Veni vidi…shoot

In a November article here I strongly suggested readers sell and avoid ownership of NVIDIA (NASDAQ:NVDA) at $322 a share, based on an absurdly high valuation. I was particularly worried rising inflation would require a rerating of the stock to fit more acceptable rates of underlying investment return. Growth-stock valuations are typically far lower during periods of excessive inflation vs. higher valuations when slight or flat gains are present in the basic cost of living. As a function of rising inflation and slower future growth rates for the business, I mentioned the stock was only worth $100 for rational long-term investors. Of course, few wanted to believe one of the biggest winners of 2021 could be grossly overvalued, and commentary by readers was not agreeable with my contrarian analysis.

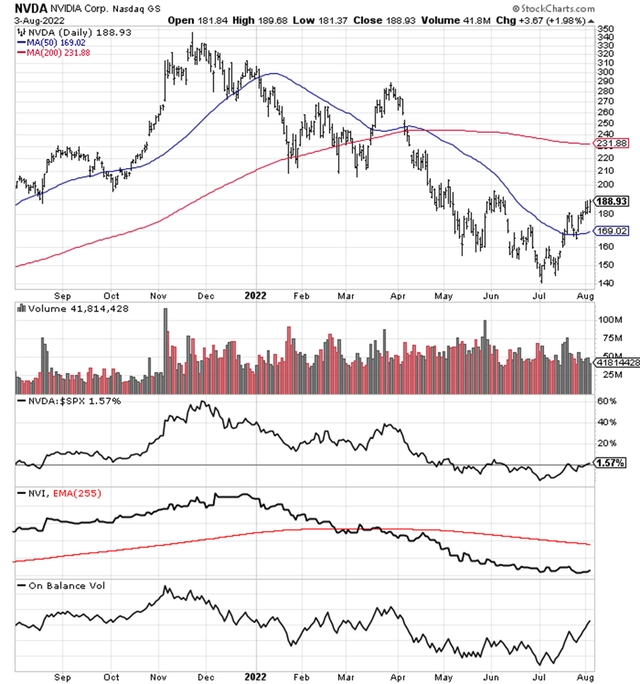

Since my bearish article, NVIDIA’s price collapsed -60% all the way down to $140 on the first trading day of July 2022. Lately, a sizable bounce to $190 has taken place, leading many analysts and investors to think a bottom has finally been outlined. While it is entirely possible $140 will be the low watermark for the year, I remain unconvinced risk has disappeared. My research continues to highlight NVIDIA’s stock as the most overvalued in the large-capitalization semiconductor space. And, if inflation refuses to fall back under 5% YoY soon or a recession in semiconductor demand is approaching, I figure a share price under $100 could become reality by the spring of 2023.

StockCharts.com, 1-Year NVIDIA, Daily Values

Overvaluation on Slowing Growth

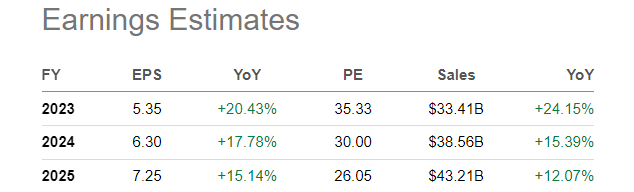

While increasing demand for graphic-heavy gaming chips, and frantic new order flow for faster crypto-mining enabling semiconductors became the norm in 2020-21, both of these growth drivers are stalling in 2022. The temporary pandemic push into gaming entertainment by consumers in 2020-21 and new console releases last year by major video game hardware companies have led to disappointing industry growth results this year. Then, the collapse in cryptocurrency pricing showed up in late 2021 and the first half of 2022. The “profit” spread involved in crypto mining is quickly evaporating (rising energy costs are also working against this computer-based mining industry). So, projecting an end to extraordinary chip demand is quite reasonable, especially if crypto prices fall further. Wall Street analysts have factored in a major slowdown in NVIDIA results as a result.

