Joe Raedle

Introduction

I hope you can read one more article about Occidental Petroleum Corporation (NYSE:OXY). I will understand if you can’t, they’ve been coming fast and furious. How about if I promise not to waste your time. I think I have some takes on this deal that you haven’t seen before. I hope you will keep reading!

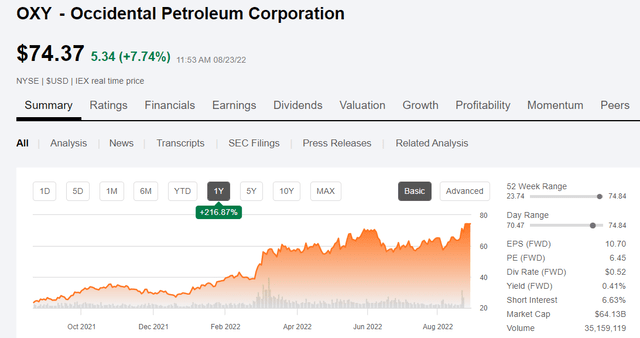

Occidental Petroleum has been the object of lot of speculation since Friday’s announcement that Warren Buffett had been granted permission by FERC to buy up to 50% of the company. The stock has rallied from the high $50’s in the intervening time.

OXY Price chart (Seeking Alpha)

I think that there is still some room for this stock to run, and am not selling. In this article I detail my reasons for remaining long, and hanging on to my stock.

Among other things, I am convinced the easiest path is higher for oil and gas due to supply constraints, and absent a deep recession – which is not off the table by any means – we will close out the year with $100+ WTI.

In that environment, OXY remains attractive at current prices. If there is a boost from a potential Buffett takeout, holders will reap a buyout bonus. If not, the stock is likely to continue to rally from low valuations.

Background

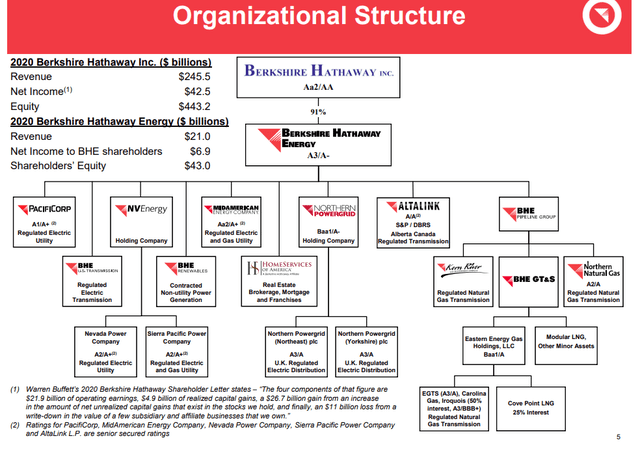

Warren Buffett, through Berkshire Hathaway Inc., (BRK.A, BRK.B) has been quietly amassing a significant stake in Occidental Petroleum. As of early August, he had acquired a 20% stake in the common shares of OXY, arousing speculation about what his true plans were. On Friday the 19th of August, the Federal Energy Regulatory Commission-FERC, granted approval to buy up to 50% of the company. This was necessary as Berkshire Hathaway Energy-BHE (not traded) participates in oil and gas pipeline transmission and storage services, which are regulated by FERC.

In 2019, Occidental Petroleum launched a bid to acquire Anadarko Petroleum, when it had already agreed to be bought by Chevron (CVX). OXY was ultimately successful in this endeavor after securing $10 bn from Mr. Buffett to supersede the Chevron offer. The final price was ~$55 bn in cash, public debt issuance, and the debt assumption of Anadarko. This transaction occurred when the oil industry was struggling with low prices and high costs. As a result OXY came within a few months of insolvency in March of 2020, with the advent of the pandemic. Fortunately the rebound was so strong in the second quarter, that the company began a rebound with higher oil prices. With the WTI price regime that’s been in play for the last year, the company has dramatically reduced debt and is expected to regain investment grade status by the end of this year.

As such, Mr. Buffett’s renewed interest comes as the company is generating massive cash flows from higher prices. There has also been a lot of M&A activity in the last couple of years with larger shale drillers taking out competitors to gain size and scale, in part to avoid be acquired themselves. The question that remains unresolved is whether Mr. Buffett will pursue the entire company to fold them into Berkshire’s energy subsidiary. I think there are good reasons for him to carry out this course of action, and will discuss them in this article.

An 8-point rationale that might lead to Berkshire Hathaway buying all of OXY

Buffett’s traits are pretty well known with the profile he has kept in the public eye the last half century. Using what is known, I have compiled this list of possible drivers for his taking the entire company private.

