bought by Lockheed in a deal valued at $4.4 billion. However, the deal was terminated in February of this year after the Federal Trade Commission saw serious antitrust problems.

After all, the company produces rockets for NASA, Boeing (BA), Raytheon (RTX), and Lockheed Martin. If Lockheed had bought AJRD, it would have gotten a huge advantage over its peers in an era critical to current defense needs. That was a total no-go.

I believe that L3Harris will likely get the deal done as it is already a supplier of key elements and not a stand-alone producer of finished missiles and rockets. Buying AJRD would not shift the competitive landscape.

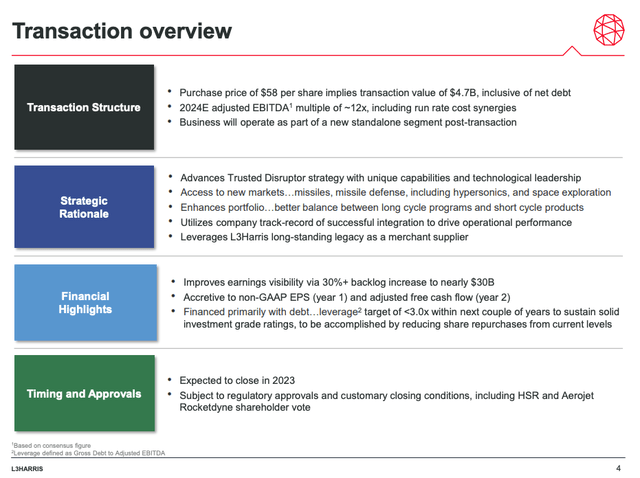

The overview below shows the deal details. AJRD will be bought for $58 per share in a transaction valued at $4.7 billion (including net debt). That’s a valuation of 12x 2024E EBITDA, which I believe is fair. The company is not overpaying for high growth expectations in one of the hottest defense niches.

L3Harris Technologies

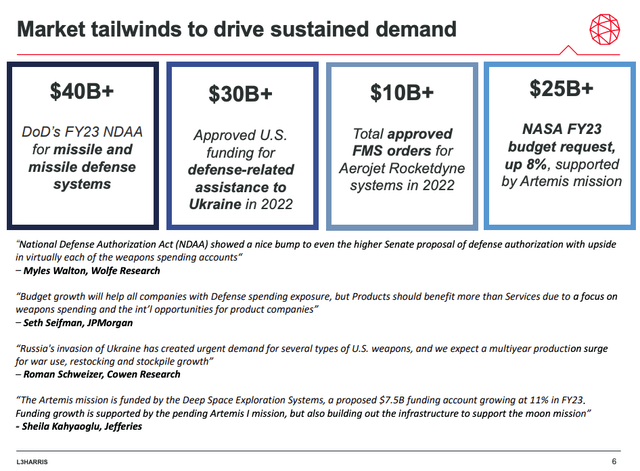

Not only will this deal improve the company’s legacy as a merchant supplier, but it will open new doors to missiles, missile defense, hypersonics, and space exploration.

L3Harris Technologies

That’s why I’m so excited to finally have AJRD in my portfolio (again, approval pending). It adds a whole new layer of capabilities. It also connects my existing holdings via new supplier/buyer relationships.

Once approved, the deal will be funded using cash and new debt. The company aims to maintain a sub-3x EBITDA leverage ratio in the years ahead, which will mean that share repurchases will be drastically reduced after the deal.

The deal is expected to close next year.

The New LHX

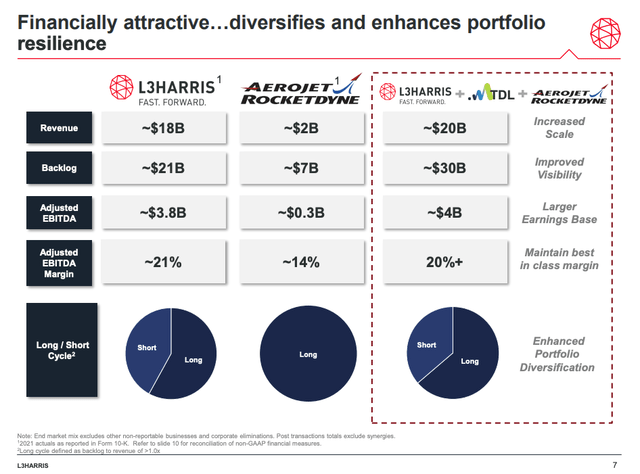

Combining L3Harris, TDL, and Aerojet Rocketdyne, the new company does roughly $20 billion in revenues. Almost all of it is anti-cyclical. The company’s backlog expands by $9 billion to $30 billion. The biggest increase comes from Aerojet.

