denizunlusu/iStock via Getty Images

The Q4 Earnings Season for the Gold Miners Index (GDX) is nearly complete, and one of the first companies to report its results was OceanaGold (OTCPK:OCANF). The company had a much better year overall, with production up more than 20% to ~362,800 ounces, and the restart of Didipio, a mine with industry-leading costs, has undoubtedly improved the investment outlook.

However, the Didipio restart was overshadowed by a sobered outlook at Haile, with cost estimates up more than 30% vs. the 2020 outlook. If OceanaGold can deliver on its recovery plan, the stock is reasonably valued. Still, I don’t see the current reward/risk profile as attractive enough to justify paying above US$2.20 for the stock with the stock extended from key support from a technical standpoint.

Haile Mine Operations (Company Presentation)

OceanaGold released its Q4 and FY2021 results last month, reporting quarterly production of ~106,600 ounces of gold, marking the best quarter for the company in nearly two years. This solid performance helped to push annual gold production to ~362,800 ounces, a 20% increase year-over-year despite a difficult year for Macraes due to COVID-19 related restrictions. The other major positive news was the restart of the company’s high-margin Didipio Mine in the Philippines, which is expected to ramp up to full production and 1.6 million-tonne per annum mining rates in Q2. Let’s take a closer look at the results below:

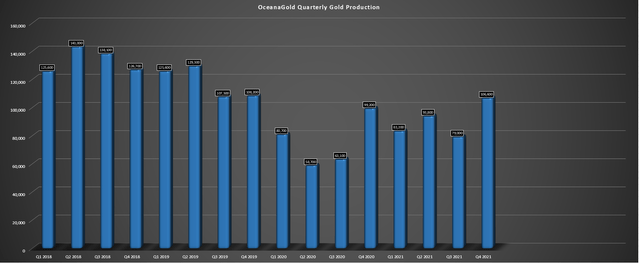

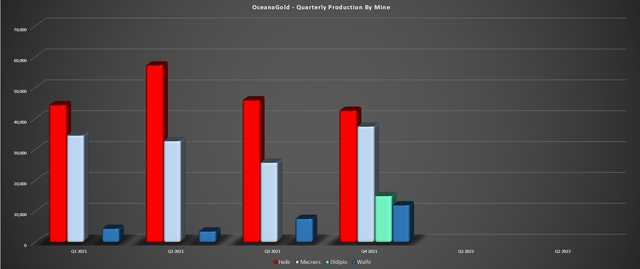

OceanaGold Quarterly Production (Company Filings, Author’s Chart)

Looking at the chart above, we can see that OceanaGold has had one of the worst production trends sector-wide over the past couple of years (output down 16% vs. Q4 2018). However, unlike Iamgold (IAG), the poor performance was mostly out of the company’s control. This is because the company’s Didipio Mine was in care & maintenance, putting a major dent in production. Fortunately, with Didipio back online and contributing ~14,900 ounces in Q4, it was a much better quarter, helped by a solid finish to the year for Macraes and Waihi (combined for ~49,300 ounces).

Based on 2022 estimates, Didipio is projected to contribute significantly more on a quarterly basis, with annual production expected to come in at ~105,000 ounces of gold and ~12,000 tonnes of copper. While this is a solid bump to the production profile vs. the ~60,000 annualized run rate in Q4 2021, the major benefit will come from a cost standpoint, with Didipio’s all-in sustaining costs [AISC] expected to come in below $600/oz. Compared to OceanaGold’s cost profile that comes in north of $1,200/oz, this will certainly help to improve this mid-tier producer’s cost profile on a consolidated basis going forward.

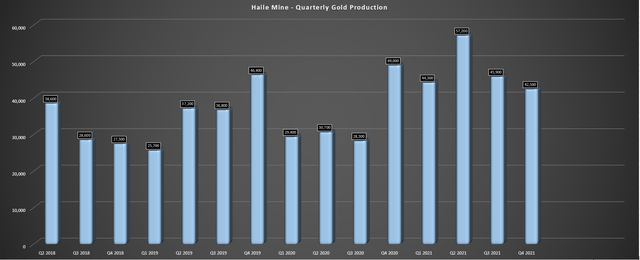

Haile

Digging into the company’s largest contributor, Haile, the mine had a much better year, reporting record annual production of 190,000 ounces at respectable costs of $1,060/oz. This was helped by higher throughput, grades, and recoveries, with ~3.15 million tonnes processed at 2.21 grams per tonne gold in 2021. This was a major improvement from grades of 1.52 grams per tonne gold in FY2020 at a much lower recovery rate of 79.5%. The performance is a welcome improvement, given that production statistics have been miles away from initial estimates since the mine began production in Q1 2017.