First, Warren likes businesses that generate a lot of cash. OXY fits that metric, generating more cash in Q-2 ($5,329 bn) than all of Berkshire Hathaway Energy, BHE-not traded, ($5,147 bn) (A wholly owned subsidiary of Berkshire Hathaway Holdings. Warren also owns a sizeable chunk of Chevron. CVX has a couple of things in common with OXY. They are both throwing off massive amounts of cash, and they are the number 1, and 2 landholders in the Permian basin. More on that later.

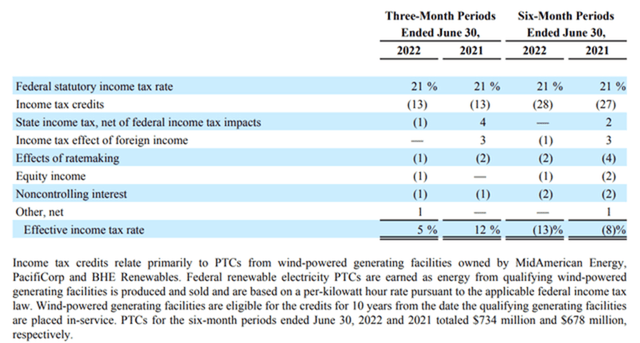

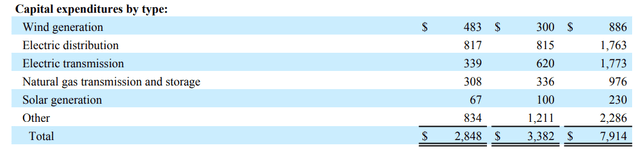

Second, Buffet needs cash flow for BHE. Their Renewables segment is building more solar, wind, hydro, geothermal and energy minerals farms/facilities at a rapid clip. (See Exhibit-A) BHE spent $3,382 bn on capex in Q-2, 2022. As we know (hopefully) renewables are capital blackholes from which little or no cash is emitted. (See Exhibit-B)Ever. If not for 45Q credits (recently supercharged under the Inflation Reduction Act), none of this nonsense would be happening under Buffett’s watch. In his mind, tax credits are almost as good as cash as they reduce taxes paid to the government. (See Exhibit-C)

An article carried in Reuters in 2014 noted where Buffett was likely to spend some of his, then-$49 bn cash hoard: “While not spectacular earners, regulated utilities tend to be steady, reliable cash generators, a feature Buffett likes.” In spite of a lot of speculation the deal making for which Buffett is famous, encountered a multi-year dry spell in the energy space that lasted until 2020.

BHE’s Renewable Footprint-Exhibit-A (“BRK.A”)

Other legacy oil and gas companies are also entering the renewables business, and using their petroleum-generated profits to fund these projects. BP CEO Bernard Looney was quoted in a Reuters article in 2021 as saying, “Higher oil prices mean BP will be able to raise more cash from selling assets that will go towards building its renewables and low-carbon business.”

As an example, BHE is completing the large, 550MW Topaz Solar project in San Luis Obispo, California. Having the cash generating capacity of OXY would definitely bridge a funding challenge for Berkshire’s clean energy business. Exhibit-B shows BHE’s capital outlays for renewables.

Exhibit-C reveals the impact of Production Tax Credits-PTC on the overall business. For Q-2, 2022 the effective tax rate for BHE Renewables is 5%, on revenues of $6.6 bn. Quite a step down from the Federal Statutory Rate of 21%. As noted above the PTC is just like cash.

BHE PTC credits Exhibit-C (“BRK.A”)

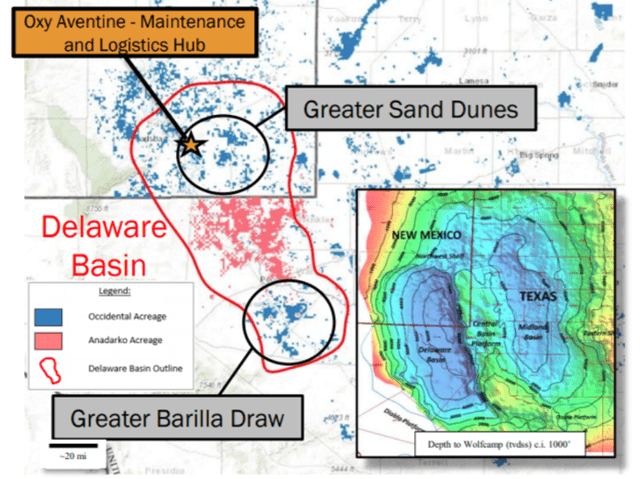

Third, Warren likes businesses with a moat. Now, you may say, “moat, what moat?” in regard to OXY. There are certainly other oil and gas producers out there. But none with the footprint in the Permian basin that OXY has. OXY owns or has leased some 3.0 mm acres in the Permian basin. They are “numero uno” by a mile. Or about 800K acres ahead of number 2, CVX.