Moreover, the new LHX portfolio will be 2/3rd long-cycle. The long cycle is denied as backlog exceeding revenue.

L3Harris Technologies

The deal is not expected to have a major impact on margins as LHX is positive that it can maintain 20% adjusted EBITDA margins.

My Gameplan

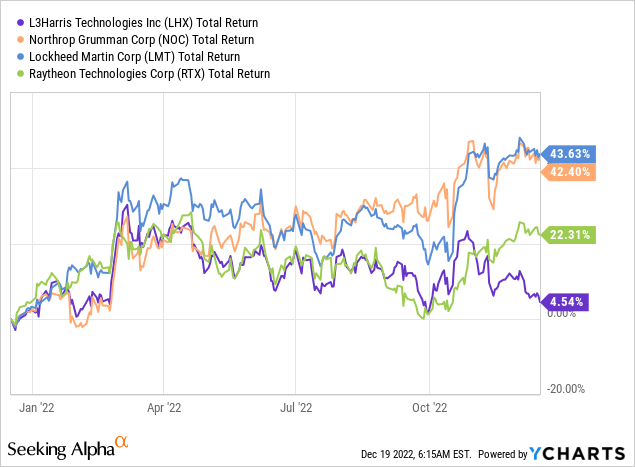

2022 has been a tough year for LHX – depending on how you look at it. On the one hand, the stock is currently flat on a year-to-date basis. On the other hand, it is underperforming its peers in a year fueled by more aggressive defense spending, the related war in Ukraine, and a flight to safety as investors are dealing with trouble in other sectors.

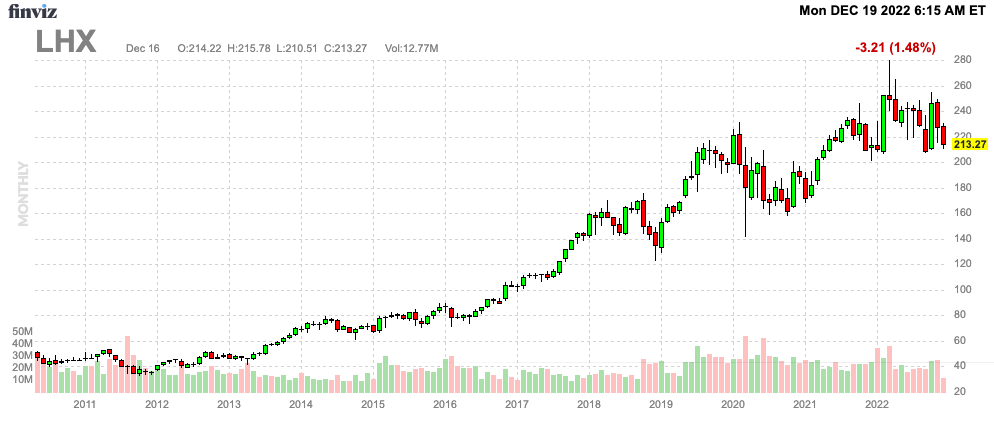

It looks like the stock may flirt again with the $200 level, which seems to be longer-term support.

FINVIZ

While I’m not that happy with this performance, I’m far from worried. I apply an ownership view when I buy long-term investments. I have to say that 2022 was a good year when it comes to the future of LHX. Especially if the AJRD deal is approved, we’re dealing with a defense contractor that has exposure in all major areas. A company that went from streamlining operations to adding new next-gen capabilities with acquisitions that will be free cash flow accretive in year two.