Haile Mine – Quarterly Production (Company Filings, Author’s Chart)

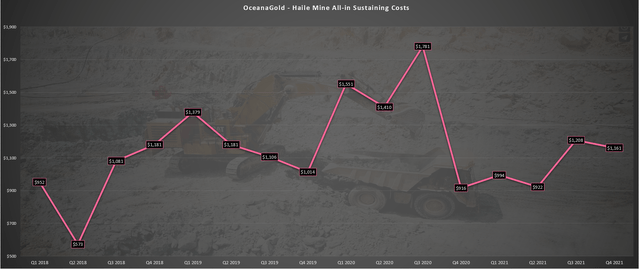

Looking at costs below, it’s clear that mine had a much better year from a cost standpoint, especially when adjusting for inflationary pressures sector-wide. This is evidenced by no quarters with costs above $1,300/oz vs. FY2021, when nearly every single quarter saw costs above $1,400/oz. On a full-year basis, AISC came in at $1,060/oz, with cash costs of $649/oz. Unfortunately, while this was certainly better than FY2020 levels, the mine is set up for a much higher-cost year in FY2022, with OceanaGold guiding for ~155,000 ounces at all-in sustaining costs of $1,550/oz.

This is related to increased capex in 2022, with an increase in capitalized mining costs. If the gold price were still hugging the $1,800/oz level, this would paint a bleak outlook, but at least the mine will enjoy reasonable margins if the gold price can remain above the $1,950/oz. The negative news, though, is that while costs will decline sharply in 2023 and 2024 as the operation benefits from higher-grade underground ore, the Life of Mine Plan [LOMP] has outlined a much less robust operation than initially envisioned relative to pre-construction and the 2020 Technical Report.

Haile Mine – All-in Sustaining Costs (Company Filings, Author’s Chart)

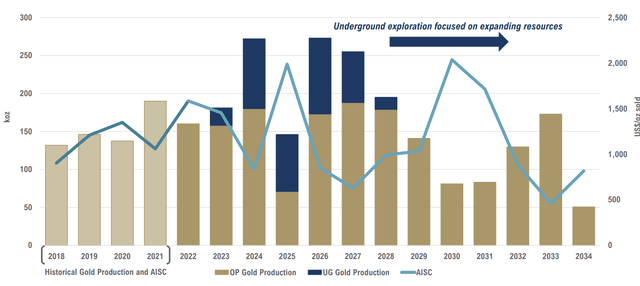

Following a technical review of the Haile Mine that was recently completed, the cut-off grade has been increased to 0.50 grams per tonne gold. Fortunately, reserves remain at 2+ million ounces despite the increased cut-off grade, translating to a mine life out to 2034. The bad news is that mining costs have increased from ~$2.00/tonne to ~$2.50/tonne; processing costs are up sharply, and the mine is expected to have higher capex than initially expected. The latter is related to increased pre-strip costs and additional potentially acid-generating [PAG] storage requirements.

These new inputs have pushed the updated all-in sustaining cost estimates over mine life to $1,080/oz, a more than 30% increase from the 2020 technical report, which projected costs of ~$800/oz. So, the view that Haile would be a low-cost mine relative to the industry average appears to be dead unless the company can optimize the operation. Several opportunities have been outlined, but some of the expected gains could be partially offset if inflationary pressures persist. Overall, this has overshadowed a better year for the company, and a $180 million impairment expense was taken at Haile in 2021.

Haile – Updated Mine Plan (Company Filings, Author’s Chart)

Mine-by-Mine Production & Margins

Looking at the remainder of the portfolio, Macraes had a better year and is expected to produce ~147,000 ounces this year at relatively high costs of $1,350/oz. Meanwhile, Waihi should contribute just over 60,000 ounces this year at AISC of $1,425/oz, improving to ~95,000 ounces in FY2022. This has set the company up for a much higher cost year overall, with current guidance set at ~470,000 ounces at $1,325/oz. While production certainly compares favorably with nearly 30% production growth, costs will increase more than 6%, and this is despite the benefit of higher margin ounces from Didipio.

OceanaGold – Quarterly Production by Mine (Company Filings, Author’s Chart)

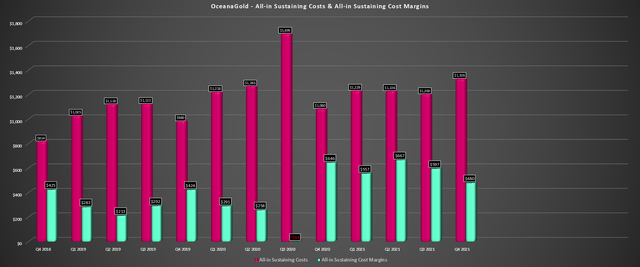

Moving over to margins, we can see that AISC margins came in at $480/oz in Q4 2021, down from $646/oz in the year-ago period. This was partially related to difficult year-over-year comps due to the lower gold price but was also related to a sharp increase in consolidated AISC. If we look ahead to FY2022, the wild card will be the gold price, which could help to boost margins in what will be a higher-cost year for the company. The good news is that if OceanaGold can deliver on its long-term goals, margins should improve meaningfully in 2024 FY2024 and costs improve at Haile and Waihi.

