Epstudio20/iStock via Getty Images

Investment Thesis

Nvidia (NASDAQ:NASDAQ:NVDA) unveiled its ambition to power the world over the next decade through its GTC 2022 keynote presentation on 22 March 2022. With multiple applications, including the automotive industry, cloud computing, medical applications, digital twin simulation programs, and AI-on-5G platforms, it is not difficult to see that NVDA will indeed be a strong contender in the hardware world. In addition, we expect its software revenue segment to expand aggressively over the next decade, as NVDA monetizes its software component moving forward.

Though highly speculative, assuming that its partnership with Intel Foundry comes through in the future, NVDA would also better grasp its supply chains moving forward. Otherwise, a new US-based Taiwan Semiconductor Manufacturing Company (TSM) plant in Arizona would work too.

For this article, we will be focusing on its opportunities in the AI, Automotive, and Data Center segments.

The Breakthrough Modulus AI Technology

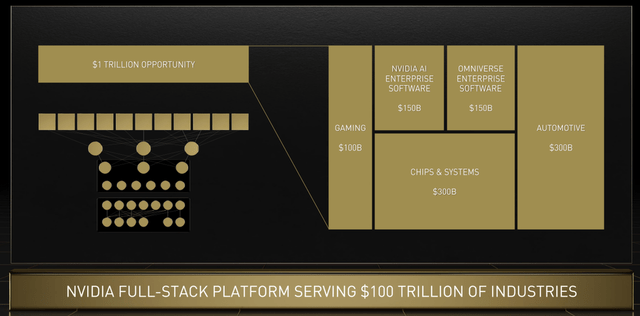

NVDA $1T Opportunity While Serving $100T Industries

As of 25 March 2022, NVDA’s stock has gained 8% post-GTC 2022 Keynote. It is evident that investors are convinced of its $1T opportunity while serving multiple breakthrough segments worth $100T, including gaming, AI enterprise, Omniverse enterprise, automotive, chips, and systems. As a full-stack computing company providing both hardware and software capabilities, NVDA has proven itself to be a force to be reckoned with. Now, even more so, since the company is finally ready to monetize its Modulus AI technology. Colette Kress, the chief financial officer of Nvidia, said:

Now we’re entering into a new phase, a new phase that we are thinking about software, and a business model for software to sell separately. The software side will offer a more predictable revenue stream. (The Register)

During the GTC 2022 keynote, NVDA also introduced its new Hopper H100 system with 4nm process and 80B transistors, overtaking the architecture launched in 2020. It is a massive improvement from the previous A100 7nm process with only 54.2B transistors. Given how only twenty of H100 can power the world’s internet traffic, we expect H100 to be the choice processor to run complex AI workloads and emerging Metaverse concepts. In addition, the NVDA CEO reported that potential customers might link up to 256 numbers of H100 chips to potentially create the world’s highest-performing GPU. A marvel, given the massive potential in complex computational processes for deep learning AI.

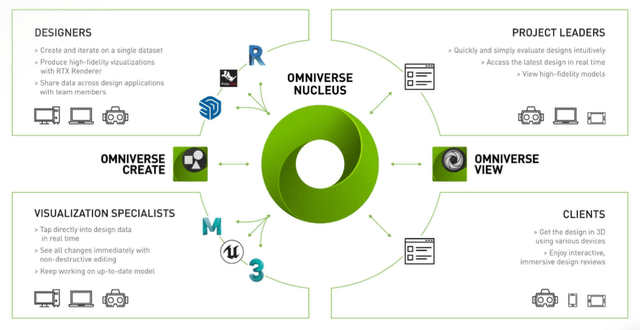

We are confident of NVDA’s capability in bringing about the next wave of AI innovations, given how its Modulus AI technology has been trained to aid the world in multiple applications through the Omniverse Digital Twin Platform. These include healthcare and drug research, climate science, manufacturing processes including automotive, the building of the Metaverse for entertainment, work, gaming, etc. The critical point of the platform is in its ability to manage complex applications, simulate workflows, and solve problems before it even happens.