OXY Footprint in Permian (OXY filings)

I’ve pretty much made a career in this blog extolling the rock quality and extent of OXY’s Permian assets. As discussed in the CVX article the other day, the Permian is a miracle of geology that is not replicated anywhere else on Earth.

I suppose as a reminder it’s worth noting that OXY’s acreage overlies the deepest, thickest parts of the Wolfcamp A, and B, as well as what little is actually worth drilling on the Avalon Bone Spring. Here’s a link to the 2019 EIA Wolfcamp report.

If you have read (m)any of my articles on the company, something you have read at least a dozen times are the five metrics for survival in shale. Here they are again.

- Great rock

- Scale

- Management

- Logistics

- Technology.

Does this amount to a moat in Warren’s mind? It’s hard to say for sure, but the fact that he has chosen to invest in Chevron and OXY suggest that he might think it does.

Fourth, Buffett is a fiend for top management. He is known for picking managers and sticking with them through tough times. When Warren gave Vicki Hollub ten billion dollars to consummate the deal with Anadarko, he was in-effect “hiring” her as the manager of his money. Had those two not formed a bond, the loan would never have occurred. Let’s understand something, Buffett loaned Vicki Hollub $10 bn, not Occidental Petroleum, regardless of the entity name on the loan papers. Among other things I think he might have admired her gutsy approach, flying to Omaha on a weekend to make her pitch.

Vicki Hollub was absolutely the right person to integrate these two companies. No one knows the Permian basin the way she does. She’s worked in the Permian for much of her 30+ year career, in various roles from Drilling Engineer to Area VP for OXY. When she speaks, this in-depth knowledge of the area permeates the conversation.

Now Buffett did reinforce his bet on the company by bringing in Steve Chazen-the former CEO, as Chairman of the Board. In part to placate Carl Icahn, a noted activist investor who took a large position in OXY in late 2019, and wanted Hollub replaced.

Chazen had hand-picked Hollub to run the company when he left, making her the first woman to run a large oil and gas company. This, to me, was a further ratification of her talents as a manager. The fact that Chazen’s deal with OXY allowed him to continue running Magnolia Oil & Gas (MGY), an Eagle Ford and Austin Chalk operator, and largely held by Institutional investors, further cemented her position at the helm of OXY. Buffett also got the former Chairman of Schlumberger (SLB) Andrew Gould to join the board.

So Vicki had a lot of “adult supervision,” that made dissident investors happier – as happy as they were going to get when the stock was in the tank anyway, but make no mistake, she has run the company through thin and thick. A lot of people would have started playing the “musical managers” game at the lows of 2020. Hollub would have been out on her ear. Not Buffett, and now his long-range thinking bears fruit. Vicki’s vision of what OXY could be with Anadarko’s assets is now in full beast mode.

Fifth, the “Deal” genie has been trampling through the oil patch the last couple of years-post the Anadarko deal. Quite a few of the formerly medium to big players-Concho Resources, WPX Energy, Parsely, Cimarex and Cabot-Coterra, Centennial and Colgate, Whiting and Oasis, have merged or been acquired. More recently, we have Devon Energy (DVN) on an absolute rampage, taking out PE companies in the Williston-Rimrock, and Eagle Ford-Validus, plays. M&A is afoot in the patch. Most of these mergers had one thing in common: the Permian basin.

At its current EV of ~$85 bn, it would take a strong company to buy OXY. Chevron and Exxon Mobil (XOM) come to mind and could carry it off easily with cash and debt. Debt that could be expunged in a year or two.

With Warren taking half of OXY, it removes the odd chance of Mike Wirth, CEO of Chevron waking up one day and deciding to complete the Anadarko deal that Vicki Hollub snatched away, by buying OXY. Don’t think he’s forgotten about that little skirmish.

Sixth, there is a trend for operators to merge or remerge with pipeline assets. Both Shell (SHEL), and BP (BP) as examples have taken their previously spun off midstream assets and folded them back into their corporate structures. What you don’t see on the org chart below, is an upstream energy company. With the other attributes I’ve listed you can see how whatever synergies that apply in the Shell and BP cases, would also apply to OXY and Berkshire, only in reverse.

