dam_point/iStock via Getty Images

Investment Thesis

Occidental Petroleum (NYSE:OXY) has started to ramp up its capital returns program. As we enter 2023, we should expect OXY to slow down its debt repayment program.

I believe that in 2023, we should expect to see OXY lay out a clear capital return framework as many of its peers in the industry have done. I believe that we could see OXY returning up to 50% of its free cash flows in 2023, and doing so sustainably.

By my assumptions, I believe that OXY’s capital return program could annualize at +12%.

With that in mind, this is why I’m bullish on OXY.

What’s Happening Right Now?

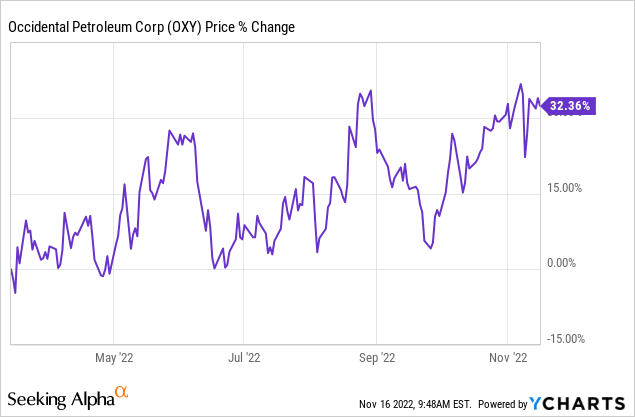

Everything that I’m about to discuss with you right now, I could have told you back in March. And yet.

Back in March, we could all have generally agreed on many of the repercussions of the Ukraine invasion. Even if we were not precisely right, we’d still be vaguely right.

What’s more, during that time, every time that OXY sold off, investors moved fast to buy the dip, because of the so-called ”Buffett put”.

So, it’s nearly as if there’s every known reason why this stock should be substantially more expensive. And yet.

Next, let’s turn our focus to the only game in town.

Capital Returns Program, Where is the Framework?

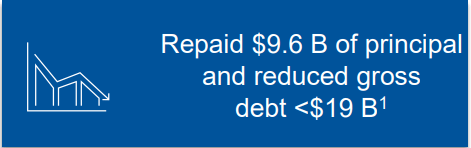

OXY Q3 2022

OXY has approximately $19 billion in net debt. OXY has maintained for a while that, starting in 2023, it will be in a position to meaningfully ramp up its capital return program. Along this theme, this is what OXY’s CEO Vicki Hollub said on the call:

As we enter 2023, we expect that our free cash flow allocation will shift significantly towards shareholder returns.

That’s everything that investors could hope, want, and expect. As readers know, having Warren Buffett onboard ensures that management is unlikely to do something foolish.

Many companies often announce buybacks, but rarely go through with them. Most notably in tech. While in the oil and gas space, in the present climate, not only do companies announce buybacks, but they also go through to completion. Only to then re-initiate their program once more. Rinse. Repeat.

OXY Stock Valuation – 4x Free Cash Flow

Nobody can predict where oil is going to be in 2023. There are a few factors that are likely to be bullish, such as a reduction in the Strategic Petroleum Reserve (”SPR”), China reopening and resuming its typical demand curve, and the loss of efficiencies from the EU Russian oil ban.

Throughout my own fossil fuel stocks, I’ve not put significant consideration into any of those catalysts having a meaningful impact.

You may believe this is foolish, given that these are ”near certainties”. But at the same time, these are known knowns, and I’m inclined to believe that these are already to some extent priced into the WTI market.

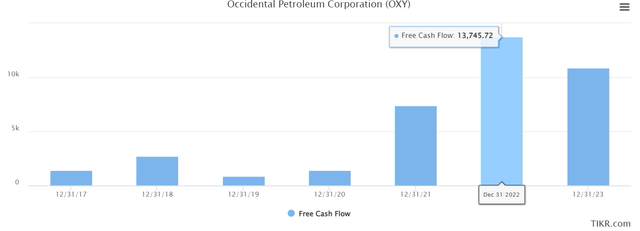

Consequently, I’ve only assumed that in 2023, with smaller interest payments, OXY ends up reporting approximately $16 billion of free cash flows.

Incidentally, I should remark that analysts following OXY actually expect 2023 to see lower free cash flows than 2022.

Put another way, analysts following the stock presume that OXY’s free cash flows in 2022 are elevated and that they’ll mean revert lower.

Am I correct to assume that OXY is priced at approximately 4x next year’s free cash flows? Or perhaps am too bullish, and the stock is more accurately priced closer to 6x next year’s free cash flows?

My argument here is that whether it’s priced at 4x or 6x next year’s free cash flows, that’s really splitting hairs and missing the forest for the trees.

The Bottom Line

So essentially, any free cash flow that’s available next year will be allocated mostly to share buybacks.

And we really want people to understand that this is not something that we’re doing on a temporary basis.

We do believe that share buybacks where we are today and where our capital needs are and our cash flow potential, share buybacks is a part of our value proposition as is a growing dividend. (CEO Vicki Hollub, Q3 call)

Occidental is predominantly a pure-play oil and gas business with heavy exposure to US sales. For investors that are bullish on oil prospects into 2023, OXY makes a lot of sense.

Not only do we know that the stock is cheap, but we also know that behind the curtain there’s one of the best capital allocators likely helping pull the strings.

Consequently, I believe that OXY’s upside hasn’t yet fully started. Until investors substantially rerate OXY’s free cash flows closer to 8x or 9x free cash flows, or approximately 12% free cash flow yields, closer to the free cash flow yields of cyclical companies within the S&P 500 (SPY), investors are still not too late to this trade in my view.

Be the first to comment