Seeking Alpha, Analysts Estimates, NVIDIA – August 4th, 2022

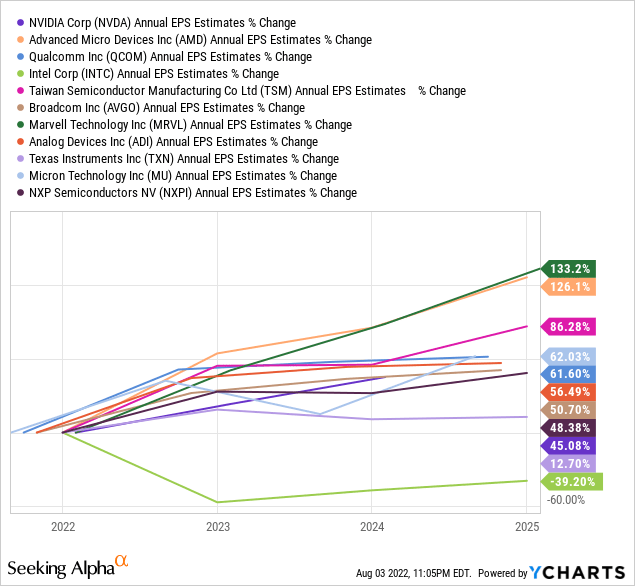

To be honest, NVIDIA’s growth forecast is slipping to the lower end of the spectrum vs. peers and competitors. Below is a graph of projected EPS growth vs. Advanced Micro Devices (AMD), Qualcomm (QCOM), Intel (INTC), Taiwan Semiconductor (TSM), Broadcom (AVGO), Marvell Technology (MRVL), Analog Devices (ADI), Texas Instruments (TXN), Micron (MU), and NXP Semiconductors N.V. (NXPI). What ultra-bullish investors forget is NVIDIA has a history of cyclical earnings, where income levels actually miss forecasts and DECLINE vs. the year ago period.

YCharts, NVIDIA Peer EPS Growth Rates

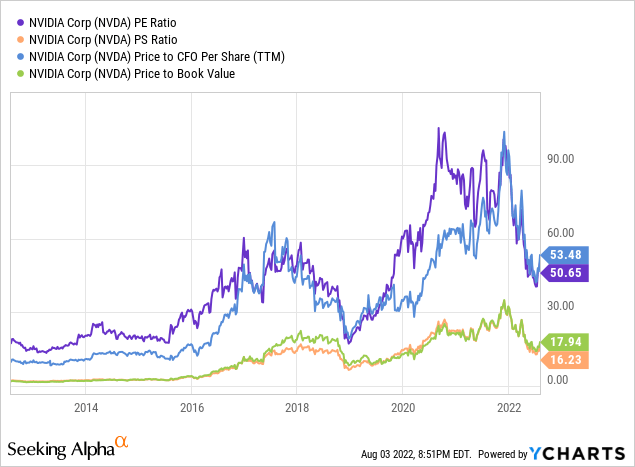

If earnings are no longer expanding at 50%+ rates like 2020-21, the stock quote is likely trading at a more normal long-term valuation, right? WRONG. NVIDIA is still trading under the assumption outsized growth is the present and future.

On a simple 10-year historical review of basic fundamental ratios like price to trailing earnings, sales, cash flow, and book value, NVIDIA remains at investment multiple premiums of 50% to 200% vs. its long-term averages.