Moreover, one of the biggest issues facing the company is supply chain bottlenecks, preventing the company from getting access to much-needed high-tech supplies.

In the third quarter, supply chain-related inflation was partially offset by mitigation strategies that included operational improvements, escalation clauses, supply chain negotiations and re-pricing efforts. In addition, for the full year, and consistent with current guidance, L3Harris expects inflation impacts to continue into year end and 2023.

Looking at ISM prices and lead times, it looks like supply chain issues are quickly fading, even if it is caused by severe economic demand weakness. It helps that LHX is mainly anti-cyclical.

Wells Fargo

A recession may actually not be the worst thing for LHX and its peers. It would ease labor and material shortages as cyclical companies would reduce orders. Non-cyclical defense companies will likely maintain production and benefit from easing input inflation.

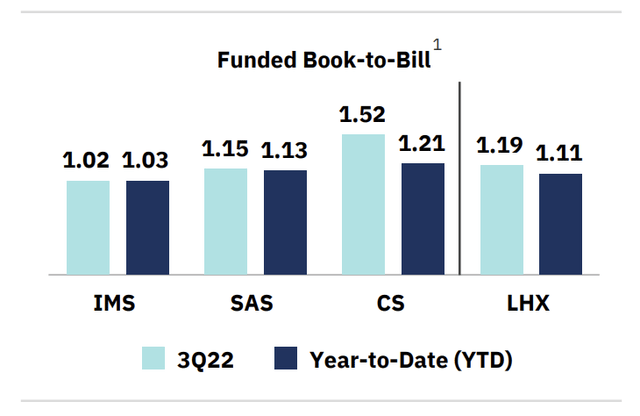

It also helps that the order flow is improving. Due to higher global defense spending, the company had a book-to-bill ratio of 1.19 in 3Q22. This means the company’s new orders are higher than its ability to produce finished products. That’s indicative of higher growth in the future.

L3Harris Technologies

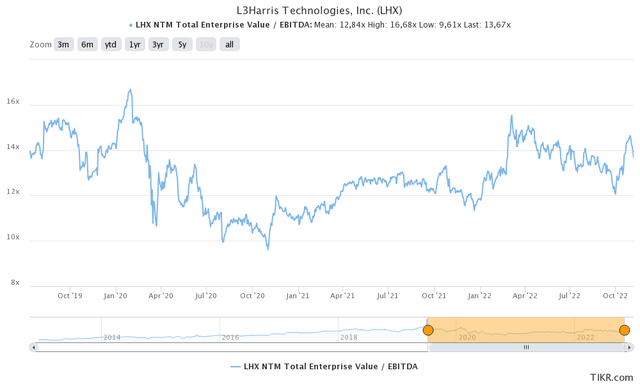

Valuation-wise, we’re dealing with a 12.4x 2024E multiple. That’s based on the company’s $40.6 billion market cap, $6.1 billion in net debt, $100 million in minority interest, and $350 million in pension liabilities. These numbers EXCLUDE the AJRD deal.

In other words, LHX shares have a similar valuation to the pending AJRD deal.

Given the company’s historic valuation range, we’re in buying territory.

TIKR.com

The only reason I’m not buying LHX with both hands (but adding gradually) is my 25% defense exposure.

Takeaway

I’m impressed with LHX. The company has made tremendous progress in the past two years when it comes to reshaping its business to service advanced defense requirements. This is now being taken to the next level with the acquisition of Viasat’s Tactical Data Links product line and Aerojet Rocketdyne.

LHX is in a good spot to benefit from the very high demand for advanced missiles, missile defense, hypersonics, multi-domain defense services, products, and its existing business.

Moreover, the company is paying a fair price for these deals (regulatory approval pending) and trading at a fair price itself.

I believe that LHX is in a good spot to outperform the market on a long-term basis.

On a side note, if you want an overview of LHX’s capabilities as a dividend growth stock, feel free to read this article. Please bear in mind that if the company gets approval to buy AJRD, it will reduce buybacks until net debt falls to less than 3.0x EBITDA again.

(Dis)agree? Let me know in the comments!

Be the first to comment