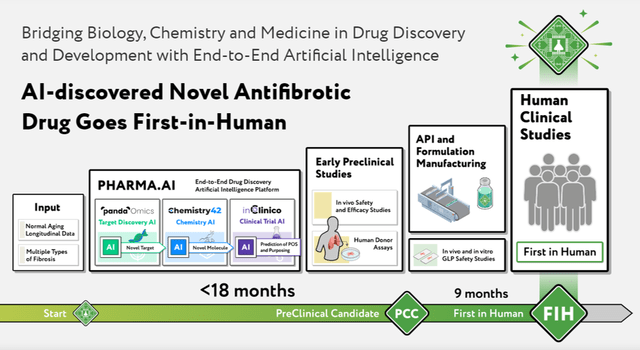

NVDA’s Impact on Drug Discoveries

Some real-life examples are from Insilico Medicine, a company developing the therapeutic candidate for idiopathic pulmonary fibrosis (IPF) using AI techniques. Typically, pre-clinical stages could take up to six years before human trials may start. However, this process is dramatically reduced to less than 18 months using NVDA’s AI technology, effectively revolutionizing the process of future drug discoveries. In addition, NVDA also offers FourCastNet physics-ML model, a new AI-based weather prediction model, which can simulate and forecast complex weather events within minutes, compared to the conventional method that takes a year.

NVDA’s Impact in the Architecture, Engineering, Construction, and Operations (AECO) Workflows

As an architect myself, we are amazed by the new operational efficiencies offered by NVDA’s technologies in the Architecture, Engineering, Construction, and Operations (AECO) workflows. With the breakthrough in AI and virtual world reality, we can view/collaborate/solve design/construction problems with global partnering teams, before the actual construction starts. In addition, AI assistants, such as Toy Jensen illustrated in the GTC 2022, will be able to aid in the design process while also increasing work efficiencies moving forward. As a result, NVDA’s software and AI machine learning capabilities are transforming and revolutionizing the world’s existing and future workflows in multiple applications and sectors.

It is really not hard to see why NVDA’s full-stack platform is and will remain highly relevant in the next few decades, given the breakneck rate that the world is adopting AI technology and its relevant GPUs. We admit that NVDA’s original starting point may have been at GPU chips powering computing and gaming segments. However, its true potential lies in its Modulus AI technology and software development, which is riding on top of its existing hardware prowess. This is the reason why NVDA is truly changing the world, multiple sectors at the same time.

NVDA’s Leadership In Automotive Software And Hardware

NVDA’s automotive segment would potentially be huge as well, given that it has secured partnerships with 20 of the top 30 passenger electric vehicle markers globally. Mercedes-Benz and Jaguar have adopted its highest-tier automotive offering, a customized NVDA DRIVE Hyperion 8, built on the NVIDIA DRIVE Orin system-on-a-chip (SoC). The system includes a complete software stack for self-driving vehicles (DRIVE AV), complete with driver monitoring and visualization (DRIVE IX) through multiple cameras, radars, and lidar sensors. Additionally, these monetized software upgrades can be performed over the air, providing new features and capabilities during the lifetime of the vehicle. It ensures steady recurring revenue for NVDA’s automotive segment, beyond the usual upgrade cycle for vehicles, which may not occur as often.

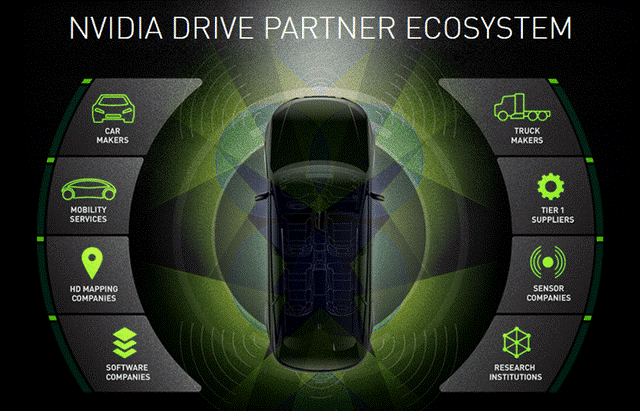

NVDA’s Multi-Tier Partnership For Automotive Systems

Nvidia

Many other automakers, including BYD, will be adopting only NVDA’s DRIVE Orin™ system-on-a-chip (SoC), serving as the brain and operating system of these vehicles. Nonetheless, monetization is still possible through continuous software upgrades. NVDA also serves other suppliers and developers, such as Aurora (AUR), Baidu (BIDU), and Sony (SONY), through multiple partnerships on software, simulation, mapping, and sensors. With a total pipeline value of over $11B for the next six years, we may expect NVDA’s automotive segment to contribute robust revenue growth, with the company estimating a $300B opportunity in the long term. Jensen Huang, founder and CEO of NVDA, said:

Future cars will be fully programmable, evolving from many embedded controllers to powerful centralized computers – with AI and AV functionalities delivered through software updates and enhanced over the life of the car. NVIDIA DRIVE Orin has been enormously successful with companies building this future, and is serving as the ideal AV and AI engine for the new generation of EVs, robotaxis, shuttles and trucks. (Seeking Alpha)

Given that the Hyperion 9 will be released by 2026, we expect more to embrace the latest DRIVE Atlan SoC (the next upgrade from Orin) as the world slowly phases out fossil fuel vehicles to meet the global goal of carbon-neutral by 2030. In addition, as electric and/or autonomous vehicles become the norm with increased capacity for electric charging over the next decade, we expect the production of SoC to be more cost-effective over time, thereby exponentially increasing adoption for the long term. Given its leadership position in the full stack automotive software market, beyond Tesla (TSLA), we expect NVDA’s automotive ambition to succeed.

The Fastest Data Center CPU, Potentially Exceeding AMD’s Genoa And Bergamo

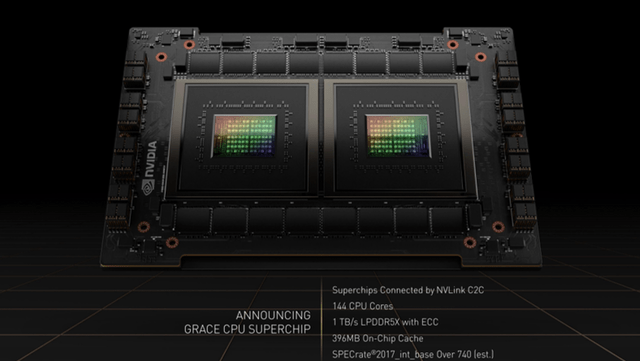

NVDA’s Latest Date Center Offering, Grace CPU Superchip

NVDA also introduced its Arm Neoverse-based discrete data center CPU, 144-core Grace CPU Superchip. We expect Grace to be a strong contender against AMD’s new generation of x86 EPYC processors, Genoa and Bergamo. The Superchip connects two CPUs via NVDA’s NVLink-C2C interconnect tech. With both companies launching the 5nm chips by 2023, we may expect intense competition as they race to be the leading chip designer in the cloud computing industry.

NVDA also claimed that its latest Superchip will offer 1.5 fold increased core performance, compared to the older 64-core AMD EPYC 7742 processors in its own DGX A100 servers previously launched in 2020. Additionally, it will offer double the power efficiency of today’s top-performing server chips. In contrast, AMD claims that its Bergamo, the company’s latest offering for the data center segment, offers only 1.25 fold of core performance with double the power efficiency over its regular N7 technology.

Given the comparison, NVDA could very well prove that the Grace CPU Superchip will be the fastest processor on the market by 2023 for a wide range of applications, including hyper-scale cloud and AI computing. Nonetheless, given that Bergamo was introduced in late 2021, it is also a matter of time before AMD presents another high-performance data-centric chip during its next Investor Day, to potentially match or take over NVDA’s Grace Superchip.

Long-Term Partnership With Intel Foundry

On 24 March 2022, NVDA highlighted the possibility of working with Intel (INTC) as another manufacturer of its chips. Currently, NVDA depends on TSM and Samsung (OTC:SSNLF) (OTC:SSNNF) for its chips manufacturing, with global supply chain issues causing NVDA’s “revenue to be gated by supply” in the past year. In the meantime, INTC, led by Chief Executive Pat Gelsinger, announced its foundry ambitions in 2021, expanding its conventional CPUs business. INTC also planned an aggressive $20B investment in two new foundry production lines in Arizona to be completed by 2024 and another $88B investment in Europe over the next decade.