YCharts, NVIDIA 10-Year Basic Fundamental Ratios

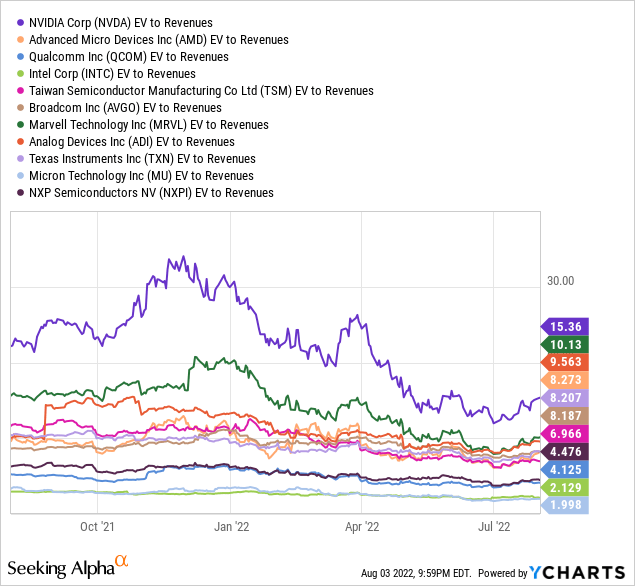

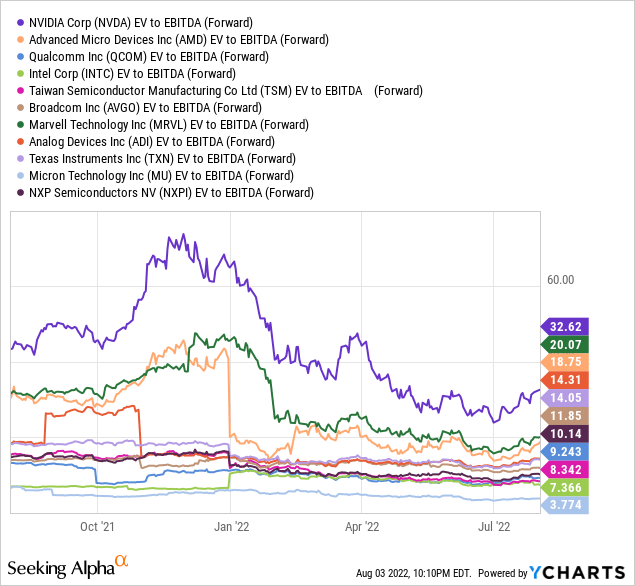

Measured against the peer group, NVIDIA’s valuation is by far the highest in the mega-capitalization chip sector. When we look at apples-to-apples comparisons of enterprise value (taking into account debt and cash holdings), EV ratios on trailing sales and even forward EBITDA highlight the stock’s valuation as one-of-a-kind for expensive upfront pricing.

YCharts, EV to Revenues – Semiconductor Group YCharts, Forward EV to EBITDA Estimates – Semiconductor Group

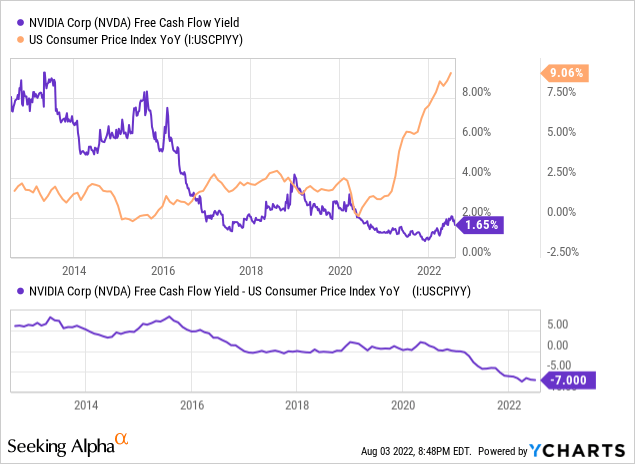

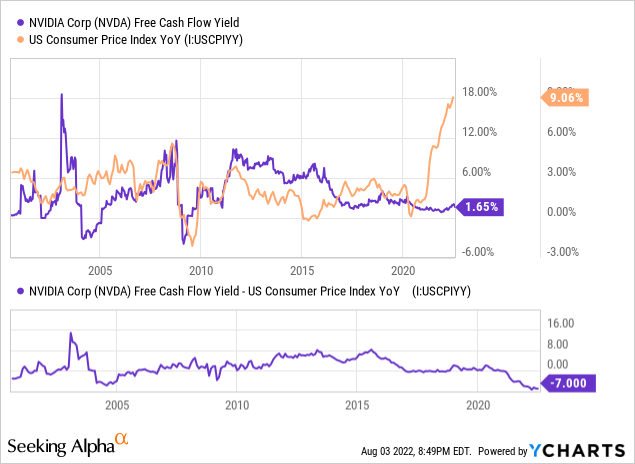

But that’s not the worst news for NVIDIA shareholders. When we logically compare prevailing inflation rates to cash flow and income returns on the price we pay for ownership, I can argue today’s valuation is even more expensive on a relative basis than the $345 all-time high last November! That’s right. Measured against inflation, NVIDIA shares are currently the most overvalued they have been in decades. You are getting a NEGATIVE -7% inflation-adjusted free cash flow return on your investment at $190 (assuming CPI inflation remains at 9%, which we all hope will not be our future reality). The company’s free cash flow yield has traded ABOVE the prevailing inflation rate about 95% of the time since 2000. The present negative “real” rate of investment return number is incredibly bearish if inflation does not come back closer to a neutral setting in 2023.

YCharts, NVIDIA 10-Year Free Cash Flow Yield vs. CPI Inflation YCharts, NVIDIA Free Cash Flow Yield vs. CPI Inflation since 2000

Final Thoughts

As opposed to other semiconductor leaders with slowing growth selling at far cheaper relative pricing than NVIDIA, a massive premium valuation still exists not entirely consistent with operating fundamentals or close to matching CPI inflation. Versus earnings and free cash flow yields in the 6% to 10% range for a number of peers with similar growth forecasts, NVIDIA’s sub-3% numbers do not make much mathematical sense. On top of the lackluster free cash flow and earnings yield situation vs. the tech sector, deeper cyclical businesses like oil/gas producers and steel manufacturers are already discounting a recession with income yields in the 15% to 20% range for equity risk takers.

NVIDIA has a history of cyclical earnings in the past, where weak demand leads to product price cuts and FALLING cash flow/earnings when times are tough. My conclusions: if CPI inflation rates remain above 5% next year and/or the economy turns weaker than expected, significant downside remains in the NVDA stock quote from $190 today. 15x sales and 33x EBITDA are borderline insane in a high-inflation world, outside of enterprises experiencing 50%-100% growth rates in both metrics annually.

I am not completely bearish on the semiconductor sector. I have written a variety of bullish tech-focused efforts in 2022. However, the chip stocks I am suggesting for ownership like Qualcomm here or smaller outfits like Everspin (MRAM) here or NVE Corp (NVEC) here maintain a more sustainable valuation on present and future projected results. One important key to long-term investment performance is being careful not to overpay for growth. I am afraid NVIDIA buyers continue to do just that.

I am modeling upside reward potential for NVIDIA to $220 a share over the next 12 months, about where price stands today. To essentially maintain the current quote, inflation must come down without a meaningful recession (which I believe is rather unlikely). To support minimal cash flow and income yields in the 3% range next year on a $220 NVDA price, we cannot afford more friction with China over Taiwan, Russia needs to play nice and withdraw from Ukraine, Democrats and Republicans have to get along and behave better (compromise on important issues), the Federal Reserve has to get lucky and achieve a soft landing for the economy, and consumers need to keep spending. That’s a lot to gulp, if you ask me.

So, if the best-case scenario is $220 for NVIDIA shares, while prices around $100 are the true intrinsic value of the business, I think avoiding or selling shares is still the smartest course of action. Theoretical 12-month target returns of +15% in upside reward vs. -50% in downside risk under different scenarios leave me in the Sell rating camp.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment