sakkmesterke/iStock via Getty Images

Shares of Nvidia (NASDAQ:NVDA) rocketed higher on March 25 after struggling for days below critical technical resistance levels at $268. It leaves some to wonder if the move higher was an actual technical break out or may turn out to be a false move higher, and if false, it should lead to the shares revisiting their lows around $207.

The move appears to have been fueled by massive trading in Nvidia call options for expiration on March 25, which created a gamma squeeze in the stock, helping to lift the stock above that technical level of resistance at $268. However, that gamma squeeze will begin to lose steam, and as it does, it should help push the stock back below $268, creating that failed breakout attempt.

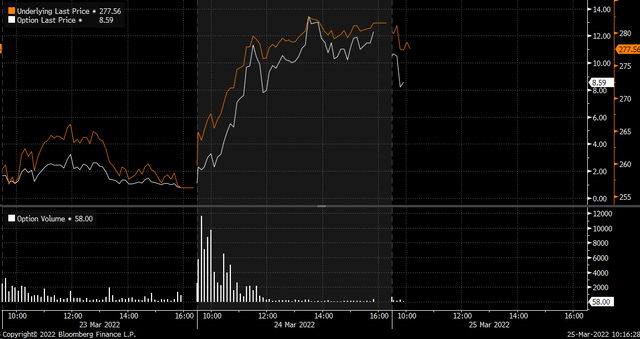

The chart shows a level of support and resistance that ran across the top of Nvidia’s stock price that started on January 14 around $268, which had extended until March 23. On March 24, the stock price rose above that level and pushed higher to its next level of resistance at $284, which coincided with a peak on January 12.

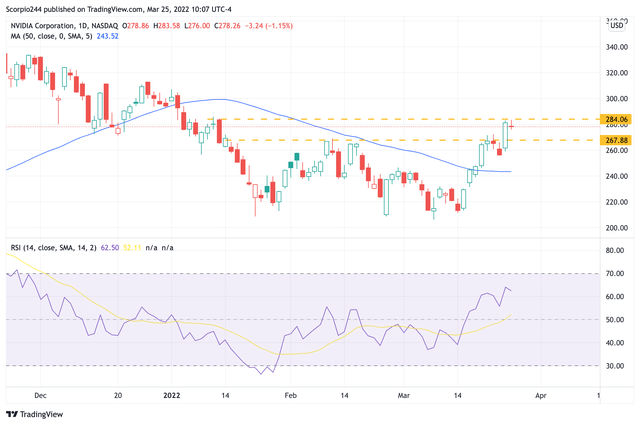

But what led to this break out was a surge in call options across multiple strike prices for the March 25 expiration date. The $270 and $280 strike prices were the most active options on March 24, with more than 90,000 contracts traded for the $270 strike price and more than 112,000 contracts traded for $280.

Interestingly, as the stock price rose, the call volume shifted from strike price to strike price. With the early volume at the start of the day focused on the $270 strike price.

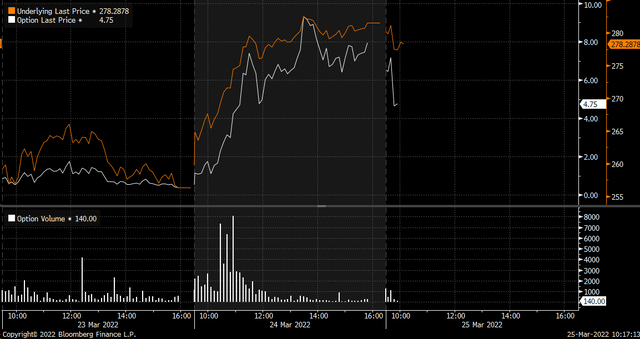

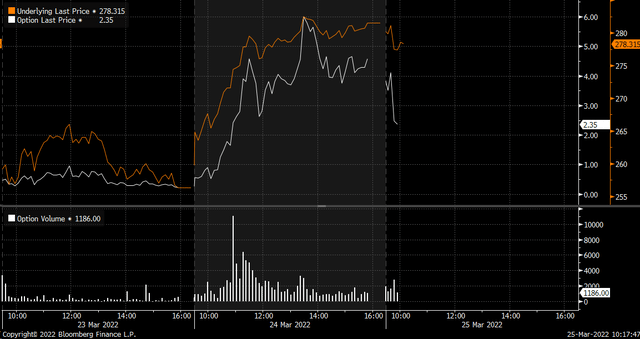

Charts used with the permission of Bloomberg Finance L.P

That then shifted to the $275 strike price by 10:30 AM

Then going to the $280 strike price by 11 AM.

The stock leveled off and started to trade sideways a little after 11 AM, as the calling buying activity was beginning to settle down, and the higher strike prices, such as the $300 calls, could not fuel a further gamma squeeze.

All of this option activity led to the market makers of Nvidia having to buy the stock to cover their synthetic short positions. The market maker in the options is nearly always the other side of a trader. So if an investor comes along and buys a call, the market maker has sold the call and is, therefore, synthetical short the stock. It means the market maker needs to buy the stock to stay hedged.

But because today is the options expiration day, and considering the amount of shares market makers are likely long, there should be a lot of stock that comes for sale in Nvidia as call start to lose value, especially if the stock is trading below $280. For example, according to data from Bloomberg, the current open interest levels suggest there is a delta value of around 360,000 shares at the $280 strike price and nearly 3.6 million shares in total between the $255 to $275 strike price. As the stock price falls, it should unwind the stock gains very quickly and ultimately push the shares back below $260.

The only thing that could keep the rally going is further call buying activity in the stock, which appears not to be materializing today as it did on March 24.

It would be a potent and bearish message for the stock from a technical perspective, which would indicate a failed breakout. That would ultimately lead to a retest of the lows around $207.

A move like this can go on for as long as the people are willing to play the game. But it is unsustainable, and not for fundamental reasons. It is purely driven by speculation.

Be the first to comment