Scott Olson/Getty Images News

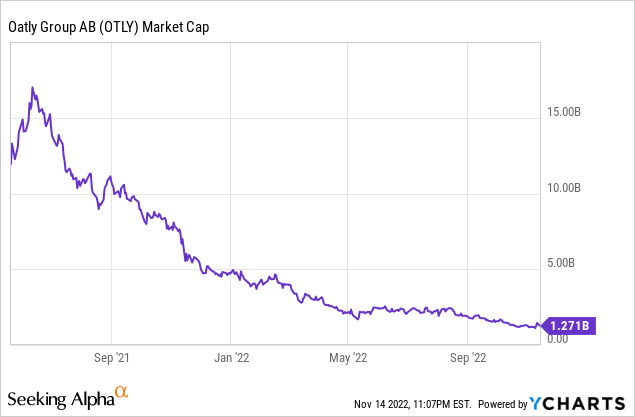

Oatly (NASDAQ:OTLY) moved down 12.65% yesterday following the publication of its fiscal 2022 third quarter earnings that saw revenue come in way below consensus and with EBITDA losses nearly 2x higher than what analysts were expecting. This caps what has been a year-long decline in the common shares of the oat milk pioneer that only went public in the Spring of last year. This was a period of unfettered hype and euphoria over companies operating in industries of the future. The Malmo, Sweden-based company once traded on a market cap north of $17 billion which at the time was more than 38x times its trailing 12-month revenue.

That an oat milk company would come to trade on a valuation comparable to the most high-flying enterprise SaaS stocks at the time was concentrated on a bullish thesis that is still broadly intact. There remains a structural shift in consumer eating patterns to plant-based alternatives. This is mainly on the back of millennial and Gen Z consumers. The reasons range from a pursuit of greater animal welfare and environmental conscientiousness. Indeed, the production of dairy milk emits significantly more carbon and uses more land and water. This tenet made Oatly a potential pick for ESG-minded investors. Hence, the company has been affected by not just the increasingly hostile risk-off environment but the more general rotation of capital away from sustainability.

The Recent Financials Were Poor And Create A Dilemma For Oatly

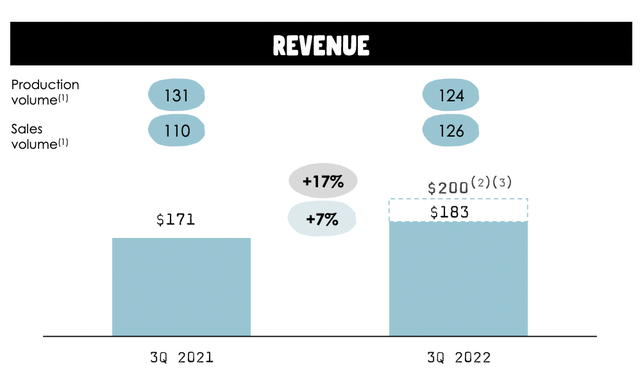

Oatly recently reported its fiscal 2022 third quarter earnings which saw revenue come in at $183 million, an increase of 7% over the year-ago quarter but a miss of $28.07 million on consensus estimates. Important to note that the company has a highly geographically diversified revenue base which meant strong USD movements during the period adversely affected revenue. This would have grown by 17% in constant currency.

Production volume at 124 million was down 5.3% from 131 million litres in the year-ago quarter but sales volume grew by 14.5% to reach 126 million. This was due to technical issues faced at its Ogden, Utah production facility which the company anticipates solving in its fourth quarter. Oatly has also commenced a production line expansion of their New Jersey factory, a move which will contribute to management’s target to exit the year with a run-rate production capacity of around 900 million litres of finished goods.

To support this, Oatly expects its full fiscal year 2022 capital expenditure to be between $220 million and $240 million. With year-to-date capital expenditure running at $170.5 million, down from $186.7 million in the year-ago comp, this should see at least $50 million spent in the fourth quarter of this year. This places the company’s liquidity position in view. Cash and equivalents as of the end of the third quarter stood at $120.3 million with another $320 million available on their undrawn revolving credit facility. Further, the total outstanding debt stood at just $4.4 million. This provides significant freedom to management to increase gearing in the quarters ahead if needed.

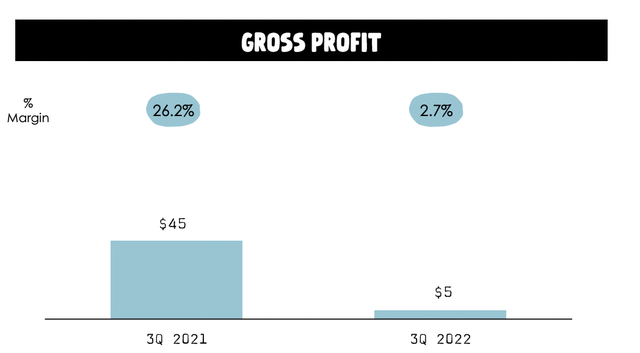

The material pullback in profitability during the quarter was the key takeaway for investors with a gross profit of just $5 million, down 88.9% from the year-ago period. Gross margin declined from 26.2% to just 2.7%. The reasons for this were multifaceted with inflationary and zero-Covid pressures contributing to the disruption. Adjusted EBITDA came in at a loss of $83 million from a loss of $27 million in the year-ago quarter.

This meant net cash used in operating activities increased to $66.6 million during the quarter with cumulative year-to-date cash burn at $215.2 million. This was up 44.8% from $148.6 million in the year-ago period. Management must be commended for providing quite a granular level of detail as to why their gross margin deteriorated as much as it did and they seemed to be clear on remedies during the earnings call for the quarter.

Is OTLY Stock Still Hyped Up Even After The Fall?

Oatly’s market cap currently sits at $1.27 billion against revenue guided to be not more than $720 million for its full fiscal 2022. This places its forward price-to-sales multiple at 1.76x which remains higher than its sector median. Consensus estimates will have to be revised down for the next year with the company already set to underperform this year’s revenue estimate of $796.31 million.

Oatly faces a tough task to reverse its gross profit slide whilst also meeting capital expenditure targets, navigating continued inflationary headwinds and falling consumer discretionary income. The previous level of investor enthusiasm can return at some point if the company shows its viability as an independent entity. For now, consumer hype rather than investor hype for plant-based alternatives continues to increase to new highs and Oatly is a hold.

Be the first to comment