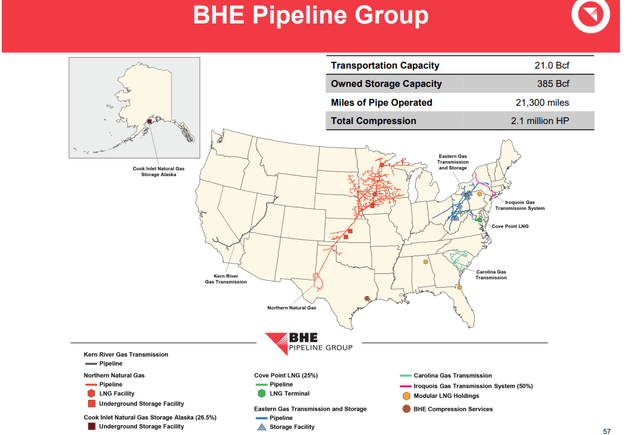

Seven, Warren likes pipelines. He made a bit of splash a couple of years ago knocking down ~$10 bn for Dominion Energy’s (D) pipelines. As you can see, with 21K miles of pipelines, BHE is one of the largest energy transmission companies in the U.S. What does this have to do with OXY, you may ask?

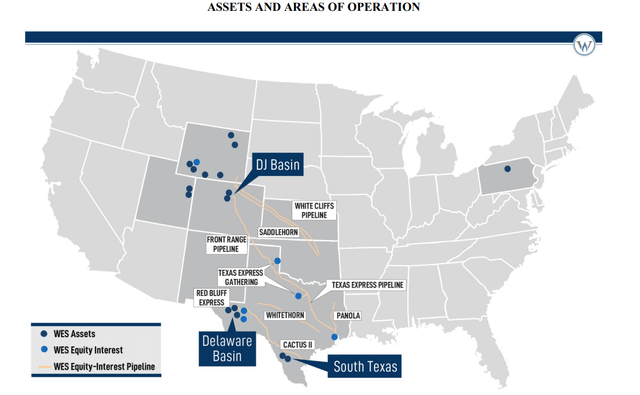

OXY owns 51% of Western Midstream Partners (WES), which as you can see below fills a significant gap in BHE’s footprint. WES assets include extensive gathering lines in the Delaware basin, a sub-basin of the Permian basin, and the DJ basin in Colorado that feed into the Cactus Pipeline that terminates in Corpus Christie, Tex. A hub for crude oil export and future LNG facilities. Then there is the Texas Express line that carries NGLs to the chemicals hub of the world, Houston, Texas and the nearby Houston ship channel.

WES controls key export infrastructure to markets that BHE does not currently serve and would fit right into their framework without any overlap. With little overlap the deal would probably pass Federal Trade Commission-FTC, and other regulatory agency review. As big as BHE is, it is still a relatively minor player in the pipeline space. Giant pipeline conglomerates such as Energy Transfer (NYSE:ET), Enbridge (NYSE:ENB), and Enterprise Products Partners (NYSE:EPD) all have several multiples more of pipeline miles than BHE.

In my view, the WES assets would form a critical part of the calculus to take OXY private.

Eighth, One final point here that supports the idea of Warren taking the company private. It’s what he does. The entire group of companies that make up BHE are 100% subsidiaries of Berkshire Hathaway. I can think of a lot of reasons for this, but won’t expand the thought further at this point.

Risks

Nothing about this notion is baked in stone. Buffett has the right, but not the obligation, to buy another ~30% of OXY. We can’t know his mind, and what he will eventually decide to do. Should he remain dormant on this issue for any length of time, and he has done this in the past, shares could sag toward the upper $50’s again in this bi-polar oil market where we are up big one day, and down big the next. I am certainly not counseling anyone what do specifically here!

Your takeaway

OXY is still cheap by the metrics we commonly use to evaluate companies in this blog. The EV of ~$85 bn yields a OCF multiple of 5.66X. For a company “in-play” as is OXY, that is extremely undervalued. Their price per flowing barrel is still pretty reasonable as well at $70K per barrel.

One thing we know from history is that if all parties agree to a merger, Buffett is willing to offer a premium for the remaining shares. In the case of Burlington Northern Sante Fe-BNSF, he offered a 31.5% premium. The past is not necessarily prologue, but as we’ve noted he generally wants it all. Thirty percent to today’s price would take them to the upper $90’s. Not unreasonable in my estimation.

Obviously this article involves a lot of speculation on my part. I think the rationale is strong for Buffett to launch a tender for the balance of the shares, should he go forward at all. Something we haven’t discussed is how Vicki Hollub might feel about being part of a corporate conglomerate. In some ways, Buffett can achieve a lot of his objectives by holding 50%. It takes the company off the potential M&A market that might develop if the mega oils, XOM or CVX, might decide to take out OXY. Something they could easily do.

Buffett has an aversion to hostile takeovers, and with the regard he has for her, would give her the final say. That would put the ball in her court about a possible merger into BHE. At this point, all we can say for sure is that time will tell.

Be the first to comment