marekuliasz/iStock via Getty Images

Obsidian Energy Ltd. (NYSE:OBE) is an independent oil and gas producer operating in three different mineral-rich regions of Alberta, Canada. The company was originally founded as a Canadian energy trust but, following the change in Canadian tax policy in 2011, it ultimately joined many other former trusts in converting to a corporation. Unfortunately for many investors, the company no longer possesses some of the qualities that attracted many investors to the trust, such as its high dividend yield.

Although Obsidian Energy currently pays no dividend, there may be a lot to like about it given today’s high energy prices. The most notable of these is that the company is well-positioned to see very strong growth over the remainder of this year. The market is not factoring in this growth, though, and Obsidian Energy looks substantially undervalued despite the strong appreciation that the stock has already delivered this year.

About Obsidian Energy

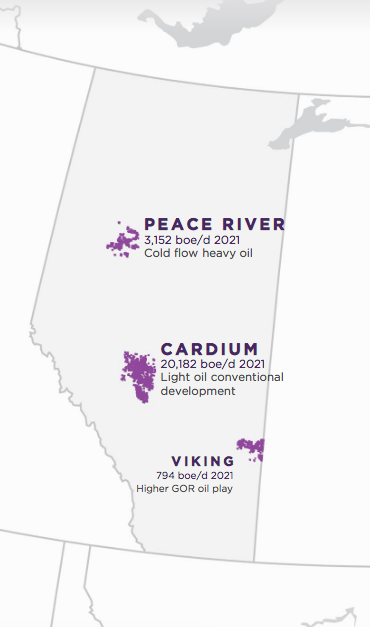

As stated in the introduction, Obsidian Energy is a mid-sized independent oil and gas producer that operates in three separate mineral-rich regions of Alberta, Canada.

OBE Investor Presentation

As we can see above, the company’s largest base of operations is in the Cardium Formation of Central Alberta. This is admittedly not an area that many American investors are likely to be familiar with. The Pembina Field in the center of the province (the area where Obsidian’s operations are) has long been a major center of the Canadian oil industry.

The Cardium Formation was originally established to have total recoverable crude oil reserves of approximately two billion barrels. Recent technology has improved the oil recovery factor by more than 400% over initial estimates, so it is not currently established what the remaining reserves of the formation are, as no widespread geological survey has been done in nearly three decades. This is still likely one of the most oil-rich areas in the world, however.

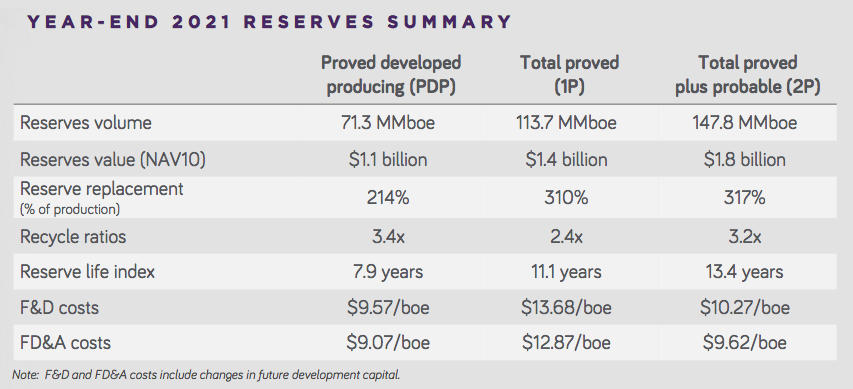

As might be expected from the mineral wealth of this area, Obsidian Energy boasts enormous reserves. An energy company’s reserves are often overlooked by investors, but they are incredibly important. This is because the production of oil and gas is an extractive industry. Obsidian Energy literally obtains the products that it sells by pulling them out of deposits in the ground. As these deposits only contain a finite quantity of resources, the company must discover or otherwise obtain new resources or it will eventually run out of products to sell. Obsidian Energy has sufficient proved reserves to produce at its current level for just over eleven years.

OBE Investor Presentation

This very long reserve life is something that should be comforting to investors who are concerned about the company’s ability to sustain itself over extended periods of time. After all, the fact that the company does not need to obtain any new acreage for a while allows it to be judicious and patient about the timing of its acquisition of new reserves. As the price of acquiring resource deposits tends to vary, Obsidian Energy can acquire new resources at a time when they are cheap. This will save the company money over the long term and allow it to use its capital in the most beneficial way for shareholders.