Despite naysayers, INTC has also marched on with the early adoption of ASML’s TWINSCAN EXE:5000 in 2018 and EXE:5200 system in 2022, the next-generation extreme ultraviolet (EUV) lithography machines for 2024 and 2025 productions, respectively. Market insiders speculated that INTC will use the TWINSCAN systems to launch 2nm chips by 2024 or 2025, the next generational technology ahead of the 4nm chips to be released by 2022, 3nm chips by 2023 by competitors such as TSM and Samsung.

On the other hand, its largest competitor, TSM, is only expected to manufacture 5nm chips from its US-based factory in Arizona from 2024 onwards. In addition, there are rumors of construction delays potentially pushing TSM’s US-based chip manufacturing behind by six months to 2025, due to the COVID-19 pandemic and labor issues. Nonetheless, we do not expect TSM to sit on its laurels. Though speculative, we expect TSM to upgrade its US-based manufacturing capabilities to include the latest technology to remain competitive. In addition, TSM may potentially outrace INTC in 2nm product launches due to the former’s deep expertise in commercializing the EUV technology.

Either way, NVDA would benefit from the in-country supply stability for the advanced 2nm chip technology moving forward. But, of course, this is assuming that INTC is able to get its chip manufacturing technology up and running by 2024. Otherwise, TSM would probably take the lead again with the 2nm technology.

So, Is Nvidia A Buy, Hold Or Sell Now?

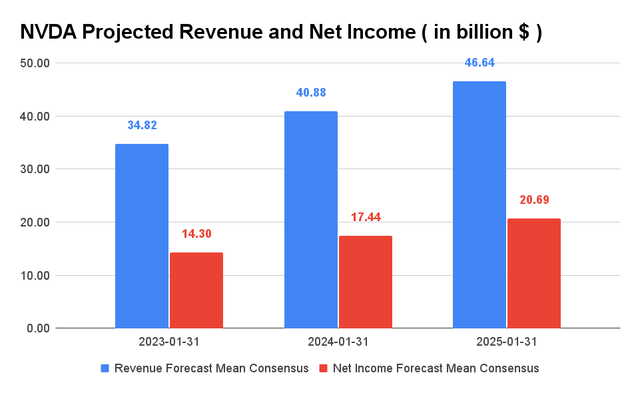

NVDA Projected Revenue and Net Income

NVDA is expected to report revenue growth at a CAGR of 15.74% over the next two years. For FQ1’23, NVDA guided revenues of $8.1B and gross margins of 65.2%, representing an impressive revenue increase of 5.9% QoQ and 43% YoY. It is also important to note that NVDA is expected to record a one-time write-off worth $1.36B for the upcoming quarter, due to the collapse of the ARM acquisition. Nonetheless, on its own, NVDA is still a force to be reckoned with, currently trading at a premium EV/NTM Revenue of 19.99x, higher than its 3Y mean of 15.03x. It is also trading at $281.5 (as of 24 March), down 18.7% from its highs in November 2021, though still at 121% in the past year. It is evident that there’s a considerable growth premium embedded in its valuations.

Despite the growth premium, we are convinced of NVDA’s multi-pronged strategy for the company’s future execution. As a result, we will not be valuing NVDA based on its previous execution, but also including its massive potential in its Modulus AI platform, data center CPUs, and NVIDIA DRIVE series for the autonomous electric vehicle industry. Given that the AI market, data center market, and electric vehicle market are expected to grow to $1.96T, $517.17B, and $823.74B by 2030 at a CAGR of 40.2%, 10.5%, and 18.2%, respectively, NVDA’s upside potential is massive, assuming successful execution and widespread adoption.

As a result, NVDA stock still looks attractive at its current valuation as the company is anticipated to smash expectations in the next decade. Tech investors who aim to invest in the market should add NVDA to their portfolio as a long-term play.

Therefore, we rate NVDA stock as a Buy.

Be the first to comment