peshkov/iStock via Getty Images

(Note: This article appeared in the newsletter June 30, 2022.)

Warren Buffett certainly makes the news whenever he decides upon a strategy. His latest move buying Occidental Petroleum (NYSE:OXY) has a lot of speculation about whether or not he buys the whole company. Idle talk may well be a waste of time as far as investing strategy goes. But acting upon whatever Warren Buffett does could engender an even worse result.

Warren Buffett does have a darn good track record. But that does not mean that jumping into whatever he has purchased lately will produce a good result for whatever time frame you’re looking at. Large investors like Warren Buffett concentrate on large companies because a large company is the only thing that will “move the needle.” Furthermore, his moves often generate significant moves in a company stock that often retrace after the initial attention fades.

The best way to duplicate whatever Mr. Buffett decides is likely to be the purchase of Berkshire Hathaway (BRK.A) (BRK.B). Then, at least, the investor does not have to “keep up” with continuing announcements and news.

The problem that usually arises is when individual investors try to “cherry-pick” the moves that are made by Warren Buffett. That can often result in underperformance of the guru that the investor is following. Warren Buffett, for example, often buys and “never” sells. Many investors, on the other hand, worry the minute the stock declines 10%. Oftentimes, they talk themselves out of a fair amount of profit simply by trading into and out of the same stock as it moves.

Probably the best thing to do whenever the headlines blare that Warren Buffett has purchased a stock is to break out the 10-K and some 10-Qs and actually read them cover to cover. It has been stated many times that doing this will put you ahead of 90% of all investors. Most of the time, while you’re doing this and developing your own investment strategy based upon your due diligence, any stock will likely retrace the movement caused by headlines. If it does not, there will be others that will in the future. I get too many emails from investors that purchase on that initial surge and then worry when the stock retraces that initial surge after the attention dies down.

Warren Buffett gets his tremendous track record by having a lot of faith in his due diligence. He has specific guidelines as to when the story changes significantly. Those guidelines are likely not based upon specific stock price movements. That is the big difference between Warren Buffett and many investors. He’s often sure when he purchases a bargain, and his investment history demonstrates that he knows what he is doing.

Many investors, on the other hand, wonder if they got a bargain when the stock declines after a purchase. Stocks rarely go up without a fair amount of volatility along the way. The key is to define what needs to happen that would cause the investor to change a strategy. This is the part that many investors do not handle well (but great investors do a lot better on).

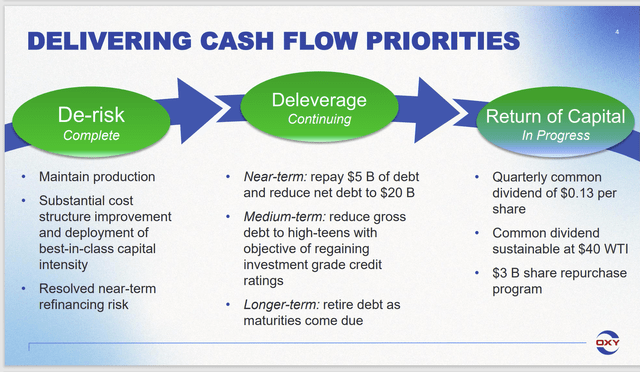

In the case of Occidental, the cash flow story has improved tremendously since the nadir of fiscal year 2020. All of a sudden, the repayment of a lot of debt appears to be well within the reach of the company. I don’t think anyone saw the great commodity prices of this year ahead of time. But even a far more modest recovery was bound to improve cash flow tremendously. The only real question was operational improvements of the acquired properties needed to reduce the leverage to acceptable levels.

Occidental Petroleum Priorities (Occidental Petroleum First Quarter 2022, Earnings Conference Call Slides.)

In fiscal year 2020, the market questioned the deleveraging strategy. Now ideally, what should have happened at a market bottom is a realization that in normal times, cash flow should equal the cash flow of the two companies plus any synergies. But a lot of the opinions at the time clearly were not thinking anything close to that. Instead, the prevailing opinion was one of an unfolding disaster, and the stock price began to reflect that opinion. To a good contrarian investor, that was a sign of a bottom approaching, and it was time to do some due diligence.

Occidental was and still is a far better operator than Anadarko. A number of us covered the Anadarko situation long before the merger was even a thought. Just getting those leases out of the newspapers was likely to provide a whole lot of savings. Then the “better operator” part would provide even more potential.

The conversation may be moot because prices have recovered far more than anyone imagined. Now, the market sees that the debt repayment plans are feasible, and the stock price is beginning to respond accordingly. It’s still up to management to demonstrate that the combined company, complete with debt and warrants, will outperform the separate companies before the merger (long term, not just when there are great commodity prices). The jury is probably still out on the long-term performance of this deal.

What’s likely to happen much sooner is a series of dividend increases as the debt levels decline. The more debt that gets paid, the less servicing costs remain. So available cash flow increases. At some point, it will likely become feasible to retire the preferred stock which would further decrease the leverage as far as the common stockholders are concerned.

The current market is a “gift” for any company that the market perceives has too much leverage. Occidental management is taking full advantage of this market by repaying debt as fast as possible. There’s a risk that commodity prices could decline at any time to put a stop to the debt progress. But that appears unlikely at the current time.

Still, this industry is known for its low visibility. The many challenges this industry has been through since 2015 attest to that low visibility. However, the main cause of the aborted 2018 recovery was too much speculative money that financed some unrealistic proposals. That money has not appeared. Therefore, the current price rally appears poised to remain in place at decent profit-making levels for the foreseeable future.

Any commodity investment needs to be watched closely as things can quickly change. Currently, it appears this common stock is well on its way to recovering to some previous levels. Should management make the acquisition work to the satisfaction of the market, then the stock could trade at levels significantly higher than the previous cycle highs. That’s really where the current risk is as the chances of the stock declining materially (and staying declined) appear to be very low. This stock is probably a consideration as part of a basket of stocks to keep the risk low.

Be the first to comment