Cavan Images/iStock via Getty Images

Earnings of OFG Bancorp (NYSE: NYSE:OFG) will most probably surge this year on the back of strength in the Puerto Rican economy, which will lift loan balances. Further, the net interest income, which is moderately sensitive to rate changes, will benefit from the rising interest rate environment. On the other hand, a normalization of loan loss reserve releases will limit earnings growth on a year-over-year basis.

Overall, I’m expecting OFG Bancorp to report earnings of $3.07 per share for 2022, up 9% year-over-year. Compared to my last report on the company, I have revised upwards my earnings estimate because of upward revisions in both loan and margin estimates. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on OFG Bancorp.

Puerto Rico’s Economy to Drive Loan Growth

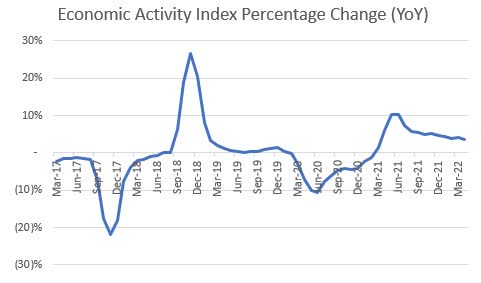

OFG Bancorp’s portfolio grew by 1.9% in the first quarter of 2022, or 7.6% annualized, which surpassed my expectations. The outlook for loan growth remains rosy mostly because the Puerto Rican economy is continuously going from strength to strength. The region’s economic activity index was up 3.5% year-over-year in April 2022, according to the Economic Development Bank of Puerto Rico.

Economic Development Bank of Puerto Rico

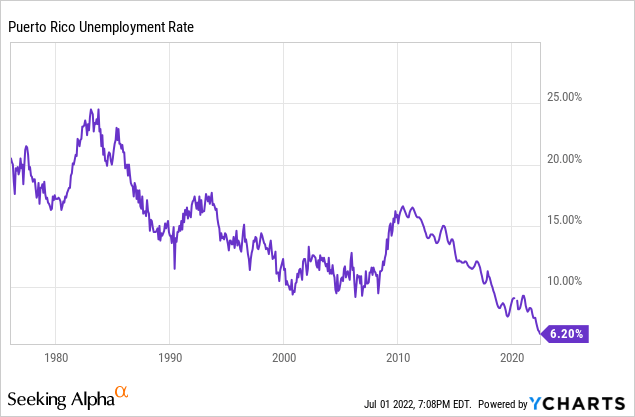

Moreover, Puerto Rico’s job market has continued to improve. The unemployment rate has dropped to only 6.2%, which is near multi-decade lows.

The management also appeared optimistic about the loan pipelines and line of credit utilization in the latest conference call. Considering the economic outlook and the apparent on-ground strength, I’m expecting the loan portfolio to increase by 5.0% by the end of 2022 from the end of 2021. In my last report on OFG Bancorp, I estimated loan growth of only 2.0% for 2022. I have revised upwards my loan growth estimate because of the first quarter’s surprising performance as well as an improvement in the economic outlook for Puerto Rico. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 4,056 | 4,432 | 6,642 | 6,501 | 6,329 | 6,645 | |||

| Growth of Net Loans | (2.2)% | 9.3% | 49.9% | (2.1)% | (2.6)% | 5.0% | |||

| Other Earning Assets | 1,173 | 1,285 | 1,095 | 459 | 896 | 1,303 | |||

| Deposits | 4,799 | 4,908 | 7,699 | 8,416 | 8,603 | 9,250 | |||

| Total Liabilities | 5,244 | 5,583 | 8,252 | 8,740 | 8,831 | 9,423 | |||

| Common equity | 853 | 908 | 953 | 994 | 1,069 | 1,132 | |||

| Book Value Per Share ($) | 16.7 | 17.7 | 18.4 | 19.3 | 20.8 | 22.9 | |||

| Tangible BVPS ($) | 15.0 | 15.9 | 15.7 | 16.7 | 18.4 | 20.5 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Net Interest Income Appears Moderately Rate-Sensitive

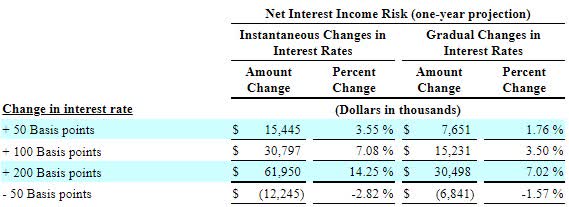

OFG Bancorp’s net interest income is only moderately sensitive to rate changes. The management’s interest-rate sensitivity analysis given in the latest 10-Q filing shows that a 200-basis points increase in interest rates could boost the net interest income by 7.02% over twelve months.

1Q 2022 10-Q Filing

This rate sensitivity is largely attributable to sticky deposit costs. An overwhelming 61% of the total deposit book is made up of non-interest-bearing deposits, which will not re-price in the event of an interest rate hike.

The Federal Reserve projects the upper limit of the target fed funds rate to reach around 3.5% later this year, up from the current 1.75%. Considering the Fed’s projection and the management’s interest-rate sensitivity analysis, I’m expecting the net interest margin to increase by 23 basis points in the last nine months of 2022 from 4.47% in the first quarter of the year.

In my last report on OFG Bancorp, I estimated the margin to increase by only four basis points this year. I have revised upwards my estimate for the margin because of the recent faster-and-greater-than-expected fed funds rate hike. Moreover, the Fed is now projecting the fed funds rate to reach a higher level than what I previously anticipated.

Improving Asset Quality to Keep Provisioning Low

After last year’s significant provision reversals, the loan loss reserve releases will likely decline this year to a more normal level. This is because heightened provision reversals cannot be sustained for a prolonged period.

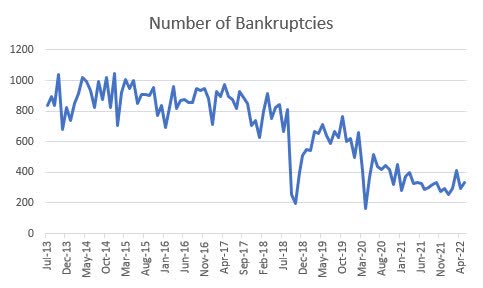

Nevertheless, the provisioning for this year will likely remain below the historical average. The outlook on the loan portfolio’s credit quality remains positive despite the rising rate environment. The rosy outlook is attributable to the strength of Puerto Rico’s economy. The number of bankruptcies in the region continues to remain near multi-year lows, as shown below.

Economic Development Bank of Puerto Rico

Moreover, the allowance level is now quite high relative to the portfolio’s credit risk; therefore, the requirement for additional provisioning will remain subdued. The allowances-to-nonperforming-loan ratio surged to 232.77% at the end of March 2022, up from 191.5% at the end of March 2021, and 126.6% at the end of March 2020.

Considering these factors, I’m expecting the provision expense, net of reversals, to remain below the historical average this year. I’m expecting the net provision expense to make up around 0.25% of total loans in 2022. In comparison, the provision expense averaged 1.39% of total loans in the last five years.

Expecting Earnings to Increase by 9%

Earnings of OFG Bancorp will most probably increase this year on the back of decent loan growth and moderate margin expansion. On the other hand, a decline in provision reversals will likely restrict earnings growth. Overall, I’m expecting OFG Bancorp to report earnings of $3.07 per share for 2022, up 9% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 304 | 316 | 323 | 408 | 407 | 447 | |||

| Net Provision for loan losses | 113 | 56 | 97 | 93 | 0 | 17 | |||

| Non-interest income | 79 | 80 | 82 | 124 | 133 | 127 | |||

| Non-interest expense | 202 | 207 | 233 | 345 | 326 | 338 | |||

| Net income – Common Sh. | 46 | 78 | 47 | 68 | 145 | 152 | |||

| EPS – Diluted ($) | 0.88 | 1.52 | 0.92 | 1.32 | 2.81 | 3.07 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

In my last report on OFG Bancorp, I estimated earnings of $2.84 per share for 2022. I have now increased my earnings estimate because I have revised upwards both my loan and margin estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

High Total Expected Return Warrants a Buy Rating

OFG Bancorp is offering a dividend yield of 2.3% at the current quarterly dividend rate of $0.15 per share. The earnings and dividend estimates suggest a payout ratio of 19.5% for 2022, which is close to the five-year average of 22%. Based on the payout ratio, I believe OFG Bancorp will not increase its dividend again this year.

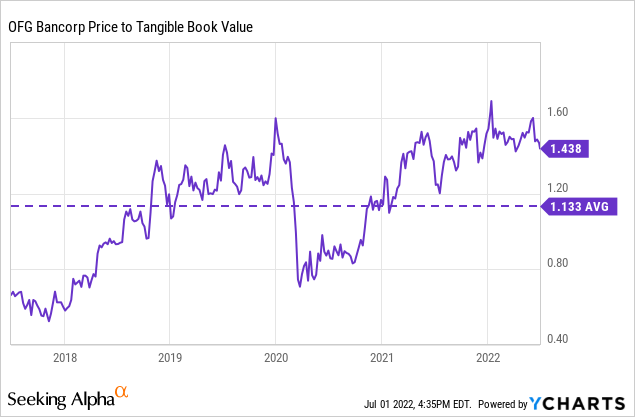

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value OFG Bancorp. The stock has traded at an average P/TB ratio of 1.13 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $20.5 gives a target price of $23.2 for the end of 2022. This price target implies a 10.0% downside from the July 1 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.93x | 1.03x | 1.13x | 1.23x | 1.33x |

| TBVPS – Dec 2022 ($) | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 |

| Target Price ($) | 19.1 | 21.1 | 23.2 | 25.2 | 27.3 |

| Market Price ($) | 25.7 | 25.7 | 25.7 | 25.7 | 25.7 |

| Upside/(Downside) | (25.9)% | (17.9)% | (10.0)% | (2.0)% | 5.9% |

| Source: Author’s Estimates |

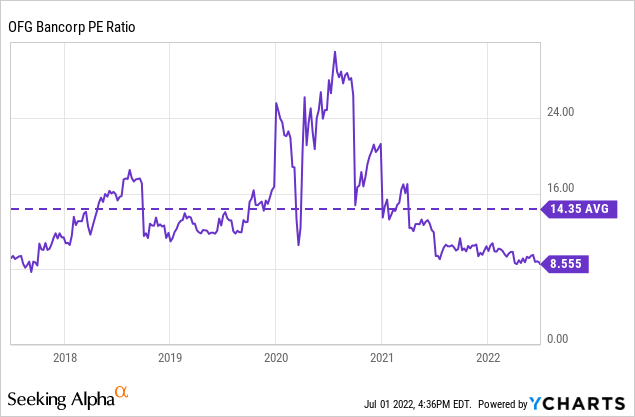

The stock has traded at an average P/E ratio of around 14.4x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $3.07 gives a target price of $44.1 for the end of 2022. This price target implies a 71.1% upside from the July 1 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 12.4x | 13.4x | 14.4x | 15.4x | 16.4x |

| EPS – 2022 ($) | 3.07 | 3.07 | 3.07 | 3.07 | 3.07 |

| Target Price ($) | 37.9 | 41.0 | 44.1 | 47.1 | 50.2 |

| Market Price ($) | 25.7 | 25.7 | 25.7 | 25.7 | 25.7 |

| Upside/(Downside) | 47.3% | 59.2% | 71.1% | 83.1% | 95.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $33.6, which implies a 30.6% upside from the current market price. Adding the forward dividend yield gives a total expected return of 32.9%. Hence, I’m maintaining a buy rating on OFG Bancorp.

Be the first to comment