The other advantage that Obsidian Energy’s reserves grant it is the ability to grow its production by increasing its exploitation of those reserves. This is the basis of our investment thesis in the company, since that is exactly what the company is planning to do. Obsidian Energy is planning to drill 29 wells throughout its average this year, although the largest single area is in the Central Alberta property. Overall, this is expected to increase the company’s production by 13% this year compared to 2021 levels.

It should be easy to see how this production growth should translate into revenue and profit growth. After all, this production growth provides the company with more oil and gas to sell and thus take advantage of today’s high energy prices. This is in stark contrast to the policy that many American producers are following of simply maintaining their production instead of growing it.

With that said though, the geology of the Cardium Formation is a bit different than some of the American oil plays. This is most noticeable in the fact that Obsidian Energy’s wells only have a 21% decline rate. This allows the company to keep its maintenance and production costs down compared to its southern peers. In fact, Obsidian Energy only had a cost of operations of $13.04 per barrel of oil equivalent produced last year. This low cost of operations benefited the company greatly during the 2020 price collapse.

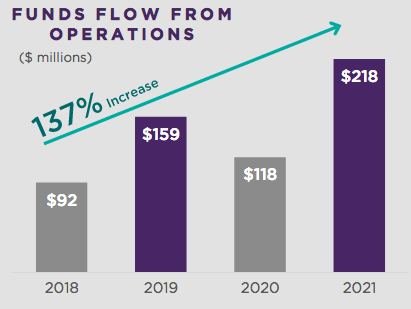

In 2020, Obsidian Energy posted funds from operations of $118 million, which was higher than it had in 2018 despite oil prices being at generational lows. Over the past four years, Obsidian Energy has managed to grow its funds from operations by 137%.

OBE Investor Presentation

Today’s high prices and the just-discussed growth program should allow Obsidian Energy to continue this growth trajectory. Management has guided for funds from operations of $309 million to $345 million, which would represent a 41.74% to 58.26% increase over 2021 levels.

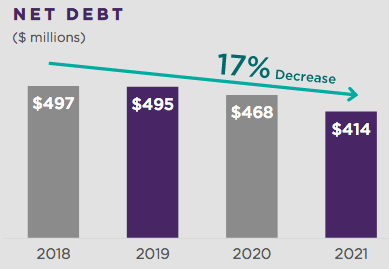

Another nice thing about Obsidian Energy is that the company has an incredibly low debt load. This is the end result of the company’s funds from operations growth and may be a major reason why it does not currently pay a dividend. Over the past four years, Obsidian Energy has reduced its net debt by 17%.

OBE Investor Presentation

This can be quite nice to see, since a company like Obsidian Energy can be somewhat more at risk from a high debt load than companies in other industries due to the volatility of commodity prices. However, we should still put the company’s net debt into perspective, as its ability to carry its debt is much more important than just the raw amount of it. This is an area in which Obsidian Energy shines, which we can see by looking at the company’s leverage ratio.

As I have pointed out in several previous articles, this ratio essentially tells us how long it would take the company to completely pay off all of its debt if it were to devote all of its pre-tax cash flow to this task. As of December 31, 2021, Obsidian Energy had a leverage ratio (defined as net debt-to-funds from operations) of 1.9x, which is a substantial improvement over the 4.0x ratio that it had in 2020. Admittedly, though, 1.9x is not nearly as good as I really want to see, although it is reasonable. The company should be able to do much better this year though and get this ratio down under 1.0x.

|

2020 |

2021 |

2022 |

|||

|

WTI Price |

$39/bbl |

$75/bbl |

$70/bbl |

$75/bbl |

$80/bbl |

|

Leverage Ratio |

4.0x |

1.9x |

0.9x |

0.8x |

0.7x |

One thing that we do see above is that the company’s ability to carry its debt is highly dependent on crude oil prices. This is certainly a potential risk, considering the volatility that these can sometimes exhibit. With that said, it still did reasonably okay in 2020 due in part to its incredibly low costs, as we already discussed.

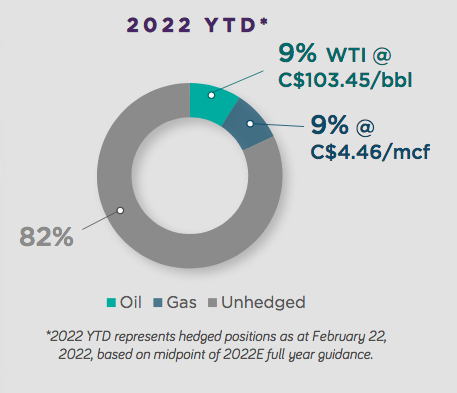

Fortunately, Obsidian Energy does have ways to protect itself against the effects that oil prices changes would have on its cash flows. One of these methods is hedging, which basically means that Obsidian Energy is utilizing financial products such as futures and forward contracts to lock in a selling price for the crude oil and natural gas that it produces. It is currently not being especially aggressive about this, however, since currently only 18% of its expected 2022 production has secured pricing under these hedges.

OBE Investor Presentation

This is admittedly lower than I would actually like to see, since a very sizable proportion of the company’s production is being sold at market prices and is thus subject to commodity price shifts. This could potentially expose Obsidian Energy’s cash flows to a great deal of volatility, as opposed to the stability that I usually like to see. With that said though, if you expect that crude oil and natural gas prices will remain high over the rest of this year (as I do), then this is probably okay.

Long-Term Macroeconomic Fundamentals

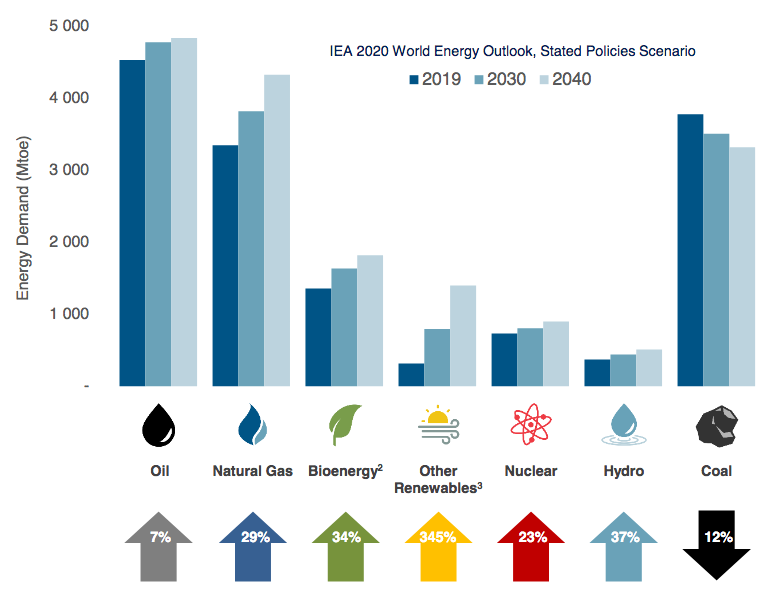

Fortunately for Obsidian Energy, the long-term fundamentals for both oil and natural gas point towards high prices and growing demand. The biggest reason for this is based on economic law, as the consumption of both products is expected to rise much more rapidly than the supply. The expectation for demand growth may be surprising, considering the lengths that some governments are going to in an attempt to reduce the consumption of fossil fuels, but it is still the fact nonetheless. As I have pointed out numerous times in the past, the International Energy Agency expects that the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years.

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

There are a few reasons for this, including economic growth in emerging markets and a desire to move away from coal as a power source. It is unlikely that the production of oil and gas will increase sufficiently to meet this demand growth, however.

One major reason for this is that the energy industry has not been investing sufficiently in exploration, infrastructure, and production capacity since oil prices crashed back in 2014 and 2015. The outbreak of the coronavirus pandemic certainly did not help, as that prompted exploration and production companies to cut their capital budgets substantially. Despite today’s much higher prices, they are still not as large as they were in 2019. In fact, Moody’s states that the energy industry needs to increase its upstream spending by $542 billion (a 54% increase) in order to avert a supply shock.

That is highly unlikely to happen, to put it mildly. Globally, energy companies are under a great deal of pressure from politicians, environmental activists, and others to improve the sustainability of their operations. The industry has also been under a great deal of pressure from shareholders to improve its returns, which have lagged those of many other sectors over the past decade. This has prompted many major producers to eschew expanding production and focus instead on maximizing free cash flow. Although the high price levels have prompted some companies to cautiously increase their capital budgets, these increases have been nowhere close to the level that would be needed to satisfy the projected demand growth. Thus, we have a situation in which demand is likely to grow much more rapidly than supply. According to economic law, that should cause energy prices to rise going forward.

Valuation

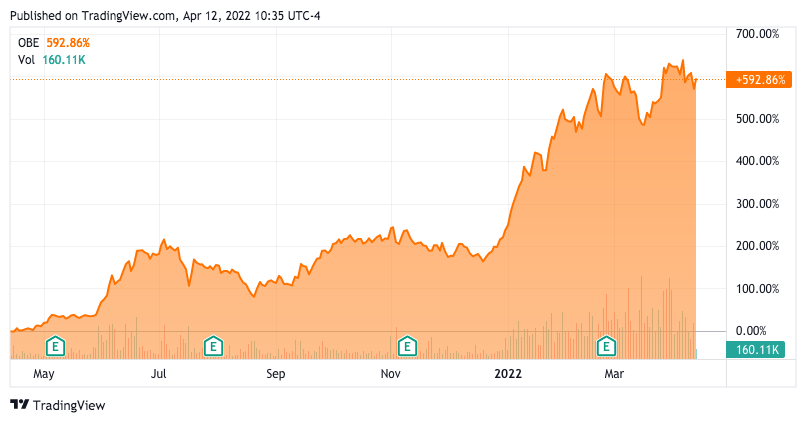

Obsidian Energy has delivered an incredible performance in the stock market over the past year. Indeed, the stock is up a whopping 592.86% over the past twelve months.

Seeking Alpha

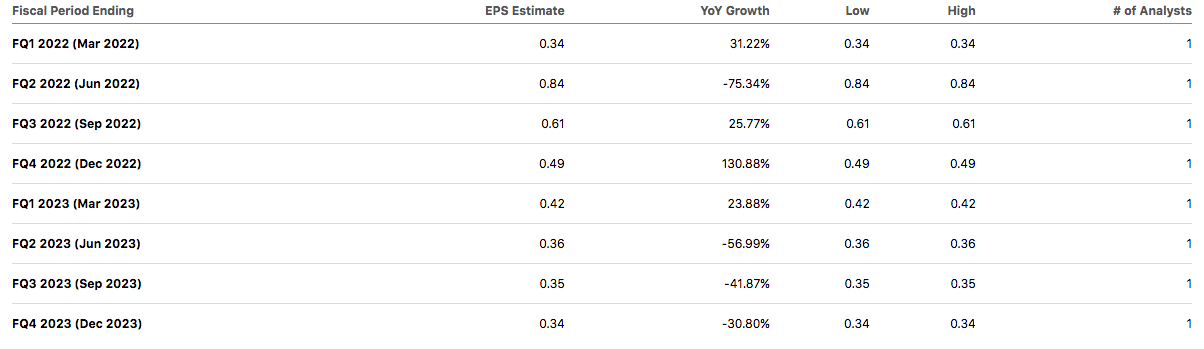

Despite this phenomenal performance, however, there are still reasons to believe that the stock is substantially undervalued. We can see this by looking at the stock’s forward price-to-earnings ratio, which tells us how much we are paying now for a dollar of earnings over the next year. The current analyst consensus is that Obsidian Energy will earn $2.27 per share over the next year.

Seeking Alpha

This is being driven by both the company’s projected growth and the fact that so little of its production is hedged. We discussed both of these things earlier in this report. This projection gives the stock a forward price-to-earnings ratio of 3.63 at the present price. This would be an incredibly low ratio in any market, let alone the very frothy one that we have had over the past decade or so. This ratio is also much lower than that of many other independent energy companies:

|

Company |

Forward P/E Ratio |

|

Obsidian Energy |

3.63 |

|

Diamondback Energy (FANG) |

6.59 |

|

Continental Resources (CLR) |

6.67 |

|

InPlay Oil (OTCQX:IPOOF) |

5.79 |

|

Enerplus (ERF) |

4.90 |

Admittedly, all of these companies look somewhat undervalued today as these are all very low ratios. However, we can clearly see that Obsidian Energy appears to be offering the best value out of this group of independent exploration and production companies. When we combine this with the strong forward fundamentals and the company’s low debt load, Obsidian Energy appears to have a lot to offer right now.

Conclusion

In conclusion, Obsidian Energy appears to be offering a lot to potential investors right now. The company is well-positioned to deliver substantial production growth this year, in direct contrast to many of its peers. This should result in earnings growth given the likelihood that energy prices will remain high for quite some time. When we combine this with the relatively low debt load and attractive valuation, the company looks like a buy.

Be the first to comment