All-in Sustaining Costs & AISC Margins (Company Filings, Author’s Chart)

Long-Term Outlook

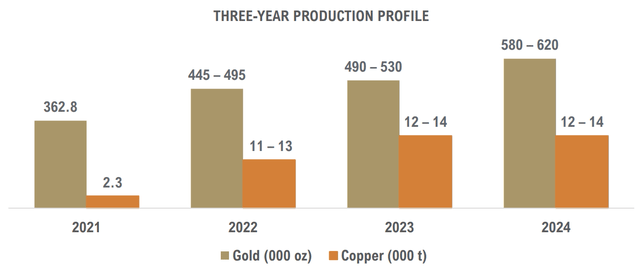

If we look at the 3-year outlook provided by the company, one might come to the conclusion that OceanaGold is one of the best growth stories sector-wide, set to enjoy 70% growth if it can meet the high end of its FY2024 guidance. However, this chart omits the past five years of production, which clearly indicates that this is not growth, but simply a recovery to just above 2017 production levels (~575,000 ounces). Hence, while production is growing, production per share is not, and the long-term production growth is anemic relative to some of Oceana’s peers.

OceanaGold Three-Year Outlook (Company Presentation)

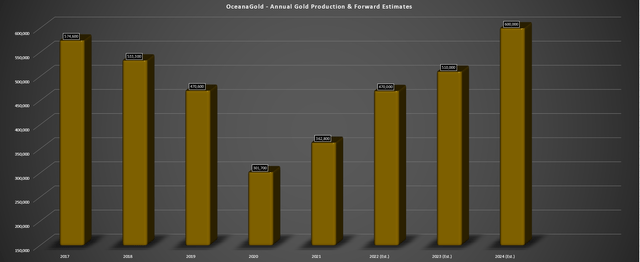

This is evidenced by the chart below, highlighting the growth being achieved from a very low watermark, given that annual gold production declined ~37% from FY2017 to FY2021. As noted earlier, some of the decline in production was out of the company’s control due to Didipio moving into care & maintenance after the provincial government blocked the license renewal for the mine. Obviously, this recovery is still bullish for the stock if it’s achieved successfully, but this is a very different business than FY2017, with operating costs likely to be 70% higher, even if FY2024 guidance is met. Let’s take a look at the technical picture:

OceanaGold – Annual Production & Forward Guidance (Company Filings, Author’s Chart)

Technical Picture

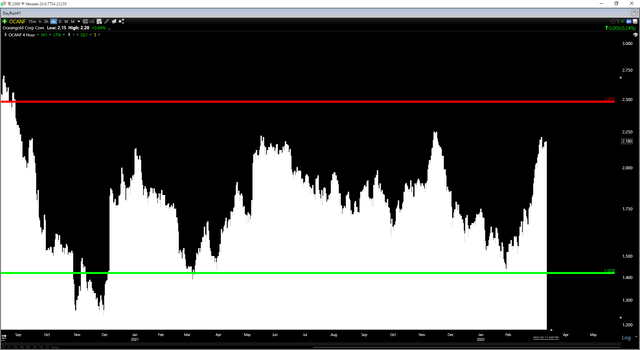

As noted in my previous article on OceanaGold, the outlook was improving, and dips below US$1.60 were likely to provide low-risk buying opportunities. This is because there was key support near US$1.45 and no strong resistance until the US$2.40 level. However, after a 40% rally off the lows, OceanaGold’s reward/risk ratio is much less attractive, with $0.25 in potential upside to resistance and nearly $0.80 in potential downside to support. This unfavorable reward/risk ratio of 0.25 to 1.0 doesn’t mean that the stock can’t continue higher, but it does suggest that this is not a low-risk buy point here at US$2.20.

OCANF Daily Chart (TC2000.com)

OceanaGold had a much better year in 2021 and has highlighted that it has the potential to grow production 70% from FY2021 levels. While this is an impressive headline number, it’s important to note that this growth is merely a recovery, given that even if the mid-point of FY2024 guidance is met, it will translate to a ~1% compound annual growth rate (FY2017-FY2024). From a production growth per share standpoint and adjusting for ~15% dilution in the period, we will see zero production growth per share.

This doesn’t mean that OceanaGold can’t do well as it ramps up production, and the share price is certainly well off its FY2017 highs, especially if the gold price remains above $1,950/oz. However, with AISC expected to come in closer to $1,050/oz in FY2024 (FY2017: $~620/oz), the company is nowhere near the market leader that it was in 2017. Combined with the fact that OceanaGold has an unfavorable reward/risk profile technically (short-term), I don’t see any way to justify chasing the stock here above US$2.20. In fact, if the stock were to rally above US$2.55 before May, I would view this as an opportunity to book some profits.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment